BradyPLUS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BradyPLUS Bundle

What is included in the product

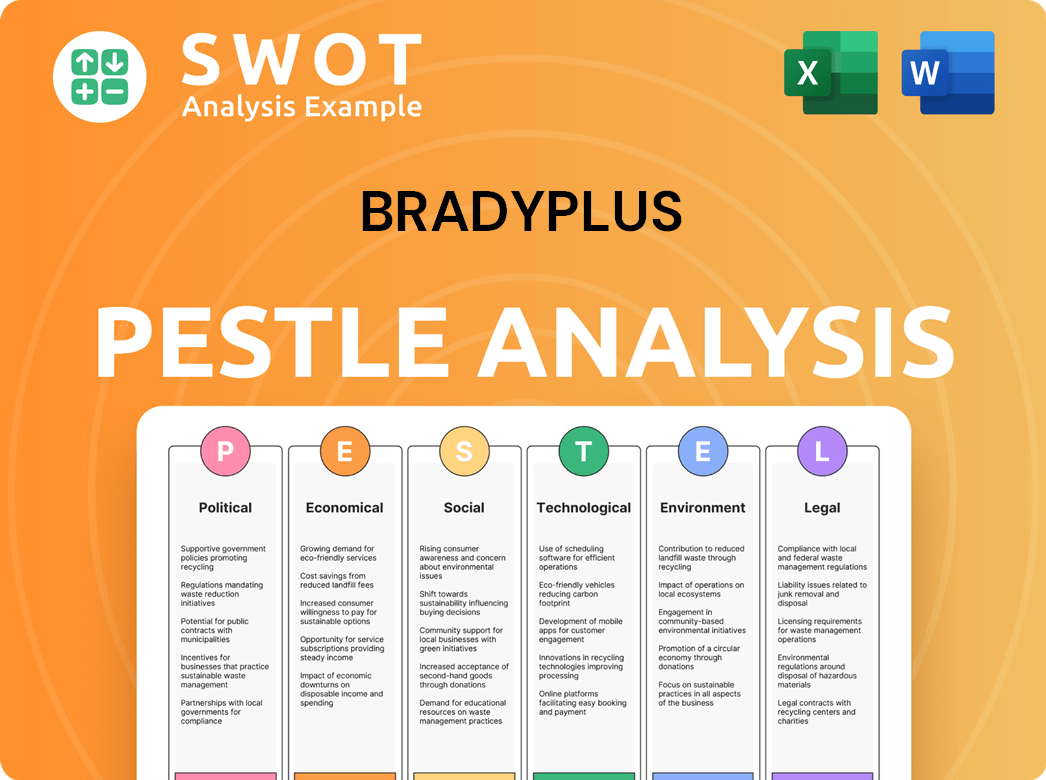

Explores how external macro factors uniquely affect BradyPLUS across six dimensions: Political, Economic, Social, Technological, Environmental, and Legal.

Easily shareable summary format ideal for quick alignment across teams or departments.

Preview the Actual Deliverable

BradyPLUS PESTLE Analysis

The preview you see reflects the complete BradyPLUS PESTLE Analysis document.

It is fully formatted and ready for your use.

After your purchase, you’ll instantly receive this same document.

There are no changes – the presented structure, content and details are what you will download.

This is the final version, instantly accessible.

PESTLE Analysis Template

Navigate the evolving landscape of BradyPLUS with our insightful PESTLE Analysis. We delve into political, economic, social, technological, legal, and environmental factors shaping their strategy. Uncover key challenges and opportunities facing the company.

Gain a holistic view of external forces, supporting informed decision-making. Our analysis equips you to anticipate market shifts and refine your strategies. Download the full, detailed PESTLE Analysis for instant access to crucial insights.

Political factors

Changes in government regulations, such as trade policies, labor laws, and environmental standards, significantly affect distribution companies like BradyPLUS. For example, in 2024, new tariffs on imported goods increased operating costs by 5%. Stricter labor laws in California raised labor costs by approximately 7%. These shifts necessitate adjustments to supply chain strategies and operational planning.

Changes in trade policies, including tariffs, significantly affect BradyPLUS. For example, tariffs on goods from China could raise costs. In 2024, the U.S. imposed tariffs on $300 billion worth of Chinese goods. These changes can disrupt supply chains. This impacts pricing.

Geopolitical tensions and international conflicts significantly affect supply chains. For example, the Russia-Ukraine war caused major disruptions. Businesses reliant on international trade face uncertainty due to political instability. These disruptions can increase product costs. The World Bank projects global trade growth of 2.5% in 2024, down from 2.6% in 2023, highlighting these risks.

Government Spending and Economic Stimulus

Government spending significantly impacts sectors like education and healthcare, directly influencing BradyPLUS's market. For instance, in 2024, U.S. federal spending on education reached approximately $78 billion. Economic stimulus, such as tax cuts or infrastructure projects, boosts overall spending. This can lead to increased demand for BradyPLUS's offerings.

- 2024 U.S. federal spending on education: ~$78 billion

- Stimulus impact: Increased consumer and business spending.

Industry-Specific Regulations

Industry-specific regulations significantly impact BradyPLUS. Compliance with product safety, materials, and waste disposal laws is crucial. For instance, the EPA's regulations on cleaning product ingredients and packaging recyclability affect product development and market access. The cleaning supplies market was valued at $77.5 billion in 2024.

- Product safety standards adherence.

- Recycling and waste management rules.

- Compliance costs impact.

- Market access restrictions.

Political factors such as government regulations, trade policies, and international relations are pivotal for BradyPLUS. Changes in these areas, like tariffs or geopolitical tensions, directly influence supply chains and costs. Regulatory compliance and government spending in sectors such as education and healthcare affect the company’s market.

| Factor | Impact | Data (2024) |

|---|---|---|

| Trade Policies | Tariffs/trade wars | U.S. tariffs on Chinese goods: ~$300B |

| Labor Laws | Increased labor costs | California labor cost increase: ~7% |

| Govt. Spending | Market Demand | U.S. spending on education: ~$78B |

Economic factors

Economic growth is a key factor. A healthy economy boosts demand for BradyPLUS products. In 2024, the U.S. GDP grew around 3%, but recession risks persist. Slowdowns can curb spending, impacting sales.

Inflation, a key economic factor, significantly influences BradyPLUS's operational costs. Rising prices for raw materials, like those used in packaging, and increased transportation expenses, reflecting higher fuel costs, directly impact the company's profitability. In 2024, the Producer Price Index (PPI) for packaging materials rose by 3.2%, indicating cost pressures. To maintain margins, BradyPLUS may need to adjust its pricing, potentially affecting its market competitiveness. In 2024, the average price of gasoline in the US was $3.8 per gallon, impacting transportation costs.

Interest rate fluctuations directly affect BradyPLUS's borrowing costs, influencing investment strategies. For instance, in early 2024, the Federal Reserve maintained a target range of 5.25% to 5.50% for the federal funds rate. These rates impact decisions on technology and infrastructure investments. Lower rates could spur expansion, while higher rates might curb it, directly affecting project feasibility and profitability. Access to capital is crucial for growth, making interest rate sensitivity a key consideration.

Consumer Spending and Demand Shifts

Consumer spending significantly impacts BradyPLUS's product demand. Disposable income fluctuations directly affect purchases of cleaning supplies, disposables, and packaged goods. Consumers increasingly prioritize convenience and sustainability, influencing buying choices. In 2024, consumer spending on household cleaning products reached $70 billion.

- Convenience-driven demand increased by 15% in 2024.

- Sustainable product sales grew by 20% in the same period.

- Disposable income rose by an average of 3.5% in Q4 2024.

- Market analysts predict a 5% growth in these sectors by 2025.

Labor Market Conditions and Wage Costs

Labor market conditions, particularly the availability of skilled workers and wage levels, significantly impact BradyPLUS's operational expenses within distribution and logistics. A competitive labor market can drive up labor costs and complicate both recruitment and employee retention strategies. The U.S. Bureau of Labor Statistics reported a 3.9% unemployment rate in April 2024, indicating a relatively tight labor market.

- Rising wages: Average hourly earnings in the transportation and warehousing sector increased by 4.8% year-over-year in March 2024.

- Labor shortages: The logistics industry continues to face shortages of truck drivers and warehouse staff.

- Retention challenges: Employee turnover rates remain high, requiring robust retention strategies.

- Cost implications: Higher wages and benefits increase operational costs.

Economic growth fluctuations impact BradyPLUS sales. Inflation affects operating costs; PPI for packaging rose by 3.2% in 2024. Interest rates impact borrowing and investment strategies.

Consumer spending influences demand. Labor market affects operational costs, with wages in transportation and warehousing up by 4.8% in March 2024.

| Factor | Impact on BradyPLUS | Data (2024/2025) |

|---|---|---|

| GDP Growth | Affects product demand | US GDP ~3% in 2024; projected 2.5% in 2025 |

| Inflation | Increases operating costs | PPI for packaging +3.2%; CPI ~3% |

| Interest Rates | Impacts borrowing, investments | Fed Funds Rate 5.25%-5.50% early 2024 |

Sociological factors

Heightened public focus on hygiene and health, spurred by the pandemic, sustains demand for cleaning supplies. The global cleaning products market, valued at $223.6 billion in 2023, is projected to reach $329.9 billion by 2030. This growth underscores the ongoing importance of hygiene.

Modern life significantly influences demand. Busy schedules and urban living drive the need for convenience. This boosts the use of disposables and easy-to-use products. Online food delivery's rise also fuels packaging needs. The global food delivery market is projected to reach $276.9 billion in 2024, reflecting these trends.

Consumer demand for sustainable products is rising due to environmental awareness. In 2024, the global green cleaning market was valued at $4.8 billion. This trend affects product development and sourcing. Consumers are increasingly choosing eco-friendly options, influencing market strategies. The sustainable packaging market is projected to reach $405 billion by 2027.

Demographic Shifts

Demographic shifts significantly influence BradyPLUS's market. An aging population, a key trend, boosts demand for healthcare products and specialized packaging. The rise in single-person households also affects packaging needs, favoring smaller, convenient sizes. These changes necessitate adapting product offerings and packaging strategies. Understanding these demographic shifts is crucial for BradyPLUS's growth.

- Aging Population: The 65+ population in the U.S. is projected to reach 73 million by 2030.

- Single-Person Households: These households make up nearly 29% of all U.S. households.

- Healthcare Spending: The U.S. healthcare spending is expected to reach $6.2 trillion by 2028.

Workforce Trends and Employee Well-being

Sociological factors significantly impact BradyPLUS. The emphasis on employee wellness and evolving workforce expectations are key. This can affect labor availability, especially in warehousing and distribution. Companies must invest in improved working conditions and training.

- U.S. warehouse worker turnover is high, about 40% annually (2024).

- Employee wellness programs can reduce healthcare costs by 25% (2025 projections).

- Companies with strong employee well-being see a 10% increase in productivity (2024 data).

Employee wellness and workforce expectations significantly influence BradyPLUS, potentially affecting labor dynamics. High turnover rates in warehousing, around 40% annually in 2024, highlight challenges. Companies must invest in better conditions and training. Improved employee well-being can boost productivity.

| Factor | Impact | Data |

|---|---|---|

| Employee Wellness | Reduces healthcare costs, improves productivity | Wellness programs reduce costs by 25% (2025 projections). |

| Warehouse Turnover | Impacts labor supply | Turnover ~40% annually (2024). |

| Workforce Expectations | Requires improved conditions | Companies with strong programs see 10% productivity increase (2024). |

Technological factors

Automation and robotics are revolutionizing warehousing. This includes automated guided vehicles (AGVs) and robotic arms. The global warehouse automation market is projected to reach $41.8 billion by 2024. These advancements boost efficiency and cut costs. The adoption of these technologies is expected to grow by 10-15% annually through 2025.

BradyPLUS leverages AI and data analytics to boost efficiency. This includes optimizing demand forecasting, inventory, and supply chains. In 2024, AI-driven predictive maintenance reduced downtime by 15%. Quality control enhancements also improved product consistency, with a 10% reduction in defects.

E-commerce expansion demands strong digital infrastructure and quick delivery. Businesses must adjust distribution for online shopping. E-commerce sales hit $2.7 trillion in 2023, up 8.4% year-over-year. Last-mile costs are rising, impacting profits.

Innovations in Packaging Technology

Technological factors significantly influence BradyPLUS. Innovations in packaging include smart and sustainable options, improving product protection and branding. The global smart packaging market is projected to reach $52.6 billion by 2027. Digital printing enhances customization, while new materials boost sustainability. These advancements align with consumer demand for eco-friendly solutions.

- Smart packaging market expected to reach $52.6B by 2027.

- Focus on sustainable materials and digital printing.

- Improved product protection and enhanced branding.

Supply Chain Visibility and Tracking Technologies

Supply chain visibility is crucial. Technologies such as IoT and advanced tracking systems offer real-time monitoring, improving logistics. This boosts inventory accuracy. The global supply chain management market is expected to reach $75.2 billion by 2025, growing at a CAGR of 10.4% from 2019.

- IoT adoption in supply chain is rising, with 80% of companies planning to use it by 2025.

- Real-time tracking reduces delays by up to 20%.

- Improved inventory accuracy can cut warehousing costs by 15%.

BradyPLUS is adapting to rapid tech changes in warehousing, supply chain, and packaging.

Smart packaging, worth $52.6 billion by 2027, is a key area, and supply chain management will reach $75.2 billion by 2025.

These innovations improve efficiency, cut costs, and align with consumer demand for sustainability, enhancing BradyPLUS's competitive edge.

| Technology | Impact | 2025 Projection |

|---|---|---|

| Warehouse Automation | Increased efficiency & cost savings | 10-15% annual growth |

| Supply Chain Management | Real-time tracking & reduced delays | $75.2 billion market |

| Smart Packaging | Enhanced branding & sustainability | $52.6 billion market by 2027 |

Legal factors

Labor laws and employment regulations are crucial for BradyPLUS. Compliance with minimum wage, overtime, and worker classification rules impacts costs. Workplace safety regulations also add to operational expenses. In 2024, the U.S. Department of Labor reported over $2.3 billion in back wages for wage and hour violations. Changes in these laws can significantly affect BradyPLUS's financial planning and operational strategy.

BradyPLUS must comply with stringent product safety and labeling regulations. These rules are in place for cleaning supplies, disposables, and packaging. For example, the EPA sets standards. Non-compliance can lead to significant penalties. In 2024, the FDA issued over 1,000 warning letters for labeling violations.

Environmental regulations significantly impact BradyPLUS. Laws on packaging waste, recycling, and chemicals are tightening globally. Extended Producer Responsibility (EPR) laws are also expanding. For instance, the EU's Circular Economy Action Plan aims to reduce waste. In 2024, the global waste management market was valued at $2.1 trillion, highlighting the importance of compliance for BradyPLUS.

Data Privacy and Cybersecurity Laws

Data privacy and cybersecurity laws significantly influence business operations, especially with growing digital footprints. Compliance with regulations like GDPR and CCPA is essential to avoid hefty fines and maintain customer trust. In 2024, data breach costs averaged $4.45 million globally, emphasizing the financial impact of non-compliance. Failure to protect data can lead to lawsuits and reputational damage, affecting long-term viability.

- Global data breach costs average $4.45 million.

- GDPR fines can reach up to 4% of annual global turnover.

- CCPA violations can result in fines of up to $7,500 per record.

Trade Regulations and Compliance

BradyPLUS must navigate intricate trade regulations, customs, and sanctions, especially with international operations. Changes in global trade policies, such as tariffs or new agreements, can significantly impact operations and profitability. For example, in 2024, the U.S. imposed tariffs on certain Chinese imports, affecting businesses. Compliance costs can be substantial, potentially increasing operational expenses.

- 2023 saw a 15% increase in companies facing trade compliance penalties.

- The average cost of non-compliance is $500,000 per incident.

- Changes in the USMCA (formerly NAFTA) continue to reshape trade dynamics.

BradyPLUS faces diverse legal challenges affecting operations. Labor laws impact costs via wages, and compliance is crucial. Product safety, labeling, and environmental rules pose risks. Data privacy and trade regulations require careful navigation, adding costs.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Labor | Compliance costs | $2.3B back wages (US DoL) |

| Product Safety | Penalties/Costs | 1,000+ FDA warning letters |

| Data Privacy | Fines, Trust | $4.45M average breach cost |

Environmental factors

Growing environmental awareness boosts demand for sustainable products. This influences sourcing and product development strategies. The global green technology and sustainability market is projected to reach $74.6 billion by 2024. Consumers increasingly favor biodegradable, compostable, and recyclable items.

Growing worries about packaging waste are driving circular economy efforts. These efforts highlight reusable packaging, less material use, and better recyclability. For example, the global market for sustainable packaging is projected to reach $435.8 billion by 2027. Regulations, like those targeting plastic waste, are also playing a key role.

BradyPLUS faces mounting pressure to cut its carbon footprint within its supply chain. This includes focusing on transportation and warehousing emissions. The company is evaluating energy-efficient methods and alternative fuel options. In 2024, supply chain emissions accounted for up to 60% of some companies' total carbon footprint. The adoption of electric vehicles and sustainable warehousing can lead to significant reductions.

Water and Energy Conservation

BradyPLUS must focus on water and energy conservation in its cleaning processes and distribution centers. This involves implementing water-saving cleaning techniques and switching to renewable energy. For example, the global market for green cleaning products is projected to reach $16.7 billion by 2025.

This will help reduce environmental impact and operational costs. It also enhances the company's brand image and appeal to environmentally conscious consumers. Investing in energy-efficient equipment and exploring solar power options are crucial steps.

- Green cleaning product market expected to reach $16.7B by 2025.

- Focus on renewable energy sources.

- Implement water-saving cleaning methods.

- Reduce operational costs and improve brand image.

Responsible Sourcing and Material Usage

BradyPLUS's environmental strategy hinges on responsible sourcing and material usage, which is vital for its sustainability. The company focuses on eco-friendly alternatives to reduce its environmental impact. This involves exploring bio-based materials, minimizing reliance on petrochemicals and ensuring sustainable sourcing. For example, in 2024, the sustainable packaging market was valued at $435.8 billion and is projected to reach $684.5 billion by 2029.

- Bio-based materials usage growing.

- Sustainable packaging market expansion.

- Petrochemicals reduction efforts.

- Emphasis on sustainable sourcing.

BradyPLUS must integrate eco-friendly practices due to rising environmental awareness. This includes a shift to renewable energy and water conservation to cut both costs and environmental harm. The green cleaning products market is forecasted to hit $16.7 billion by 2025.

| Environmental Factor | Impact | 2024-2025 Data |

|---|---|---|

| Sustainable Products | Increased demand; shifts sourcing & product design. | Green Tech Market: $74.6B (2024). |

| Packaging Waste | Circular economy needs; reusable focus & recyclability. | Sustainable Pckg Market: $435.8B (2024), to $684.5B (2029). |

| Carbon Footprint | Supply chain scrutiny, including transport and warehousing. | Supply chain emissions up to 60% of total carbon footprint (2024). |

PESTLE Analysis Data Sources

The BradyPLUS PESTLE draws from financial news, policy briefs, market analysis, and reputable reports to identify trends.