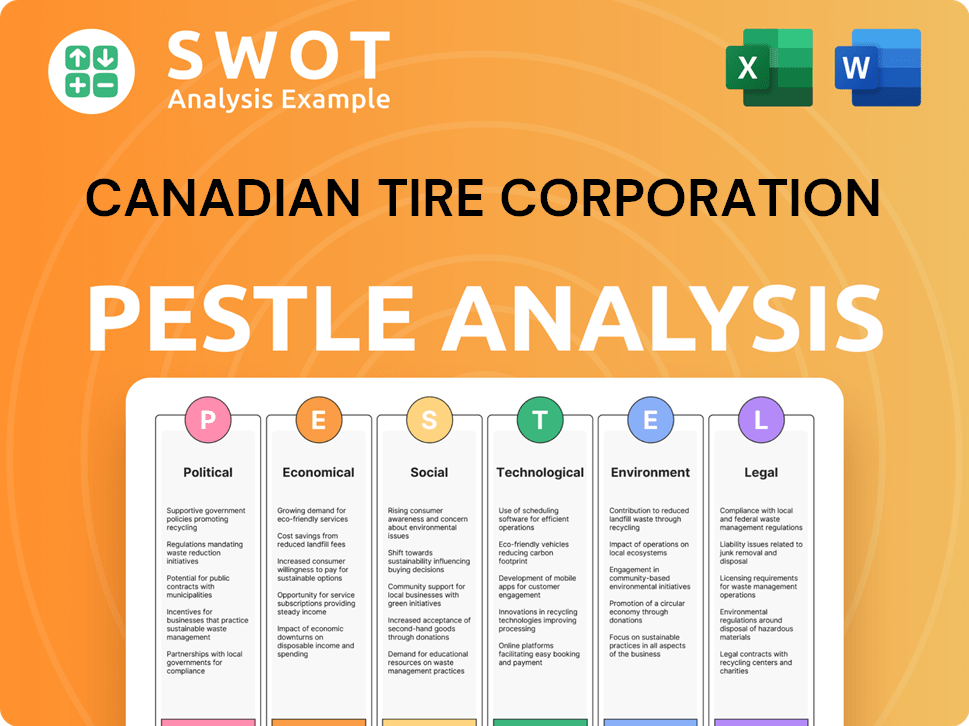

Canadian Tire Corporation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canadian Tire Corporation Bundle

What is included in the product

Explores how macro-environmental factors impact Canadian Tire. Identifies threats and opportunities across various dimensions.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Canadian Tire Corporation PESTLE Analysis

This preview shows the Canadian Tire Corporation PESTLE Analysis in full.

It's the same high-quality, professionally-formatted document you'll get.

The layout and content are identical.

Download immediately after purchase and start using it!

What you're previewing here is the actual file—ready to use.

PESTLE Analysis Template

Canadian Tire Corporation faces a dynamic environment. Our PESTLE Analysis dives into the crucial external factors impacting their strategy and operations. Explore political and economic shifts, technological advancements, social trends, legal landscapes, and environmental pressures. Uncover risks, opportunities, and crucial insights that matter. Download now to gain a competitive edge.

Political factors

Government regulations, including tax policies, significantly influence Canadian Tire's operations. Changes to corporate tax rates, like the federal rate of 15% and Ontario's 11.5%, directly impact financial planning. Stricter labor laws and regulations also affect operational costs and profitability. The potential expansion of digital services taxes could increase expenses for e-commerce operations. These factors require careful strategic consideration and financial planning.

Trade agreements, like USMCA, significantly impact Canadian Tire's operations by affecting supply chain costs. Reduced tariffs under USMCA can lower expenses for imported goods, enhancing profitability. Conversely, trade disputes and potential tariffs, as seen in automotive or aluminum sectors, could raise costs. In 2024, Canada's trade with US totaled CAD 946.3 billion. The USMCA is critical for Canadian Tire.

Canada's political stability fosters a positive environment for businesses, benefiting Canadian Tire's retail operations and supply chains. Investments in infrastructure, like the $180 billion infrastructure plan announced in 2024, can enhance the efficiency of distribution networks. Canada consistently scores high in global political stability rankings, supporting a favorable business climate for long-term investments. This stability is key for Canadian Tire's strategic planning and expansion initiatives.

Geopolitical Conditions

Canadian Tire's international operations, particularly its supply chains in Asia, face geopolitical risks, including trade restrictions and international conflicts. These factors can disrupt sourcing and increase costs. For instance, potential tariffs on Canadian and Chinese goods could significantly impact the company's profitability. In 2024, Canadian Tire's international sourcing accounted for a substantial portion of its inventory, highlighting its vulnerability to these pressures.

- Trade disputes can lead to higher costs.

- Geopolitical instability affects supply chains.

- Tariffs can reduce sales and profitability.

- International sourcing is a key factor.

Government Stimulus and Economic Policies

Government policies significantly affect Canadian Tire. Stimulus measures and economic recovery plans directly impact consumer spending, crucial for retail performance. Infrastructure spending and green energy initiatives, as outlined in the 2024 budget, offer opportunities. These investments can boost sales in automotive and home improvement divisions.

- 2024 Federal Budget: Focus on infrastructure and green initiatives.

- Impact: Potential growth in automotive and home improvement sectors.

- Consumer Spending: Directly influenced by economic policies.

Political factors significantly influence Canadian Tire. Government regulations impact operations through taxes and labor laws; digital service taxes are potential threats. Trade agreements such as USMCA offer both opportunities and risks. Canada's stability supports the business environment.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Tax Policies | Affects financial planning and operational costs | Federal corporate tax: 15%; Ontario: 11.5% |

| Trade Agreements | USMCA impacts supply chain and tariffs | Canada-US trade: CAD 946.3B in 2024 |

| Political Stability | Positive for business, supports investments | Canada's stability consistently highly ranked. |

Economic factors

Inflation significantly influences Canadian Tire's operational expenses and consumer buying behavior. High interest rates can curb consumer spending, especially for credit-dependent purchases, which can lower sales. The Bank of Canada's recent actions, including maintaining the overnight rate at 5%, directly impact Canadian Tire's financial strategies. In Q1 2024, Canadian Tire's retail sales faced pressure due to economic uncertainty and higher interest rates, reflecting the sensitivity of its performance to these factors.

Consumer spending is a major economic driver. Despite some uplift in consumer confidence, high living costs and increased unemployment challenge consumers. This leads to cautious spending and reduced non-essential purchases. Canadian Tire's sales are heavily influenced by these consumer behaviors. For Q1 2024, retail sales decreased by 0.1% in Canada.

Canadian Tire heavily relies on imports, making it vulnerable to exchange rate volatility. The Canadian dollar's value against the USD directly impacts import costs. For example, a weaker CAD increases the expense of goods. In 2024, the CAD/USD rate fluctuated, affecting profit margins. This necessitates careful hedging strategies for financial stability.

Labor Costs and Availability

Changes in labor laws, such as minimum wage increases, directly impact Canadian Tire's labor costs. For example, in Ontario, the minimum wage increased to $16.55 per hour in October 2023. Rising wages and potential labor shortages can lead to increased operational expenses. This might drive investment in automation and digital solutions. Such moves can streamline operations and potentially offset rising labor costs.

- Ontario's minimum wage reached $16.55/hour in late 2023.

- Labor shortages in retail can affect staffing costs.

- Automation investments may rise to manage costs.

Economic Growth

Economic growth in Canada is a key factor for Canadian Tire, impacting consumer spending and sales. Strong economic growth typically boosts revenue in areas such as automotive and home improvement. Conversely, a slowdown can decrease consumer spending, affecting Canadian Tire's overall sales performance. In 2024, Canada's GDP growth is projected to be around 1.5%, influencing the company's financial outlook.

- 2024 GDP growth forecast: approximately 1.5%

- Consumer spending sensitivity: high impact on revenue streams

- Key segments affected: automotive, home improvement

- Economic downturn impact: potential sales decline

Economic factors profoundly shape Canadian Tire's performance. Inflation and interest rates impact consumer spending and operational costs. In Q1 2024, retail sales saw a -0.1% decrease in Canada. The company is also influenced by labor costs and exchange rate fluctuations.

| Economic Factor | Impact | 2024 Data/Example |

|---|---|---|

| Inflation | Higher costs & reduced spending | CPI increased 2.7% (Apr 2024) |

| Interest Rates | Influences consumer credit and spending. | Bank of Canada rate at 5% (May 2024) |

| Exchange Rates | Affect import costs and profit margins. | CAD/USD volatility in 2024. |

Sociological factors

Changing consumer preferences significantly impact Canadian Tire. The rising interest in health, wellness, and sustainability drives demand. For example, sales of eco-friendly products increased by 15% in 2024. Canadian Tire has responded by expanding its offerings. This includes more fitness equipment and sustainable product lines.

Age demographics significantly influence shopping habits. Younger consumers favor online shopping, with e-commerce sales in Canada projected to reach $68.3 billion in 2024. Older demographics often prefer in-store experiences. Canadian Tire must balance physical stores and digital platforms to cater to all age groups, potentially investing in user-friendly online interfaces and enhanced in-store experiences.

Urbanization in Canada impacts Canadian Tire's product demand. In 2024, over 80% of Canadians live in urban areas, influencing consumer needs. This shift necessitates adapting product offerings and store designs. For example, smaller urban stores may prioritize space-saving items and convenience products.

Community Engagement and Trust

Canadian Tire's brand purpose centers on enhancing Canadian life, with community support at its core. The company's public image is significantly shaped by its community involvement. Initiatives like Canadian Tire Jumpstart Charities and disaster relief efforts foster trust and community connections. These actions resonate with Canadians, reinforcing the brand's commitment to social responsibility. The company's strategies aim to strengthen these bonds for long-term sustainability.

- Jumpstart has helped over 3.2 million kids participate in sports and activities.

- Canadian Tire donated over $10 million to support disaster relief efforts in 2024.

- Community involvement is a key factor in brand perception.

Diversity, Inclusion, and Belonging

Canadian Tire recognizes the growing importance of diversity, inclusion, and belonging. The company's commitment to equity and fostering an inclusive environment boosts its brand image and employee morale. This focus aligns with societal expectations for corporate social responsibility. Canadian Tire's initiatives likely include diverse hiring practices and inclusive marketing strategies.

- In 2024, Canadian Tire was recognized for its diversity and inclusion efforts.

- The company's employee satisfaction scores reflect its focus on belonging.

- Canadian Tire's marketing campaigns increasingly feature diverse representation.

Shifting consumer preferences toward health and sustainability influence Canadian Tire's offerings. Age demographics impact shopping habits, requiring a balance of physical and digital retail experiences, with e-commerce expected to hit $68.3B in 2024.

Urbanization shapes product demand and store designs, catering to city-living needs, with over 80% of Canadians in urban areas. Community involvement, like Jumpstart (3.2M kids helped) and $10M+ in disaster relief, strengthens the brand.

Diversity, inclusion, and belonging boost the brand image, with recognitions in 2024 reflecting these efforts. Employee satisfaction and marketing increasingly showcase diverse representation, supporting its corporate social responsibility.

| Factor | Impact | Example/Data (2024/2025) |

|---|---|---|

| Consumer Preferences | Influence product demand | Eco-friendly product sales up 15% |

| Age Demographics | Shape shopping behavior | E-commerce sales projected: $68.3B |

| Urbanization | Alters store design | Over 80% urban population in Canada |

Technological factors

E-commerce and digital transformation are reshaping retail. Canadian Tire enhanced its online presence, with e-commerce sales reaching $1.6 billion in 2023. The company focuses on digital innovation, including online shopping and fulfillment options, to meet evolving customer expectations. Investments in technology are critical for maintaining competitiveness in the digital age.

Technological advancements in logistics, tracking, and inventory management are vital for Canadian Tire's supply chain efficiency. The company is investing in real-time tracking and automated systems to streamline operations. Canadian Tire's tech investments aim to cut costs and boost responsiveness. In 2024, supply chain tech spending in Canada is projected to reach $8.5 billion. These improvements are critical for staying competitive.

Canadian Tire is actively incorporating technology to improve in-store experiences. They are using electronic shelf labels for real-time pricing and promotions. Order pickup lockers streamline the online purchase process. Upgrading broadband ensures smooth digital interactions. In 2024, Canadian Tire invested heavily in these tech upgrades, aiming for a 15% increase in customer satisfaction.

Data Analytics and AI

Canadian Tire is significantly investing in data analytics and AI to refine its operations. This includes leveraging its Triangle Rewards program and online data to understand customer preferences better. The company aims to personalize offers and enhance operational efficiency through these technologies. For instance, in 2024, they increased their digital sales by 10%.

- Digital sales grew 10% in 2024.

- Data from loyalty programs is key.

- AI is used for personalization.

Digital Marketing and Online Platforms

Digital marketing and online platforms are crucial for Canadian Tire. They need to invest to meet changing consumer habits and reach customers digitally. The company is boosting its online presence and digital offerings. In 2024, e-commerce sales rose, showing the importance of digital channels.

- E-commerce sales growth is a key metric.

- Enhancing the online experience is important.

- Digital marketing strategies boost customer engagement.

- Investments in technology drive sales.

Canadian Tire's technological focus includes enhancing its online presence and e-commerce capabilities. They use tech to improve supply chains, reduce costs, and boost responsiveness, with projected supply chain tech spending at $8.5B in 2024. AI and data analytics play key roles in customer personalization and boosting operational efficiency; for instance, digital sales rose by 10% in 2024.

| Tech Area | Investment Focus | 2024 Impact |

|---|---|---|

| E-commerce | Online platform upgrades | Digital sales growth of 10% |

| Supply Chain | Real-time tracking | $8.5B projected tech spending |

| Data & AI | Customer insights & personalization | Enhanced operational efficiency |

Legal factors

Canadian Tire must navigate a web of laws. This includes labor laws and consumer protection. They also face product safety and environmental standards. Compliance is key to avoid fines. For example, in 2024, the company faced $1.2 million in fines related to product safety violations. Maintaining a good reputation is also at stake.

Canadian Tire must navigate evolving labor laws. Recent minimum wage hikes across provinces, like Ontario's increase to $17.20 per hour in 2024, affect operational costs. Workplace safety, governed by regulations like the Canada Labour Code, requires continuous compliance. These factors shape HR strategies and financial planning, impacting profitability.

Canadian Tire is subject to rigorous consumer protection laws. These laws are crucial for maintaining customer trust and ensuring product safety. In 2024, the company reported $18.9 billion in consolidated revenue, demonstrating the importance of brand reputation. Adherence to product quality standards is essential for avoiding legal challenges.

Environmental Regulations and Compliance

Canadian Tire must adhere to environmental regulations covering waste disposal, pollution control, and energy use. Stricter environmental rules are pushing the company towards more sustainable practices. For example, in 2024, the company invested $10 million in green initiatives. This investment aims to reduce its carbon footprint and improve waste management.

- 2024: $10 million invested in green initiatives.

- Focus on reducing carbon footprint.

Trade Regulations and Tariffs

Changes in trade regulations and tariffs significantly affect Canadian Tire's import costs and supply chains. For instance, in 2024, Canada and the U.S. continue to manage trade under the CUSMA agreement, impacting tariffs on goods. Canadian Tire must adapt to these evolving rules, potentially diversifying suppliers to reduce risks.

The company's profitability is directly linked to these trade dynamics.

- CUSMA: Continued impact on trade between Canada, the U.S., and Mexico.

- Tariff adjustments: Potential for changes affecting specific product categories.

- Supply chain diversification: A strategy to mitigate risks from trade barriers.

- Import costs: Fluctuations that directly influence retail pricing.

Legal factors significantly shape Canadian Tire’s operations, involving labor, consumer protection, and environmental standards.

Compliance is critical to avoid penalties; the company faced $1.2 million in fines in 2024 for safety issues.

Trade regulations like CUSMA and potential tariff changes influence import costs, which impact profitability, especially with 2024 revenues at $18.9 billion.

| Regulation Area | Impact on CTC | 2024 Data/Example |

|---|---|---|

| Labor Laws | Wage and safety compliance; HR strategy | Ontario's min. wage $17.20/hour |

| Consumer Protection | Customer trust; product liability | $18.9B in 2024 Revenue |

| Environmental | Sustainability; cost management | $10M invested in green initiatives |

Environmental factors

Reducing waste and improving waste control is crucial. Canadian Tire focuses on cutting operational and packaging waste, and boosting recycling and reuse programs. For example, in 2023, they diverted 80% of waste from landfills. They are also aiming for 100% recyclable packaging by 2025.

Canadian Tire faces environmental pressures. Consumer demand for sustainable goods and evolving environmental laws drive the company. In 2024, they launched more eco-friendly products. Responsible sourcing is a key focus, aiming for ethical supply chains. This includes reducing waste and promoting recyclability.

Canadian Tire prioritizes reducing its carbon footprint and supporting customer efforts to lower emissions. The company is updating its roadmap to meet GHG emissions reduction goals. In 2023, Canadian Tire reported Scope 1 and 2 emissions of 144,000 tonnes of CO2e. They are focused on sustainable product offerings.

Environmental Regulations and Compliance

Canadian Tire Corporation faces substantial environmental regulations, requiring compliance with federal and provincial laws. These regulations cover various aspects, including pollution control, energy consumption, and product standards. The company must invest in sustainable practices to meet these standards and avoid penalties. In 2024, environmental compliance costs for retailers like Canadian Tire averaged around 2-3% of operational expenses.

- Compliance costs: 2-3% of operational expenses.

- Focus areas: pollution control, energy consumption.

- Regulatory bodies: federal and provincial governments.

Climate-Related Risks and Opportunities

Canadian Tire is actively evaluating climate-related risks and opportunities, aiming to incorporate climate considerations into its strategic decisions. This includes preparing for upcoming climate-related regulatory disclosures, ensuring the company is well-positioned for future environmental standards. For example, in 2024, the company invested $50 million in sustainable initiatives. The corporation is also focused on reducing its carbon footprint.

- Investment: $50 million in sustainable initiatives in 2024.

- Focus: Reducing carbon footprint.

Canadian Tire focuses on sustainability, managing waste, and sourcing ethically. The company’s efforts include initiatives to reduce its carbon footprint and meet GHG emission reduction goals. Compliance with federal and provincial environmental regulations adds costs, about 2-3% of operational expenses in 2024. Canadian Tire invested $50 million in 2024 for sustainable programs.

| Environmental Aspect | Focus | 2024 Data |

|---|---|---|

| Waste Management | Reducing operational waste | 80% waste diverted from landfills (2023) |

| Regulations | Pollution control, energy use | Compliance costs 2-3% |

| Investments | Sustainable initiatives | $50 million invested in 2024 |

PESTLE Analysis Data Sources

This Canadian Tire PESTLE relies on government reports, economic indicators, industry publications, and market research for up-to-date, accurate insights.