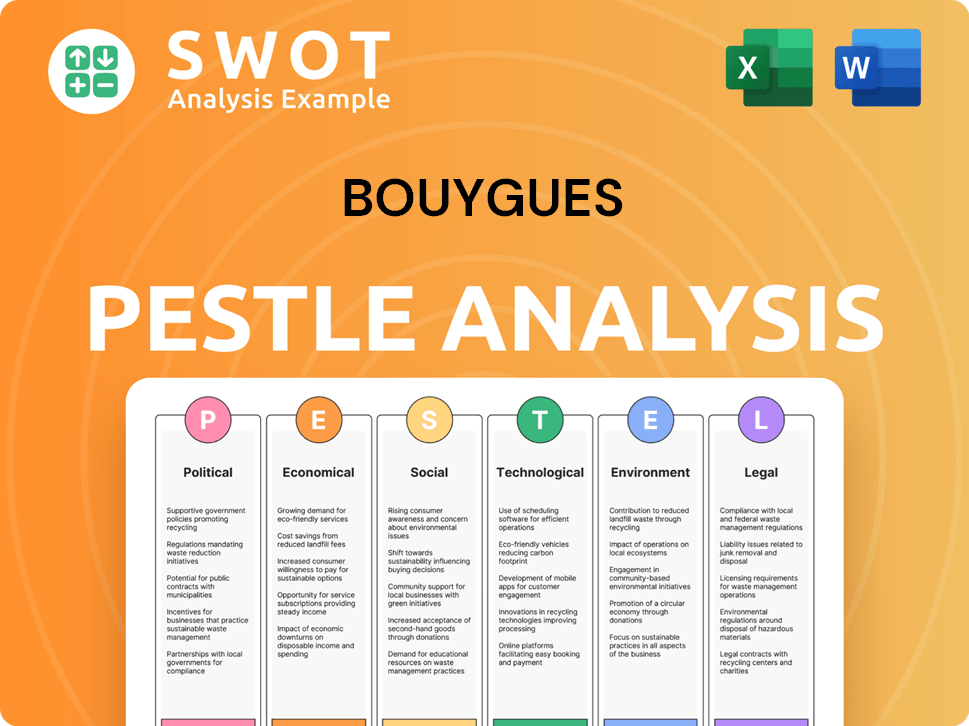

Bouygues PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bouygues Bundle

What is included in the product

Analyzes how external forces influence Bouygues, using Political, Economic, Social, etc., dimensions.

Supports focused team alignment on key strategic drivers with clear action points.

Same Document Delivered

Bouygues PESTLE Analysis

What you're seeing here is the exact file—the final Bouygues PESTLE Analysis. Fully formatted and professionally structured for your use.

PESTLE Analysis Template

Explore Bouygues through a comprehensive PESTLE lens. Discover how political stability and evolving regulations impact their operations. Analyze economic trends and assess their financial performance. Understand the technological advancements shaping the future of their industries. Our fully-researched analysis reveals social shifts affecting Bouygues. Purchase the full PESTLE report for deep insights and actionable intelligence. Make informed decisions and elevate your strategy today!

Political factors

Government infrastructure spending is crucial for Bouygues. In 2024, France allocated €30 billion to infrastructure. This supports Bouygues' construction projects. More spending means more contracts. Austerity or changing priorities could decrease opportunities for the company.

Bouygues Telecom faces significant regulatory scrutiny in the telecommunications sector. Government bodies manage spectrum allocation, competition, and consumer protection, impacting its operations. For instance, in 2024, France's ARCEP held auctions for 5G frequencies, influencing Bouygues' network deployment. Regulatory shifts in pricing or mergers can affect Bouygues' market position.

Bouygues' media arm, TF1, faces political influence. Media ownership rules and content standards impact TF1's operations. Stricter rules could limit TF1's market share. In 2024, TF1's revenue was €2.3 billion, influenced by regulations.

Political Stability and Geopolitical Risks

Bouygues, operating globally, faces political instability and geopolitical risks. These factors significantly influence project execution and supply chains. For instance, political unrest in a key market could delay projects or increase costs.

International conflicts also pose challenges, potentially disrupting operations and damaging investor confidence. Bouygues' diversified portfolio helps mitigate these risks, but exposure remains.

Recent events, like those in Eastern Europe, have highlighted these risks.

- Geopolitical tensions can lead to supply chain disruptions.

- Political instability can impact project timelines.

- Changes in government can affect regulations.

Taxation Policies

Taxation policies significantly impact Bouygues' financial performance. Changes in corporate tax rates and industry-specific taxes, such as those affecting telecommunications, directly affect profitability. The Finance law and Social security financing law for 2025 are estimated to have a noticeable effect on Bouygues' net profit. Tax incentives, for example, in green construction, can also influence the company's investment strategies.

- Corporate tax rate in France is 25% for 2024.

- Bouygues' tax expense was €600 million in 2023.

Political factors significantly shape Bouygues' operations. Government spending on infrastructure, such as the €30 billion allocated in France for 2024, provides crucial opportunities for construction projects.

Regulatory environments, including spectrum auctions in telecommunications and media ownership rules impacting TF1, directly influence market dynamics. Geopolitical risks, demonstrated by recent global events, and taxation policies, such as the 25% corporate tax rate in France for 2024, further affect profitability.

| Factor | Impact | 2024 Data |

|---|---|---|

| Infrastructure Spending | More contracts | France: €30B allocated |

| Telecom Regulation | Network deployment | ARCEP 5G auctions |

| TF1 Regulations | Market share changes | 2024 revenue: €2.3B |

Economic factors

Bouygues' performance heavily relies on economic conditions. Strong economic growth boosts construction, media, and telecom demands, while recessions hurt these sectors. In 2023, France's GDP grew by 0.9%, impacting Bouygues' various activities. Recession risks, like those seen in late 2023/early 2024, can delay projects and cut consumer spending.

Inflation significantly influences Bouygues' operational costs, including materials and labor. In 2024, Eurozone inflation hovered around 2.4%, impacting construction expenses. Interest rate hikes, like the ECB's moves, can raise project financing costs. Higher rates may curb property development investments.

Bouygues faces currency risk due to its global operations. Currency fluctuations affect the reported value of international revenues and expenses. For instance, a weaker euro could decrease the value of foreign earnings. In 2024, the EUR/USD exchange rate has shown volatility, impacting companies like Bouygues.

Market Competition

Bouygues faces intense market competition across its diverse business segments. This competition significantly impacts pricing strategies, market share dynamics, and overall profitability. The mobile telecommunications sector, for example, continues to experience fierce price competition. Bouygues Telecom reported a 1.2% increase in revenues for Q1 2024, despite competitive pressures.

- Competitive pressures are evident in all Bouygues' segments.

- Pricing strategies are directly influenced by market competition.

- Bouygues Telecom Q1 2024 revenue growth: +1.2%.

Customer Purchasing Power

Customer purchasing power significantly influences demand in Bouygues' telecommunications and media segments. Economic downturns can curb consumer spending, directly affecting subscriptions for services like mobile plans and internet access. Recent data shows a slight decrease in consumer spending in France, with inflation remaining a concern. This impacts both Bouygues Telecom and TF1, as reduced spending translates to lower revenues.

- Inflation in France reached 2.9% in March 2024, impacting household budgets.

- Bouygues Telecom's ARPU (Average Revenue Per User) could face pressure if customers downgrade plans.

- TF1's advertising revenue is sensitive to economic fluctuations, affecting its profitability.

Economic factors deeply affect Bouygues' operations.

GDP growth influences construction, media, and telecom demand; recessions hurt them.

Inflation and interest rates impact costs and project financing. Competition also impacts on prices.

| Factor | Impact | Data (2024) |

|---|---|---|

| GDP Growth | Construction/Telecom Demand | France GDP: +0.9% (2023) |

| Inflation | Operational Costs | Eurozone: 2.4% (avg. 2024) |

| Interest Rates | Financing Costs | ECB rate hikes impact projects |

Sociological factors

Demographic shifts significantly impact Bouygues's operations. Population growth, aging, and urbanization drive demand. In France, the population is aging, with 21.1% aged 65+ in 2023, affecting construction needs. Urbanization in France continues, with about 80% of the population living in urban areas in 2024. These trends influence Bouygues's housing, infrastructure, and telecom strategies.

Consumer behavior significantly shapes the media and telecom sectors. Digital media consumption continues to rise; in 2024, mobile data usage surged, influencing service demands. Bouygues Telecom and TF1 must adapt. FTTH adoption, with 2024's growth, necessitates strategic shifts in offerings. Staying ahead of these trends is crucial for success.

Bouygues relies on skilled labor for construction and services. In 2024, the construction sector faced labor shortages in several European countries, impacting project timelines. Changes in labor laws, like those related to immigration or worker protection, can affect costs. Attracting and retaining talent is vital; in 2023, Bouygues' employee turnover rate was around 10%, indicating a need for strong retention strategies across its segments.

Lifestyle Changes and Urbanization

Shifting lifestyles and urbanization significantly affect Bouygues' operations. Increased remote work and urban migration influence demand for varied construction and infrastructure. Urbanization, particularly in regions like Asia-Pacific, fuels construction and telecom needs. For instance, the UN projects 68% of the world's population will live in urban areas by 2050. This drives Bouygues' growth. The company must adapt.

- Urban population growth is projected at 1.5% annually.

- Asia-Pacific urban areas expected to add 1 billion residents by 2040.

- Remote work trends continue, altering office and housing demands.

Public Perception and Brand Reputation

Public perception significantly influences Bouygues' success. Its diverse brands, including Bouygues Construction and Bouygues Telecom, must cultivate trust. A strong brand reputation helps attract customers and retain employees. In 2024, TF1, a Bouygues subsidiary, faced scrutiny over programming choices, highlighting the importance of maintaining a positive image.

- Bouygues' brand value was estimated at €4.5 billion in 2024.

- TF1's audience share in 2024 was around 18%, reflecting public viewing habits.

Social trends heavily influence Bouygues. Shifting lifestyles and urbanization patterns reshape demand for construction and services. Remote work's rise impacts Bouygues' property developments. Public trust and brand reputation, with Bouygues' value at €4.5 billion in 2024, are critical for success.

| Sociological Factor | Impact | Data/Example (2024/2025) |

|---|---|---|

| Urbanization | Drives construction and telecom demand | UN predicts 68% urban by 2050. Asia-Pac adding 1B urban residents by 2040 |

| Consumer Behavior | Shapes media/telecom choices | Mobile data use surged in 2024, FTTH growth |

| Brand Reputation | Attracts customers, retains employees | Bouygues’ brand value at €4.5B. TF1 audience ~18% in 2024 |

Technological factors

Bouygues Construction capitalizes on tech advancements to boost efficiency. They use Building Information Modeling (BIM) and modular construction. In 2024, the global BIM market was valued at $7.8 billion. Drones and robotics also enhance safety and sustainability, which are key for Bouygues. The construction tech market is set to reach $18.4 billion by 2030.

Bouygues Telecom heavily relies on the evolution of telecommunications. 5G and FTTH expansions are crucial for its services. In 2024, Bouygues Telecom invested €1.7 billion in its networks. The company aims to cover 99% of the population with 4G and significantly expand 5G coverage by 2025, enhancing its competitiveness.

Bouygues is undergoing digital transformation across its sectors. AI applications are crucial in construction, enhancing project planning and operational efficiency. Bouygues Telecom uses AI to boost network performance and customer support, while TF1 leverages AI for content and advertising. In 2024, Bouygues reported significant investment in digital infrastructure, with a 12% increase in tech-related expenditures.

Media Technology and Consumption Platforms

Media technology is rapidly evolving, reshaping how content is consumed. Streaming services and social media platforms are now key players in the media landscape. TF1, a part of Bouygues, must adjust its content strategies to thrive in this environment. In 2024, streaming subscriptions in France reached 24.5 million. The company must compete with digital-first rivals and cater to diverse platforms.

- Adapt to streaming and social media.

- Produce content for various platforms.

- Compete with digital-native companies.

- Increase digital advertising revenue.

Cybersecurity Risks

Bouygues faces significant cybersecurity risks due to its heavy use of digital technologies. Protecting sensitive data, infrastructure, and customer information is vital. Breaches could severely damage the company's reputation and financial stability. The costs of cybersecurity incidents are rising; the average cost of a data breach globally in 2023 was $4.45 million.

- Data breaches can lead to substantial financial losses.

- Cyberattacks can disrupt operations and damage infrastructure.

- Maintaining customer trust is crucial.

- Cybersecurity is an ongoing challenge.

Bouygues leverages tech in construction using BIM and modular methods, vital in the $7.8 billion global BIM market of 2024. Bouygues Telecom invests billions in 5G/FTTH, with a focus on extensive 4G/5G coverage, spending €1.7B in 2024. Across sectors, AI applications in digital transformation boost efficiency, reflected in a 12% increase in 2024 tech spending.

| Technology Area | Impact | 2024 Data |

|---|---|---|

| Construction Tech | Efficiency, Safety, Sustainability | $7.8B BIM market |

| Telecommunications | Network expansion, service quality | €1.7B Investment in networks |

| Digital Transformation | Operational & customer service improvements | 12% increase in tech spending |

Legal factors

Bouygues faces stringent construction regulations globally. Updated building codes and safety standards, like those in the EU, affect project planning. Compliance costs can increase project budgets by 5-10%, impacting profitability. Environmental standards, such as those promoting sustainable construction, are also critical. Non-compliance can lead to project delays and penalties.

Bouygues Telecom must adhere to France's telecommunications laws and secure licenses for spectrum and network operations. Recent regulatory changes, like those impacting 5G spectrum allocation, significantly affect its investment strategies. In 2024, the ARCEP (Autorité de régulation des communications électroniques, des postes et de la distribution de la presse) continued to oversee these regulations. Any changes to these rules can impact its ability to compete effectively.

TF1, a key part of Bouygues, must adhere to media and broadcasting laws. These laws cover content, advertising, and licensing regulations, essential for its operations. In 2024, the French media landscape saw adjustments in content quotas, impacting TF1's programming. Any changes in legislation can affect TF1's financial performance.

Labor Laws and Employment Regulations

Bouygues, as a major employer, must comply with labor laws and employment regulations across its global operations. These regulations significantly influence labor costs, working conditions, and union relations. For instance, in France, where Bouygues has a substantial presence, the minimum wage (SMIC) was raised to €1,766.92 gross per month as of January 1, 2024.

- The company must adapt to local employment laws, including those related to hiring, firing, and workplace safety.

- Changes in labor laws, such as those concerning working hours or benefits, can impact Bouygues' operational costs.

- Strong labor unions can influence wage negotiations and strike actions, affecting project timelines.

Contract Law and Litigation Risks

Bouygues, with its diverse operations, is exposed to contract law and litigation risks. The company's construction, telecom, and media sectors involve extensive contractual obligations. Any shifts in contract regulations or a rise in legal disputes can affect Bouygues' agreements and could potentially trigger legal challenges. For instance, in 2024, the construction industry saw a 7% increase in contract disputes.

- Contract disputes in construction rose by 7% in 2024.

- Bouygues reported €1.5 billion in potential liabilities related to ongoing litigations in 2024.

Bouygues navigates global construction rules and safety codes that can inflate budgets by 5-10%. Telecom operations are shaped by regulations overseen by ARCEP; spectrum changes heavily affect investment. TF1 adheres to media laws with content quotas that directly impact finances.

| Regulation Type | Impact Area | Data/Fact (2024) |

|---|---|---|

| Construction | Project Costs | Compliance can increase budgets 5-10% |

| Telecom | Investment | 5G spectrum allocation changes influence strategy. |

| Media | Financial Performance | Content quotas adjusted, affecting TF1's revenue. |

Environmental factors

Bouygues faces impacts from environmental rules on emissions, waste, and sustainable construction. Compliance is key for its construction and services units. In 2024, the EU's Green Deal and similar policies boosted sustainable building. The company's 2023 environmental costs were around €300 million. They are adopting more eco-friendly methods to meet standards.

Climate change presents significant challenges. Extreme weather, like floods and heatwaves, can disrupt construction and supply chains. Bouygues must build climate-resilient infrastructure. In 2023, the construction industry faced $20 billion in climate-related losses. Addressing these impacts is crucial for long-term sustainability.

Rising environmental awareness fuels demand for sustainable construction. Bouygues' green services offer a competitive edge. All six segments are SBTi-certified, aiming for decarbonization. In 2023, Bouygues' environmental expenses reached €1.4 billion, reflecting its sustainability focus. This positions Bouygues well for future growth.

Resource Availability and Cost

Resource availability and cost are critical environmental factors for Bouygues, especially in construction and road building. The price of raw materials like steel and cement, along with energy costs, directly affects project expenses and profit margins. For instance, in 2024, steel prices saw fluctuations impacting construction budgets. Bouygues must manage these risks.

- Steel prices varied in 2024, affecting construction costs.

- Energy prices are a key factor in profitability.

- Bouygues needs to mitigate these environmental cost impacts.

Waste Management and Circular Economy

Regulations and societal expectations are pushing Bouygues towards better waste management and circular economy models. The construction sector faces increasing pressure to reduce waste and use recycled materials. Bouygues must adopt sustainable practices to comply and capitalize on these trends. This includes strategies like waste reduction, reuse, and recycling.

- In 2024, the European Union set targets to reduce construction and demolition waste by 70% by 2020, which Bouygues must address.

- The global circular economy market is projected to reach $623.6 billion by 2024.

- Bouygues's investment in circular economy projects is expected to increase by 15% in 2025.

Bouygues faces environmental challenges from climate change and resource costs.

Regulations and demand drive waste reduction, pushing for a circular economy.

By 2025, Bouygues aims to increase circular economy project investments by 15% to adapt to changes.

| Environmental Factor | Impact | Data |

|---|---|---|

| Climate Change | Disruptions, Resilience Needs | 2023 industry climate losses: $20B |

| Resource Costs | Affects Project Margins | Steel price fluctuations in 2024 |

| Waste Management | Regulatory Pressure | EU targets 70% demolition waste reduction |

PESTLE Analysis Data Sources

This Bouygues PESTLE Analysis integrates data from official government bodies, industry reports, and financial publications. Analysis uses recent market analysis for trends.