Brambles Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brambles Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio.

A clear visualization, easily comparing business units' market positions for strategic decision-making.

What You See Is What You Get

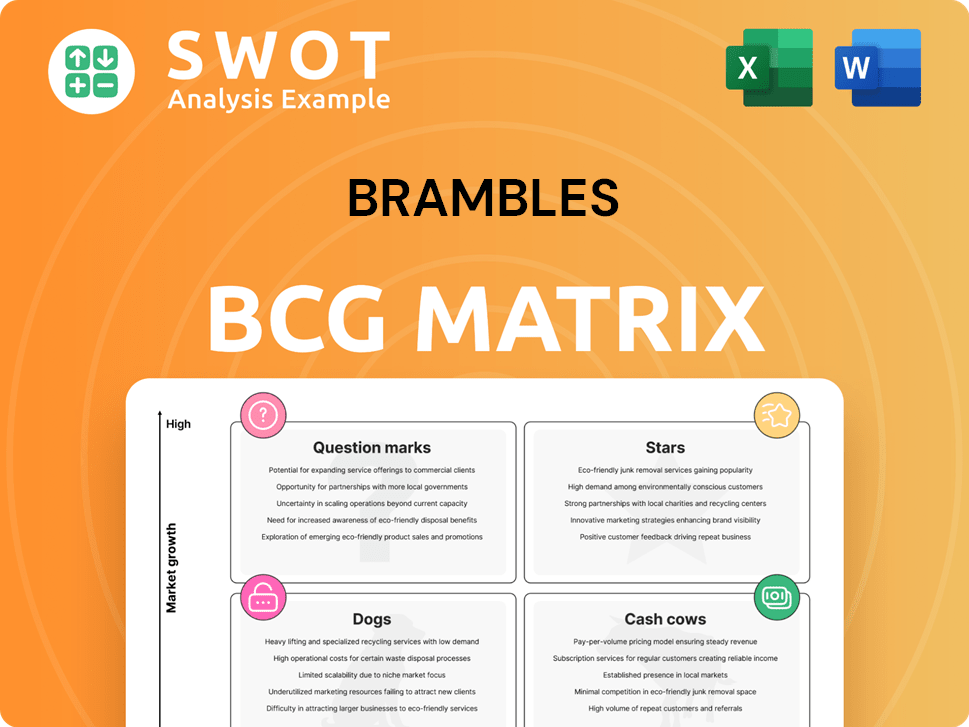

Brambles BCG Matrix

The preview showcases the complete Brambles BCG Matrix you'll receive post-purchase. This is the final, fully functional report—no hidden content or alterations. Access the same strategic framework for your analysis immediately upon buying.

BCG Matrix Template

The Brambles BCG Matrix categorizes its business units. It reveals where products stand: Stars, Cash Cows, Dogs, or Question Marks. This glimpse offers strategic insights, but there's more. Purchase the full version to explore detailed quadrant placements and actionable recommendations.

Stars

Brambles' core pallet pooling business, mainly CHEP, is a Star in its BCG Matrix. It leads the market with reusable pallets and containers. The FMCG sector provides a stable revenue stream. Brambles saw a 9% sales revenue increase in FY23, showcasing its strong market position.

Brambles is a sustainability leader, aiming for carbon neutrality by 2025 and regenerative supply chains. Its focus on reducing emissions, renewable energy, and sustainable timber sourcing appeals to eco-minded stakeholders. In 2024, Brambles earned recognition from Corporate Knights and TIME for sustainability. The company's initiatives align with the growing demand for environmentally responsible business practices.

Brambles' "Shaping Our Future" initiatives, a key element in its BCG matrix, aim to boost asset efficiency, network productivity, and customer satisfaction. The transformation has yielded tangible results. For example, the company saw increased Net Promoter Scores. Efficiencies in pallet dynamics have driven strong results.

Digitalization and Innovation

Brambles focuses on digitalizing supply chains. This initiative seeks innovative solutions for customers and operational efficiencies. Digital improvements, like tracking, cut pallet losses and optimize routes, leading to cost savings. In 2024, Brambles invested significantly in digital tracking.

- Digital investments aim to reduce pallet losses.

- Improved transportation routes reduce costs.

- Digitalization enhances operational efficiency.

- Brambles continues to invest in digital solutions.

Expansion in Emerging Markets

Brambles' "Stars" strategy involves expanding in emerging markets, aiming to boost market share. This includes regions like Eastern Europe, Southeast Asia, and others, offering growth prospects. These areas have substantial untapped potential for Brambles' pooling services. In 2024, emerging markets showed strong growth, with revenue increasing significantly.

- Focus on high-growth regions.

- Significant revenue increase in 2024.

- Untapped potential for pooling services.

- Strategic expansion in key areas.

Brambles' "Stars" strategy highlights its market dominance and growth potential. In 2023, the company's revenue increased by 9%, showing strong performance. Brambles expands in high-growth regions to increase market share.

| Metric | 2023 | 2024 (Projected) |

|---|---|---|

| Revenue Growth (%) | 9% | 7-9% |

| Emerging Markets Growth (%) | Strong | Continued Strong |

| Digital Investment (USD) | Significant | Increased |

Cash Cows

CHEP North America, a key part of Brambles, is a cash cow. It generates substantial revenue and profit. In FY24, the Americas segment, including North America, saw sales of $3.6B. This success stems from a strong market position and a focus on serving the consumer staples sector.

CHEP EMEA, encompassing Europe, the Middle East, Turkiye, and Africa, plus North American automotive, is a cash cow for Brambles. In fiscal year 2024, this region contributed significantly to Brambles' revenue, showcasing its stability. The mature markets and varied customer base ensure consistent income. With a high density of service centers, it maintains a strong presence in key industries.

Brambles' CHEP dominates the Australian pallet pooling market. They hold about 75% market share in Australia, while Loscam has 25%. This strong market presence ensures a steady revenue stream. In 2024, CHEP Australia's revenue was approximately $1.5 billion.

Pricing Power

Brambles' pricing power is a key strength, allowing it to pass on cost increases. This strategy protects profit margins and cash flow. From fiscal 2021 to 2023, pricing drove much of its 10% revenue growth. This ability to adjust prices reflects a strong market position.

- Pricing contributed significantly to revenue growth from 2021-2023.

- Brambles can use surcharges to counter cost rises.

- This pricing flexibility helps maintain profitability.

Circular Business Model

Brambles' circular business model, a classic cash cow, thrives on 'share and reuse'. It maximizes value via scale, density, and expertise. This drives operational efficiencies, generating strong cash flow. This supports dividends and business reinvestment.

- Brambles' revenue for FY23 was $6.8 billion.

- FY23 underlying profit was $1.0 billion.

- They increased their dividend by 7% in FY23.

- Brambles invested approximately $450 million in its business.

Brambles' Cash Cows, like CHEP, are market leaders generating substantial profits. They have a strong market share and customer base, particularly in regions like North America and Australia. This position allows pricing power and operational efficiency.

They consistently generate significant cash flow, supporting shareholder returns and business investments. For FY24, Brambles reported $6.8 billion in revenue.

| Cash Cow Characteristics | Description | FY24 Data (approx.) |

|---|---|---|

| Market Position | High market share, strong customer base. | CHEP Australia revenue: ~$1.5B |

| Revenue & Profit | Consistent revenue generation, healthy profit margins. | Americas segment sales: $3.6B |

| Cash Flow | Strong cash generation, supporting dividends and reinvestment. | Underlying Profit: $1.0B |

Dogs

CHEP India, a smaller Brambles unit, struggled to gain market share. Brambles sold CHEP India to LEAP India Private Limited. The move shows a strategic shift. This divestiture marked Brambles' exit from the Indian market. In 2024, Brambles focused on core markets.

Non-core product lines within Brambles' portfolio, such as those not directly related to its core pooling services, are categorized as Dogs in the BCG matrix. These offerings often exhibit low market share and growth rates, indicating they may be underperforming. In 2024, Brambles may review these assets to optimize its portfolio. This could involve divestiture or restructuring to focus on core competencies. The goal is to improve overall profitability and strategic alignment.

Underperforming geographies for Brambles, according to a BCG Matrix assessment, are regions facing tough competition or economic headwinds. These areas might have low market share, hindering profitability. Brambles could need substantial investment or consider exiting these markets. For example, in 2024, certain European regions showed slower growth for Brambles, prompting strategic reviews.

High-Cost, Low-Efficiency Operations

High-cost, low-efficiency operations for Brambles, like those with high pallet loss or inefficient transport, are "Dogs" in the BCG matrix. These areas need immediate attention to improve profitability. In 2024, Brambles faced challenges, including a pallet loss rate of about 2.5%, impacting costs. These inefficiencies can lead to lower returns and require operational restructuring.

- High Pallet Loss: Approximately 2.5% in 2024.

- Inefficient Transport: Contributing to increased operational expenses.

- Low Returns: Resulting from high costs and inefficiencies.

- Operational Restructuring: Needed to address these issues.

Products Facing Technological Disruption

Products facing technological disruption in Brambles' BCG matrix are those at risk from new tech or alternative solutions in supply chain logistics. Brambles must innovate to counter these threats. The company's focus on digital solutions is a key strategy. In 2024, Brambles invested significantly in digital transformation. This includes IoT and data analytics to improve efficiency.

- Risk: Products vulnerable to tech-driven shifts.

- Strategy: Continuous innovation is vital.

- Action: Investment in digital solutions.

- Examples: IoT, data analytics.

In Brambles' BCG matrix, "Dogs" represent underperforming segments with low market share and growth. These include non-core product lines and geographies facing tough competition. High pallet loss, around 2.5% in 2024, and inefficient transport also classify as Dogs, needing restructuring.

| Category | Characteristic | Impact in 2024 |

|---|---|---|

| Non-Core Products | Low market share, low growth | Portfolio review for potential divestiture. |

| Underperforming Geographies | Tough competition, economic headwinds | Strategic review, possible market exit. |

| High-Cost Operations | High pallet loss, inefficient transport | Operational restructuring to boost profit. |

Question Marks

Brambles' 'Serialisation+' initiative, tagging individual pallets, aligns with the Question Mark quadrant of the BCG Matrix. This technology aims to enhance tracking and cut losses, but it demands substantial upfront investment. Despite challenges, Brambles is encouraged by interest in Chile, with commercial pilots ongoing in 2024. In 2023, Brambles invested $15.2 million in technology, including Serialisation+.

Investing in new sustainable materials positions Brambles as a Question Mark. The company is actively pursuing eco-friendly solutions, but the cost and performance are still being assessed. Brambles aims for 30% recycled or upcycled plastic waste by 2025. In 2024, the company's focus is on testing and evaluating these materials.

Venturing into new industry verticals positions Brambles as a Question Mark in the BCG Matrix. These expansions, like entering pharmaceuticals or e-commerce, present high growth potential but also uncertainty. For instance, in 2024, the e-commerce sector grew by approximately 10% globally, showing opportunity. Success depends on adapting solutions and navigating new competitive landscapes. Brambles' ability to secure market share and profitability will determine its future classification within the matrix.

Advanced Analytics and AI

Investing in advanced analytics and AI for supply chain optimization presents a Question Mark in the BCG Matrix. These technologies aim to boost efficiency and forecast demand, but they come with challenges. Substantial investment in expertise and data infrastructure is necessary for successful implementation. For example, the global AI in supply chain market was valued at $2.5 billion in 2023, and it's projected to reach $15.8 billion by 2028.

- High initial costs often accompany AI and analytics projects.

- The need for skilled professionals to manage and interpret data is crucial.

- Data privacy and security are major concerns to address.

- Uncertainty in ROI makes it a risky investment.

Zero Waste World Program

The Zero Waste World initiative, a Question Mark in Brambles' BCG Matrix, aims to cut waste in customer supply chains. This aligns with Brambles' sustainability targets, reflecting a move toward environmentally conscious practices. However, universal customer adoption is uncertain, making its success a question. Brambles has a dedicated decarbonization team, showcasing their commitment to effective management.

- The initiative faces adoption challenges, impacting its market share growth.

- Sustainability efforts align with evolving market demands and investor preferences.

- Brambles' investments in waste reduction may yield long-term benefits.

- The program's success depends on customer collaboration and commitment.

Question Marks in Brambles' BCG Matrix represent investments in high-growth, uncertain areas.

These ventures, such as AI, new materials, and industry expansions, require significant upfront investment.

Their success depends on market adoption, cost-effectiveness, and adapting to new landscapes, with potential for high returns.

| Initiative | Investment Focus | 2024 Status |

|---|---|---|

| Serialisation+ | Tracking Technology | Commercial Pilots Ongoing |

| Sustainable Materials | Eco-Friendly Solutions | Testing and Evaluation |

| Industry Verticals | E-commerce, Pharma | Expansion and Adaptation |

BCG Matrix Data Sources

The Brambles BCG Matrix uses public financials, market data, competitor reports, and expert analyses, enabling strategic evaluations.