Brambles SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brambles Bundle

What is included in the product

Analyzes Brambles’s competitive position through key internal and external factors.

Provides a structured framework for identifying critical elements in planning.

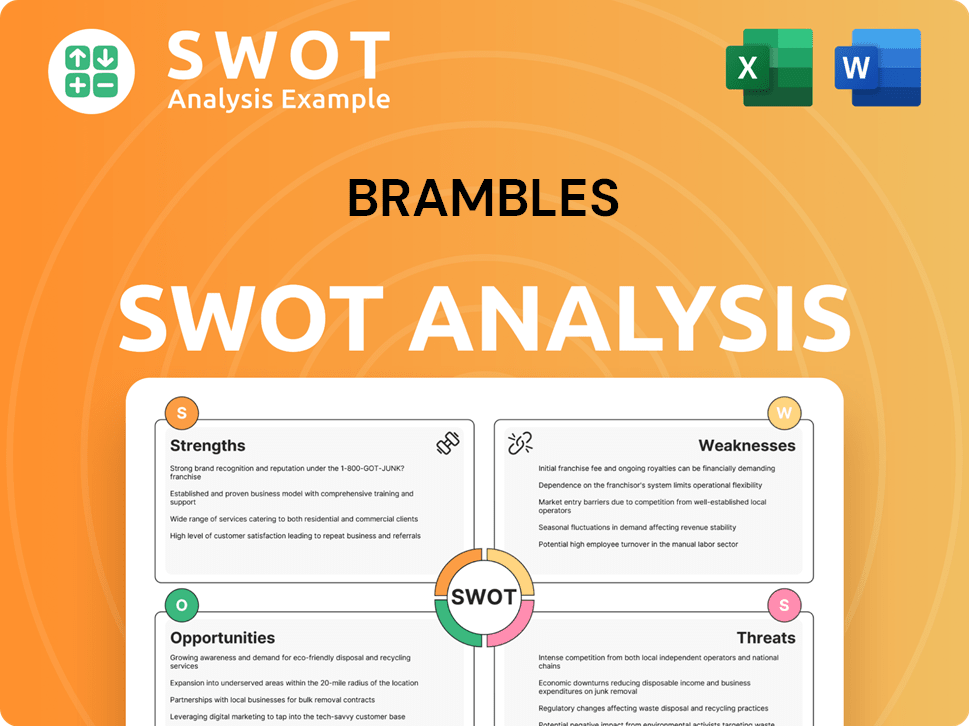

Preview the Actual Deliverable

Brambles SWOT Analysis

The displayed analysis is the very same SWOT report you’ll receive after purchasing. See the full insights now!

SWOT Analysis Template

Our Brambles SWOT analysis briefly touched upon key areas: their market position and some vulnerabilities. But, the real power lies deeper! Did you catch a glimpse of potential areas for innovation and revenue growth? Imagine the actionable insights in the full version.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Brambles, through CHEP, dominates the global supply-chain logistics market with reusable assets. Their circular business model, focusing on share and reuse, is both sustainable and efficient. This approach offers a strong alternative to single-use packaging, resonating with today's environmental concerns. In FY23, Brambles reported a revenue of $6.8 billion, highlighting their market leadership.

Brambles boasts a vast network, operating in around 60 countries. They manage over 347 million pallets, crates, and containers. This scale includes more than 750 service centers globally. This extensive reach boosts efficiency and offers a significant competitive edge.

Brambles showcases strong financial performance. Recent periods saw revenue and profit growth. The company prioritizes shareholder value. This includes higher dividends and share buy-backs. In FY24, Brambles increased the dividend by 8%.

Commitment to Sustainability and Ambitious Targets

Brambles demonstrates a strong commitment to sustainability, setting ambitious goals for 2025. These targets include achieving carbon neutrality within its operations and sourcing 100% sustainable timber. The company aims to be a regenerative, nature-positive business, responding to increasing customer and regulatory pressures. This focus can boost its brand image and attract environmentally conscious investors. Brambles' dedication to sustainability is evident in its 2024 sustainability report.

- Carbon Neutrality: Brambles aims for carbon neutrality in its operations by 2025.

- Sustainable Timber: The company targets 100% sustainable timber sourcing by 2025.

- Regenerative Business: Brambles strives to become a regenerative, nature-positive business.

Customer Relationships and Value Proposition

Brambles excels in customer relationships by catering to diverse sectors like consumer goods, retail, and manufacturing. Their pooling solutions offer cost-effective and sustainable transport, boosting customer loyalty and providing a strong value proposition. This approach has helped Brambles achieve significant financial results. In 2024, Brambles reported revenue of $6.8 billion.

- Diverse Sector Coverage: Serving consumer goods, retail, and manufacturing.

- Pooling Solutions: Cost-effective, efficient, and sustainable transport.

- Financial Performance: $6.8 billion in revenue in 2024.

Brambles possesses a strong market position, largely due to its vast global network and efficient asset management, handling over 347 million pallets and containers worldwide. This operational scale supports significant revenue generation. Strong financials, with $6.8 billion in revenue in FY24, alongside increasing dividends, signal financial health and shareholder focus.

| Strength | Description | Data |

|---|---|---|

| Market Leadership | Dominance in global supply chain logistics with reusable assets through CHEP. | $6.8B Revenue (FY24) |

| Extensive Network | Operates in ~60 countries, with >750 service centers. | >347M assets managed |

| Financial Performance | Solid revenue, profit growth, and shareholder returns. | 8% dividend increase (FY24) |

Weaknesses

Brambles' efficiency hinges on global supply chains. Disruptions like pallet shortages or customer inventory changes affect operations. In FY23, supply chain issues influenced Brambles' performance. This dependence can lead to unexpected capital expenditure needs.

Brambles faces input cost volatility, especially with lumber for pallets. Fluctuating lumber prices directly affect their operational expenses. Despite efforts to adjust pricing, significant cost swings can pressure profits. In 2024, lumber prices saw notable volatility. This can lead to margin squeezes if cost increases outpace pricing adjustments.

Brambles faces operational hurdles in managing its extensive reusable asset pool, scattered across many locations and clients, which may lead to asset loss or damage. The company is always trying to decrease uncompensated losses. In fiscal year 2023, Brambles reported approximately a 1.6% loss rate. This is a critical area.

Complexity of a Global Network

Brambles faces operational challenges due to its global presence. Operating across various countries, the company encounters a wide array of regulations and logistics setups. Effectively managing this complexity requires substantial resources and specialized knowledge. This can lead to increased costs and potential inefficiencies. For example, in FY23, Brambles reported a 6% increase in operating costs due to global operational adjustments.

- Diverse Regulatory Landscape: Navigating varying legal requirements across different nations.

- Logistics Infrastructure: Managing supply chains in countries with varying infrastructure quality.

- Market Dynamics: Adapting to unique consumer behaviors and economic conditions in each market.

- Resource Allocation: Efficiently distributing expertise and financial resources across global operations.

Potential for Increased Competition

Despite its market leadership, Brambles faces competition from established players and the threat of new entrants. This could lead to increased competition, affecting market share and pricing. The global pallet market, where Brambles is a significant player, was valued at approximately $68.8 billion in 2023.

This competition can arise from alternative packaging solutions. The industry may see impacts on Brambles' revenue, which was around $6.8 billion in the 2023 financial year, and profitability. Increased competition may also drive down margins.

- New entrants or alternative packaging solutions could erode Brambles' market share.

- Competition could pressure pricing, affecting revenue and profitability.

- The market is subject to shifts due to innovation and economic factors.

Brambles deals with supply chain vulnerabilities. This includes input cost volatility, primarily from lumber prices, which affects profit margins. Its expansive global footprint also presents operational hurdles due to the diverse regulatory landscape and logistics infrastructure, increasing costs.

| Weaknesses | Impact | 2024/2025 Data Points |

|---|---|---|

| Supply Chain Disruptions | Operational & Financial Risks | Lumber price volatility continues, +2% in Q1 2024. |

| Cost Volatility | Margin Pressure | Reported loss rates at ~1.7% (FY24) |

| Competition | Market Share & Profit | Global pallet market estimated $72B (2024) |

Opportunities

Brambles can expand in emerging markets like Eastern Europe, Southeast Asia, and India. These regions offer substantial growth potential due to their expanding economies. For instance, China's logistics market is predicted to reach $2.4 trillion by 2025. Awareness of sustainable solutions also drives opportunities. Brambles' 2024 revenue was $6.8 billion; expansion could boost this further.

Brambles can diversify by offering more reusable packaging and logistics services. This expands revenue opportunities. In 2024, Brambles' revenue was approximately $6.8 billion. Diversification can address changing customer demands.

Brambles can capitalize on digital transformation. Investing in technology improves supply chain visibility. This leads to better asset tracking and optimized routes. It also allows for data-driven insights for clients. In 2024, supply chain tech spending hit $25.4 billion. This boosts efficiency and creates new services.

Increasing Demand for Sustainable Packaging

The rising global focus on environmental concerns and the push for eco-friendly practices are boosting the need for sustainable packaging. Brambles is ready to meet this demand by offering reusable packaging options. This positions them well to gain environmentally aware customers. In 2024, the sustainable packaging market was valued at $350 billion, expected to reach $450 billion by 2025, indicating a significant growth opportunity for companies like Brambles.

- Market Growth: The sustainable packaging market is booming.

- Customer Appeal: Attracts customers focused on environmental impact.

- Regulatory Pressure: Helps companies comply with new rules.

- Brambles Advantage: Well-positioned with reusable solutions.

Collaborating on Circular Economy Initiatives

Brambles can leverage partnerships to drive circular economy initiatives. Collaborating, for example, on programs like Zero Waste World can boost its sustainability leadership. This approach can lead to new business opportunities. Brambles' focus on reusable packaging solutions is key.

- Zero Waste World program aims to reduce waste.

- Reusable packaging solutions are a market driver.

- Sustainability leadership enhances brand value.

Brambles thrives in growing sustainable packaging. This attracts eco-conscious customers. Digital transformation increases efficiency, enhancing services. Partnerships boost sustainability, boosting business.

| Opportunity | Description | Impact |

|---|---|---|

| Market Expansion | Emerging market growth. | Boosts revenue; China logistics projected to $2.4T by 2025. |

| Diversification | Reusable packaging expansion. | Addresses customer demand. |

| Digital Transformation | Tech investments, better supply chain. | Boosts efficiency, new services ($25.4B supply chain tech spending in 2024). |

| Sustainability | Meets eco-friendly packaging needs. | Attracts environmentally-aware customers ($350B in 2024 to $450B by 2025). |

| Partnerships | Circular economy collaborations. | Boosts sustainability leadership. |

Threats

Economic downturns pose a significant threat. Reduced consumer spending directly decreases the volume of goods transported, lowering the demand for Brambles' services. This decline can severely impact revenue and profitability. For instance, a 2% drop in global GDP could translate to a noticeable decrease in Brambles' earnings. Furthermore, economic uncertainty often leads to delayed investments and reduced business activities.

Brambles faces threats from fluctuating foreign exchange rates due to its global operations. These fluctuations can significantly affect its reported financial results. In fiscal year 2024, currency headwinds impacted revenue. Adverse exchange rate movements can diminish the value of international revenues.

Brambles faces threats from evolving regulations and trade policies. Stricter environmental rules on packaging could increase costs, impacting profitability. Trade policy shifts and tariffs might disrupt supply chains, affecting market access. For instance, in 2024, changes in import duties on wood pallets could affect Brambles. These factors require strategic adaptation.

Disruptions in Global Supply Chains

Disruptions in global supply chains pose a significant threat to Brambles. Geopolitical events, like the ongoing Russia-Ukraine war, and natural disasters can halt the movement of goods, impacting Brambles' operations. Such disruptions can lead to higher costs and service interruptions, affecting profitability. For example, in 2023, supply chain issues contributed to a 5% increase in operational costs for some companies.

- Geopolitical instability can disrupt supply routes.

- Natural disasters can damage infrastructure.

- Increased costs due to delays.

- Service disruptions affecting customers.

Intensifying Competition and Pricing Pressure

Brambles faces escalating competition, potentially squeezing its profits. Rivals and innovative packaging could steal market share. This could force Brambles to lower prices. The company's margins might suffer as a result.

- Competition from CHEP, IFCO, and other players.

- Customer adoption of reusable packaging solutions.

- Pricing pressure impacting profitability.

Brambles confronts economic and geopolitical risks. Fluctuating exchange rates and supply chain disruptions like the Russia-Ukraine war can severely affect financial results and operational costs. Intense competition from reusable packaging options and CHEP also presents profit margin challenges.

| Threat | Impact | Financial Data |

|---|---|---|

| Economic downturn | Reduced demand & profitability | 2% GDP drop may significantly lower earnings. |

| Currency fluctuations | Diminished revenues | Currency headwinds in fiscal year 2024 affected revenue. |

| Supply Chain Disruptions | Increased costs | 5% rise in op. costs due to issues in 2023 |

SWOT Analysis Data Sources

The SWOT analysis draws upon financial reports, market research, and expert evaluations to provide accurate and reliable insights.