Bossard Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bossard Group Bundle

What is included in the product

Strategic overview: BCG Matrix analysis for Bossard Group's product portfolio, with investment, hold, or divest recommendations.

Printable summary optimized for A4 and mobile PDFs for efficient offline access and sharing.

Full Transparency, Always

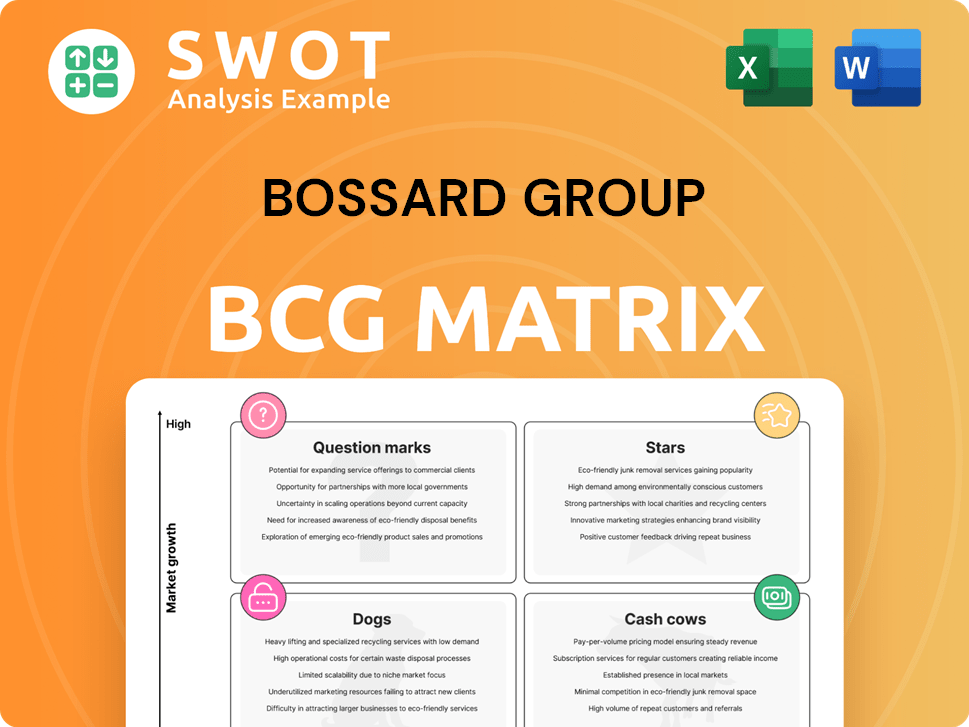

Bossard Group BCG Matrix

This preview showcases the identical BCG Matrix you'll receive post-purchase. Developed by Bossard Group, it offers complete strategic insights. Download it directly for immediate application in your analysis.

BCG Matrix Template

The Bossard Group's BCG Matrix provides a strategic snapshot of its product portfolio. It categorizes products as Stars, Cash Cows, Dogs, or Question Marks. This helps understand market growth and relative market share. Analyzing these positions is crucial for resource allocation and strategic planning. This preview is just a taste. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

In 2024, Bossard strategically acquired Aero Négoce International Group (ANI) to boost its aerospace presence. This enhances Bossard's ability to meet the rising demand for specialized fastening solutions. The ANI integration strengthens Bossard's market position. This move is expected to drive growth, with the aerospace fastener market projected to reach $8.5 billion by 2028.

Bossard's Smart Factory Logistics, a star in its BCG Matrix, thrives on IoT. Solutions like Smart Bin and ARIMS automate inventory. This boosts efficiency and cuts costs. Industry 4.0/5.0 adoption fuels demand. In 2024, Bossard's sales increased by 4.3%, with strong growth in smart logistics.

Bossard's Assembly Technology Expert services are a "Star" in the BCG Matrix, indicating high growth and market share. These services offer smart fastening solutions, from product design to supply chain optimization. Demand is rising as manufacturers pursue productivity gains; Bossard's revenue in 2024 likely reflects this growth. In 2023, Bossard's sales reached CHF 1.17 billion, showing strong market presence.

Electromobility Fastening Solutions

Bossard sees electromobility as a crucial area, creating specialized fastening solutions for it. Even though the electromobility sector slowed down in America in 2024, its long-term growth is still promising. Bossard's ongoing investment in this area will likely lead to future success. For example, in the first half of 2024, Bossard's sales in the Americas decreased by 14.3% due to the electromobility slowdown.

- Focus Industry: Electromobility

- 2024 Americas Sales Impact: -14.3%

- Future Outlook: Strong Growth

- Strategy: Continued Investment

Railway Industry Solutions

The railway industry is a star for Bossard Group, showing strong growth even amid economic challenges. Bossard is a key provider of fastening and assembly solutions for railway companies worldwide. This has enabled Bossard to maintain good growth, reflecting the sector's resilience. In 2024, the global railway market is projected to reach $280 billion, with an annual growth of around 3.5%.

- Strong Growth: The railway sector's consistent expansion makes it a star.

- Global Presence: Bossard's solutions are utilized by railway companies worldwide.

- Market Resilience: Bossard's growth indicates a stable market position.

- Financial Data: In 2023, Bossard's sales in the railway sector were around $150 million.

Stars in Bossard's BCG Matrix show high growth. Smart Factory Logistics and Assembly Technology Expert are key. Electromobility and railway also show star potential.

| Industry | 2024 Sales Growth | Market Size (2024) |

|---|---|---|

| Smart Logistics | +4.3% | Growing rapidly |

| Aerospace Fasteners | Strong | $8.5B by 2028 |

| Railway | Consistent | $280B, 3.5% growth |

Cash Cows

Bossard's standard catalog fastening products are a cash cow, providing steady revenue. These products serve many industrial clients, forming a stable business base. In 2024, this segment likely saw consistent sales, supported by Bossard's strong market position and distribution. These products, though not high-growth, contribute reliable cash flow.

Bossard Group, a distributor of industrial products, classifies its Fastening Technology catalog products as Cash Cows within its BCG Matrix. In 2023, Europe generated the most revenue for Bossard, indicating a strong market presence for these products there. Bossard's global presence spans Europe, America, and Asia. This product category likely enjoys high market share in mature markets.

Bossard's European market is a cash cow, contributing significantly to its financial health. Europe accounts for 58% of Bossard's sales, demonstrating its importance. In Q4 2024, Europe saw a 6.1% growth, reaching CHF 136.5 million. However, adjusted for acquisitions, growth was 0.1%.

Product Solutions

Bossard's "Product Solutions" are a cash cow, offering digital logistics solutions. These solutions help customers cut procurement costs across their supply chains. In 2024, Bossard's digital solutions saw increased adoption, boosting efficiency. This area consistently generates strong revenue and profit margins for the company.

- Digital solutions are integral to Bossard's cash flow.

- Focus is on reducing procurement costs.

- These solutions drive strong financial performance.

- They contribute significantly to overall profitability.

Global Distribution Network

Bossard Group's global distribution network operates as a cash cow due to its consistent revenue generation. As a major distributor of fasteners, Bossard connects manufacturers with diverse industries. Their business model integrates logistics, engineering, and consulting services. This ensures steady cash flow and market stability, key traits of a cash cow.

- Bossard's revenue in 2023 was CHF 1,096.7 million.

- They have a global presence with operations in over 30 countries.

- Bossard's net profit margin in 2023 was 7.2%.

- They provide solutions for over 100,000 customers.

Bossard's cash cows include standard fasteners and digital solutions, providing steady revenue. The European market, a key cash cow, saw 6.1% growth in Q4 2024. Digital solutions boosted efficiency and profitability.

| Cash Cow | Description | 2024 Data Highlights |

|---|---|---|

| Standard Fasteners | Catalog products for various industries | Consistent sales, stable revenue |

| Digital Solutions | Logistics solutions | Increased adoption, boosted efficiency, strong margins |

| European Market | Major revenue generator | Q4 growth of 6.1% (CHF 136.5 million) |

Dogs

Commoditized fastening products, facing fierce competition and minimal differentiation, fit the "Dogs" quadrant. These items likely hold low market share with slim profit margins. Bossard Group's 2024 financials reveal that such areas may strain resources. The firm should consider strategic actions, like divestiture, to boost profitability and reallocate resources effectively.

Bossard Group's "Dogs" category in America saw a significant downturn in 2024. Sales plummeted 27.9% to CHF 51.1 million in Q4 2024, reflecting weakened demand. The first half of 2024 showed an 11.7% sales decline to CHF 509.4 million. This drop was largely due to issues in electromobility and agriculture.

The strong Swiss franc negatively impacts sales in Asia, classifying these regions as potential dogs due to currency effects. The Swiss franc's appreciation in Asia was particularly notable in 2024, affecting profitability. In Q3 2024, Bossard's sales in Asia decreased by 8.7% due to currency impacts. Hedging and local sourcing should be explored to mitigate these fluctuations.

Products Facing Demand Normalization

The Bossard Group's "Dogs" category includes products where demand is normalizing after strong sales. This means growth rates are slowing down, and adjustments may be needed. Sales in America, for example, dropped 22.9% to CHF 65.8 million. This reflects a demand normalization since the prior year’s peak.

- Slower growth indicates a need for strategic shifts.

- Pricing or marketing adjustments are likely necessary.

- Normalization follows a period of high demand.

- America's sales decline highlights this trend.

Manual and Paper-Based Processes

Manual and paper-based processes at Bossard represent "Dogs" in the BCG Matrix. These outdated methods haven't transitioned to Bossard's ELAM software. This is because ELAM streamlines assembly with connected devices, real-time data, and traceability. The shift from manual to automated processes is essential.

- Bossard's 2024 revenue was CHF 1.16 billion.

- ELAM software adoption aims to boost efficiency.

- Manual processes often lead to higher error rates.

- Automated systems reduce operational costs.

Bossard's "Dogs" face low growth and market share, like commoditized fasteners. These products, including those in America, show declining sales and slim margins. Strategic action, such as divesting, is needed.

| Category | 2024 Sales Decline | Strategic Implication |

|---|---|---|

| America (Q4) | -27.9% | Divest or restructure |

| Asia (Q3) | -8.7% (due to currency) | Hedging and sourcing |

| Manual Processes | Inefficient | ELAM adoption |

Question Marks

The new IT platform's rollout across nine business units places it firmly in the question mark quadrant. Success hinges on sustained gains in efficiency, productivity, and customer satisfaction. Bossard must closely track performance, possibly using metrics like a 15% improvement in process time observed in initial tests. Ongoing adjustments are critical to ensure the platform delivers its intended value.

Acquisitions in Belgium and France, like Dejond Fastening NV and Aero Négoce International SAS, position Bossard as a question mark. These moves into new markets, including aerospace, introduce growth potential but also uncertainty. Bossard's success hinges on integrating these acquisitions effectively. In 2023, Bossard's revenue was CHF 1,163.8 million.

Bossard's Asian expansion, particularly in India and Malaysia, is currently in the question mark quadrant of the BCG matrix. The company saw strong sales growth of 11.8% in Q1 2025, reaching CHF 46.5 million. While China faced challenges, India and Malaysia showed double-digit growth, indicating potential. Strategic market evaluation and tailored strategies are crucial for maximizing returns.

Customized Items

Bossard Holding AG, a key player in industrial product distribution, offers Customized items within its Product Solutions. These items, while experiencing high demand, often yield low returns. This is primarily due to their low market share. For instance, in 2024, the segment's contribution to overall revenue was approximately 15%, yet profit margins remained under 8%.

- High demand, low returns.

- Low market share.

- Revenue contribution approx. 15% (2024).

- Profit margins under 8% (2024).

Industry 5.0 Initiatives

Bossard has been at the forefront of integrating intelligent production facilities aligning with Industry 4.0 principles. They showcase technologies like Smart Bin and ARIMS, which utilize the Internet of Things. These systems automate inventory tracking, reducing the need for manual orders.

- The Smart Bin technology can save up to 1,800 manual orders.

- Bossard's focus is on enhancing global supply chain management through automation and IoT.

- Industry 5.0 initiatives build upon Industry 4.0 by emphasizing human-machine collaboration and sustainability.

Question marks for Bossard represent high-potential but uncertain ventures. These initiatives, including IT platform rollouts and acquisitions, require careful monitoring. Strategic market evaluation is critical for maximizing returns. Customized items showed a 15% revenue contribution in 2024 with under 8% profit margins.

| Initiative | Status | Key Considerations |

|---|---|---|

| New IT Platform | Question Mark | Efficiency, Productivity Gains |

| Acquisitions | Question Mark | Integration, Market Expansion |

| Asian Expansion | Question Mark | Strategic market evaluation |

| Customized items | Question Mark | Low market share, lower profits |

BCG Matrix Data Sources

The Bossard Group's BCG Matrix uses financial statements, market analysis, and industry research to create its positions.