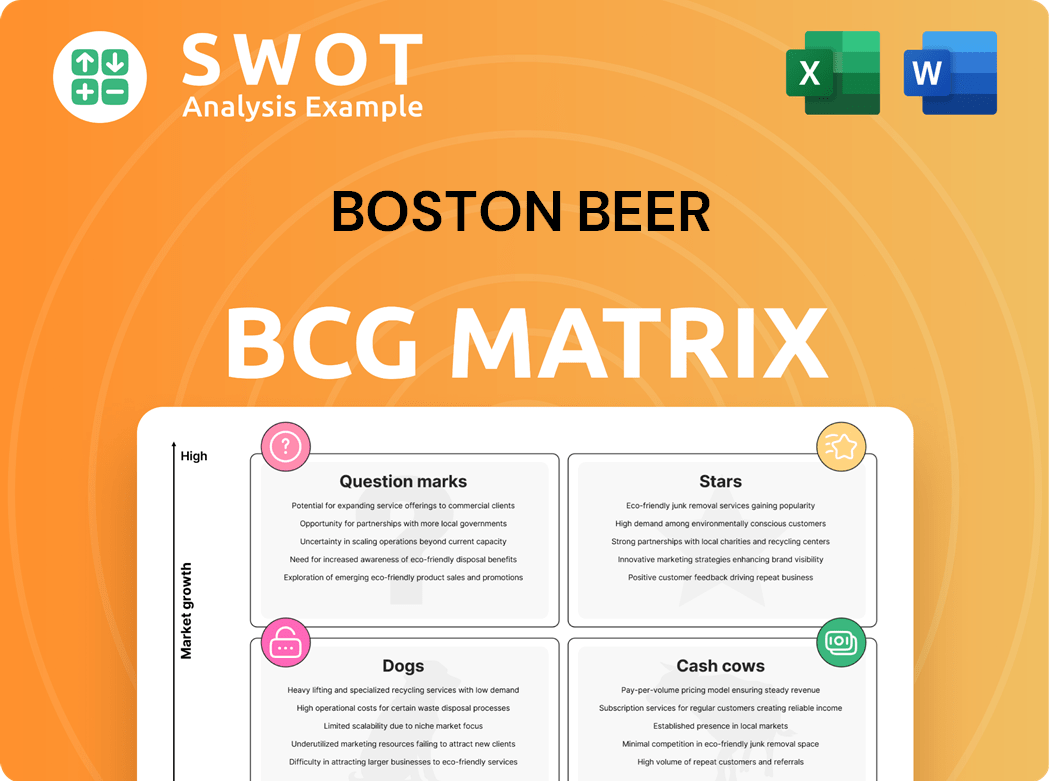

Boston Beer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boston Beer Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

BCG Matrix gives a clear picture of Boston Beer's portfolio, aiding in resource allocation.

Full Transparency, Always

Boston Beer BCG Matrix

The preview showcases the complete Boston Beer BCG Matrix document you'll receive after buying. It's the final, ready-to-use report, offering a clear strategic view without any alterations. This purchased version is designed for in-depth analysis and immediate application. The purchased document is identical to what you see now.

BCG Matrix Template

Boston Beer's BCG Matrix offers a snapshot of its diverse portfolio. Identifying product stars and cash cows is crucial for resource allocation. This reveals which brands drive growth and which provide steady income. Understanding question marks helps guide innovation decisions, while dogs reveal potential areas for restructuring. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Twisted Tea is a star within Boston Beer's portfolio. It shows consistent growth and a leading 84% market share in the hard tea segment. The brand’s success stems from strong consumer appeal. Twisted Tea continues to be a key driver for Boston Beer.

Hard Mountain Dew has experienced notable growth since its launch. Its distinctive taste and strong brand recognition position it as a star in Boston Beer's portfolio. The strategic shift of Hard MTN Dew's distribution to Boston Beer's network, starting in May 2024, is expected to boost performance. This transition is projected to positively impact sales throughout 2025. In 2024, Boston Beer's depletions decreased 1.4%, but Hard Mountain Dew is a growth driver.

Sun Cruiser, Boston Beer's vodka iced tea, is off to a strong start. The brand's success in initial markets has prompted ambitious expansion plans. Distribution points are set to triple by mid-2025. This move highlights the company's confidence in growth and innovation. The Boston Beer Company's net revenue for Q3 2024 was $537.4 million.

Samuel Adams (Seasonal Brews)

Samuel Adams' seasonal brews shine as stars within Boston Beer's portfolio. These craft beers, appealing to a niche market, drive revenue and brand loyalty. Their distinctive flavors cater to evolving consumer tastes, ensuring a strong position in the craft beer sector. The company's focus on innovation and seasonal offerings has been a key factor in maintaining its market share. In 2024, Boston Beer saw sales influenced by these seasonal releases, contributing to overall financial performance.

- Focus on seasonal releases boosts brand visibility.

- Craft beer popularity continues to rise.

- Innovation in flavors drives consumer interest.

- Seasonal brews contribute significantly to revenue.

Innovation in Emerging Categories

Boston Beer showcases innovation in emerging categories, especially in craft beer and hard seltzer. Brands like Twisted Tea and Sun Cruiser highlight market expansion efforts. The company navigates competitive pressures effectively. In Q3 2024, Boston Beer saw a 1.7% increase in depletions. This shows successful operational cost management.

- Twisted Tea's volume grew by 25% in Q3 2024.

- Sun Cruiser's sales are increasing.

- Boston Beer's operating income rose in 2024.

- The company's focus is on innovation.

Boston Beer's stars include Twisted Tea, Hard Mountain Dew, Sun Cruiser, and Samuel Adams' seasonal brews. These brands drive growth with strong market positions. Innovation and effective distribution fuel their success.

| Brand | Category | Key Metric (2024) |

|---|---|---|

| Twisted Tea | Hard Tea | 84% Market Share |

| Hard Mountain Dew | Hard Soda | Growth Driver |

| Sun Cruiser | Vodka Iced Tea | Expansion in 2025 |

| Samuel Adams | Craft Beer | Seasonal Sales |

Cash Cows

Samuel Adams' flagship beers, despite market challenges, remain cash cows, consistently generating revenue due to strong brand recognition. In 2024, Boston Beer reported a net revenue of $499.2 million in Q1, indicating continued sales. However, the reliance on these established brands limits growth potential, impacting Boston Beer's overall expansion.

Angry Orchard, a decade-long leader in hard cider, remains a cash cow for Boston Beer. Despite growing competition, it retains a significant market presence. In 2020, Angry Orchard's sales hit $222.4 million, making it the top-selling cider brand. It held a 50% share of the U.S. cider market in 2021, showcasing its robust financial performance.

Boston Beer's distribution network is a cash cow, efficiently delivering products. With 500 sales reps, it reaches retailers and operators. This network supports brands like Truly and Samuel Adams. In 2024, the company's focus is on enhancing distribution for growth.

Contract Brewing

Boston Beer's contract brewing strategy is a cash cow, offering a reliable revenue stream. This hybrid model combines in-house production with third-party breweries. It allows Boston Beer to manage demand and control costs effectively. Contract brewing and packaging represented approximately 24% of their output in 2024.

- Hybrid production model.

- Flexibility in meeting demand.

- Cost optimization.

- 24% output from contract in 2024.

Brand Equity

Boston Beer Company's brand equity is a significant cash cow, ensuring consistent revenue. Its robust reputation and consumer trust foster reliable cash generation. The company's pioneer status in the U.S. craft beer market bolsters its financial stability. In 2024, Boston Beer's net revenue was approximately $1.9 billion, reflecting its strong brand. The brand's value supports sustained profitability.

- 2024 Net Revenue: Approximately $1.9 billion

- Strong brand reputation drives consumer loyalty.

- Pioneer in the craft beer movement.

- Consistent revenue streams.

Cash cows for Boston Beer include established brands like Samuel Adams, Angry Orchard, its distribution network, and contract brewing. These generate steady revenue, supported by the company's brand equity and consumer trust. In 2024, Boston Beer's net revenue was approximately $1.9 billion.

| Cash Cow | Description | 2024 Data |

|---|---|---|

| Samuel Adams | Flagship beer brand | Q1 net revenue $499.2M |

| Angry Orchard | Leading hard cider | Market share: ~50% (2021) |

| Distribution Network | Efficient product delivery | 500 sales reps |

| Contract Brewing | Hybrid production model | ~24% output |

| Brand Equity | Strong brand reputation | Net Revenue: ~$1.9B |

Dogs

Some of Boston Beer's smaller beer brands, like Dogfish Head, might be "Dogs" due to waning interest. Revitalizing these brands demands heavy investment, potentially with limited returns. In 2023, a $42.6 million impairment charge hit Dogfish Head. This reflects challenges in a competitive market.

Legacy beer products from Boston Beer, like Samuel Adams, face tough competition. Traditional beer segments show reduced profitability. These beers have limited growth potential currently. Boston Beer shifted to diversify its offerings, notably with Truly hard seltzer. In 2023, Boston Beer's net revenue was about $2.0 billion.

Dogs, in the Boston Consulting Group (BCG) Matrix, represent underperforming product lines with minimal growth prospects. These lines, holding low market share in low-growth markets, often drain resources. Boston Beer's product lines may fall into this category. In 2024, Boston Beer's net revenue decreased by 2.3%, reflecting challenges in some product segments. These units typically break even, consuming cash without significant returns.

Acquired Brands Not Meeting Expectations

Boston Beer faces challenges with acquired brands that haven't met expectations. These underperforming brands, like Dogfish Head, may need significant restructuring. In 2023, the company took a $42.6 million non-cash impairment charge primarily for the Dogfish Head brand. This reflects difficulties in integrating and growing certain acquisitions.

- Dogfish Head's impairment charge of $42.6 million in 2023.

- Focus on turning around underperforming acquired brands.

- Difficulty in integrating and growing acquired brands.

- Impact on overall financial performance.

Products with Minimal Market Share

In the Boston Beer BCG Matrix, "Dogs" are products with minimal market share and low growth rates. These products, like some of Boston Beer's less popular brands, may be candidates for divestiture. Such products should ideally be avoided or minimized. Expensive turnaround plans rarely yield positive results; for instance, in 2024, Boston Beer's focus was on core brands.

- Low market share and growth.

- Potential for divestiture.

- Avoid or minimize these products.

- Turnaround plans are usually ineffective.

Dogs in Boston Beer's BCG Matrix, like Dogfish Head, struggle with low market share and growth. These brands, often acquired, underperform and require restructuring. In 2023, a $42.6 million impairment charge highlighted their financial strain.

| Category | Description | 2023 Data |

|---|---|---|

| Financial Impact | Impairment Charges | $42.6M (Dogfish Head) |

| Market Share | Low compared to core brands | Decreasing in some segments |

| Growth Rate | Limited, often negative | Boston Beer's net revenue decreased by 2.3% in 2024 |

Question Marks

Truly Hard Seltzer, once a high-growth product, now struggles in the competitive hard seltzer market. Boston Beer's Truly saw its market share at 15.2% in Q4 2023. Total revenue for Truly reached $773.4 million. The company is trying to boost sales.

Hard kombucha is a question mark for Boston Beer's BCG matrix, signifying high growth with low market share. To succeed, the company must boost marketing and distribution efforts. The U.S. alternative adult beverage market is expanding, with hard kombucha's popularity increasing. In 2024, hard kombucha sales are projected to reach $150 million.

CBD/THC-infused beverages are in the question mark quadrant for Boston Beer. This market is experiencing rapid growth, but faces regulatory hurdles. Consumer acceptance is key, especially with younger demographics. The global cannabis beverage market was valued at $963.8 million in 2023, and is expected to reach $3.8 billion by 2028.

RTD Mocktails

RTD mocktails present a high-growth opportunity for Boston Beer, fitting the "Question Mark" quadrant in a BCG matrix due to their uncertain future. The market is expanding, with non-alcoholic beverage sales increasing. Boston Beer could leverage its distribution network but must address regulatory hurdles and consumer preferences. Recent data shows the non-alcoholic beverage market is valued at billions, with RTD mocktails contributing significantly to growth.

- Market growth in non-alcoholic beverages is substantial, with RTD mocktails as a key driver.

- Regulatory challenges and consumer acceptance are crucial factors.

- Boston Beer's existing infrastructure could be an advantage.

- The financial data shows that the global non-alcoholic beverage market was valued at USD 919.78 billion in 2023.

Emerging AABs

Emerging Alcohol Alternative Beverages (AABs) like hard tea and hard coffee represent "Question Marks" in Boston Beer's BCG Matrix. These products have potential but require strategic decisions. The company must quickly increase market share to avoid becoming "Dogs," or low-growth, low-share products. The best approach involves either significant investment to gain market dominance or divesting these offerings.

- Hard seltzer sales in 2024 are projected to reach $4.5 billion.

- Boston Beer's Truly brand faces competition in the hard seltzer market.

- On-premise craft mocktails represent a growing segment.

- The company's strategic decisions will determine the future of these AABs.

Boston Beer views hard kombucha as a question mark, focusing on high growth with low market share. The hard kombucha market is projected to hit $150 million in sales in 2024. Success demands strong marketing and distribution to gain traction in the expanding U.S. alternative adult beverage market.

| Product | Growth Status | Market Share |

|---|---|---|

| Hard Kombucha | High | Low |

| CBD/THC Drinks | Rapid | Low |

| RTD Mocktails | High | Low |

BCG Matrix Data Sources

The Boston Beer BCG Matrix leverages company financials, market growth analyses, and industry reports for robust positioning.