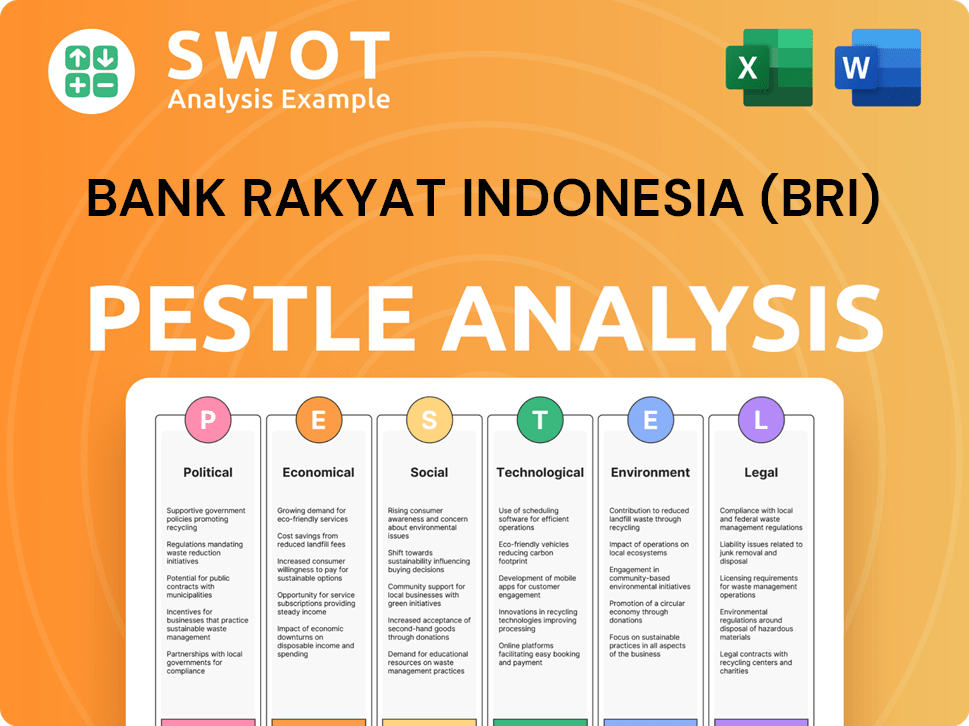

Bank Rakyat Indonesia (BRI) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Rakyat Indonesia (BRI) Bundle

What is included in the product

Examines BRI's environment using Political, Economic, Social, Tech, Environmental, and Legal factors, highlighting risks and opportunities.

Allows users to modify or add notes specific to their own context, region, or business line.

Same Document Delivered

Bank Rakyat Indonesia (BRI) PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured. This BRI PESTLE analysis explores political, economic, social, technological, legal, and environmental factors impacting BRI. The preview reveals its comprehensive research and structured analysis. Instantly download the finished document after purchase.

PESTLE Analysis Template

Uncover the external factors shaping Bank Rakyat Indonesia (BRI) with our comprehensive PESTLE analysis. Explore the political landscape and economic shifts impacting BRI's strategic decisions. Identify technological advancements and social trends driving industry changes. Our detailed analysis covers environmental factors and legal implications affecting BRI. Understand the complete market context for better investment decisions and strategic planning. Gain valuable insights and strengthen your position by downloading the full version now!

Political factors

Indonesia's government stability directly affects BRI, as MSMEs are its focus. Programs like KUR impact BRI's lending and target market health. In 2024, KUR disbursed Rp278.7 trillion. Policy changes can affect BRI's business volume and risk exposure. The government's MSME support is crucial for BRI's success.

BRI, as a state-owned enterprise, navigates a regulatory landscape shaped by Bank Indonesia (BI) and the Financial Services Authority (OJK). Regulatory changes, including those related to capital adequacy, can directly affect BRI. In 2024, BRI's capital adequacy ratio (CAR) stood at 26.5%, indicating strong financial health. Government strategies also influence BRI's direction.

Political connections can affect banking outcomes. BRI, being state-owned, faces governance and decision-making influences. Transparency and strong governance are vital to manage political risks. In 2024, Indonesia's political landscape saw increased focus on banking sector regulations. BRI's commitment to governance is key.

International Relations and Regional Initiatives

Indonesia's involvement in regional initiatives, like the Belt and Road Initiative (BRI), creates both chances and obstacles for Bank Rakyat Indonesia (BRI). These initiatives might boost economic activity and infrastructure, potentially helping BRI's customers. However, they could also bring about economic security concerns and dependencies. The geopolitical climate in the area also impacts the general economic scene.

- In 2024, Indonesia's trade with China, a key BRI partner, was valued at over $100 billion.

- BRI projects in Indonesia have faced delays, with some infrastructure projects experiencing cost overruns.

- The Indonesian government is focusing on balancing foreign investment with national interests, which impacts BRI's operations.

Policies on Financial Inclusion

The Indonesian government actively promotes financial inclusion, especially in areas with limited access. BRI’s mission mirrors this by focusing on micro, small, and medium enterprises (MSMEs) and remote communities. Government backing for expanding financial access, including digital solutions, strongly supports BRI’s goals and growth potential within these segments. This synergy fosters BRI's expansion and strengthens its role in national economic development. As of early 2024, Indonesia aimed to increase financial inclusion to over 90% by 2025.

- Government initiatives like the National Strategy for Financial Inclusion (SNKI) support BRI’s objectives.

- Digital financial services are key, with mobile banking and e-wallets expanding rapidly.

- BRI benefits from policies promoting MSME development and access to credit.

- Regulatory support facilitates BRI's expansion into underserved markets.

BRI's MSME focus aligns with Indonesian political support, vital for lending. In 2024, KUR's Rp278.7T disbursement underscored this. Policy changes impact BRI’s operations. MSME policies are key.

| Political Factor | Impact on BRI | 2024/2025 Data |

|---|---|---|

| Government Stability | Influences lending environment | Ongoing support for MSMEs via policy (e.g., KUR). |

| Regional Initiatives (e.g., BRI) | Affects infrastructure & trade | Trade with China (BRI partner) exceeded $100B in 2024. |

| Financial Inclusion Policies | Boosts BRI's market & growth | Aim for 90%+ financial inclusion by 2025; digital services expand. |

Economic factors

Indonesia's economic growth is crucial for BRI. Strong growth boosts MSME activity, increasing loan demand. In 2024, Indonesia's GDP growth is projected to be around 5%. Inflation and interest rates, influenced by Bank Indonesia, also affect BRI's operations. Stability is key for loan quality and sustained growth.

BRI heavily relies on the MSME sector, which forms its core customer base. The sector's health directly impacts BRI's financial outcomes. In 2024, MSMEs contributed over 60% to Indonesia's GDP. MSME access to finance, influenced by economic conditions, is critical. Factors like market access and productivity affect BRI's loan portfolio quality.

Bank Indonesia's interest rate decisions directly impact BRI's financial performance. As of May 2024, the benchmark interest rate is at 6.25%, influencing BRI's funding costs and loan pricing. This affects BRI's net interest margin, a key profitability metric. Lower rates can boost MSME loan affordability, stimulating economic activity.

Inflation and Purchasing Power

Inflation significantly influences purchasing power, affecting both individuals and businesses, thereby impacting the demand for BRI's financial services and borrowers' ability to repay loans. High inflation can also elevate BRI's operational costs, squeezing profit margins. The Indonesian inflation rate was 3.05% in February 2024, slightly up from 2.58% in January 2024, indicating a need for vigilant risk management. Monitoring these trends is crucial for BRI's strategic planning and financial stability.

- Indonesia's inflation rate reached 3.05% in February 2024.

- Rising inflation can increase BRI's operational expenses.

- Inflation affects the ability of borrowers to repay loans.

- Monitoring inflation is important for strategic planning.

Investment and Foreign Direct Investment (FDI)

Investment and Foreign Direct Investment (FDI) are crucial for Indonesia's economic growth, impacting businesses and MSMEs. Higher investment boosts demand for banking services. BRI, with its initiatives, attracts substantial investment, which benefits both its clients and the wider economy. However, such investments also introduce potential risks that need careful management.

- In 2023, Indonesia's FDI reached $44.1 billion, a 13.8% increase from 2022.

- BRI's loan portfolio expanded, reflecting the investment's impact.

- The government aims to attract $50 billion in FDI in 2024.

Indonesia's economic growth, projected at 5% in 2024, directly impacts BRI, especially MSMEs. Inflation, at 3.05% in February 2024, and interest rates (6.25% as of May 2024) influence BRI's operations and loan performance. FDI, reaching $44.1B in 2023, fuels growth, benefiting BRI.

| Factor | Impact on BRI | Data (2024) |

|---|---|---|

| GDP Growth | Boosts loan demand, MSME activity | Projected 5% |

| Inflation | Affects loan repayment, operational costs | 3.05% (Feb) |

| Interest Rates | Impacts funding costs, loan pricing | 6.25% (May) |

Sociological factors

Financial inclusion in Indonesia is crucial, with a notable unbanked population, especially in rural areas. Education, trust, and cultural norms significantly impact banking adoption. BRI aims to boost financial inclusion by understanding these sociological factors. In 2024, approximately 51% of adults in Indonesia are fully banked.

Indonesia's large, young population offers BRI a vast market. With over 277 million people in 2024, including a significant youth demographic, BRI can tailor services. Urbanization drives demand for digital banking; in 2024, 56.7% of Indonesians lived in urban areas. Mobile banking adoption is rising, with 75% of adults using smartphones.

Poverty and income inequality significantly affect financial inclusion, crucial for BRI's MSME focus. In Indonesia, approximately 9.3% of the population lived below the poverty line in September 2024, highlighting accessibility challenges. BRI addresses this by offering tailored, affordable financial products to underserved communities. This strategy aims to reduce inequality and boost economic participation. In 2024, the Gini ratio for Indonesia was around 0.38, indicating moderate income disparity.

Cultural Norms and Trust

Cultural norms and trust significantly influence financial inclusion, acting as potential barriers for institutions like Bank Rakyat Indonesia (BRI). Addressing these cultural nuances is crucial for BRI's success. Tailoring financial products and services to align with local customs builds trust and fosters community engagement. BRI must navigate these factors to expand its reach effectively.

- In 2024, BRI reported a significant increase in microloan disbursements, indicating successful community engagement.

- BRI's focus on Sharia-compliant products caters to specific cultural and religious preferences, boosting trust.

- BRI's extensive network of branches and agents in remote areas demonstrates a commitment to understanding and serving diverse communities.

Social Impact and Community Development

Bank Rakyat Indonesia (BRI) significantly impacts society by focusing on micro, small, and medium enterprises (MSMEs) and financial inclusion. BRI's commitment to community development and empowering small businesses strengthens its reputation and operational social license. Social implications of lending practices and supporting community initiatives are increasingly crucial. BRI's actions have led to positive outcomes, enhancing its brand image and community relations. For example, BRI provided Rp 28.3 trillion in loans for the people's business credit (KUR) in 2024.

- MSME Focus: BRI's core business supports MSMEs, crucial for economic growth.

- Financial Inclusion: BRI expands access to financial services, especially in underserved areas.

- Community Development: BRI invests in projects that benefit local communities.

- Social License: Positive social impact enhances BRI's reputation and operational freedom.

Sociological factors critically shape Bank Rakyat Indonesia (BRI). They focus on financial inclusion amid varied adoption rates in 2024. Urbanization and tech adoption offer growth opportunities. BRI targets underserved MSMEs, impacting poverty and inequality with specific loan disbursements.

| Factor | Impact | Data (2024) |

|---|---|---|

| Financial Inclusion | Influences access & usage | 51% fully banked |

| Demographics | Impacts service tailoring | 277M population |

| Poverty & Inequality | Challenges for access | Gini ratio of 0.38 |

Technological factors

Digital advancements rapidly transform banking in Indonesia. BRI's digital strategy boosts efficiency, customer experience, and reach. Internet and smartphone use are key drivers. BRI's digital banking users reached 30.3 million in Q1 2024, a 25% YoY increase.

The fintech industry is rapidly evolving, intensifying competition for BRI. Fintechs provide innovative services, potentially reaching new customer bases. BRI must enhance its digital offerings, partner with fintechs, or consider acquisitions to stay competitive. In 2024, global fintech investments reached $113.7 billion, signaling strong growth.

Mobile banking and digital platforms are crucial for BRI to offer accessible services. BRImo and BRISPOT are key to its digital strategy. BRI's digital transactions in 2024 reached 3.8 billion, a 49.9% increase. MSMEs are a major target for BRI's digital expansion.

Data Analytics and AI

Bank Rakyat Indonesia (BRI) is leveraging data analytics and AI to gain deeper insights into customer behavior, which in turn, enhances its ability to personalize products and services. This technological integration also significantly improves risk management capabilities. In 2024, BRI allocated approximately $500 million towards digital transformation initiatives, including AI and data analytics projects. These technologies streamline processes like loan approvals and fraud detection, with AI-driven fraud detection systems reducing fraudulent transactions by 35% in the last year.

- $500 million allocated for digital transformation in 2024.

- 35% reduction in fraudulent transactions due to AI.

Cybersecurity and Data Protection

Cybersecurity and data protection are critical for BRI due to its digital platform reliance. BRI must invest in strong security measures to protect customer data and maintain trust, as cyber threats evolve. In 2024, the global cybersecurity market was valued at $223.8 billion, projected to reach $345.4 billion by 2025. Continuous vigilance and adaptation are necessary to address evolving cyber threats.

- BRI's digital banking users grew significantly in 2024, increasing the need for robust cybersecurity.

- Data breaches can lead to financial losses and reputational damage, impacting BRI's customer base.

- Investment in AI-driven threat detection is becoming crucial for proactive cybersecurity.

BRI's tech focus is about efficiency and customer experience, marked by digital user growth to 30.3M in Q1 2024. The bank’s commitment to digital includes $500M for AI and data initiatives in 2024, with AI cutting fraud by 35%. Cybersecurity investment is crucial as global cyber spending hit $223.8B.

| Key Aspect | Details |

|---|---|

| Digital User Growth | 30.3 million digital banking users by Q1 2024 |

| Investment in Digital | $500 million allocated in 2024 |

| Impact of AI | 35% reduction in fraudulent transactions |

| Cybersecurity Market Size | $223.8 billion in 2024 |

Legal factors

Bank Rakyat Indonesia (BRI) is heavily regulated by Bank Indonesia and the OJK. BRI must adhere to rules on capital, liquidity, and risk. In 2024, BRI's capital adequacy ratio (CAR) was around 25%. Regulatory changes can affect BRI's profits. Compliance is crucial.

The Financial Services Authority (OJK) is vital for supervising Indonesian financial institutions like BRI. OJK regulations cover digital banking, financial reporting, and consumer protection. BRI must comply with OJK rules, which are updated frequently. For example, in 2024, OJK issued new regulations on cybersecurity for banks.

Bank Rakyat Indonesia (BRI) is subject to rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. BRI must implement robust Know Your Customer (KYC) procedures to verify client identities. In 2024, global AML fines totaled $5.2 billion, emphasizing compliance importance. BRI's AML efforts are crucial to prevent illicit financial activities, safeguarding its reputation and operations.

Consumer Protection Laws

Consumer protection laws are crucial for BRI, especially given its focus on MSMEs and individual customers. These regulations ensure fair practices and transparency in financial dealings. BRI must comply with consumer protection laws, which are continuously updated to reflect evolving market dynamics and consumer needs. Failure to comply can result in penalties and reputational damage. In 2024, the Indonesian government strengthened consumer protection regulations.

- BRI's compliance with consumer protection laws is regularly audited by the Indonesian Financial Services Authority (OJK).

- In 2024, OJK reported a 15% increase in consumer complaints against financial institutions.

- BRI allocated approximately $10 million in 2024 for consumer protection initiatives.

Sustainable Finance Regulations

Indonesia actively promotes sustainable finance and green investments, with regulations like POJK 51 of 2017. These rules mandate that banks such as Bank Rakyat Indonesia (BRI) incorporate environmental, social, and governance (ESG) principles into their operations and reporting. BRI's adherence to these regulations is crucial for its operational integrity. Compliance is increasingly vital, reflecting a global shift towards sustainable practices. For example, in 2024, BRI allocated approximately $5 billion to green financing initiatives.

- POJK 51/2017 mandates ESG integration.

- BRI allocated $5B to green financing (2024).

BRI must adhere to rigorous banking regulations from Bank Indonesia and OJK. In 2024, global AML fines reached $5.2 billion, stressing compliance. Sustainable finance rules like POJK 51 influence BRI, with $5 billion allocated to green initiatives in 2024.

| Regulation | Governing Body | BRI Impact (2024) |

|---|---|---|

| Capital Adequacy | Bank Indonesia | CAR approx. 25% |

| Consumer Protection | OJK | $10M allocated for initiatives |

| ESG Compliance | OJK | $5B for green financing |

Environmental factors

Climate change presents significant risks for BRI. Physical risks include increased natural disasters, potentially impacting borrowers and assets. Transition risks involve shifts to a low-carbon economy, affecting BRI's investments in carbon-intensive sectors. BRI must assess and manage these environmental risks, especially in vulnerable sectors. In 2024, Indonesian floods and droughts cost the economy billions, highlighting the need for climate risk assessment.

BRI can tap into sustainable finance, a growing trend where banks fund green projects. This offers BRI a chance to create green loans, backing eco-friendly ventures. In 2024, green bonds hit $1.1 trillion globally. BRI's efforts align with global climate goals, boosting its reputation.

BRI and its clients must comply with environmental regulations. Banks assess borrowers' environmental performance, especially those in high-impact industries. Evolving environmental laws affect lending and risk assessments. For instance, in 2024, Indonesia increased green financing targets. BRI's green loan portfolio grew by 30% in Q1 2024, reflecting this shift.

ESG Reporting and Disclosure

Bank Rakyat Indonesia (BRI) faces increasing pressure to disclose its environmental, social, and governance (ESG) performance. Regulations and stakeholder demands necessitate improved ESG reporting to showcase BRI's sustainability efforts. Enhanced transparency is crucial for attracting investors and maintaining regulatory compliance. BRI's ability to meet these expectations impacts its reputation and access to capital.

- In 2024, global ESG assets under management reached $40.5 trillion.

- BRI's 2023 Sustainability Report showed a 20% increase in green financing.

- The Indonesian government mandates ESG reporting for financial institutions by 2025.

Natural Resource Management and Impact

Indonesia's economy heavily relies on natural resources, making BRI susceptible to environmental factors. Deforestation and biodiversity loss pose risks to sectors BRI finances, such as agriculture and forestry. Addressing these issues is crucial for sustainable banking practices and risk mitigation. BRI's environmental strategy should align with Indonesia's commitment to reduce emissions.

- Indonesia's deforestation rate decreased by 75% in 2023 compared to the 2019-2020 period, reaching the lowest level in 20 years, according to the Indonesian Ministry of Environment and Forestry.

- BRI's sustainability report for 2024 will likely showcase investments in green financing and initiatives supporting sustainable resource management.

- The Indonesian government aims to achieve net-zero emissions by 2060, influencing BRI's lending policies.

Environmental factors significantly affect BRI, particularly through climate change and resource dependence.

Physical and transition risks, stemming from climate change, can impact BRI's assets and investments.

BRI benefits from sustainable finance trends and must adhere to evolving environmental regulations and ESG reporting to maintain compliance and investor confidence.

| Aspect | Impact on BRI | 2024-2025 Data/Trends |

|---|---|---|

| Climate Change | Increased risks from natural disasters, transition risks in carbon-intensive sectors. | Green bond market reached $1.1T in 2024; BRI's green loan portfolio grew 30% in Q1 2024. |

| Sustainable Finance | Opportunities in green lending, supporting eco-friendly ventures. | Global ESG assets under management hit $40.5T in 2024; BRI's green financing rose 20% in 2023. |

| Regulations & ESG | Need to comply with environmental laws, report ESG performance. | Indonesia mandates ESG reporting for financial institutions by 2025; Govt. targets net-zero emissions by 2060. |

PESTLE Analysis Data Sources

This BRI PESTLE analysis integrates diverse data from government sources, financial reports, and industry-specific research. We use credible publications, and economic forecasts.