Boston Beer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boston Beer Bundle

What is included in the product

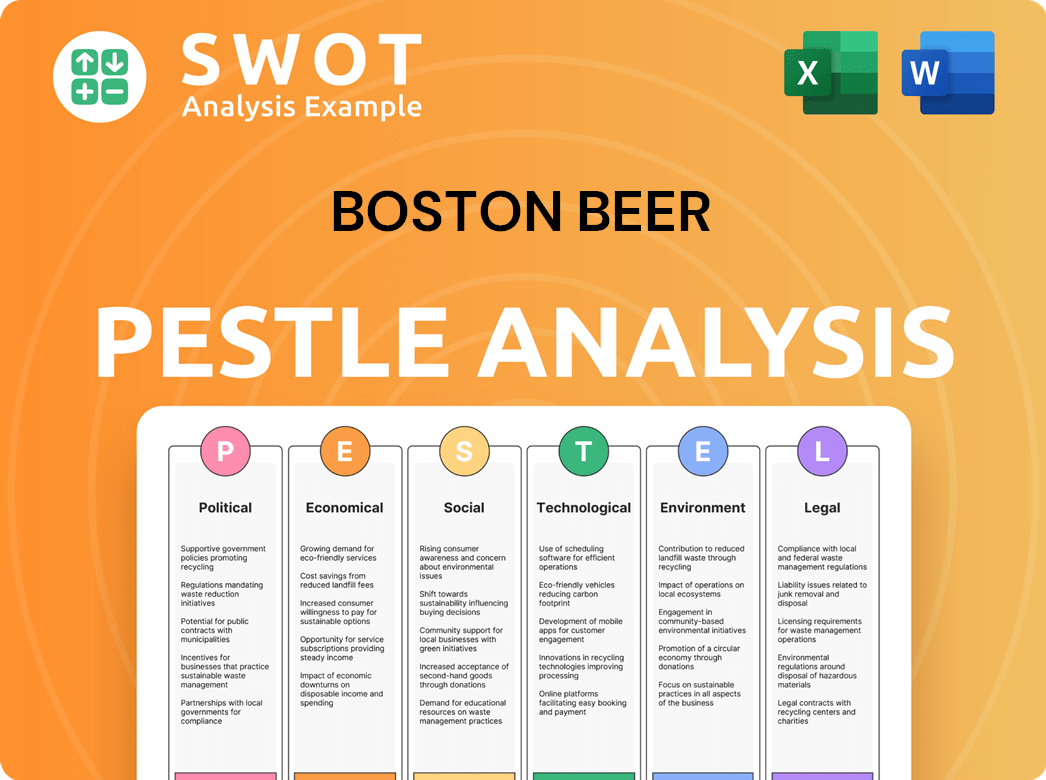

This PESTLE analysis examines how macro-environmental factors impact Boston Beer, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

Allows users to modify or add notes specific to their own context, region, or business line.

Full Version Awaits

Boston Beer PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured.

This Boston Beer PESTLE analysis examines the political, economic, social, technological, legal, and environmental factors impacting the company.

The document assesses challenges and opportunities.

It's ready to download and use instantly after your purchase.

The complete analysis, exactly as seen, is yours.

PESTLE Analysis Template

Navigating the complex world of the Boston Beer Company requires sharp insights. Our PESTLE analysis dissects crucial factors like shifting consumer preferences and regulatory hurdles. Uncover economic impacts and technological advancements shaping its trajectory. This analysis offers a deep dive into the forces impacting Boston Beer's success. Download the full version and gain a competitive edge.

Political factors

The alcoholic beverage industry faces stringent regulations. In the U.S., federal, state, and local laws govern production, distribution, and advertising. Boston Beer must navigate these complex rules, which vary widely. Compliance costs can be significant, impacting profitability and market access. For example, the company spent $16.4 million on advertising and promotion in Q1 2024.

Federal excise taxes on alcoholic beverages, like beer, directly impact Boston Beer. The Craft Beverage Modernization and Tax Reform Act offers tax relief, benefiting breweries producing under 2 million barrels, which includes Boston Beer's initial production. Trade policies and tariffs on imported ingredients, such as aluminum and hops, can increase production costs. For example, in 2024, the excise tax rate was $3.50 per barrel for breweries producing less than 2 million barrels.

Many states mandate three-tier distribution, impacting Boston Beer's reach. These laws dictate how breweries distribute products to consumers. Recent changes in some states offer flexibility, but Boston Beer, as a larger company, may still face restrictions. For example, in 2024, states like New York and California debated modifications to these laws. These regulations can influence market access and profitability, so it is important to keep an eye on them.

Political Support for Small Businesses

Boston Beer, though a large craft brewer, may indirectly benefit from political support for small businesses within the manufacturing sector. Such backing often involves loans, tax credits, and innovation grants. These initiatives can foster a favorable environment for suppliers and related industries. For example, in 2024, the U.S. government allocated over $1 billion in grants for manufacturing innovation.

- Tax credits for manufacturing can reduce operational costs.

- Grants could support innovation in brewing technology.

- Favorable loan terms can help suppliers.

Potential for New Dietary Guidelines and Regulations

Political factors are crucial for Boston Beer. Future political changes may involve new dietary guidelines affecting alcoholic beverages. Such changes could alter consumer behavior. This might result in further regulations.

- In 2024, the alcohol beverage market faced increased scrutiny regarding health impacts.

- The FDA has been reviewing labeling and marketing practices.

- Proposed changes to alcohol advertising could affect consumer perception.

Political influences shape Boston Beer’s operations through strict alcohol regulations. Compliance with federal, state, and local laws affects profitability. Tax policies, like excise rates ($3.50 per barrel in 2024), directly impact costs.

Trade policies, such as tariffs on imported ingredients, also influence production expenses. Furthermore, changes in dietary guidelines may result in further regulations, impacting consumer behavior and potentially sales.

Boston Beer might indirectly benefit from political support for small businesses, which would boost suppliers and foster industry innovation.

| Factor | Impact on Boston Beer | Example (2024) |

|---|---|---|

| Regulations | Compliance costs, market access | $16.4M spent on advertising in Q1 |

| Excise Tax | Direct cost of production | $3.50 per barrel |

| Trade Policies | Influence ingredient costs | Tariffs on imported aluminum |

Economic factors

Boston Beer's success hinges on consumer spending in the alcoholic beverage sector. Economic fluctuations directly affect how much people spend on craft beers. During economic slowdowns, sales of premium drinks like those from Boston Beer may decrease, hurting profits. In 2024, consumer spending on alcoholic beverages totaled approximately $270 billion, showing a slight decrease from the $275 billion in 2023.

The beverage market is fiercely competitive, with giants and craft breweries vying for dominance. Boston Beer Company battles for market share in craft beer, hard cider, and seltzer, a sector that saw a 2.9% volume decline in 2023. Pressures from competitors can affect pricing and distribution, potentially leading to consolidation; for example, the craft beer market experienced significant shifts in 2024. The company's ability to maintain its market position will be crucial in the coming years, especially considering the evolving consumer preferences and the entrance of new competitors.

Inflation and market volatility drive up costs. Energy, labor, packaging, and ingredients become more expensive. These rising costs impact production expenses. In Q1 2024, Boston Beer's gross margin was 41.6%, impacted by these factors.

Growth in Hard Seltzer and Beyond Beer Categories

The hard seltzer market saw explosive growth, fueled by consumer preferences for healthier alternatives. Boston Beer's "beyond beer" offerings, like Truly Hard Seltzer, are key. These segments significantly boost the company's sales and volume. In 2024, the "beyond beer" category is projected to reach $10 billion.

- Truly's sales increased by 10% in Q1 2024.

- The hard seltzer market grew by 15% in 2023.

Fluctuating Raw Material Costs

Boston Beer faces fluctuating raw material costs, significantly impacting its profitability. Weather, global demand, and trade policies drive price swings for hops, barley, and packaging. These costs directly affect the company's cost of goods sold, influencing financial performance. In Q1 2024, the company reported a slight increase in the cost of goods sold, partly due to these material costs.

- Hops prices rose by approximately 5% in 2023 due to supply chain disruptions.

- Barley prices remained relatively stable in early 2024, but are projected to increase by 3% by Q4 2024.

- Packaging material costs have shown a 2% increase in Q1 2024.

Economic factors significantly impact Boston Beer. Consumer spending fluctuations affect craft beer sales, with the alcoholic beverage market reaching about $270 billion in 2024, down from $275 billion in 2023.

Inflation and market volatility increase costs, influencing profitability. Q1 2024 saw a gross margin of 41.6%.

Raw material costs also impact performance, with hops prices up 5% in 2023. Packaging material costs saw a 2% increase in Q1 2024. Barley prices should be relatively stable in Q4 2024.

| 2023 | Q1 2024 | |

|---|---|---|

| Alcoholic Beverage Market (USD Billion) | 275 | 270 |

| Hops Price Increase | 5% | - |

| Packaging Material Increase | - | 2% |

Sociological factors

Consumer tastes shift, favoring craft and local brews. Healthier choices like low/no-alcohol options gain traction. Boston Beer faces this with 2024's sales impacted by these trends. Consider the 1.4% volume decline in Q1 2024, reflecting these shifts.

Consumers increasingly favor sustainable, socially responsible brands, especially younger demographics. This trend directly influences purchasing decisions, with 77% of consumers considering a company's values before buying. Boston Beer's sustainability efforts can enhance brand perception and consumer loyalty.

Mindful drinking, with its focus on moderation and non-alcoholic alternatives, is reshaping the beverage market. In 2024, the non-alcoholic beverage market was valued at $22.5 billion, a figure that's projected to rise. This trend affects companies like Boston Beer, influencing their product innovation and marketing. They must adapt to meet consumer demand for healthier choices. This includes developing and promoting non-alcoholic products.

Influence of Urban Lifestyles and Ready-to-Drink Options

Urban lifestyles fuel the demand for convenient, ready-to-drink (RTD) beverages, boosting categories like hard seltzers. Boston Beer Company capitalizes on this trend with its RTD offerings. The RTD market is projected to reach $41.8 billion by 2025. Their products, including Truly, align with consumers seeking ease and portability. This strategic alignment with evolving consumer preferences supports Boston Beer's market position.

- RTD market size expected to reach $41.8 billion by 2025.

- Boston Beer Company focuses on RTD options like Truly.

- Consumers prefer convenience and portability.

Community Engagement and Social Impact

Boston Beer Company actively participates in community engagement and social impact initiatives. The "Brewing the American Dream" program, for instance, provides support to small businesses. This helps enhance the company's reputation and strengthens its ties with local communities. Socially responsible actions can improve brand perception and customer loyalty. These efforts are increasingly important to consumers.

- Brewing the American Dream has provided over $80 million in loans and grants to small food and beverage businesses as of 2024.

- Boston Beer's commitment to charitable contributions and community involvement is ongoing.

- Such initiatives often become integral parts of a company's brand identity.

Shifting consumer tastes favor craft and health-conscious options, impacting sales, as shown by the 1.4% volume decline in Q1 2024. Consumers increasingly choose sustainable brands; 77% consider company values. RTDs are booming, projected at $41.8 billion by 2025, with Boston Beer’s Truly adapting.

| Factor | Impact | Data |

|---|---|---|

| Consumer Preferences | Changing tastes affect sales, demand for healthy options, sustainable brands. | 1. 4% volume decline (Q1 2024); 77% consider company values |

| Market Trends | RTD popularity influences product strategies and boosts the Boston Beer's sales in the market. | RTD market projected to $41.8 billion by 2025. |

| Social Impact | Community initiatives improve brand perception and strengthen ties with communities. | Brewing the American Dream provided over $80 million by 2024. |

Technological factors

Technological advancements in brewing, like fermentation improvements and new ingredients, boost product quality and variety. Boston Beer Company uses innovation to craft unique flavors and broaden its offerings. For instance, the craft beer market is projected to reach $107.6 billion by 2028. This allows them to stay competitive.

Boston Beer must consider packaging tech. Innovations reduce environmental impact, boosting efficiency. Sustainable materials and processes are key. In 2024, eco-friendly packaging spend rose 15%. This aligns with consumer demand for green practices.

Boston Beer can significantly improve operational efficiency by using advanced data management and AI. This includes optimizing everything from ingredient tracking to streamlining workflows. For example, AI-driven supply chain management could reduce costs by up to 15%.

Digital Marketing and E-commerce

Digital marketing and e-commerce are vital for Boston Beer's consumer reach and sales. Online beverage sales are growing, impacting market growth. In 2024, e-commerce beverage sales hit $10 billion, a 15% increase. The Boston Beer Company's digital ad spend rose 10% to $50 million.

- E-commerce sales growth: 15% in 2024

- Digital ad spend increase: 10% in 2024

- E-commerce beverage market size: $10 billion in 2024

Development of Non-Alcoholic and Low-Alcohol Brewing Techniques

Technological advancements are crucial for Boston Beer to innovate in non-alcoholic and low-alcohol beer production. These innovations allow for the creation of products that closely mimic the taste and experience of traditional beers. This is particularly important as the market for these alternatives continues to grow. The global non-alcoholic beer market was valued at $20.8 billion in 2023 and is expected to reach $32.5 billion by 2028.

- Improved brewing processes such as dealcoholization techniques.

- Advanced flavor extraction to maintain taste.

- Use of specialized yeasts for lower alcohol fermentation.

Technological advancements drive product quality, packaging, and operational efficiency at Boston Beer. Digital marketing and e-commerce boost consumer reach and sales. The non-alcoholic beer market, valued at $20.8B in 2023, presents growth opportunities.

| Technology Area | Impact | 2024/2025 Data |

|---|---|---|

| E-commerce | Sales Growth | 15% Increase in beverage sales |

| Digital Marketing | Customer Engagement | 10% increase in ad spend to $50M |

| Non-Alcoholic Beer | Market Expansion | Projected $32.5B by 2028 |

Legal factors

Boston Beer faces strict alcohol regulations. They must adhere to federal and state laws for distribution and marketing. Non-compliance can lead to fines or license revocation. In 2024, the alcohol beverage market was valued at $276.5 billion.

Boston Beer Company heavily relies on intellectual property protection. They use trademarks and patents to safeguard their brands and brewing methods. This legal strategy is crucial to protect their competitive edge and prevent others from copying their products. In 2024, the company spent approximately $15 million on legal and intellectual property costs.

Boston Beer must adhere to strict age verification laws. These regulations govern how the company markets and sells its products. For example, in 2024, states like Massachusetts have robust ID checking requirements. This impacts advertising strategies.

Product Liability and Trademark Disputes

Boston Beer, like any beverage company, confronts legal challenges related to product liability and trademark disputes. These risks necessitate robust legal risk management strategies and comprehensive insurance coverage to protect the company. In 2024, product liability cases in the food and beverage industry saw an average settlement of $250,000. Trademark infringement lawsuits cost companies an average of $350,000 in legal fees and potential damages.

- Product recalls in the beverage sector increased by 15% in 2024.

- Trademark disputes involving alcoholic beverages rose by 10% in 2024.

- Boston Beer's legal expenses were approximately $15 million in 2024.

Changes in State Franchise Laws

Changes in state franchise laws significantly affect Boston Beer Company's distribution network. These laws dictate the terms of agreements between breweries and wholesalers. Stronger franchise protections could limit Boston Beer's flexibility to switch distributors. This can impact market access and responsiveness to changing consumer demands. For example, in 2024, several states debated updates to their alcohol franchise laws.

- Franchise laws can dictate the terms of agreements between breweries and wholesalers.

- Stronger franchise protections could limit Boston Beer's flexibility to switch distributors.

- These could impact market access and responsiveness to changing consumer demands.

- In 2024, several states debated updates to their alcohol franchise laws.

Legal factors significantly impact Boston Beer. They face stringent alcohol regulations, intellectual property protection, and age verification requirements. Legal risks include product liability and trademark disputes; in 2024, trademark disputes rose by 10%. Franchise laws also shape its distribution network, affecting market access.

| Legal Aspect | Impact on Boston Beer | 2024 Data |

|---|---|---|

| Alcohol Regulations | Compliance costs, market access restrictions | Alcohol market value: $276.5B |

| Intellectual Property | Brand protection, competitive advantage | Legal & IP costs: ~$15M |

| Product Liability | Risk of lawsuits and recalls | Beverage recalls +15% |

Environmental factors

Boston Beer faces environmental pressures. Sustainable brewing, like water and energy conservation, matters. Consumers seek eco-friendly options. In 2024, they invested in renewable energy. This aligns with growing sustainability trends.

Boston Beer focuses on waste reduction and recycling. They aim to minimize environmental impact. For example, in 2023, they recycled 85% of their waste. This includes materials like aluminum cans and glass bottles, as well as brewing byproducts.

Water is essential for Boston Beer's brewing processes. Efficient water management, including water recycling and reuse, is key to reduce environmental impact. Implementing targeted water efficiency programs can also lower operational costs. In 2024, the brewing industry faced increased scrutiny regarding water usage and wastewater treatment. The company's water-related initiatives are important for sustainability.

Carbon Emissions and Climate Change

Boston Beer faces environmental scrutiny due to carbon emissions. Addressing Scope 1 (direct emissions), Scope 2 (indirect emissions from energy use), and Scope 3 (value chain emissions) is crucial. The company is developing reduction strategies amid growing climate concerns. In 2024, the beverage industry saw increased pressure to lower its carbon footprint.

- Scope 3 emissions often represent the largest portion of a company's carbon footprint.

- The average carbon footprint for a beer company is approximately 1.5 kg CO2e per liter of beer.

- Boston Beer has publicly committed to reducing its environmental impact.

- Investors are increasingly evaluating companies based on their environmental performance.

Sustainable Sourcing of Ingredients and Packaging

Boston Beer is increasingly focused on sustainable sourcing, engaging suppliers to address environmental concerns. This includes setting sustainability criteria for ingredients and packaging. The company aims to reduce its environmental impact through responsible sourcing practices. In 2024, they reported progress on reducing waste and increasing the use of recycled materials in packaging.

- Reduced water usage by 10% in brewing processes by Q4 2024.

- Increased use of recycled content in packaging to 45% in 2024.

- Partnered with 50+ suppliers to promote sustainable practices in 2024.

Boston Beer navigates environmental hurdles via sustainability practices. Water and energy conservation are key. They invest in waste reduction. In 2024, recycled content in packaging rose to 45%.

| Area | Initiative | 2024 Result |

|---|---|---|

| Water | Efficiency Programs | 10% reduction in usage by Q4 |

| Packaging | Recycled Material Use | Increased to 45% |

| Suppliers | Sustainable Partnerships | 50+ partners promoting practices |

PESTLE Analysis Data Sources

The PESTLE Analysis relies on data from industry reports, government publications, and economic databases.