Bouygues Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bouygues Bundle

What is included in the product

Bouygues' BCG Matrix analysis offers tailored insights for its diverse portfolio. It highlights investment, hold, or divest strategies.

Easily create and share your BCG matrix with the drag-and-drop-ready PowerPoint design.

What You See Is What You Get

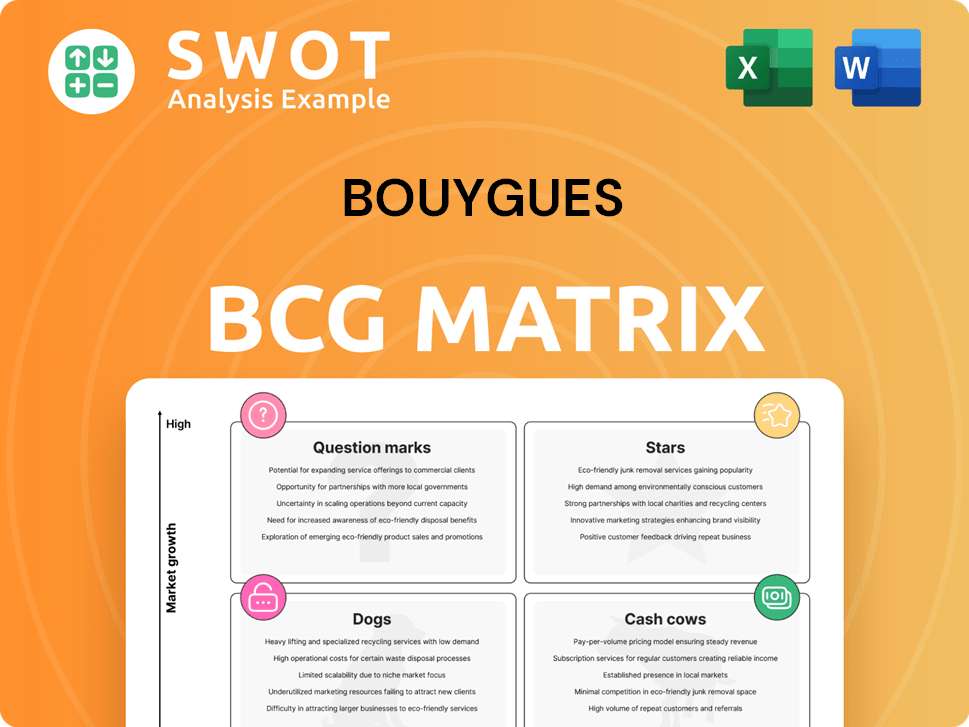

Bouygues BCG Matrix

The BCG Matrix displayed here is the complete document you receive. It's a fully functional report ready for immediate application, reflecting professional design and analysis.

BCG Matrix Template

See how Bouygues' diverse portfolio breaks down across the BCG Matrix. This reveals the growth potential and resource needs of each business unit. Question Marks need investment; Stars, continued support; Cash Cows, harvesting; Dogs, divestiture. Understanding these positions is crucial for strategic allocation. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Equans' strategic plan highlights significant growth prospects. The plan targets a COPA margin near 4% by 2025 and 5% by 2027. This focus on margin improvement is vital for Bouygues' profitability. Equans' strategic direction underscores leadership in the energy services sector.

Bouygues Construction's Civil Works division demonstrates strong growth. The backlog surged 43% year-on-year. This signals a strong market presence in infrastructure projects. The division leads its sector. It requires strategic support to sustain growth.

Bouygues Telecom's fixed broadband is a Star. In 2024, it saw substantial growth. The company added 615,000 FTTH customers. This brought the total to 4.2 million. Investments support its leading market position.

TF1+ Digital Performance

TF1+ is performing well in the digital space. In 2024, digital advertising revenue rose by 39% year-on-year, highlighting its attractiveness to advertisers. This growth signifies significant potential in the expanding digital advertising market, requiring continued investment. Strategic positioning is crucial to sustain this impressive growth and secure market share.

- 2024's 39% year-on-year growth in digital advertising revenue.

- TF1+ is capitalizing on the expanding digital advertising market.

- Sustained investment and strategic moves are essential for maintaining growth.

Sustainability Initiatives

Bouygues demonstrates a strong commitment to sustainability. They aim to achieve SBTi certification across all six business segments, signaling high-growth potential. Their focus on environmental and energy transitions aligns with global trends, boosting their image. Investing in sustainable solutions is key for long-term growth and market leadership.

- Bouygues targets a 40% reduction in its scope 1 & 2 emissions by 2030.

- The company allocated €3.2 billion to green investments in 2023.

- Bouygues Construction aims to increase its revenue from green projects to 50% by 2025.

Bouygues Telecom's fixed broadband is a Star, demonstrating strong growth. In 2024, it added 615,000 FTTH customers, reaching 4.2 million. Investments in its leading market position support ongoing success.

| Metric | Data | Year |

|---|---|---|

| FTTH Customer Growth | +615,000 | 2024 |

| Total FTTH Customers | 4.2 million | 2024 |

| Investment Focus | Leading Market Position | Ongoing |

Cash Cows

Colas, Bouygues' roads division, acts as a cash cow, showing stable performance and a large market share in a mature market. In 2023, Colas reported revenues of €15.2 billion, demonstrating strong revenue generation. This division provides essential road construction materials and services, ensuring consistent cash flow. Strategic infrastructure investments can boost efficiency and increase cash flow further.

Bouygues Telecom's mobile services are cash cows, holding a solid market share in a competitive sector. Bouygues added 2.8 million mobile plan customers, including La Poste Telecom subscribers. Generating substantial cash flow is a key strength. Efficiency and cost control are vital for boosting profitability. In 2024, the company's mobile revenue increased.

Bouygues Construction's Building division is a cash cow, supported by a robust market stance and ongoing projects. This segment consistently delivers revenue and cash flow, acting as a dependable income source. In 2024, the division's backlog saw steady growth. Enhancing efficiency and project management can further boost profitability within this established business unit.

Equans' Maintenance Contracts

Equans' maintenance contracts are a cash cow for Bouygues, generating consistent revenue. These contracts, being well-established, need minimal promotion. Focusing on efficiency boosts cash flow. In 2024, recurring revenue from maintenance contracts is expected to be stable.

- Stable revenue streams.

- Low investment needs.

- Efficiency focus.

- Predictable cash flow.

TF1 Linear TV Advertising

TF1's linear TV advertising, a cash cow for Bouygues, shows stable revenue. TF1, as a media leader, leverages its strong market position. Optimizing ad strategies is key to maintaining profitability. In 2023, TF1 reported €2.08 billion in revenue. This stability is crucial for Bouygues' financial health.

- Stable Revenue: TF1's advertising revenue remains consistent.

- Market Leader: TF1 benefits from its established market share.

- Strategic Focus: Optimization is key to maintaining profits.

- Financial Impact: Contributes significantly to Bouygues' cash flow.

Cash cows, like Colas and TF1, generate steady cash flow with low investment needs. They have a strong market presence, demonstrated by Colas’ €15.2 billion in 2023 revenue. Efficiency improvements boost profitability.

| Feature | Impact | Example |

|---|---|---|

| Stable Revenue | Predictable cash flow | TF1’s €2.08 billion in 2023 revenue |

| Low Investment | High profitability | Colas |

| Efficiency Focus | Enhanced cash flow | Bouygues Telecom |

Dogs

Bouygues Immobilier's commercial property arm is a Dog in the BCG matrix. Sales are stagnant, reflecting a low market share in a slow-growth market. In 2024, this segment saw minimal revenue growth. This area consumes resources without generating significant returns.

Equans' UK new-build business faces exit, signaling low growth and market share, fitting the "Dog" category. This segment strains resources without generating substantial returns. Bouygues' strategic focus in 2024 includes exiting underperforming areas. Divestiture could free up capital for better investments.

La Poste Telecom, a "dog" in Bouygues' BCG matrix, faces challenges. Its EBITDA contribution remains limited until 2028. The migration of mobile customers to Bouygues Telecom's network is key. Strategic alternatives may be needed if profitability doesn't improve. In 2024, Bouygues Telecom's revenue was €8.1 billion.

Challenging Real Estate Market

Bouygues Immobilier is navigating a tough real estate market. Residential unit reservations saw a year-over-year improvement, but commercial property activity is stalled. This situation suggests a 'dog' status in the BCG Matrix. The backlog decreased to about €0.9 billion, down 6% compared to the end of December 2023.

- Commercial property activity is stagnant.

- Residential unit reservations saw a year-on-year improvement.

- The backlog was around €0.9 billion.

- Backlog decreased by -6% compared to the end of December 2023.

Colas Rail and Roads (Flat Backlog)

The flat backlog in Colas Rail and Roads indicates stagnation. This suggests limited expansion within these sectors. Strategic assessment is crucial to explore revitalization or resource reallocation. Focus on optimizing current projects and minimizing investments. In 2024, Bouygues reported a slight decrease in Colas' order book.

- Flat Backlog: Signifies restricted growth.

- Strategic Review: Needed for sector viability.

- Resource Allocation: Consider shifting investments.

- Optimization: Prioritize current projects.

Several Bouygues segments, like commercial property and parts of Equans, are classified as Dogs. These areas show slow growth and low market share, as seen in 2024 revenue figures.

They often consume resources without generating significant returns, such as Equans' UK new-build business.

Strategic actions may involve exits or reallocations to improve financial performance.

| Segment | Status | Key Issue (2024) |

|---|---|---|

| Commercial Property | Dog | Stagnant sales; minimal revenue growth |

| Equans (UK New-Build) | Dog | Exit planned; low growth |

| La Poste Telecom | Dog | Limited EBITDA until 2028 |

Question Marks

TF1+ is a question mark, as it aims for high growth in digital markets with low market share. The marketing strategy focuses on market adoption. This expansion requires substantial investment. In 2024, TF1's revenue was €2.4 billion, with digital growth potential.

Equans' solar farm installations are a question mark in Bouygues' BCG matrix, showing high growth potential in the renewable energy sector. These projects, including data centers and hospitals, need significant upfront investment. In 2024, the global solar market grew, with installations increasing by 30% year-over-year, indicating substantial opportunities, especially in the EU. Strategic partnerships are crucial for success.

Bouygues Telecom's B.IG brand, a "question mark" in its BCG Matrix, focuses on family-friendly bundles. Launched in 2024, it aims for high growth with competitive pricing. This strategy requires substantial investment. Currently, Bouygues Telecom holds about 18.5% of the French mobile market share.

New Digital Innovation Opportunities

The Aduna venture, a collaboration between Bouygues Telecom and Free, exemplifies a question mark in Bouygues' BCG matrix, focusing on network APIs. These initiatives, while holding high growth potential, currently have a low market share. To succeed, significant investment in both development and marketing is crucial for capturing market share. This strategic move aligns with the broader trend of telecom operators exploring new revenue streams through digital innovation.

- Bouygues Telecom's revenue in 2023 was €8.1 billion.

- The European API market is projected to reach $2.2 billion by 2024.

- Bouygues Telecom invested €1.7 billion in its networks in 2023.

- Aduna aims to capture a portion of the growing API market.

International Expansion

Bouygues' international expansion efforts fit the "Question Mark" category in the BCG Matrix. This signifies high growth potential but uncertain market share. Expansion involves exploring new markets and strategic partnerships. Success demands robust market analysis and substantial investment.

- Bouygues operates in over 80 countries, showing an existing global footprint.

- The company's construction arm, Bouygues Construction, generates a significant portion of its revenue internationally.

- Bouygues Telecom has been expanding its presence in regions like Spain.

- Strategic partnerships are crucial for navigating new markets and mitigating risks.

TF1+ faces high growth in digital markets with low market share, necessitating significant investment. In 2024, TF1's revenue was €2.4B, reflecting its digital growth potential.

Equans' solar farm installations are question marks, eyeing renewable energy growth. These projects require upfront investment; the global solar market grew by 30% year-over-year in 2024.

B.IG, launched in 2024, is a question mark focusing on family bundles. The strategy of competitive pricing requires substantial investment; Bouygues Telecom holds about 18.5% of the French mobile market.

Aduna, a Bouygues Telecom and Free collaboration, focuses on network APIs. This venture has high growth potential with a low market share. Success requires significant development and marketing investments.

Bouygues' international expansion efforts, a "Question Mark," highlight high growth potential in new markets. This involves strategic partnerships and market analysis. Bouygues operates in over 80 countries, with Bouygues Construction generating revenue internationally.

| Business Unit | Status | Key Metrics (2024) |

|---|---|---|

| TF1+ | Question Mark | Revenue: €2.4B, Digital Growth Focus |

| Equans (Solar) | Question Mark | Global Solar Market Growth: 30% YoY |

| B.IG | Question Mark | Launched in 2024, 18.5% Market Share |

| Aduna | Question Mark | Focus on Network APIs |

| International Expansion | Question Mark | Bouygues operates in 80+ countries |

BCG Matrix Data Sources

The Bouygues BCG Matrix is fueled by financial reports, market analyses, and industry insights, delivering data-backed quadrant placements.