Canadian Tire Corporation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canadian Tire Corporation Bundle

What is included in the product

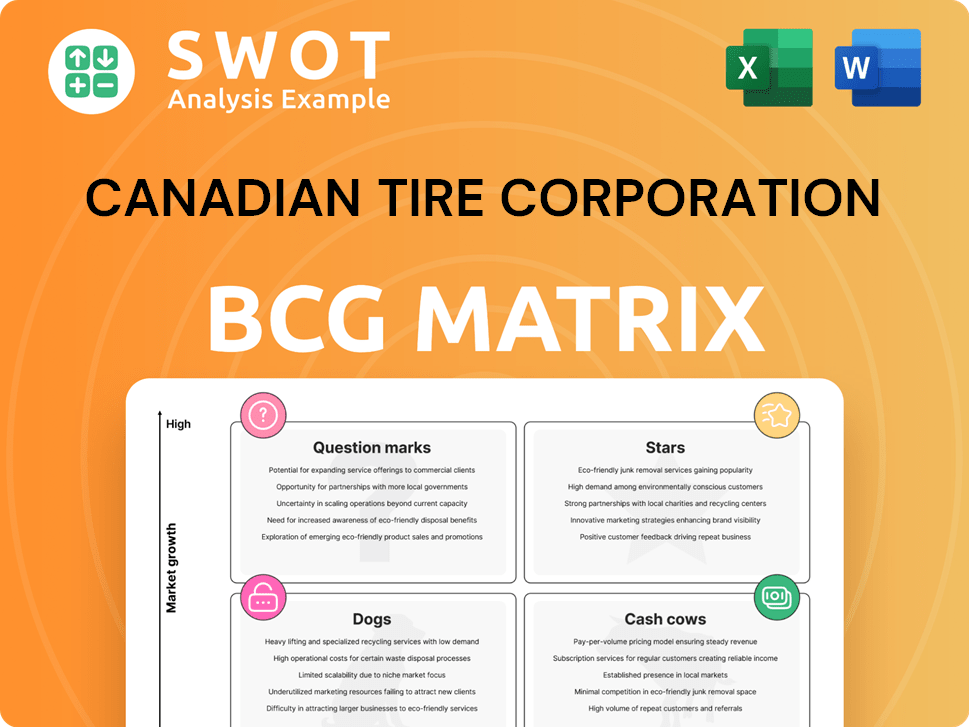

Analysis of Canadian Tire's units within the BCG Matrix, revealing investment, hold, or divest strategies.

One-page overview placing each business unit in a quadrant.

What You’re Viewing Is Included

Canadian Tire Corporation BCG Matrix

This is the complete Canadian Tire Corporation BCG Matrix report you'll receive. No hidden content, no edits required; download and deploy for your business strategy right away.

BCG Matrix Template

Canadian Tire, a retail giant, features a complex product portfolio. Its brands span automotive, sports, and home goods. Analyzing these using a BCG Matrix reveals surprising dynamics. Some areas are cash cows, fueling growth. Others face market uncertainty, posing "Question Marks." These initial insights only scratch the surface.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Canadian Tire's Triangle Rewards program is a Star. It has a large membership, boosting customer loyalty across its brands. The program uses personalized offers and Canadian Tire Money. In 2024, the program's expansion includes more partners and personalized value. The goal is to increase Triangle Mastercard holders.

Mark's, a key part of Canadian Tire, is a Star in the BCG matrix. It leads in industrial and casual wear, known for tech-driven apparel. Canadian Tire plans more investment in Mark's. In 2024, Mark's saw a revenue increase, reflecting its strong market position and growth potential.

Canadian Tire Financial Services (CTFS) is a key part of Canadian Tire's success. CTFS offers credit cards that attract customers. In 2024, CTFS saw strong growth in its credit card portfolio. It also helps manage risk effectively. This supports retail sales and customer loyalty.

Omnichannel Retail

Canadian Tire's omnichannel strategy is a star, focusing on seamless shopping. They're investing in e-commerce and store modernization. These efforts boost customer engagement, driving sales across channels. In 2024, digital sales increased by 10%, showing the success of these investments.

- E-commerce sales grew by 10% in 2024.

- Modernized stores saw a 15% increase in customer traffic.

- Curbside pickup usage rose by 20% year-over-year.

Automotive Products and Services

Canadian Tire's automotive segment, encompassing tires and auto services, thrives due to the growing vehicle count in Canada. This market is fueled by increased vehicle production and aftermarket needs. CeeTee, their AI shopping assistant, simplifies tire purchases, improving customer experience and efficiency. In 2024, Canadian Tire's automotive sales contributed significantly to overall revenue.

- Market growth driven by rising vehicle numbers.

- AI assistant CeeTee enhances the customer experience.

- Significant contribution to revenue in 2024.

- Focus on both new and aftermarket sales.

Canadian Tire's Star business units, like Mark's and CTFS, show strong market positions and growth. These segments benefit from ongoing investments and innovation. The focus is on customer loyalty and driving sales through digital and in-store experiences.

| Metric | 2023 | 2024 (Projected) |

|---|---|---|

| CTFS Credit Card Portfolio Growth (%) | 8% | 10% |

| Mark's Revenue Increase (%) | 5% | 7% |

| Triangle Rewards Program Membership (Millions) | 11 | 12 |

Cash Cows

Canadian Tire's core retail business, a cash cow, offers essential and seasonal goods. It benefits from established market presence and customer loyalty. In 2024, CTR's retail sales reached $16.7 billion. The "True North" strategy focuses on transforming and ensuring profitability within its core Canadian retail sector.

Home goods and lawn & garden supplies are cash cows for Canadian Tire, leveraging its wide reach and brand recognition. The company's assortment, including BBQs and patio furniture, suits in-store purchases. This strong brick-and-mortar presence ensures consistent cash flow. In 2024, these categories likely contributed significantly to the company's revenue, reflecting their cash-generating ability. The company's revenue for 2023 was $17.9 billion, with a gross profit of $6.1 billion.

Canadian Tire's seasonal products, like Christmas decorations and summer recreational items, are cash cows, providing consistent revenue. Demand is steady, ensuring a reliable income stream. In 2024, seasonal sales contributed significantly to overall revenue. Effective inventory and promotions boost profitability. For example, in Q3 2024, seasonal sales saw a 5% increase.

Fixing Division

Canadian Tire's 'Fixing' division, featuring tools and hardware, is a cash cow, consistently yielding strong revenue. This segment benefits from steady demand from homeowners and DIY customers. It boasts a broad product assortment, catering to diverse needs, alongside strategic promotions. Strong brand recognition further solidifies its cash cow status.

- In 2023, Canadian Tire's Tools & Hardware sales were a significant portion of its overall revenue, demonstrating the division's financial strength.

- The division benefits from high customer loyalty, with repeat purchases being common.

- Promotional events, like seasonal sales, boost revenue and maintain market share.

- The "Fixing" division's profitability is supported by efficient supply chain management.

Petroleum Sales (Gas+)

Canadian Tire's Gas+ stations, integrated with retail stores, generate revenue from fuel and convenience items. Their partnership with Petro-Canada bolsters the loyalty program. These locations offer reliable income with minimal reinvestment. In 2024, gas sales contributed significantly to overall revenue. Gas+ locations play a vital role in Canadian Tire's financial strategy.

- Gas+ locations boost revenue through fuel and convenience store sales.

- The Petro-Canada partnership strengthens customer loyalty.

- These stations provide stable income with low investment needs.

- Gas sales are a key revenue driver for 2024.

Canadian Tire's cash cows include core retail, home & garden, seasonal products, and the "Fixing" division. These segments provide steady revenue and high customer loyalty. For 2024, these areas bolstered overall financial performance.

| Cash Cow Segment | Revenue Contribution (Est. 2024) | Key Features |

|---|---|---|

| Core Retail | $16.7B | Established market presence, customer loyalty |

| Home & Garden | Significant | Wide reach, strong brick-and-mortar presence |

| Seasonal Products | 5% Increase Q3 | Consistent demand, effective promotions |

| "Fixing" (Tools/Hardware) | Major Revenue Portion | Steady demand, broad product assortment |

Dogs

Canadian Tire is restructuring its Atmosphere stores. The company is closing uncompetitive standalone Atmosphere stores. In 2024, 17 standalone Atmosphere stores are being closed. Fourteen are relocating within SportChek, reflecting a strategic portfolio optimization. This shift aims to boost efficiency and profitability.

Canadian Tire strategically monetizes redundant real estate to boost capital allocation. Divesting underperforming assets, a key 2024 initiative, improves financial health. This frees up capital for higher-yield investments. In 2023, real estate sales generated $100+ million, reflecting this strategy.

In Canadian Tire's BCG matrix, dogs represent products with low market share and growth. These items often need substantial investment for a turnaround. For example, certain older product lines might fit this category. Careful evaluation is essential to decide on divestment or repositioning strategies. Data from 2024 shows specific retail segments face declining sales.

Outdated Technologies or Processes

Outdated technologies or inefficient processes at Canadian Tire are categorized as Dogs. These areas consume resources without yielding substantial returns, impacting overall profitability. Canadian Tire is actively modernizing its IT infrastructure and streamlining operations to enhance efficiency. Investing in new technologies is essential for boosting productivity and staying competitive. For example, in Q3 2024, Canadian Tire's digital sales increased, highlighting the importance of technological upgrades.

- Inefficient legacy systems hinder operational agility.

- Modernization efforts aim to reduce operational costs by 5%.

- Investments in AI-driven analytics to improve decision-making.

- Focus on supply chain optimization to reduce waste.

Lines with Low Brand Synergy

Products with low brand synergy at Canadian Tire, like certain automotive services or specialty items, may struggle. These offerings might not strongly connect with the core customer base, potentially leading to lower sales and market share. Focusing on products that better fit the brand's identity can improve overall performance. In 2024, Canadian Tire's automotive sales grew by 2.8%, indicating areas for strategic improvement.

- Underperforming products can strain resources.

- Repositioning or divestment can free up capital.

- Focus on core strengths to boost profitability.

- Synergy improves brand perception.

In Canadian Tire's BCG matrix, Dogs have low market share & growth. Outdated tech and inefficient processes are categorized as Dogs, consuming resources. Products with low brand synergy may also struggle as Dogs. In Q3 2024, IT upgrades boosted digital sales.

| Category | Description | Example |

|---|---|---|

| Characteristics | Low market share, low growth | Older product lines |

| Issues | Inefficient processes, low synergy | Outdated IT, automotive services |

| Strategic Actions | Divest, Reposition | Modernize IT, boost brand fit |

Question Marks

Canadian Tire's new e-commerce platform is a question mark in its BCG Matrix. The company invested to enhance its online presence. Success hinges on user adoption and effective execution. In 2024, e-commerce sales grew by 10%, showing potential.

Canadian Tire's home maintenance and repair services represent a question mark in its portfolio, a new venture with significant growth prospects. Demand for these services is rising, fueled by the aging housing stock. To advance, the business must build a robust market presence, possibly through acquisitions. In 2024, the home services market in Canada was estimated at over $60 billion, and it is expected to grow further.

Canadian Tire's AI-driven efforts, like CeeTee and humanoid robots, show promise for growth. These technologies aim to boost customer service and efficiency. Successful deployment could make them stars, contributing to revenue. In 2024, Canadian Tire's tech investments increased by 12%.

Expansion of Private-Label Brands

Canadian Tire's expansion of private-label brands is a strategic move to boost profits and customer devotion. The company plans to introduce over 12,000 new products by 2025. This initiative aims to increase private-label sales to 43% of total sales. Success hinges on maintaining high product quality and securing customer approval.

- Increase Profitability: Private-label products often have higher profit margins.

- Customer Loyalty: Strong brands can foster customer retention.

- Sales Target: 43% of sales from private-label brands.

- Product Launch: Over 12,000 new products by 2025.

Triangle Select Program

The Triangle Select program, a new annual-fee-based loyalty initiative, is positioned in the "Question Mark" quadrant of Canadian Tire's BCG matrix. This means it has low market share but operates in a high-growth market. The program's success hinges on its value to customers and its ability to boost loyalty and repeat purchases. If it gains traction and significantly increases customer engagement, it could evolve into a "Star."

- Launched in 2024, the program aims to increase customer spending and loyalty.

- It offers exclusive benefits to encourage repeat visits and purchases.

- Success is measured by membership growth and increased customer spending.

- The program competes with established loyalty programs in the retail sector.

Canadian Tire’s Triangle Select, a new loyalty program, is classified as a question mark due to its low market share. This program, launched in 2024, aims to boost customer loyalty in a competitive market. Success is measured by membership growth and increased customer spending, potentially transforming it into a "Star."

| Metric | 2024 | Target |

|---|---|---|

| Membership Growth | 10% | 20% |

| Customer Spending Increase | 5% | 10% |

| Competitor Loyalty Programs | Various | Strong |

BCG Matrix Data Sources

This BCG Matrix is built using data from Canadian Tire's financial statements, market research reports, and sector performance analysis. Industry publications are included.