Breakthru Beverage Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Breakthru Beverage Group Bundle

What is included in the product

Strategic overview of Breakthru Beverage Group's portfolio based on the BCG Matrix framework across all quadrants.

Printable summary optimized for A4 and mobile PDFs, providing a concise view of Breakthru's portfolio.

What You See Is What You Get

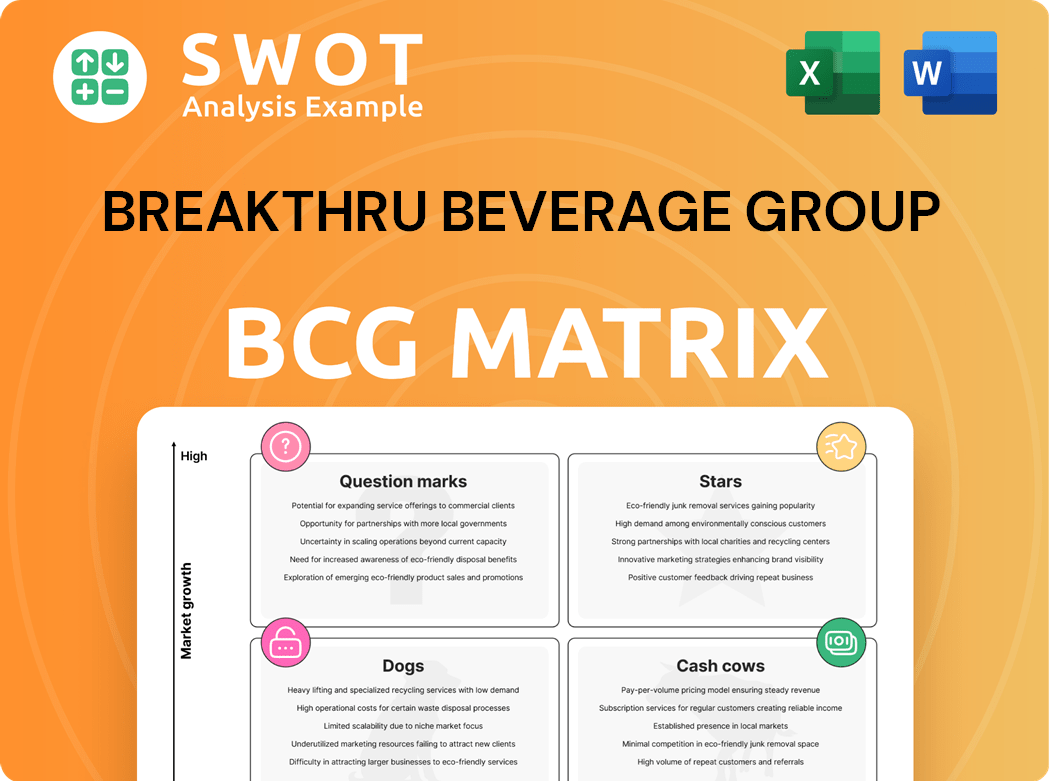

Breakthru Beverage Group BCG Matrix

The Breakthru Beverage Group BCG Matrix displayed is the final deliverable. Purchase grants access to the full, ready-to-use document, free of watermarks or alterations.

BCG Matrix Template

Breakthru Beverage Group's BCG Matrix reveals strategic product placements. It highlights high-growth, high-share "Stars" and steady "Cash Cows." Identify underperforming "Dogs" needing restructuring or divestiture. Uncover "Question Marks" requiring careful investment analysis.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Premium Spirits (Tequila, Whiskey) are stars. Tequila and whiskey are growing, especially in premium markets. In 2024, tequila sales rose, with high-end brands leading. Whiskey also saw gains, driven by consumer interest in quality. These trends confirm the "star" status.

The Ready-to-Drink (RTD) cocktail market is experiencing significant growth, with spirits-based RTDs leading the charge. Breakthru Beverage Group is prioritizing RTD brands, aiming to meet consumer preferences for convenience and quality. In 2024, the RTD market is projected to reach $47.6 billion, with an expected annual growth rate of 13.79% through 2028.

Breakthru Beverage Group (BBG) views sparkling wine as a growth area, anticipating continued expansion in 2024. White wine, particularly in the $11-$25 price range, offers another avenue for growth, aligning with consumer preferences. BBG is actively investing in its Aspect fine wine division to capture the premium market segment, aiming for outperformance. In 2023, the U.S. wine market was valued at approximately $70.5 billion.

Non-Alcoholic Beverages

The non-alcoholic beverage sector is booming, with sales nearing $1 billion. Breakthru Beverage Group (BBG) is strategically investing in this area, recognizing its growth potential. BBG collaborates with firms such as DioniLife to broaden its ANA product range. This move reflects the rising consumer interest in health-focused choices.

- ANA sales are approaching $1 billion.

- BBG is partnering with companies like DioniLife.

- This strategy aligns with health-conscious trends.

E-commerce Platforms (Breakthru NOW)

Breakthru Beverage Group's e-commerce platform, Breakthru NOW, is a rising star. The platform is experiencing substantial sales growth and is expanding its reach. It uses AI to personalize the customer experience, helping businesses.

- Breakthru NOW sales increased by 18% in 2024.

- The platform is now available in 12 states.

- AI personalization has boosted customer engagement by 25%.

Stars include premium spirits, RTDs, and the e-commerce platform Breakthru NOW, showing high growth and market share. In 2024, Tequila and Whiskey saw significant gains, and the RTD market is projected to hit $47.6 billion. Breakthru NOW's sales jumped 18%.

| Star Category | 2024 Performance | Key Drivers |

|---|---|---|

| Premium Spirits | Tequila and Whiskey sales increased | Consumer preference for quality. |

| RTD Cocktails | Market projected to reach $47.6B | Convenience, expanding portfolio. |

| Breakthru NOW | Sales increased by 18% | AI personalization, expanded reach. |

Cash Cows

Established wine brands, like those in Breakthru Beverage Group's portfolio, consistently generate revenue due to their loyal customer base. Breakthru's distribution network ensures these brands maintain a strong market presence. For example, in 2024, the wine market saw a revenue of $76.3 billion in the United States. These brands benefit from Breakthru's ability to reach diverse consumer segments effectively. Steady sales and brand recognition solidify their status as cash cows.

Vodka, including Stoli, is a cash cow for Breakthru. It generates consistent revenue. Breakthru is growing its Stoli partnership. In 2024, vodka sales are steady. The company is expanding into new markets.

Breakthru Beverage Group's established partnerships with Diageo and Moët Hennessy USA are critical for supplying popular products. These relationships ensure a steady supply, vital for consistent revenue. In 2024, Diageo reported a net sales increase of 1.4%, showcasing the value of these partnerships. Breakthru's leadership adjustments aim to enhance these relationships, boosting efficiency.

Traditional Beer Brands

Traditional beer brands, though challenged by craft and non-alcoholic alternatives, remain crucial for Breakthru Beverage Group's sales. These established brands leverage Breakthru's distribution network, ensuring widespread availability. In 2024, traditional beer brands still command a substantial market share. Breakthru's strategic support helps maintain their market presence.

- Market share of traditional beer brands in 2024: approximately 60% of the total beer market.

- Breakthru Beverage Group's 2024 revenue from beer sales: $4.5 billion.

- Distribution network reach: 100,000+ retail accounts.

- Estimated annual growth rate of traditional beer brands: 2-3%.

Fine Wine Division (Aspect)

Breakthru Beverage Group's Aspect fine wine division is a cash cow. It thrives by selling high-end wines, outperforming the broader premium wine market. This division focuses on luxury wines, ensuring robust sales and profitability. Aspect benefits from strong demand for premium products, despite market challenges.

- Aspect's focus on high-end wines drives consistent revenue.

- The division's profitability remains strong amid market fluctuations.

- Aspect's performance contrasts with the struggling overall wine market.

Cash cows in Breakthru Beverage Group's portfolio are key revenue generators. They have steady sales and strong brand recognition. Examples include established wine brands, vodka (like Stoli), and partnerships with suppliers like Diageo and Moët Hennessy USA.

| Category | Description | 2024 Data |

|---|---|---|

| Wine Market Revenue | Total U.S. wine market in 2024 | $76.3 billion |

| Vodka Sales | Steady and consistent | Expanding in markets |

| Diageo Sales Growth | Increase reflecting partnership value | 1.4% |

| Beer Sales | $4.5B from Beer | 60% market share |

Dogs

Dogs in Breakthru's portfolio are wine brands with falling sales and market share. These face challenges in a competitive market. Breakthru might need to rethink its investments in these brands. Consider selling them to free up resources. In 2024, overall wine sales dipped, impacting brand performance.

Flavored Malt Beverages (FMBs) might be dogs in Breakthru Beverage's portfolio, potentially facing headwinds. The FMB market saw a slight dip in 2024, with sales volumes down by about 2% due to evolving consumer tastes. Breakthru might shift resources away from these slower-growing areas. This strategic move would focus on segments with better growth prospects.

Overstocked inventory, like "Dogs" in BCG Matrix, means too much stock and slow sales, tying up Breakthru's capital. In 2024, Breakthru focused on cutting excess inventory across its portfolio. This included reducing slow-moving items, which helps free up cash.

Regional Brands with Limited Appeal

Regional brands with limited national appeal, like some within Breakthru Beverage Group's portfolio, face growth challenges. These brands often have a strong presence in specific areas but lack broader market recognition. Breakthru must evaluate expansion possibilities or concentrate on boosting sales in current markets. For instance, a 2024 report showed that regional craft breweries saw a 5% decrease in national market share.

- Market Share: Regional brands struggle to compete nationally.

- Growth Potential: Expansion is key, but challenging.

- Sales Optimization: Focus on boosting current market sales.

- Strategic Decisions: Requires careful market assessment.

Commodity Spirits

Commodity spirits, positioned in the BCG matrix as "Dogs," encounter challenges due to premiumization and competition. Breakthru Beverage Group must strategize to maintain profitability. This may involve differentiating these products or focusing on high-volume sales. The spirits market saw a 3.4% volume decline in 2023, signaling a need for adaptive strategies.

- Volume declines in the spirits market demand innovative sales tactics.

- Differentiation or volume-driven strategies are critical for maintaining profitability.

- Breakthru must adjust to evolving consumer preferences and market dynamics.

Dogs represent underperforming wine brands in Breakthru's portfolio. These brands face declining sales and market share. Breakthru may need to consider strategic actions. This includes potential divestiture to reallocate resources, especially with overall wine sales decreasing in 2024.

| Category | 2023 Sales | 2024 Forecast |

|---|---|---|

| Wine Sales Decline | -2.5% | -1.8% |

| FMB Market Dip | -2% | -1.5% |

| Spirits Volume Drop | -3.4% | -2.8% |

Question Marks

Emerging spirits, such as Mezcal, fit the question mark category due to their rising popularity but modest market share. Breakthru Beverage Group invested in this area, expanding distribution for brands like Nosotros. In 2024, the global mezcal market was valued at approximately $800 million, with projections of significant growth. The expansion indicates Breakthru's bet on this category's future success.

Innovative RTD sub-categories, like those with unique flavors or functional ingredients, need investment to succeed. Breakthru Beverage Group is assessing this space for growth. The global RTD market was valued at $34.9 billion in 2024. Experts predict it will reach $47.8 billion by 2028. This shows the importance of strategic investments.

New craft beer styles and brands with limited distribution are question marks for Breakthru. These innovations require evaluating their market share potential and consumer appeal. In 2024, craft beer sales reached $25.5 billion, but growth slowed. Breakthru must analyze these brands' ability to compete. Successful brands could boost Breakthru's market position.

Low- and No-Alcoholic Spirits Alternatives

The low- and no-alcoholic spirits alternatives market is emerging, necessitating investment in brand awareness and distribution. Breakthru's strategic alliance with DioniLife targets the rising demand for these products. The non-alcoholic beverage market is projected to reach $34.7 billion by 2027. This segment is positioned as a "question mark" due to its growth potential and need for strategic investment.

- Market growth is driven by health-conscious consumers.

- Breakthru invests in marketing and distribution.

- Partnerships are vital for market penetration.

- High growth potential with uncertain outcomes.

Online Sales and Direct-to-Consumer Initiatives

Online sales and direct-to-consumer (DTC) initiatives present both opportunities and challenges for Breakthru Beverage Group. While the e-commerce market is expanding, building the necessary infrastructure for DTC requires substantial investment. Breakthru must refine its e-commerce strategies to fully leverage this growing channel and reach consumers effectively. DTC sales in the beverage alcohol market are projected to increase.

- DTC sales in the US alcoholic beverage market were valued at $3.1 billion in 2023.

- The DTC market requires investments in logistics, technology, and marketing.

- Optimized e-commerce strategies can include targeted advertising and improved user experience.

Mezcal, a question mark, saw an $800 million market in 2024, with growth. RTDs need investment; the $34.9B market in 2024 to $47.8B by 2028. Craft beer and new brands require market potential assessments; $25.5B in 2024. Low/no-alcohol spirits, like DioniLife, are emerging; the market is expected to reach $34.7B by 2027. DTC in the US alcoholic beverage market was $3.1B in 2023.

| Category | Market Value (2024) | Growth Drivers |

|---|---|---|

| Mezcal | $800M | Rising popularity |

| RTDs | $34.9B | Innovation |

| Craft Beer | $25.5B | New brands |

| Low/No-Alcohol | Projected $34.7B by 2027 | Health-conscious consumers |

| DTC | $3.1B (2023) | E-commerce expansion |

BCG Matrix Data Sources

Breakthru Beverage Group's BCG Matrix uses financial statements, market data, industry analysis, and expert insights to inform its structure.