Computer Age Management Services Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Computer Age Management Services Bundle

What is included in the product

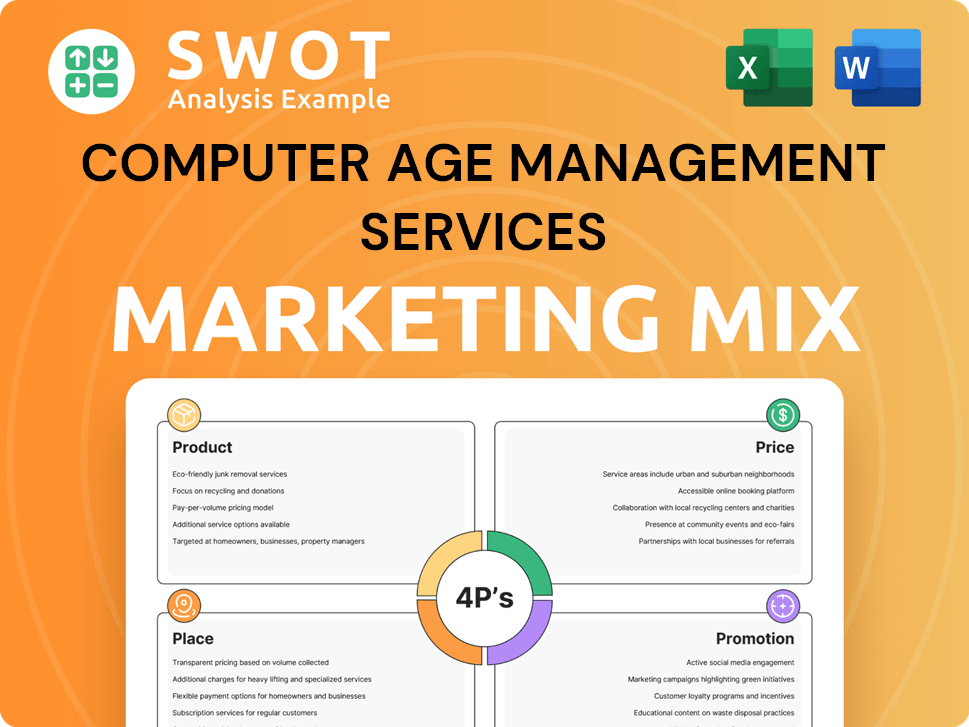

Delivers a complete analysis of Computer Age Management Services' marketing strategies using Product, Price, Place, and Promotion.

Unpacks CAMS' marketing strategies, offering quick understanding & clear, concise summaries.

Full Version Awaits

Computer Age Management Services 4P's Marketing Mix Analysis

The preview reflects the final Computer Age Management Services 4P's Marketing Mix Analysis.

See the exact document you'll download instantly upon purchase.

It’s a complete, ready-to-use marketing analysis. No modifications needed. Buy now.

4P's Marketing Mix Analysis Template

Computer Age Management Services (CAMS) navigates the digital landscape, its marketing intricate. Their product strategy likely focuses on software solutions & service quality.

Pricing reflects the value they provide, probably tiered for different clients' needs. Distribution involves direct channels and possibly partnerships.

Promotion employs digital marketing, events, & sales for brand building. Uncover their tactics in a comprehensive analysis of CAMS’s 4Ps.

Get a clear picture of how CAMS effectively aligns its marketing with its objectives in an editable and practical Marketing Mix.

Dive deeper. Instant access awaits for the full, actionable 4Ps report, and take a great advantage in business analysis.

Product

CAMS provides investor services, including consolidated account statements and transaction handling. Their online portals and apps offer easy mutual fund management. They also assist with KYC requirements, streamlining investor interactions. In 2024, CAMS processed over 1 billion transactions. This made them crucial for investor convenience.

Transaction processing is crucial for CAMS, handling financial transactions for mutual funds. They execute buy/sell orders, manage dividends, and related activities. Their IT infrastructure processes a high transaction volume. In 2024, CAMS processed over 1.5 billion transactions. This showcases their operational efficiency in the financial sector.

CAMS offers tech solutions for financial services. This includes online transaction platforms and investor interfaces. They use AI and blockchain for efficiency and security. In FY24, CAMS' tech segment saw a 15% revenue increase. They manage over ₹25 trillion in assets.

Services for Financial Institutions

CAMS extends its services beyond mutual funds, supporting insurance companies, banks, and NBFCs. These services include back-office support, data management, and processing, crucial for operational efficiency. This allows institutions to streamline operations, thus concentrating on core functions. CAMS processes over $300 billion in financial assets annually.

- Data Management: Handling vast data volumes.

- Back-Office Support: Streamlining operational processes.

- Processing Services: Ensuring accurate transactions.

- Client Base: Expanding to various financial sectors.

Ancillary Services

Computer Age Management Services (CAMS) boosts its offerings with ancillary services, going beyond core functions. These include data analytics, digital communication platforms, and compliance management. They also support alternative investment funds (AIFs), portfolio management services (PMS), and the National Pension Scheme (NPS). This expansion provides added value and deeper insights for clients.

- CAMS manages over ₹27.7 lakh crore in assets as of March 2024, including AIFs and PMS.

- Data analytics services help clients make better investment decisions.

- Digital platforms improve client communication.

- Compliance services ensure regulatory adherence.

CAMS simplifies mutual fund management through user-friendly platforms and consolidated statements. Their crucial services handle investor transactions and meet KYC requirements efficiently. In 2024, they managed over ₹27.7 lakh crore in assets, showcasing their market presence. This includes AIFs, PMS, and NPS, offering data analytics.

| Feature | Description | 2024 Data |

|---|---|---|

| Transaction Processing | Executes buy/sell orders and manages dividends | 1.5+ billion transactions |

| Tech Solutions | Offers online platforms and interfaces for investors | 15% revenue increase (FY24) |

| Ancillary Services | Provides data analytics, and digital communication | ₹27.7L crore assets managed |

Place

CAMS boasts a vast network of service centers across India, a key element of its distribution strategy. As of 2024, CAMS manages over 90% of the mutual fund assets in India, which is supported by a physical presence. These centers offer investors convenient access for transactions and inquiries, improving customer service. This extensive network supports both investors and distributors, ensuring broad market reach.

CAMS has embraced digital transformation, providing online platforms and mobile apps. MyCAMS and MFCentral enable investors to manage portfolios, transact, and access statements digitally. In 2024, over 70% of transactions were done online, reflecting the shift towards digital convenience. Mobile app users grew by 45% in the last year, indicating rising adoption.

CAMS excels in direct sales, partnering with financial giants like asset management companies. They foster strong B2B relationships, offering tailored solutions. In FY24, CAMS' revenue from these services reached ₹1,084.71 crore, demonstrating their client focus. This approach ensures seamless integration of services. Their client retention rate is consistently high, above 95% as of March 2024.

Collaboration with Distributors and Intermediaries

CAMS strategically partners with distributors and intermediaries, equipping them with tools to enhance client service. This collaborative approach extends CAMS's reach, leveraging the existing networks of financial professionals. These partnerships are vital for expanding market penetration and ensuring product accessibility. As of 2024, CAMS supports over 60,000 distributors across India.

- Extensive Network: CAMS has a vast network of distributors.

- Technology Integration: Provides platforms and tools for intermediaries.

- Market Expansion: Helps in wider product distribution.

- Mutual Benefit: Enhances service for clients and expands reach.

Integration with Financial Ecosystem

CAMS plays a crucial role in India's financial landscape, acting as a vital link between various entities. They facilitate seamless information and transaction flow within the financial ecosystem. As of 2024, CAMS processes over 80% of the mutual fund transactions in India. Their integration ensures smooth operations across the industry.

- Processes over 80% of mutual fund transactions.

- Connects investors, distributors, and AMCs.

- Ensures seamless flow of information.

CAMS's distribution strategy involves extensive service centers and digital platforms for investors. In 2024, a significant portion of transactions occurred online, increasing efficiency. Strong B2B relationships and partnerships are pivotal for expanding market presence and client service. The strategy boosts market reach.

| Aspect | Details | Data (2024/2025) |

|---|---|---|

| Physical Presence | Service Centers Across India | Manages over 90% of mutual fund assets in India |

| Digital Platforms | MyCAMS, MFCentral | 70%+ online transactions, 45% app user growth (2024) |

| B2B Relationships | Partnerships | FY24 Revenue: ₹1,084.71 crore, 95%+ client retention |

Promotion

CAMS highlights its two decades of financial services experience. They focus on operational excellence to instill trust. CAMS aims to build confidence through high service delivery standards. For example, in FY24, CAMS processed over 1.5 billion transactions. This reflects their reliability.

CAMS promotes its tech-focused solutions and innovation efforts. They invest in AI and blockchain to offer efficient and secure services. This approach positions CAMS well in the evolving fintech sector.

CAMS emphasizes its market leadership in mutual fund transfer agency. It showcases its large market share and handles substantial assets and transactions. This highlights their established presence and operational scale. CAMS processed ₹2.5 trillion in mutual fund transactions in FY24. Their market share in the industry is approximately 70% as of March 2024.

Client-Centric Approach and Tailored Solutions

CAMS highlights its client-centric approach in its promotional efforts, underscoring tailored solutions for varied financial institutions. This messaging focuses on meeting the specific needs of mutual funds, banks, and insurers. Their promotions emphasize customization to boost client satisfaction. For example, in FY24, CAMS saw a 15% increase in client retention rates, showcasing the effectiveness of their approach.

- Client satisfaction is a primary focus.

- Customized solutions are offered to meet various needs.

- Promotion emphasizes tailored services.

- Client retention rates increased by 15% in FY24.

Industry Partnerships and Collaborations

CAMS actively forges partnerships within the financial sector. They boost their offerings through collaborative projects like MFCentral. These alliances promote CAMS by showcasing their active ecosystem role.

- MFCentral, a joint venture, simplifies mutual fund transactions.

- Partnerships enhance market reach and service integration.

- Collaborations boost brand visibility.

CAMS promotes client-centric services. They emphasize tailored financial solutions for institutions. Partnerships and technology are central to their strategy, seen in MFCentral. In FY24, client retention rose by 15%.

| Promotion Element | Strategy | Impact (FY24) |

|---|---|---|

| Client Focus | Tailored solutions | 15% Client retention growth |

| Partnerships | MFCentral | Enhanced reach |

| Technology | AI, Blockchain | Efficiency |

Price

CAMS heavily relies on transaction fees, making up a large part of its income. These fees cover various services, including opening accounts, handling buy/sell orders, and distributing dividends. In 2024, transaction-based revenue accounted for approximately 65% of CAMS's total revenue, showcasing its importance. This revenue stream is directly tied to the volume of transactions processed.

CAMS generates revenue through asset under management (AUM)-based fees, reflecting the AAUM of serviced mutual funds. This model links their earnings to the growth of the mutual fund industry. For instance, in FY24, CAMS' revenue from operations was approximately ₹1,175 crore. This fee structure incentivizes CAMS to support client success.

CAMS collects annual maintenance fees for tasks like maintaining investor records and sending communications. These fees create a reliable income source. In FY24, CAMS reported ₹97.73 Cr from other income, indicating the significance of recurring revenue. This helps in financial stability.

Fees for Value-Added Services

CAMS boosts revenue through value-added services, like data analytics and digital platforms. Pricing varies, based on the service and client needs. For instance, in FY24, revenue from "Other Income" (which includes these services) was ₹120.53 Cr. These offerings enhance their core services.

- Data analytics services pricing depends on the complexity and scope.

- Digital platform services are often subscription-based.

- Compliance management services are priced based on regulatory requirements.

Pricing for Other Business Segments

CAMS tailors pricing for services to other financial entities, like insurance companies, banks, and NBFCs, and for new ventures such as account aggregation and NPS services. These pricing strategies are customized to the unique requirements of each service line and client segment. For instance, account aggregation services may be priced based on transaction volume or the number of accounts managed. In fiscal year 2024, CAMS's revenue from "other services" grew by 25%, indicating a strong demand and effective pricing strategies.

- Pricing models are customized for each business segment.

- Account aggregation pricing may depend on transaction volume.

- NPS services are also included in the pricing strategy.

- "Other services" revenue grew 25% in FY2024.

CAMS uses a dynamic pricing strategy. They have transaction fees for core services, like opening accounts, which made up 65% of 2024's revenue. Fees also come from assets under management, Annual maintenance fees, and other services. Pricing depends on each service and client.

| Pricing Strategy | Revenue Stream | FY24 Revenue (₹ Cr) |

|---|---|---|

| Transaction-based | Transaction Fees | Approx. 763 (65% of total) |

| AUM-based | AUM Fees | Linked to AAUM growth |

| Fixed & Recurring | Annual Maintenance | 97.73 |

| Value-added | Data, Digital | 120.53 (Other Income) |

| Customized | Other Services | 25% growth |

4P's Marketing Mix Analysis Data Sources

For the Computer Age Management Services analysis, we leverage company reports, financial filings, press releases, and industry insights.