Bossard Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bossard Group Bundle

What is included in the product

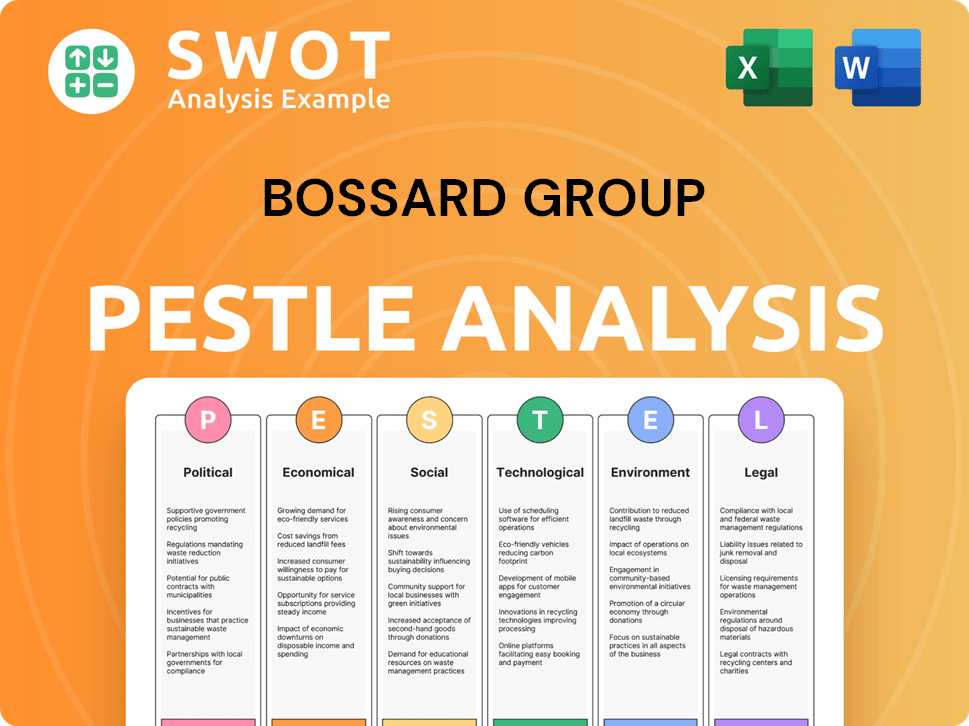

Provides a strategic assessment of external influences on Bossard Group using Political, Economic, etc. factors.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Bossard Group PESTLE Analysis

The preview presents the complete Bossard Group PESTLE Analysis.

It includes all the strategic insights and formatted data.

The content shown in the preview is the exact document you’ll download after payment.

This ready-to-use file helps analyze various factors.

Purchase and get immediate access!

PESTLE Analysis Template

Bossard Group faces a dynamic world shaped by multifaceted external forces. Our PESTLE analysis offers a concise overview of these influences. We dissect the political, economic, social, technological, legal, and environmental factors. This analysis allows a clear understanding of opportunities and risks impacting their strategies. Download the full PESTLE analysis and make informed decisions instantly.

Political factors

Trade policies and tariffs are crucial for Bossard Group. Changes in international trade, like tariffs, can alter import/export costs. In 2024, new tariffs on steel and aluminum could raise costs. These changes affect product competitiveness and raw material expenses, impacting the company's bottom line. For instance, a 10% tariff increase might reduce profit margins by 2-3%.

Political stability where Bossard operates is vital for business continuity. Manufacturing regulations impact operations and costs. For instance, the EU's new environmental rules in 2024/2025 add compliance burdens. Political shifts can change trade policies, affecting supply chains.

Geopolitical events significantly influence Bossard. Conflicts or political instability in core markets can disrupt supply chains. This impacts demand and creates business environment uncertainty. Bossard's global reach heightens its vulnerability to such disruptions. For example, in 2024, supply chain disruptions cost businesses worldwide an estimated $2 trillion.

Government initiatives in key industries

Government initiatives play a crucial role for Bossard. Support in sectors like electric vehicles or infrastructure boosts demand for their fastening solutions. The 'Make in India' initiative has notably benefited Bossard. For 2024, infrastructure spending in the U.S. is projected at $477 billion, creating opportunities.

- Infrastructure spending in the U.S. projected at $477 billion in 2024.

- 'Make in India' positively impacts Bossard's business.

Political risk in acquisition targets

When Bossard Group considers acquiring companies in new markets, it must assess political risks. These risks include government instability, policy changes, and potential trade barriers. Stable political environments with clear regulations are crucial for smooth integration. Political risk can significantly impact the success of an acquisition, affecting profitability and operations. For example, in 2024, political instability in certain regions led to a 15% decrease in foreign direct investment.

- Regulatory compliance costs can increase by up to 20% in unstable political environments.

- Political risk insurance premiums have risen by 10-15% in the last year due to increased global uncertainties.

- Acquisitions in politically unstable countries have a 30% higher failure rate.

Political factors greatly affect Bossard Group’s operations.

Changes in tariffs and trade policies can increase costs, impacting competitiveness.

Political stability and government initiatives are crucial for the company's success.

| Aspect | Impact | Example (2024) |

|---|---|---|

| Tariffs | Affects import/export costs and profit margins | Steel/aluminum tariffs may reduce profit margins by 2-3%. |

| Political Stability | Vital for supply chain continuity & investment. | Instability can decrease foreign direct investment by 15%. |

| Government Initiatives | Boosts demand; support sectors like EV and infrastructure | U.S. infrastructure spending: $477 billion. |

Economic factors

Bossard's success hinges on global economic growth and industrial output, especially in manufacturing. A slowdown in these areas can directly impact sales. In 2024, global industrial production growth is projected at around 2.8%, with varying regional performances. Economic uncertainty can indeed lead to decreased sales. The manufacturing sector's health is crucial for Bossard.

Fluctuations in currency exchange rates, especially a strong Swiss franc, pose challenges for Bossard. A stronger franc can make their products more expensive in foreign markets, potentially decreasing sales. For instance, in 2024, a 5% appreciation of the Swiss franc against the Euro could reduce reported revenue by a similar percentage. Currency risk management strategies are therefore critical.

Rising inflation increases operating costs, including labor and transportation, impacting profitability. Raw material costs, crucial for fastener production, are another significant economic factor. In 2024, Eurozone inflation averaged 2.4%, affecting business expenses. Steel prices, a key raw material, fluctuated, with potential impacts on Bossard's margins.

Interest rates and access to financing

Interest rate shifts affect Bossard's and its clients' borrowing expenses. Favorable financing is crucial for Bossard's operations and investments. The European Central Bank held rates steady in April 2024, impacting borrowing. Access to capital is critical for potential acquisitions and expansion. For example, in 2023, Bossard's net debt was CHF 155.5 million.

- ECB held rates steady in April 2024.

- Bossard's net debt in 2023 was CHF 155.5 million.

Market demand in key sectors

Bossard Group's market demand heavily relies on sectors like automotive (including e-mobility), electrical engineering, medical, railway, robotics, and aerospace. Economic conditions and investments in these sectors directly influence Bossard's sales performance. For instance, the automotive sector, a key driver, saw a global production increase of 9% in 2023, boosting demand for Bossard's fasteners. The rise in e-mobility, with increased battery production, also fuels demand.

- Automotive sector growth of 9% in 2023.

- E-mobility battery production expansion.

Bossard faces risks from global economic shifts. Manufacturing slowdowns and currency fluctuations, such as a strong Swiss franc, can curb sales. Rising inflation and interest rate changes impact costs and financing. Demand is tied to key sectors, like automotive, which grew 9% in 2023.

| Factor | Impact | 2024 Data/Forecasts |

|---|---|---|

| Industrial Output | Sales Impact | 2.8% global production growth (est.) |

| Currency Exchange | Sales/Revenue | CHF appreciation against EUR potentially reduces revenue |

| Inflation | Operating Costs/Margins | Eurozone avg. 2.4% |

Sociological factors

Bossard relies on skilled labor in engineering and logistics, which are crucial for its services. Regions' demographic shifts and educational attainment impact talent pools. For example, in 2024, the demand for skilled workers in Switzerland, where Bossard has a significant presence, remained high, with a focus on technical and vocational training. This impacts recruitment costs and operational efficiency.

Customers now demand comprehensive solutions, not just products, alongside robust technical support and streamlined inventory control. Bossard's 'Proven Productivity' initiative directly responds to this shift. In 2024, the demand for integrated solutions grew by 15% in key markets. Smart Factory solutions are also vital.

An aging global population boosts demand in medical and life science sectors, key for Bossard. This demographic shift influences fastener needs for medical devices. The global geriatric population is projected to reach 1.4 billion by 2030, increasing demand. Healthcare spending is expected to reach $11.2 trillion by 2025.

Urbanization and infrastructure development

Urbanization and infrastructure development significantly boost demand for construction and industrial fasteners. Bossard benefits from these trends by supplying essential components for projects globally. The global construction market is projected to reach $15.2 trillion by 2030, creating substantial opportunities. Bossard's revenues in 2024 were CHF 1.07 billion.

- Construction spending in the US increased by 10.7% in February 2024.

- Bossard's strategic focus includes expanding into high-growth regions.

- Infrastructure investments are a key driver for the fastener market.

- The Asia-Pacific region is expected to see the most rapid urbanization.

Awareness of sustainability and ethical practices

Societal focus on sustainability and ethics shapes how companies operate. Customers and stakeholders now demand responsible practices. Bossard Group must show commitment to ethical sourcing and supply chain management. These expectations are critical for maintaining a positive brand image and attracting environmentally conscious investors. For example, in 2024, sustainable investments reached over $40 trillion globally.

- Growing consumer demand for eco-friendly products.

- Increased scrutiny of supply chain labor practices.

- Investor pressure for ESG (Environmental, Social, and Governance) compliance.

- Rising regulatory requirements for sustainability reporting.

Societal shifts toward sustainability and ethics require Bossard to adopt responsible practices. Demand for eco-friendly products, as seen in the US where sustainable product sales surged by 20% in early 2024, is escalating. Bossard must address these expectations for a strong brand image and investor trust. ESG investments exceeded $40 trillion globally in 2024.

| Aspect | Details | Impact for Bossard |

|---|---|---|

| Sustainable Demand | 20% growth in US sustainable product sales (early 2024). | Adapt product offerings & sourcing. |

| ESG Investments | Over $40T globally in 2024 | Maintain ESG compliance for investment. |

| Ethical Concerns | Rising focus on labor practices | Ensure ethical supply chain. |

Technological factors

The rise of Industry 4.0 and smart manufacturing significantly impacts Bossard. Their Smart Factory solutions align with these trends. In 2024, the smart factory market was valued at $95.5 billion, projected to reach $156.5 billion by 2029. Bossard's offerings, like automated inventory, are key.

Advancements in fastening technology are critical. Continuous innovation in materials, designs, and application methods is key. Bossard's technical consulting ensures they offer cutting-edge solutions. In 2024, Bossard invested CHF 14.5 million in R&D, showcasing their commitment to staying ahead.

Bossard Group's success hinges on strong IT infrastructure and digitalization. They use advanced ERP systems to streamline global operations. This includes supply chain management and customer relationship management. Digital tools enhance services and internal workflows. In 2024, IT spending in manufacturing hit $90 billion.

Automation and robotics

Automation and robotics significantly shape Bossard Group's market. Customers' adoption of automated assembly lines directly impacts the demand for specialized fasteners and assembly solutions. Bossard must ensure its products are compatible with these advanced manufacturing systems. This trend is reflected in the growing market for automated assembly components, which is expected to reach $12.5 billion by 2025.

- Robotics market growth: projected to reach $214 billion by 2026.

- Automation in manufacturing: increasing efficiency and precision.

- Bossard's focus: developing solutions for automated assembly.

Data analytics and artificial intelligence (AI)

Bossard Group can significantly benefit from data analytics and AI. These technologies can refine demand forecasting, helping to predict market needs more accurately. Moreover, AI facilitates inventory optimization, ensuring the right parts are available when needed. AI also improves internal efficiency through automation. In 2024, the global AI market was valued at $234.8 billion, with projections soaring to $1.81 trillion by 2030.

- Improved demand forecasting with AI.

- AI-driven inventory optimization.

- Enhanced customer service through data analysis.

- Automation of internal processes.

Technological advancements drive Bossard Group's growth, with a strong focus on smart manufacturing and automation, alongside increasing investments in R&D. The smart factory market is expanding, and Bossard is well-positioned to benefit. Data analytics and AI are also critical, optimizing inventory and improving forecasting.

| Technology Area | Impact on Bossard | 2024-2025 Data |

|---|---|---|

| Industry 4.0 & Smart Manufacturing | Smart Factory solutions align with market trends | Smart factory market projected to reach $156.5B by 2029. |

| Fastening Technology | Innovation in materials & methods enhances offerings | Bossard invested CHF 14.5 million in R&D in 2024. |

| IT & Digitalization | Enhances global operations, supply chain, and CRM | IT spending in manufacturing hit $90B in 2024. |

Legal factors

Bossard faces complex product safety and quality standards across diverse industries and regions. They must meet these standards to maintain customer trust and avoid potential legal issues. In 2024, product recalls cost businesses an average of $12 million, highlighting the risks of non-compliance. Compliance is essential for business continuity, with 80% of consumers prioritizing product safety.

Supply chain regulations are intensifying. Bossard must navigate increasing rules on transparency, ethical sourcing, and due diligence. This impacts supplier relations and value chain compliance. In 2024, the EU's Corporate Sustainability Reporting Directive (CSRD) expanded reporting requirements, influencing Bossard's operations. These regulations drive up compliance costs, affecting profitability.

Bossard Group, operating globally, must adhere to intricate trade compliance and customs regulations. These include import/export laws across various countries, influencing operational efficiency. For instance, changes in EU customs regulations in 2024/2025 could affect supply chain lead times. Non-compliance can lead to significant financial penalties. In 2023, companies faced an average of $200,000 in fines for trade violations.

Employment and labor laws

Bossard Group must adhere to varied employment and labor laws across its global operations. These regulations encompass working conditions, wages, and employee rights, differing significantly by country. Non-compliance can result in substantial legal and financial penalties, affecting profitability. For example, in 2024, the European Union introduced stricter labor laws.

- Compliance costs can increase operational expenses by up to 5% in some regions.

- Legal disputes related to labor laws increased by 10% in 2024.

- Employee training on new labor laws is essential.

Acquisition and merger regulations

Bossard Group's acquisitions and mergers must adhere to global anti-trust laws. Regulatory approval is crucial, particularly in regions with strict rules. For instance, the EU's merger control saw about 2,500 notifications in 2024. Failure to comply can lead to significant penalties, delaying or even blocking deals. Bossard's compliance strategy includes thorough due diligence and legal counsel.

- EU merger control saw around 2,500 notifications in 2024.

- Failure to comply can lead to significant penalties.

Bossard must meet diverse global standards for product safety. This includes avoiding product recalls, which can cost millions. EU's 2024 CSRD expands reporting needs, increasing compliance costs, and trade laws demand adherence.

| Regulation | Impact | 2024 Data |

|---|---|---|

| Product Safety | Risk of recalls and legal issues | Average cost of recalls $12M |

| Trade Compliance | Affects supply chain lead times | Avg. fines for violations $200,000 |

| Employment Laws | Compliance penalties | EU introduced stricter laws |

Environmental factors

The rising global emphasis on sustainability and environmental protection intensifies regulations on materials, waste, and emissions. Bossard must assess its products' and operations' environmental footprint. For example, EU's Green Deal aims to cut emissions by 55% by 2030. This will affect supply chains and product design.

Customer preferences are shifting towards sustainability, boosting demand for eco-friendly products. This trend is particularly relevant for Bossard, influencing the need for fasteners made from recycled materials. For example, the global market for green building materials is projected to reach $426.4 billion by 2025, indicating significant growth potential. This shift pushes for lighter, energy-efficient designs, aligning with sustainability goals. Bossard can capitalize on this by offering innovative, sustainable fastening solutions.

Resource availability and costs are critical for Bossard. Environmental regulations and resource scarcity affect the cost of raw materials like steel, impacting production expenses. For instance, steel prices saw fluctuations in 2024, influenced by global supply chain issues. This directly impacts Bossard's profitability. The company needs to manage these risks.

Climate change and extreme weather events

Climate change poses rising risks to Bossard Group's operations and supply chains. Extreme weather events, intensified by climate change, could disrupt logistics and manufacturing. These disruptions can lead to higher costs and reduced efficiency. The World Bank estimates that climate change could push 100 million people into poverty by 2030.

- Increased frequency of extreme weather events.

- Potential supply chain disruptions.

- Rising operational costs due to climate-related impacts.

- Growing stakeholder pressure for sustainability.

Waste management and recycling

Waste management and recycling are key environmental factors impacting Bossard. Integrating recycled materials and ensuring product recyclability are crucial. The global waste management market is projected to reach $2.5 trillion by 2028. Bossard's sustainable practices can enhance its brand image and reduce environmental impact.

- Global recycling rates remain low, with about 9% of plastic waste recycled.

- The EU's Circular Economy Action Plan aims to boost recycling and reduce waste.

- Companies that prioritize sustainability often see improved financial performance.

Environmental factors significantly impact Bossard through regulations on emissions and materials. Sustainability trends, like the green building materials market projected at $426.4 billion by 2025, shape customer demand. Climate change and resource scarcity increase risks, potentially raising costs and disrupting supply chains.

| Factor | Impact | Data |

|---|---|---|

| Regulations | Affect materials and emissions | EU aims to cut emissions by 55% by 2030 |

| Customer Preference | Demand for eco-friendly products | Green building market to $426.4B by 2025 |

| Climate Change | Supply chain disruption, cost rises | World Bank: 100M in poverty by 2030 |

PESTLE Analysis Data Sources

Our PESTLE utilizes diverse data: financial reports, industry research, government publications, and policy updates. This ensures a data-driven analysis of Bossard's environment.