Breakthru Beverage Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Breakthru Beverage Group Bundle

What is included in the product

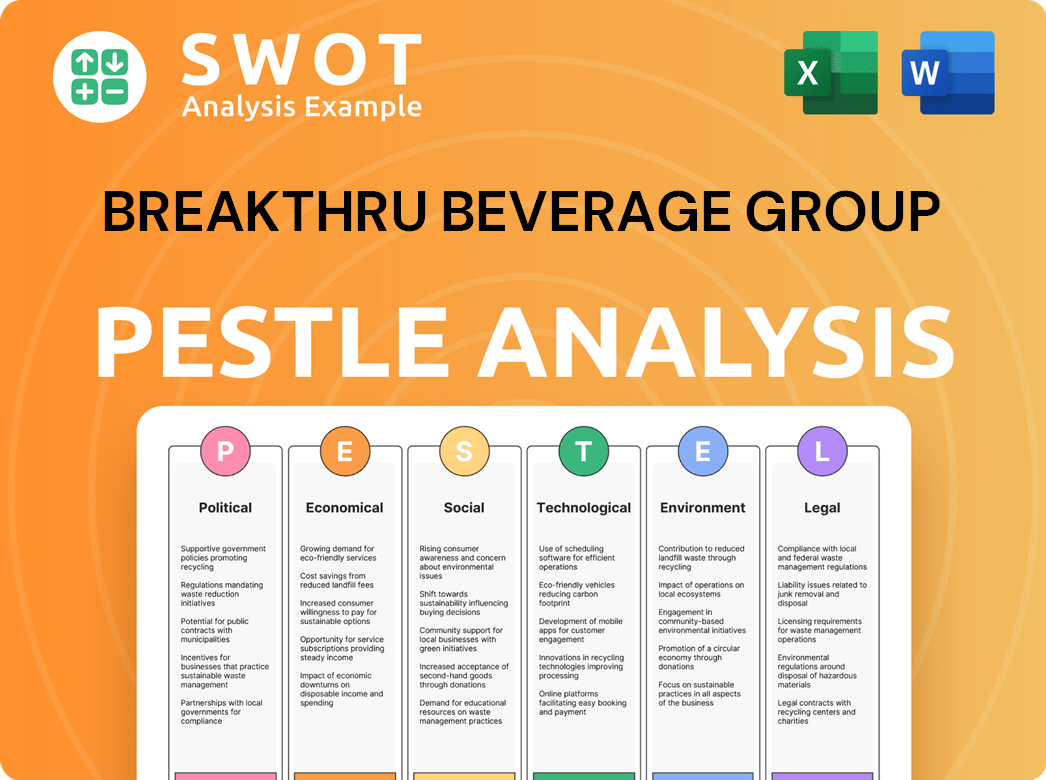

Identifies macro-environmental factors impacting Breakthru Beverage Group across Political, Economic, Social, etc.

A shareable summary for quick alignment across teams & departments.

Preview the Actual Deliverable

Breakthru Beverage Group PESTLE Analysis

What you're seeing is the complete Breakthru Beverage Group PESTLE analysis. This detailed preview accurately represents the document you'll receive.

The layout and content in the preview will be exactly the same in the final downloadable version.

This document is professionally formatted and structured as presented here.

Download this real-world, ready-to-use Breakthru Beverage analysis directly after purchase.

PESTLE Analysis Template

Navigate the complex world impacting Breakthru Beverage Group with our PESTLE analysis. Uncover how external forces shape the industry giant's trajectory, including regulatory changes. Our analysis provides key insights into market opportunities and threats. We also break down social trends and technological advancements affecting Breakthru's operations.

Understand market dynamics, assess competitive strategies, and support better decisions. This meticulously crafted analysis reveals crucial data about economic indicators and the global market, helping your brand stay informed. Gain a critical edge in the market! Download the full report.

Political factors

Trade policies and tariffs can greatly impact Breakthru Beverage Group. Changes in trade agreements and tariffs affect the cost of imported alcoholic beverages. For example, in 2023, the US and Canada faced trade tensions with potential tariff impacts. This could change Breakthru's pricing and product availability.

The beverage alcohol industry faces stringent government regulations across North America, impacting distribution significantly. Licensing requirements, varying by state and province, can restrict market access and operational flexibility. The three-tier system in the US, separating producers, distributors, and retailers, adds complexity. These regulations directly influence Breakthru Beverage Group's distribution strategies and costs, potentially affecting profitability. The Alcohol and Tobacco Tax and Trade Bureau (TTB) oversees federal regulations.

Political stability significantly impacts Breakthru Beverage Group's operations. Changes in alcohol-related taxation policies can directly affect profitability; for instance, in 2024, excise taxes on alcohol saw adjustments across several states. Public health initiatives, such as those promoting responsible drinking, also influence marketing and sales strategies. Adapting to these shifts is key to maintaining market share.

Lobbying and industry advocacy

Breakthru Beverage Group, like other major beverage distributors, actively engages in lobbying and advocacy. These efforts aim to influence legislation and regulations that impact the industry. The goal is to protect their business interests and create a favorable policy environment. According to OpenSecrets, the alcohol industry spent over $25 million on lobbying in 2023.

- Breakthru likely lobbies on issues like excise taxes, distribution rights, and labeling requirements.

- Industry groups like the Wine & Spirits Wholesalers of America (WSWA) are key players in these efforts.

- In 2024, these lobbying efforts will likely focus on navigating evolving regulations related to e-commerce and direct-to-consumer sales.

Public health policies related to alcohol

Government regulations significantly affect Breakthru Beverage Group. Policies targeting alcohol consumption, like age limits and advertising rules, directly impact demand. For example, excise taxes can alter pricing and sales. These factors are crucial for Breakthru's strategic planning.

- Excise taxes on alcohol vary greatly by state, impacting Breakthru's profitability.

- Advertising restrictions can limit brand visibility and market reach.

- Changes in drinking age laws can influence the consumer base.

Political factors significantly impact Breakthru Beverage Group's operations through regulations and lobbying efforts. Changes in alcohol-related taxation and excise duties influence profitability; in 2024, these taxes varied significantly by state, impacting pricing and sales. Lobbying by industry groups, like the WSWA, aims to shape legislation favorable to their interests.

| Aspect | Impact | Example (2024) |

|---|---|---|

| Taxation | Affects pricing and profitability | Excise tax varied greatly by state, impacting sales. |

| Regulations | Impacts market access and advertising | Changes in advertising regulations affected brand visibility. |

| Lobbying | Influences legislation | WSWA lobbying efforts aimed to protect industry interests. |

Economic factors

Economic conditions, specifically consumer spending and disposable income, significantly affect beverage demand. High inflation or economic downturns can curb discretionary spending, potentially reducing sales volumes. For example, in early 2024, consumer spending softened slightly due to inflation. This might lead to a preference for more affordable beverage choices.

Inflation, particularly in 2024, has driven up Breakthru Beverage Group's operational costs. The prices of raw materials like glass and aluminum, essential for packaging, have increased. Labor costs are also rising, with the U.S. average hourly earnings up 4.1% year-over-year as of March 2024. These factors impact profitability.

Breakthru Beverage Group, with operations in the US and Canada, faces exchange rate risks. The fluctuating USD/CAD exchange rate directly impacts import/export costs and revenue translation. For example, a weaker CAD increases the cost of Canadian imports for Breakthru. In 2024, the USD/CAD exchange rate has shown volatility, affecting profit margins. Currency fluctuations require careful hedging strategies.

Market competition and consolidation

The North American beverage distribution sector is highly competitive, featuring major firms like Breakthru Beverage Group. Consolidation, through mergers and acquisitions, reshapes the competitive environment, presenting both opportunities and hurdles. In 2024, the market saw a 3% increase in M&A deals within the beverage sector. This trend impacts market share and pricing strategies.

- Breakthru Beverage Group faces competition from major players.

- Consolidation can lead to changes in market share and pricing.

- M&A activity increased by 3% in 2024.

Supply chain costs and efficiency

Breakthru Beverage Group's operational success hinges on its supply chain's efficiency and cost-effectiveness, which are key economic factors. Increased transportation expenses, warehouse rent hikes, or logistics inefficiencies can significantly affect operational costs. These factors can disrupt product delivery and limit Breakthru's competitiveness. For example, in 2024, the average cost to ship a container increased by 15% due to fuel prices.

- Supply chain disruptions can lead to inventory management challenges and affect product availability, thereby impacting sales.

- Efficient logistics, including optimized routes and warehousing, are crucial for maintaining profitability.

- Rising fuel prices, labor costs, and warehousing expenses can escalate the overall supply chain costs.

- Breakthru must continuously evaluate and adapt its supply chain strategies to mitigate risks.

Consumer spending fluctuations impact beverage demand, with inflation in early 2024 softening spending. Rising costs, including raw materials and labor, influence profitability; US hourly earnings rose 4.1% YOY in March 2024. Exchange rate volatility, like USD/CAD, impacts costs, requiring hedging.

| Factor | Impact | 2024 Data |

|---|---|---|

| Consumer Spending | Affects demand | Softened in early 2024 |

| Inflation | Raises costs | Packaging & labor costs up |

| Exchange Rates | Impacts import costs | USD/CAD volatility |

Sociological factors

Consumer preferences shift rapidly in the beverage industry. RTDs and premium spirits are booming, while low/no-alcohol options gain traction. Breakthru must adjust its offerings. The RTD market is projected to reach $40 billion by 2025.

Consumer interest in health and wellness significantly impacts the beverage industry. Demand is rising for healthier choices like low-sugar and non-alcoholic options. The global market for non-alcoholic beverages is projected to reach $1.04 trillion by 2028. This trend directly influences Breakthru Beverage Group's product offerings and marketing strategies.

Demographic shifts significantly impact Breakthru Beverage Group. The aging population and growing multiculturalism in North America alter consumer preferences. Millennials and Gen Z, key demographics, drive demand for diverse beverages. Data indicates that in 2024, the 25-34 age group is a major alcohol consumer.

Social responsibility and ethical consumerism

Consumers now often prioritize a company's social and environmental impact when making purchasing decisions. Breakthru Beverage Group's dedication to corporate social responsibility, such as its community engagement and ethical conduct, significantly affects how consumers view and remain loyal to the company. In 2024, about 77% of consumers expressed a preference for brands committed to sustainability. These factors influence brand perception and loyalty.

- 77% of consumers prefer sustainable brands (2024).

- Ethical practices boost consumer trust.

- Community involvement enhances brand image.

On-premise vs. off-premise consumption habits

Consumer drinking habits are shifting, impacting Breakthru Beverage Group's distribution channels. The choice between on-premise (bars, restaurants) and off-premise (home) consumption is key. Remote work trends influence on-premise visits. For example, in 2024, off-premise alcohol sales in the U.S. reached $250 billion.

- On-premise sales are rebounding, but face competition.

- Off-premise sales remain strong, driven by convenience.

- Remote work boosts at-home consumption trends.

Social factors dramatically shape Breakthru's market. Sustainable brands and ethical practices drive consumer trust, with 77% of consumers favoring sustainable companies in 2024. Community engagement further boosts brand perception and loyalty, critical for success. Consumer habits, like on-premise vs. off-premise consumption, also play a key role.

| Factor | Impact | Data (2024) |

|---|---|---|

| Sustainability Preference | Brand Loyalty | 77% consumers prefer sustainable brands |

| Ethical Practices | Consumer Trust | Ethical conduct enhances brand image |

| Consumption Habits | Channel Distribution | Off-premise sales: $250B in U.S. |

Technological factors

E-commerce and digital platforms reshape beverage distribution. Breakthru uses B2B platforms to boost customer experience and efficiency. Digital sales in the U.S. alcohol market hit $6.1 billion in 2023, with growth expected. Breakthru's digital investments align with market trends, enhancing its competitiveness.

Breakthru Beverage Group leverages technology to enhance its supply chain. Inventory tracking, logistics, and warehousing are optimized through technology. Automation reduces costs and improves efficiency. Data analytics and IoT devices play a crucial role. In 2024, the beverage industry saw a 15% increase in supply chain tech adoption.

Breakthru Beverage Group utilizes data analytics and business intelligence to understand sales trends, consumer behavior, and operational efficiency. These tools enable data-driven decisions in inventory management, marketing, and sales strategies. In 2024, the beverage industry saw a 6% rise in data analytics adoption for supply chain optimization. This allows Breakthru to refine its approach.

Route optimization and fleet management software

Route optimization and fleet management software are pivotal for Breakthru Beverage Group. This technology enhances delivery efficiency and cuts down on expenses, particularly important for a large distributor. Using such tools, the company can monitor vehicle performance and driver behavior. This leads to better fuel efficiency and reduced maintenance costs. The market for fleet management solutions is expected to reach $38.6 billion by 2025.

- Improved fuel efficiency can lead to savings of 10-15% on fuel costs.

- Maintenance cost reductions can be around 5-10% with better fleet management.

- The global fleet management market was valued at $24.1 billion in 2023.

- Software can reduce delivery times by 15-20%.

Emerging technologies (AI, Blockchain)

Breakthru Beverage Group is likely assessing how AI and Blockchain can enhance its operations. AI could optimize demand forecasting, potentially reducing waste and improving inventory management. Blockchain might be used to enhance supply chain transparency, a growing consumer demand. These technologies could lead to cost savings and increased efficiency.

- AI in supply chain management could reduce costs by 10-20% according to recent studies.

- Blockchain adoption in the food and beverage industry is projected to reach $1.2 billion by 2025.

- Improved traceability can boost consumer trust and brand loyalty.

Breakthru integrates digital platforms, with US alcohol e-sales at $6.1B in 2023. Supply chain tech adoption in the beverage sector rose 15% in 2024, enhancing operations. The company uses data analytics; fleet management is boosted by a $38.6B market by 2025.

| Technology Area | Impact | Data Point |

|---|---|---|

| E-commerce | Market Growth | $6.1B in U.S. alcohol e-sales in 2023 |

| Supply Chain Tech | Adoption Rate | 15% industry increase in 2024 |

| Fleet Management | Market Size | $38.6B projected by 2025 |

Legal factors

Breakthru Beverage Group navigates intricate alcohol laws across US and Canada. These regulations, differing by region, affect licensing, product registration, pricing, and marketing. For instance, 2024 data shows that compliance costs in some states can reach millions annually. The company must adhere to these to operate legally and avoid penalties. Furthermore, understanding these laws is crucial for strategic market entry and expansion.

Trade and tariff regulations significantly affect Breakthru Beverage Group. They influence the import and export of beverages. The World Trade Organization (WTO) data shows that average tariffs on alcoholic beverages range from 10% to 30%. These costs impact Breakthru's operations. Customs duties and trade agreements are crucial for managing costs and market access.

Breakthru Beverage Group faces labor law compliance, impacting operational costs. In 2024, labor costs for similar firms averaged 35% of revenue. Workplace safety regulations, like those enforced by OSHA in the US and similar bodies in Canada, require ongoing investment. Non-compliance can lead to hefty fines; OSHA penalties for serious violations can exceed $15,000 per incident. Employee relations, including union negotiations, also play a vital role.

Food and beverage safety regulations

Breakthru Beverage Group must rigorously adhere to food and beverage safety regulations to guarantee product quality and consumer safety. These regulations govern all aspects, from storage and handling to transportation. Non-compliance can lead to severe penalties, including product recalls and legal repercussions. The Food and Drug Administration (FDA) oversees these standards, with violations potentially resulting in significant fines, which in 2024, could range from $1,000 to over $1 million depending on the severity and frequency of the violation.

- FDA inspections are frequent, with a 2023 report showing an average of 1,500 inspections per year for beverage distributors.

- Failure to comply can result in product seizures, as seen in a 2024 case involving a major beverage distributor.

- Breakthru must maintain detailed records to prove compliance, which is a key focus during audits.

- Ongoing training programs for employees handling products are crucial for maintaining compliance.

Antitrust and competition laws

Breakthru Beverage Group, a major player in beverage distribution, must comply with antitrust and competition laws. These laws aim to prevent monopolies and ensure fair market competition. The company's acquisitions and business practices undergo careful scrutiny. In 2024, the Federal Trade Commission (FTC) and Department of Justice (DOJ) actively investigated potential anti-competitive behaviors within the alcohol distribution sector.

- FTC and DOJ investigations in 2024 targeted the alcohol distribution sector.

- Breakthru's acquisitions are subject to regulatory review.

- Compliance is essential to avoid significant penalties.

Breakthru must navigate evolving alcohol laws, incurring high compliance costs. Compliance costs may reach millions annually in certain states, according to 2024 data. Sticking to these laws prevents penalties, supporting legal operations. It’s key for market strategy and future expansion.

| Legal Aspect | Impact | 2024 Data/Example |

|---|---|---|

| Licensing & Regulations | Operational costs, market access | Compliance costs millions/yr in some US states |

| Trade & Tariffs | Import/Export costs, pricing | Avg. alcohol tariffs: 10-30% (WTO data) |

| Labor Laws | Operational expenses, compliance | Labor costs approx. 35% of revenue |

Environmental factors

Consumer and regulatory pressures are mounting for sustainable packaging. Breakthru Beverage Group's packaging use impacts its environmental footprint. In 2024, the global market for sustainable packaging reached $365.3 billion. Using recycled materials or alternative packaging is crucial. The sustainable packaging market is expected to reach $537.8 billion by 2029.

Breakthru Beverage Group's distribution network significantly impacts its carbon footprint. Transportation and logistics contribute to emissions. Recent data indicates that the beverage industry is under pressure to adopt sustainable practices. Regulations are pushing for fuel-efficient fleets. In 2024, the industry saw a 10% increase in the adoption of electric vehicles.

Water is essential for beverage production, making its availability and quality crucial, especially for producers. Regions facing water stress could see production challenges, indirectly affecting distributors like Breakthru Beverage Group. Corporate responsibility initiatives may focus on water stewardship, supporting sustainable practices. In 2024, the beverage industry's water footprint was a significant concern, with companies increasingly adopting water-saving technologies.

Waste management and recycling

Breakthru Beverage Group must focus on waste management and recycling to reduce its environmental footprint. This includes managing packaging waste and other operational waste responsibly. Implementing robust recycling programs is crucial. In 2024, the global waste management market was valued at approximately $2.2 trillion. Effective waste management can reduce operational costs.

- Reduce, reuse, and recycle programs.

- Compliance with environmental regulations.

- Investment in eco-friendly packaging.

- Waste reduction targets.

Climate change impact on supply chain

Climate change poses significant risks to Breakthru Beverage Group's supply chain. Extreme weather events, such as droughts and floods, can disrupt the availability of essential agricultural products like grapes and grains, impacting production. For instance, in 2024, the wine industry faced challenges due to climate-related issues. These disruptions can increase costs and affect distribution. Breakthru needs to consider these climate-related risks to ensure business continuity.

- 2024 saw a 10% drop in wine production in some regions due to climate change.

- Extreme weather events caused $15 billion in supply chain disruptions in the beverage industry in 2024.

Breakthru must tackle environmental challenges to stay competitive. Sustainable packaging, valued at $365.3B in 2024, is crucial. Carbon footprint and water usage require careful management through eco-friendly practices. Climate change risks necessitate supply chain resilience.

| Environmental Aspect | Impact | 2024 Data |

|---|---|---|

| Sustainable Packaging | Reduce footprint | Market at $365.3B |

| Carbon Footprint | Distribution impact | 10% EV adoption rise |

| Water Management | Production, quality | Water footprint concern |

PESTLE Analysis Data Sources

The Breakthru Beverage Group PESTLE Analysis incorporates data from industry reports, government databases, and financial news.