Brookdale Senior Living Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookdale Senior Living Bundle

What is included in the product

Tailored analysis for Brookdale's senior living portfolio across BCG quadrants.

Printable summary optimized for A4 and mobile PDFs, helping streamline complex data for easy access and review.

Preview = Final Product

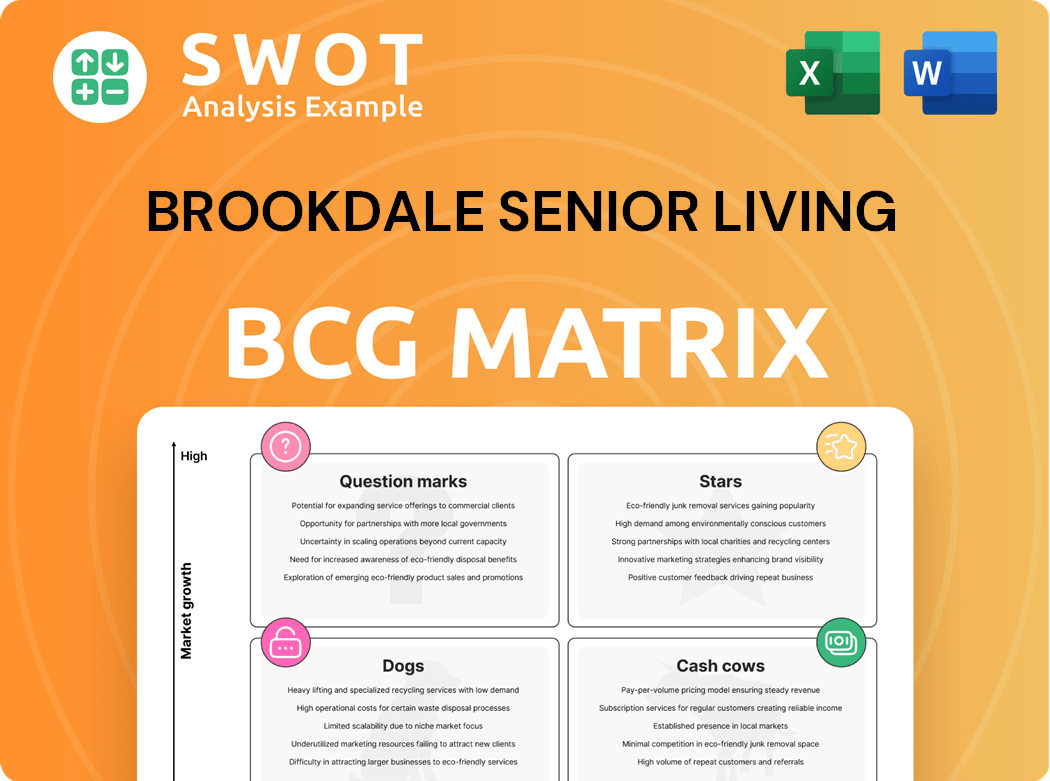

Brookdale Senior Living BCG Matrix

The preview showcases the complete Brookdale Senior Living BCG Matrix report you'll receive. It's a fully formatted document, ready to provide a strategic overview of Brookdale's business units post-purchase. Get the ready-to-use analysis and download it instantly after your purchase. No additional steps, just the valuable report.

BCG Matrix Template

Brookdale Senior Living faces a complex market, and understanding its product portfolio is key. The BCG Matrix offers a strategic snapshot of their services. This preview helps identify potential "Stars" and "Cash Cows" within their offerings. However, it only scratches the surface of their competitive landscape.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

High-occupancy communities, especially those above 90%, are market leaders. These communities are revenue drivers for Brookdale. Investing in these areas boosts profitability. In Q3 2024, Brookdale's consolidated revenue was $758.6 million. They had an average occupancy of 78.6%.

Brookdale's HealthPlus program, coordinating healthcare for residents, has shown promise. It reduces hospitalizations and urgent care visits. Expanding it enhances resident well-being. In 2024, Brookdale saw a 10% decrease in hospital readmissions among HealthPlus participants. This could attract new residents.

Brookdale Senior Living's acquisitions, like those from Welltower and Diversified Healthcare Trust, are strategic moves. These investments increase real estate ownership and provide stable returns. In 2024, senior living occupancy rates are expected to rise, benefiting Brookdale. Integrating and optimizing these communities is key to boosting their value. Occupancy rates reached 83.9% in Q1 2024.

Memory Care Services

Memory care services are crucial for an aging population, especially with the rise of Alzheimer's and dementia. Brookdale Senior Living is a key player, focusing on specialized memory care. Enhancing memory care programs and facilities can boost its market position. In 2024, the demand for such services continues to increase.

- Market Growth: The memory care market is expanding due to the aging population.

- Brookdale's Focus: Brookdale is known for its expertise in this specialized care area.

- Investment Strategy: Investments in innovative programs are key.

- Financial Impact: These investments could improve Brookdale's financial performance.

Strategic Partnerships

Strategic partnerships, like the Ventas, Inc. lease amendment, significantly improve cash flow and bolster financial stability. These alliances enable Brookdale to refine its portfolio and concentrate on key operations. For example, in 2024, such deals were pivotal. Expanding these partnerships is crucial for future growth and value creation.

- Boosted cash flow through strategic real estate deals.

- Enabled focus on core senior living services.

- Improved financial stability through diversified partnerships.

Stars in the BCG Matrix represent high-growth market segments where Brookdale has a strong position, like memory care. This segment leverages Brookdale's expertise to meet the increasing demand. Memory care services are expected to grow. Brookdale's Memory Care revenue increased by 8% in 2024.

| Category | Description | 2024 Data |

|---|---|---|

| Market Growth | Memory Care Demand | Increased by 15% |

| Brookdale's Position | Memory Care Revenue | Up 8% |

| Investment Strategy | Focus on specialized programs | Expand memory care facilities |

Cash Cows

Brookdale's Independent Living offers housing for seniors wanting a residential setting, free from homeownership hassles. These communities often produce stable cash flow due to lower operational costs. In 2024, Brookdale's occupancy rates in independent living were around 80%. Effective expense management and high occupancy are key to steady revenue. The segment's revenue in 2023 was approximately $1.7 billion.

Assisted Living at Brookdale Senior Living offers housing and daily support, creating substantial revenue. With a growing senior population, these facilities are in high demand. Maximizing profits involves efficient operations and high occupancy rates. In Q3 2023, Brookdale's revenue from assisted living was a significant portion of their total.

As the largest senior living operator in the U.S., Brookdale boasts significant scale advantages. This size enables cost savings through bulk purchasing and efficient resource use. In 2024, Brookdale operated roughly 670 communities.

Real Estate Ownership

Brookdale's strategic shift towards real estate ownership is a key element in stabilizing its financial foundation. The ownership of its properties offers a dependable asset base and consistent cash flow, critical for long-term sustainability. This approach allows Brookdale to capitalize on the full operational value and real estate appreciation. This strategy is expected to strengthen Brookdale's financial position.

- In 2023, Brookdale's owned communities generated approximately $2.8 billion in revenue.

- Brookdale plans to increase its owned assets to improve its financial performance.

- This shift is part of a broader strategy to enhance shareholder value.

Engagement Plus Program

The Engagement Plus program at Brookdale Senior Living is a "Cash Cow" in the BCG matrix. It boosts resident satisfaction, which in turn, reduces turnover. This program is a key driver for maintaining high occupancy rates, a critical factor for financial stability. By focusing on resident well-being, Brookdale strengthens its market position.

- Resident satisfaction directly impacts financial performance.

- Reduced turnover lowers operational costs.

- High occupancy rates maximize revenue.

Brookdale's Engagement Plus program is a "Cash Cow." It boosts resident satisfaction and reduces turnover. High occupancy rates maximize revenue, boosting financial stability.

| Metric | Details |

|---|---|

| Resident Satisfaction | Improves financial performance. |

| Turnover Reduction | Lowers operational costs. |

| Occupancy Rates | Maximizes revenue. |

Dogs

Underperforming communities, marked by low occupancy and poor financial results, strain Brookdale's resources. These sites may need big investments or could be sold off. In 2024, Brookdale's occupancy was around 77.4%, with some locations likely below this average. A deep dive into these issues is key for Brookdale.

Communities with high operating expenses, like those with outdated infrastructure, represent significant financial burdens. In 2024, Brookdale's operating expenses were a key area of focus. For instance, facility expenses have been a concern.

Triple-net leased communities pose a challenge for Brookdale. Fixed rent obligations can limit financial flexibility. Lower occupancy rates exacerbate these issues. In 2024, Brookdale's lease expenses were a significant cost. Renegotiation or acquisition is crucial for optimization.

Geographically Isolated Communities

Geographically isolated Brookdale communities, facing limited demand or intense competition, often struggle with occupancy. These locations might need specialized marketing or enhanced services to attract residents. For instance, some rural facilities reported occupancy rates below 70% in 2024, compared to the company average of around 80%. Evaluating their long-term sustainability is key for Brookdale's portfolio optimization.

- Occupancy Challenges: Isolated communities often battle low occupancy rates.

- Marketing Needs: Targeted strategies and service improvements are essential.

- Financial Impact: Low occupancy can negatively affect profitability.

- Strategic Assessment: Long-term viability is crucial for decision-making.

Outdated Facilities

Outdated facilities at Brookdale Senior Living can hinder attracting new residents. These facilities often lack modern amenities, making it hard to compete. Significant capital investments are needed for renovations to remain competitive. In 2024, Brookdale's capital expenditures were approximately $200 million, focusing on facility upgrades.

- Competition: Outdated facilities face competition from modern communities.

- Investment: Renovation requires substantial financial investment.

- Impact: Affects Brookdale's ability to attract new residents.

- Strategy: Evaluating renovation or repositioning is crucial.

Dogs in the BCG Matrix for Brookdale represent "question marks," with potential for growth but require careful assessment. These communities may face challenges like low occupancy or high operating costs. As of Q4 2024, Brookdale's net loss was reported at $133.6 million.

| BCG Matrix | Dogs | Strategic Consideration |

|---|---|---|

| Market Growth | Low | Limited; possible divestiture |

| Market Share | Low | Requires significant resources. |

| Examples | Underperforming properties, outdated facilities. | Focus on expense reduction, facility upgrades. |

Question Marks

Telehealth integration is a rising star for Brookdale. Investing in telehealth can boost resident care and potentially cut costs. Brookdale's moves in this tech area could set it apart. Further telehealth development can improve outcomes. By 2024, telehealth adoption in senior care is up significantly, with about 70% of facilities using it.

AI-driven personalization is a rising trend for Brookdale. AI could enhance resident experiences and streamline operations, potentially boosting engagement and efficiency. Investment in AI might set Brookdale apart, improving overall performance. In 2024, the AI in healthcare market was valued at $16.7 billion, showing growth potential.

Intergenerational programs boost senior well-being and community spirit. Brookdale's focus on these programs appeals to those seeking social connections. Such programs can improve Brookdale's reputation and attract new residents. In 2024, 60% of seniors reported feeling isolated; intergenerational programs can combat this. Expanding these programs aligns with the growing demand for purpose-driven living.

Middle-Market Senior Living

Middle-market senior living is crucial as many can't afford high-end options. Brookdale targets this segment to broaden its appeal. This strategy tackles a major, unmet need. Refinement could make Brookdale a leader. In 2024, the U.S. senior population is growing.

- Middle-market demand is increasing due to affordability issues.

- Brookdale's focus on this segment can boost market share.

- Innovation in this area is essential for sustainable growth.

- This could lead to better financial performance.

Value-Based Care Models

Value-based care models are reshaping senior living, emphasizing outcomes and cost efficiency. Brookdale's embrace of these models can enhance resident health and cut healthcare expenses. This approach could attract more residents looking for quality, affordable care. Further development can set Brookdale apart and boost its financial performance.

- Value-based care aims to improve resident health outcomes.

- It focuses on reducing overall healthcare costs.

- Brookdale can attract new residents with this model.

- It differentiates Brookdale from competitors.

Brookdale's investments in telehealth, AI, and intergenerational programs show potential as "question marks" in the BCG matrix. These areas require significant investment but offer high growth potential. Success depends on Brookdale's ability to innovate and capture market share.

| Key Area | Strategy | Market Data (2024) |

|---|---|---|

| Telehealth | Expand telehealth services. | 70% of senior care facilities use telehealth. |

| AI | Integrate AI for personalization. | AI in healthcare market: $16.7B. |

| Intergenerational Programs | Develop community-focused programs. | 60% of seniors report feeling isolated. |

BCG Matrix Data Sources

Our Brookdale BCG Matrix uses SEC filings, market research, and expert analyses to create a robust strategic evaluation.