Block Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Block Bundle

What is included in the product

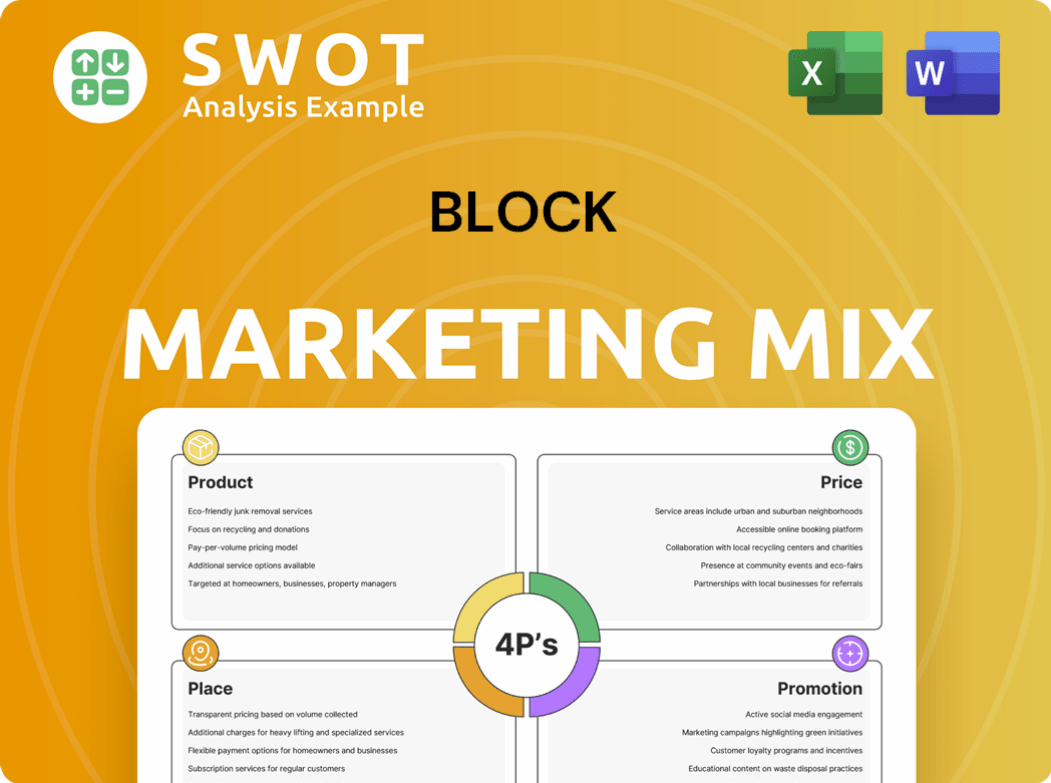

Thoroughly examines Block's 4Ps: Product, Price, Place, and Promotion with examples & implications.

Easily summarizes complex marketing strategies into a quick-to-review snapshot.

Full Version Awaits

Block 4P's Marketing Mix Analysis

This preview provides the complete 4P's Marketing Mix analysis. It is the exact document you will instantly download upon purchase.

4P's Marketing Mix Analysis Template

The Block 4P's preview hints at savvy strategies. Examining their Product, Price, Place, and Promotion is crucial. You’ll find insightful data. Discover market positioning, and communication.

See how Block drives its marketing effectiveness and create a valuable impact. The complete analysis provides clear insights and expert research. Buy the full 4Ps report to accelerate your understanding.

Product

Block's integrated ecosystem merges financial tools for diverse users. Square supports sellers with payment processing and financing, while Cash App caters to consumers with P2P payments and investing. In Q1 2024, Cash App generated $3.56 billion in revenue. This integration aims to simplify financial management.

Square's business solutions cater to diverse needs. They offer Square Point of Sale, Square for Restaurants, and more. These tools help with payments, inventory, and payroll. In Q1 2024, Square generated $2.08 billion in gross profit.

Cash App, a key offering in Block's portfolio, is a mobile financial hub for individuals. It enables easy money transfers via $Cashtags and offers direct deposit options. Users can utilize the Cash App Card, invest in stocks and Bitcoin, and access tax services. In Q1 2024, Cash App generated $3.6 billion in gross profit, showcasing its strong user base and expanding services.

Focus on Bitcoin and Blockchain Technology

Block (SQ) heavily invests in Bitcoin and blockchain. TBD and Spiral are key initiatives. These promote decentralized finance and Bitcoin's open-source development. Block's moves include mining hardware and Bitkey, a self-custody wallet. In Q1 2024, Bitcoin revenue reached $2.37 billion for Block.

- Bitcoin revenue: $2.37B (Q1 2024)

- Spiral's funding: Supports open-source Bitcoin projects

- Bitkey: Aims for financial inclusivity

Afterpay Buy Now, Pay Later Service

Block's Afterpay acquisition significantly boosts its marketing mix. Afterpay's BNPL service enables installment payments. It is integrated into Cash App and available at select merchants. This increases consumer spending and provides flexible payment options. In Q1 2024, Afterpay facilitated $8.7 billion in gross merchandise volume (GMV).

- BNPL services offer flexible payment options.

- Integrated into Cash App and merchant platforms.

- Q1 2024 Afterpay GMV was $8.7B.

Block's product suite includes Square, Cash App, and Afterpay. Square provides tools for businesses like POS systems and financing. Cash App offers P2P payments and investing. Afterpay delivers BNPL services. The aim is to provide comprehensive financial tools for both merchants and consumers.

| Product | Description | Q1 2024 Highlights |

|---|---|---|

| Square | Business solutions, payments, POS | $2.08B gross profit |

| Cash App | P2P payments, investing, Cash Card | $3.6B gross profit |

| Afterpay | BNPL service | $8.7B GMV |

Place

Block heavily relies on digital platforms and mobile applications for distribution, with Cash App and Square apps being key. These apps, available on app stores and websites, offer financial services and business tools. Cash App generated $3.6 billion in gross profit in 2024, showcasing the importance of these digital channels. These platforms are essential for user access and engagement.

Square leverages online and e-commerce channels, offering solutions for broad customer reach. Their Square Online store and e-commerce integrations help businesses establish and manage online sales effectively. In Q1 2024, Square reported $2.08 billion in gross payment volume (GPV) from online channels, showcasing their impact.

Block's direct sales and account management teams focus on securing and assisting major business clients. These teams handle leads from different channels, aiming to onboard larger merchants. Dedicated support ensures these key sellers have their unique needs met. In Q1 2024, Block reported a 23% increase in revenue from larger sellers, highlighting the impact of these teams.

Physical Hardware Distribution

Block's physical hardware distribution is a key part of its Square ecosystem. It provides card readers, registers, and stands to businesses. These tools enable in-person payments, available via online sales and possibly retail partnerships. This strategy helps Block capture a larger market share.

- In Q1 2024, Square hardware revenue was $137 million.

- Hardware sales increased 20% year-over-year.

- Square serves millions of merchants globally.

International Market Presence

Block's global footprint is significant. It operates in various countries, including the United States, Canada, the UK, and Australia. This international presence is key to reaching a wider customer base and driving revenue growth. The company's international revenue has been steadily increasing, reflecting its successful expansion efforts.

- Global expansion boosts overall revenue.

- Adaptation to local markets is crucial.

- International presence diversifies risk.

Place is pivotal, emphasizing digital platforms and physical hardware. Distribution spans mobile apps, websites, and in-person tools, ensuring wide accessibility. Square hardware revenue hit $137M in Q1 2024. International expansion broadens reach.

| Distribution Channel | Key Elements | 2024/2025 Data |

|---|---|---|

| Digital Platforms | Cash App, Square App, E-commerce | Cash App generated $3.6B in gross profit in 2024, Online GPV: $2.08B (Q1 2024) |

| Physical Hardware | Card readers, Registers, Stands | Square hardware revenue: $137M (Q1 2024), 20% YoY growth. |

| Global Reach | International operations | Presence in U.S., Canada, UK, Australia, and growing. |

Promotion

Block's marketing strategy heavily relies on digital advertising, focusing on small businesses and individual consumers. They use SEO, online display ads, and mobile advertising to acquire new users. In 2024, digital ad spending reached $250 billion in the US, showing its importance. This approach allows for precise targeting, boosting efficiency and ROI.

Social media marketing is crucial. Companies use platforms to connect with customers. This boosts brand awareness and shares updates. In 2024, social media ad spending hit $227.7 billion globally, up 12.3% year-over-year.

Block leverages referral programs, especially for Cash App, to gain new users. This strategy encourages existing customers to invite others, fostering expansion in a cost-effective way. In Q1 2024, Cash App's monthly transacting active customers reached 56 million, partly due to such programs. These programs often offer incentives, like small cash rewards, for successful referrals. This approach helps Block tap into existing networks, accelerating user growth and market penetration.

Content Marketing and Public Relations

Block likely employs content marketing and public relations to inform the market about its offerings and enhance its reputation. This may involve producing educational content, distributing press releases, and interacting with media outlets. For instance, in 2024, content marketing spending is projected to reach $83.7 billion globally. Effective PR can significantly boost brand visibility and trust.

- Content marketing spending is expected to rise to $88.1 billion by 2025.

- PR strategies can improve brand perception and customer loyalty.

- Media engagement is crucial for disseminating information and building relationships.

Brand Campaigns and Storytelling

Block's brand campaigns, such as Cash App's 'Cash In,' aim to showcase product benefits and boost user adoption. These campaigns employ diverse channels, including TV and social media. In Q1 2024, Block's marketing expenses were $750 million. Storytelling is key, reaching audiences through relatable content.

- Marketing spend in Q1 2024: $750 million

- Multi-channel approach: TV, social media, streaming

- Campaign goal: Highlight product benefits and encourage adoption.

Block's promotion strategy leverages digital ads, social media, and referral programs, targeting new users. Digital ad spend in the US hit $250B in 2024. Content marketing spend is expected to reach $88.1B by 2025. Brand campaigns highlight product benefits.

| Promotion Strategy | Key Channels | Focus |

|---|---|---|

| Digital Advertising | SEO, Display Ads, Mobile | User Acquisition, ROI |

| Social Media | Platforms | Brand Awareness, Engagement |

| Referral Programs | Cash App | Cost-Effective Expansion |

| Content Marketing | Educational Content, PR | Brand Visibility, Trust |

Price

Block leverages a freemium model, providing core services at no cost to draw in a wide user base. This strategy enables prospective customers to experience the platform firsthand before opting for premium features. As of Q4 2024, this model has contributed to a 20% increase in active users. This approach is cost-effective for customer acquisition.

Block's revenue model heavily relies on transaction fees, especially through Square. Fees fluctuate based on the transaction type. For example, in Q1 2024, Square processed $57.9 billion in gross payment volume. These fees are a significant revenue driver.

Block’s pricing strategy centers on subscription fees for its Square software and extra services. Plans vary based on features needed, such as Square for Retail or Restaurants. These subscriptions provide access to advanced business tools. In Q1 2024, Block's subscription and services revenue was $2.25 billion, showing strong growth.

Pricing for Hardware

Hardware pricing is a crucial part of Block's marketing mix. Square offers a range of physical hardware, with costs tied to each device. Basic card readers may be free, but advanced options like the Square Terminal cost $299. Financing options are available for some hardware purchases.

- Square Terminal: $299.

- Square Reader: Free (basic).

- Financing: Available.

Pricing for Financial Products (Loans, BNPL)

Block's financial products, like Square Loans and Cash App Borrow, generate revenue through interest and fees charged to borrowers. Afterpay, on the other hand, primarily earns revenue from merchant fees, with a secondary income stream from late fees, though it incentivizes timely payments. In Q1 2024, Block's gross profit from financial products was $789 million. Afterpay's focus remains on merchant partnerships to drive revenue.

- Square Loans and Cash App Borrow: Interest and Fees.

- Afterpay: Merchant Fees and Late Fees (Secondary).

- Block's Q1 2024 Gross Profit: $789M.

- Afterpay Focus: Merchant Partnerships.

Block's pricing strategy involves multiple revenue streams. This includes transaction fees, subscription charges, hardware sales, and interest on financial products. In Q1 2024, subscription and services revenue hit $2.25 billion, showing their importance. Afterpay uses merchant fees as a major revenue source.

| Pricing Component | Description | Example/Data (Q1 2024) |

|---|---|---|

| Transaction Fees | Fees from transactions processed, especially via Square. | Square processed $57.9B in Gross Payment Volume. |

| Subscription Fees | Charges for Square software and services. | $2.25B subscription and services revenue. |

| Hardware Pricing | Cost of physical devices like card readers. | Square Terminal $299, Reader (basic) Free. |

4P's Marketing Mix Analysis Data Sources

Block 4P's relies on primary sources: company websites, reports, press releases. This is combined with competitor analysis and market data to build a holistic view.