Brookdale Senior Living Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookdale Senior Living Bundle

What is included in the product

Analyzes Brookdale's position, assessing its competitive landscape, threats, and market dynamics.

Instantly spot competitive threats via the dynamic calculation of each force's impact.

Preview Before You Purchase

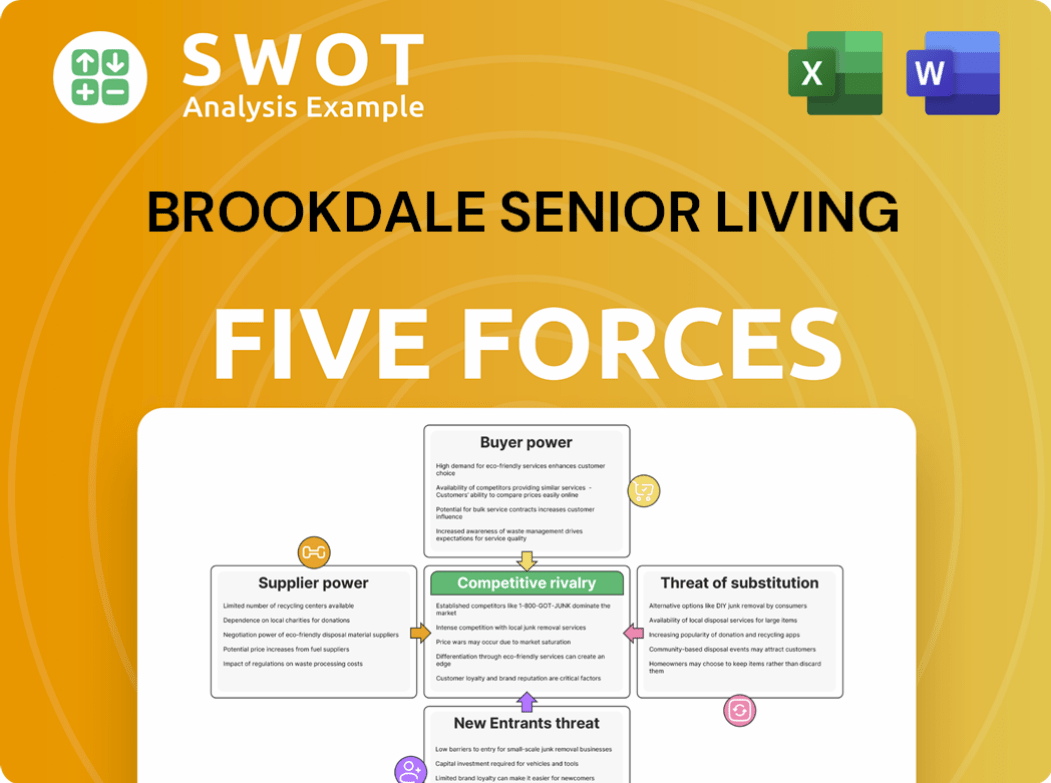

Brookdale Senior Living Porter's Five Forces Analysis

This preview reveals the complete Brookdale Senior Living Porter's Five Forces analysis. It dissects competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants within the senior living industry. This is the same comprehensive document you'll receive instantly after purchase, offering a detailed strategic overview.

Porter's Five Forces Analysis Template

Brookdale Senior Living faces moderate rivalry, with numerous competitors vying for market share. Buyer power is relatively high due to consumer choice and sensitivity to pricing. The threat of new entrants is moderate, constrained by capital requirements. Substitute threats, such as in-home care, pose a substantial challenge. Supplier power, related to labor and resources, is also significant.

This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Brookdale Senior Living.

Suppliers Bargaining Power

Labor costs significantly impact Brookdale's financials. Staffing agencies and healthcare professionals hold considerable power due to ongoing labor shortages. This pushes up operational expenses, a critical factor in the senior care sector.

Staffing is a major challenge; 55% of respondents in a recent survey cited it as the biggest issue, up 9% from 2024. These costs can directly affect profitability and service delivery.

Real estate owners, such as REITs like Ventas, hold considerable bargaining power over Brookdale. Lease agreements and rent hikes from these owners directly affect Brookdale's financial health. In 2024, Ventas and Brookdale have adjusted their Master Lease with Ventas having $1.6B in assets. These deals offer Ventas expansion prospects and help Brookdale extend community leases.

Food, medical equipment, and pharmaceutical suppliers affect Brookdale's costs. However, Brookdale's large size may offer negotiation advantages. In 2024, healthcare spending in the US is projected to reach $4.8 trillion, influencing supplier pricing. Trade policies, including potential tariffs, could also impact these costs. For example, in late 2024, proposed tariffs on goods from China and Mexico could affect the prices of medical supplies.

Technology Providers

Technology providers' influence is rising due to the importance of technology in senior care. These suppliers offer software, hardware, and telehealth solutions, impacting care coordination and efficiency. Brookdale's HealthPlus program expansion, which integrates technology for value-based care, highlights this shift. This trend is evident as the global telehealth market is projected to reach $175.5 billion by 2026.

- Technology providers' influence is growing.

- They supply software, hardware, and telehealth solutions.

- Brookdale's HealthPlus expansion uses technology.

- Telehealth market is projected to reach $175.5 billion by 2026.

Insurance Companies

Insurance companies significantly influence Brookdale's financial landscape by affecting healthcare costs and coverage for residents, indirectly impacting revenue and expenses. In 2024, healthcare spending in the U.S. is projected to reach $4.8 trillion. Rising insurance costs, a persistent challenge, will continue to pressure profitability in 2025. This dynamic necessitates careful financial planning and cost management by Brookdale to maintain margins.

- Healthcare spending in the U.S. reached $4.5 trillion in 2023.

- Insurance costs continue to rise at a rate of approximately 5-7% annually.

- Brookdale must negotiate with providers and manage costs effectively.

- Changes in insurance policies affect resident affordability.

Brookdale faces supplier bargaining power from varied sources. Food, medical equipment, and pharmaceutical suppliers influence costs, though size may offer negotiation leverage. Healthcare spending in the U.S. reached $4.5 trillion in 2023, impacting supplier pricing.

| Supplier Type | Impact on Brookdale | 2024 Data Point |

|---|---|---|

| Food | Cost of goods sold | Inflation driven price increases of 3-5% |

| Medical Equipment | Operational costs | Projected spending $150B on equipment |

| Pharmaceuticals | Resident Care Costs | Drug spending increased by 7% |

Customers Bargaining Power

Seniors and their families are often highly price-sensitive, significantly impacting Brookdale's pricing power, particularly with substantial out-of-pocket expenses. Around 50% of costs are typically paid out-of-pocket, influencing affordability. In 2024, the average monthly cost for assisted living ranged from $4,000 to $6,000, highlighting the financial strain. This sensitivity limits Brookdale's ability to increase prices, especially in competitive markets.

Customers at Brookdale Senior Living are increasingly seeking personalized care plans, which boosts their bargaining power. Brookdale provides tailored care based on individual requirements, offering diverse services for seniors. In 2024, a significant portion of Brookdale's revenue, approximately $2.8 billion, comes from these customizable service packages.

The internet has revolutionized information access, giving senior living customers unprecedented power to compare options and negotiate. Reviews and ratings are readily available, influencing choices. In 2024, U.S. News & World Report recognized numerous Brookdale communities as "Best Senior Living," based on resident and family surveys, highlighting the importance of online reputation. This transparency strengthens customer bargaining power.

Switching Costs

Switching costs for Brookdale Senior Living's customers are moderate. While relocating is challenging, the emotional and financial burdens aren't prohibitive. As of Q4-2024, the senior housing occupancy rate in key markets was 87.7%. This suggests a supply-demand imbalance that slightly reduces customer bargaining power. This dynamic influences customer decisions.

- Moderate Switching Costs

- Q4-2024 Occupancy: 87.7%

- Supply-Demand Imbalance

- Customer Influence

Demand Outpacing Supply

The bargaining power of Brookdale's customers varies. While high demand and limited supply in some areas may reduce customer power, this isn't consistent everywhere. The 80+ age group is growing, creating historic demand for senior housing. Absorption rates averaged over 35,000 units annually from 2021 to 2024, exceeding pre-2020 levels.

- Increased demand for senior housing.

- Absorption rates reached historic levels.

- Limited supply in certain markets.

- Customer power is not uniform.

Brookdale's customers, typically seniors and their families, wield significant bargaining power due to price sensitivity and access to information. Assisted living costs averaged $4,000-$6,000 monthly in 2024, a financial burden. This influences choices, despite moderate switching costs.

| Factor | Impact | Data (2024) |

|---|---|---|

| Price Sensitivity | High | Monthly costs: $4,000-$6,000 |

| Information Access | High | Online reviews, U.S. News & World Report ratings |

| Switching Costs | Moderate | Occupancy rates: 87.7% |

Rivalry Among Competitors

The senior living market's fragmentation, with many local players, heightens competition. Leading companies like Brookdale Senior Living, Atria Senior Living, and Sunrise Senior Living compete fiercely. In 2024, Brookdale operates over 600 communities. This competitive landscape pressures pricing and service quality.

Companies in senior living intensely battle for occupancy, impacting pricing and marketing strategies. Brookdale's February 2025 occupancy rose to 79.3%, up from 77.9% in 2024, showing positive growth. This increase of 140 basis points year-over-year highlights the competitive landscape. Such rivalry often results in promotional offers and service enhancements to attract residents.

Competitors distinguish themselves through specialized services like memory care and rehabilitation. Brookdale Senior Living provides comprehensive and affordable senior care across 41 states. They offer independent living, assisted living, memory care, and skilled nursing. In 2024, Brookdale's revenue reached $2.8 billion, reflecting its wide service range.

Brand Reputation

Brand reputation is crucial; competition in senior living is fierce. Brookdale emphasizes quality care, tailoring services to residents' needs. This focus on personalized care and diverse services helps Brookdale compete. Strong brand reputation is key to attracting and retaining residents.

- Brookdale operates over 600 communities across the U.S.

- Brookdale's revenue in 2023 was approximately $3.2 billion.

- The senior living market is expected to grow significantly by 2030.

New Development

New construction and expansion by competitors intensify rivalry, especially in markets experiencing modest demand growth. A survey indicates that 58% of respondents anticipate increased construction starts in the upcoming year, a substantial rise from 2024, when only 22% foresaw such an increase. This surge in development could lead to heightened competition for Brookdale Senior Living.

- Increased competition in the market.

- Potential for price wars to attract residents.

- Higher marketing expenses.

- Possible impact on occupancy rates.

Competition in the senior living market is intense due to fragmentation and new developments. Brookdale, with over 600 communities, faces rivals like Atria and Sunrise. Fierce competition affects pricing, marketing, and occupancy rates. Brookdale's 2024 revenue was $2.8 billion, showing its market position.

| Metric | Brookdale (2024) | Industry Average (2024) |

|---|---|---|

| Occupancy Rate | 77.9% | 83% |

| Revenue | $2.8B | Varies |

| Communities | 600+ | Varies |

SSubstitutes Threaten

Home healthcare presents a significant threat to Brookdale Senior Living by offering an alternative for seniors. These services enable individuals to stay in their homes, potentially reducing demand for senior living communities. The home healthcare market is growing, with an estimated value of $133.8 billion in 2024, showcasing its increasing viability as a substitute. Services include medical care, personal assistance, and health monitoring, which can effectively manage health conditions.

Adult day care centers offer an alternative to full-time residential care, posing a threat to Brookdale Senior Living. The global elderly care market is projected to reach $2636.08 billion by 2029, with an 8.1% CAGR. These centers provide daytime supervision and activities, appealing to families seeking support. As the market grows, the availability of substitutes increases competitive pressure on Brookdale.

Family caregiving poses a considerable threat to Brookdale. Informal care from family members often serves as a direct substitute. With nearly 60% of older adults requiring long-term care, the availability of family support directly impacts Brookdale's potential residents. This dynamic influences occupancy rates and revenue, as families choose home-based care over professional facilities, specifically in 2024.

Technology-Enabled Care

Technology-enabled care presents a significant threat to Brookdale Senior Living. Telehealth and remote monitoring allow seniors to receive care at home, potentially decreasing demand for facility-based services. This shift is driven by advancements like healthcare-grade mobile computers that improve care quality and streamline workflows. The market for remote patient monitoring is growing, with projections showing substantial expansion in the coming years. This trend poses a challenge to traditional senior living models.

- The global telehealth market was valued at $62.4 billion in 2023 and is projected to reach $238.6 billion by 2032.

- The remote patient monitoring market is expected to reach $1.7 billion by 2029.

- Mobile health (mHealth) is a quickly growing segment of healthcare.

Government Programs

Government programs, particularly those that fund in-home care or offer financial aid, pose a threat to Brookdale Senior Living by making substitutes more appealing. Changes in administrations can lead to shifts in regulations affecting staffing, assisted living oversight, and Medicare Advantage. For instance, in 2024, Medicare Advantage enrollment continues to grow, potentially impacting Brookdale's revenue streams. Tax policy changes can also indirectly affect the affordability of senior living options.

- Medicare Advantage enrollment increased by 7% in 2024.

- Federal spending on home health care reached $84 billion in 2023.

- Tax credits for caregivers could decrease the demand for assisted living.

- Regulatory changes could increase operational costs.

Brookdale faces substitution threats from various sources. Home healthcare, valued at $133.8 billion in 2024, offers an alternative to senior living facilities. Family care and adult day care centers also reduce demand. Technological advancements, such as telehealth ($62.4B in 2023), further enhance the appeal of alternatives.

| Substitute | Market Size/Value (2024) | Impact on Brookdale |

|---|---|---|

| Home Healthcare | $133.8 billion | Reduces demand for facilities |

| Adult Day Care | $2.6 trillion (2029) | Offers daytime supervision |

| Family Caregiving | Variable | Direct substitute, impacts occupancy |

| Telehealth | $238.6 billion (2032) | Provides remote care |

Entrants Threaten

High capital costs present a significant barrier. The senior living industry demands substantial initial investments in real estate, construction, and trained staff. In 2024, construction costs for senior living facilities have increased, making it harder for new companies to enter the market. Securing financing has also become challenging, with interest rates impacting project viability.

Licensing, certification, and healthcare regulations create significant barriers for new senior living entrants. A shifting political landscape, especially with a new administration, introduces evolving policies that directly impact Senior Living Communities (SLCs). Increased regulatory oversight might elevate costs and operational complexity for companies like Brookdale. In 2024, healthcare compliance costs rose by 7%, affecting profitability. This regulatory burden can deter new competitors.

Brookdale Senior Living, as a large operator, enjoys significant economies of scale that pose a barrier to new competitors. These economies of scale are evident in purchasing, marketing, and administrative efficiencies. New entrants often struggle to match the cost structures of established players like Brookdale. For instance, Brookdale operates 647 communities across 41 states, providing them with a substantial advantage. This scale allows Brookdale to leverage favorable industry dynamics effectively.

Brand Recognition

Established brands like Brookdale Senior Living benefit from strong brand recognition, making it harder for new entrants to compete. This advantage stems from existing resident trust and established reputations. Brookdale's leadership in the senior living market is evident.

- Brookdale has the most communities on the U.S. News & World Report Best Senior Living list for four years.

- Brand recognition impacts occupancy rates and financial performance.

- New entrants face high marketing costs to build brand awareness.

Market Saturation

Market saturation poses a threat as some areas become overcrowded with senior living communities, diminishing the appeal for new entrants. The senior housing market has shown resilience post-pandemic, yet challenges persist, including the need to build more communities to accommodate future residents. In 2024, occupancy rates are expected to continue their upward trajectory, but the expansion of new communities needs to be balanced with the existing supply. The industry is actively working on new models to meet the needs of the middle-market demographic, a significant factor in sustainable growth.

- Occupancy rates are expected to increase in 2024, but the expansion of new communities needs to be balanced with the existing supply.

- The senior housing market is actively working on new models to meet the needs of the middle-market demographic.

The threat of new entrants to Brookdale is moderate, facing barriers like high costs. Initial investments in 2024 remain substantial, impacting new entrants. Regulations and compliance add complexity.

| Factor | Impact | Details |

|---|---|---|

| Capital Costs | High Barrier | Construction & financing costs increased in 2024. |

| Regulations | Significant Barrier | Compliance costs increased by 7% in 2024. |

| Economies of Scale | Advantage for Brookdale | Brookdale operates 647 communities. |

Porter's Five Forces Analysis Data Sources

This analysis uses data from SEC filings, industry reports, competitor analyses, and market research to evaluate the forces impacting Brookdale.