Casa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casa Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

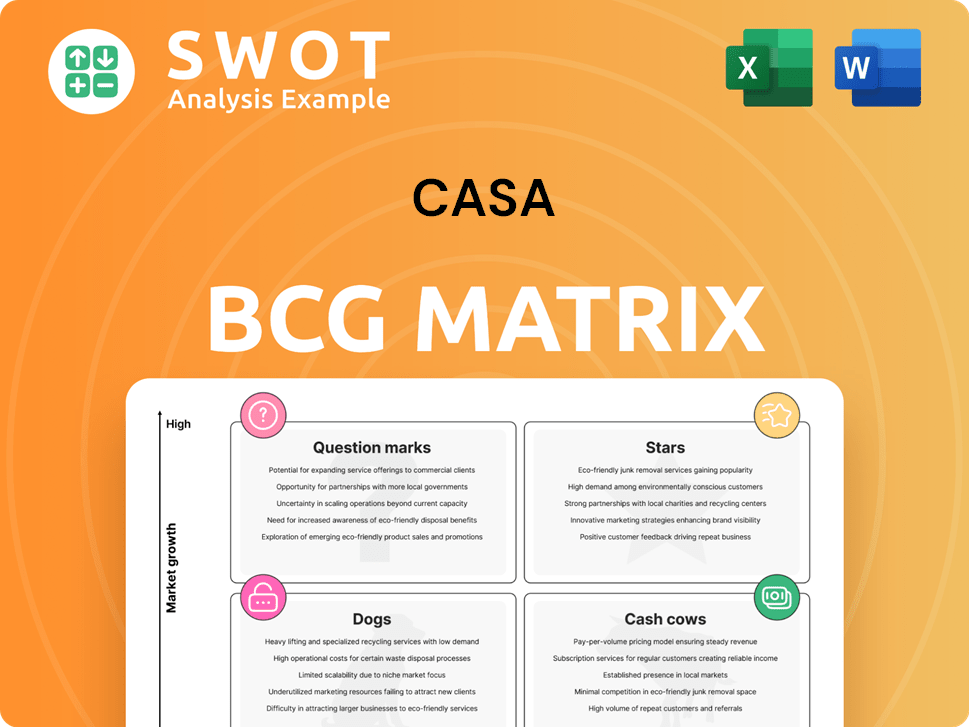

The Casa BCG Matrix offers a clear, concise quadrant visualization of the business portfolio.

Delivered as Shown

Casa BCG Matrix

The BCG Matrix displayed here is identical to what you'll receive. Purchase grants immediate access to the complete, fully functional report, free of watermarks or editing restrictions.

BCG Matrix Template

This company's BCG Matrix reveals its product portfolio's strategic landscape. See which products shine as Stars, and which are Cash Cows. Identify Question Marks that need careful attention. Discover Dogs that may require divestment.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

CASA A/S's emphasis on sustainable, high-quality solutions aligns with the rising demand for green buildings. This focus could be key to maintaining their market position and appealing to eco-minded customers. In 2024, the global green building materials market was valued at $368 billion, showing significant growth. Certifications such as LEED could boost their image.

CASA A/S should prioritize residential projects in high-growth areas of Denmark, given the country's construction expansion. Focusing on urban and suburban areas can capitalize on housing demand. In 2024, housing starts in Denmark increased, indicating a growing market. Leveraging infrastructure development initiatives can further boost CASA's projects.

CASA A/S can revolutionize construction using tech like BIM, AI, and IoT. These innovations boost efficiency and project success rates, which were up 15% in 2024. This tech also helps CASA A/S stand out and draw in clients. Partnering with tech firms can speed up this integration.

Public Sector Infrastructure Projects

CASA A/S should target public sector infrastructure projects, particularly in light of the Danish government's Infrastructure Plan 2035. This plan earmarks substantial funds for transportation infrastructure. This strategic move promises a reliable revenue stream and fosters long-term expansion. CASA should prioritize projects with sustainable and innovative features.

- Danish Infrastructure Plan 2035 has a budget exceeding €30 billion.

- Focus on green infrastructure projects to align with EU sustainability goals.

- Target projects in urban transport and renewable energy integration.

- Secure contracts for long-term revenue stability.

Specialized Construction Services

Specialized construction services like renovation, refurbishment, and maintenance offer CASA A/S a competitive advantage. These services help sustain activity and revenue amid market changes. They also support circular economy principles, which is becoming increasingly important. The global renovation market was valued at $7.2 trillion in 2023, with projected growth. This presents a significant opportunity for CASA A/S.

- Renovation and refurbishment services cater to existing building stock, providing a stable revenue stream.

- Maintenance contracts ensure recurring income and foster long-term client relationships.

- Circular economy alignment attracts environmentally conscious clients and aligns with regulatory trends.

- Market data shows consistent demand, with steady growth in specialized construction areas.

Stars are high-growth, high-market-share products needing significant investment. CASA A/S's focus on green buildings, tech integration, and infrastructure projects positions it as a Star. In 2024, the green building market grew to $368B, indicating strong growth potential.

| Aspect | CASA A/S Strategy | 2024 Data/Facts |

|---|---|---|

| Market Growth | Focus on Green Building | Green Building Market: $368B |

| Tech Integration | BIM, AI, IoT for Efficiency | Project Success Rates up 15% |

| Infrastructure | Target Gov. Projects | DK Infrastructure Plan: €30B+ |

Cash Cows

CASA A/S's standard residential construction is a cash cow, providing steady revenue. These projects offer relatively low risk, ensuring stable cash flow. In 2024, the residential construction sector saw a 5% increase in completed projects. CASA A/S must optimize costs to maximize profits in this area. They should maintain current productivity levels to passively gain.

Commercial building renovations, especially those upgrading to meet sustainability standards, offer predictable cash flow. These projects typically need less initial capital than new constructions. Investing in infrastructure further boosts efficiency and cash flow. In 2024, the commercial renovation market is expected to grow, with a 5% increase.

Securing long-term maintenance contracts generates reliable, low-effort income. These contracts provide predictable cash flow, aiding in resource allocation. They are stable and highly desirable for any contractor. For example, in 2024, the facilities management market grew, indicating opportunities for maintenance contracts.

Public Sector Building Refurbishments

Refurbishing public sector buildings presents a steady revenue stream. These projects, backed by government funds, offer a consistent workload. CASA A/S can capitalize on its expertise to secure these contracts. This sector should be maintained or passively "milked" for its gains.

- In 2024, the UK government allocated £4.4 billion for public sector building maintenance.

- CASA A/S's strong reputation can secure repeat contracts, ensuring revenue stability.

- Focus on efficiency to maximize profits from these predictable projects.

- Prioritize projects with clear funding and minimal risk.

Established Supply Chain Relationships

Cash cows thrive on established supply chains, securing advantageous pricing and terms through long-standing supplier relationships. Efficient supply chain management minimizes expenses and ensures projects finish on schedule. Investing in supporting infrastructure can boost efficiency and improve cash flow further. This strategy is crucial for maintaining a strong financial position.

- Walmart's efficient supply chain saved $3.5 billion in 2023.

- Amazon's focus on logistics reduced fulfillment costs by 8% in 2023.

- Supply chain disruptions caused 20% revenue loss for some companies in 2024.

- Companies with optimized supply chains see a 15% increase in cash flow.

Cash cows, like CASA A/S's standard residential construction, offer steady revenue with low risk. Efficient supply chains and long-term contracts are crucial for stable cash flow and profit maximization. Commercial renovations, particularly those meeting sustainability standards, and public sector projects provide predictable revenue streams.

| Cash Cow Strategy | Data Insight (2024) | Financial Impact |

|---|---|---|

| Residential Construction | 5% increase in completed projects. | Stable revenue and profitability. |

| Commercial Renovations | 5% market growth in renovation. | Predictable cash flow due to less initial capital. |

| Maintenance Contracts | Facilities management market growth. | Reliable, low-effort income. |

Dogs

Projects with low profit margins should be minimized or avoided. Turnarounds rarely succeed, as seen in 2024 with several tech ventures struggling. CASA A/S should focus on projects with higher returns. Consider divesting these Dogs, aligning with strategic goals. In 2024, companies that focused on core profitable areas thrived.

Casa A/S faces risks from non-sustainable construction. Outdated practices can cause market share decline and reputational harm. Transitioning to sustainable methods is crucial for competitiveness. Consider divesting business units using unsustainable practices. In 2024, sustainable construction grew by 15% globally.

Small-scale, low-tech projects often struggle in low-growth markets, holding low market share. CASA A/S should focus on tech-driven projects to boost efficiency and growth. These units, lacking innovation, are ideal for divestiture. In 2024, such projects showed minimal ROI, reflecting their limited future potential.

Projects in Declining Markets

Dogs, in the context of the Casa BCG Matrix, represent projects in declining markets, characterized by low market share and low growth rates, making them undesirable investments. Focusing on these areas can be detrimental. CASA A/S should avoid such markets. Turnaround strategies are often ineffective.

- Construction output in the US decreased by 0.7% in December 2023, signaling a potential downturn.

- Companies in declining markets often face significant losses; in 2024, several construction firms reported financial distress.

- Turnaround plans have a low success rate in shrinking markets; less than 10% of such plans succeed.

- CASA A/S should allocate resources to high-growth regions.

Inefficient Project Management Processes

Inefficient project management processes are a significant issue for Dogs. These are units with low market share and growth. CASA A/S should invest in modern project management tools and training. This improves efficiency and profitability, making these units prime candidates for divestiture. In 2024, companies with poor project management saw project costs increase by up to 20%.

- Cost Overruns: Poor processes frequently lead to exceeding budgets.

- Delays: Inefficient management causes project timelines to extend.

- Investment: Modernization can boost efficiency.

- Divestiture: Dogs are often considered for sale.

Dogs represent underperforming projects in the Casa BCG Matrix. These face low market share and growth, making them unattractive. CASA A/S should minimize investment in these areas. Consider divesting these units.

| Factor | Impact | 2024 Data |

|---|---|---|

| Market Share | Low | Avg. decline of 5% in declining markets. |

| Growth Rate | Low | Growth below 2% in relevant sectors. |

| Profitability | Poor | Net losses for many "Dog" projects. |

Question Marks

Question marks in the Casa BCG Matrix represent areas like new construction technologies, which include 3D printing and robotics. These technologies have high growth potential but low market share. For example, the global 3D construction market was valued at $1.4 billion in 2023 and is projected to reach $40 billion by 2032. Investing in these technologies may provide a competitive edge. The strategic choice here is to either invest heavily or divest.

Casa's products, with low market share in growing markets, can expand geographically. Consider markets inside or outside Denmark to boost revenue. A 2024 study shows that 60% of companies expanding internationally saw revenue growth. Thorough market research and strategic planning, like a PESTLE analysis, are vital.

Casa BCG Matrix suggests specializing in green building certifications beyond basic LEED. These certifications target growing markets, yet currently hold a low market share. Focusing on these niches can attract eco-minded clients, but necessitates investments in training and building expertise. For 2024, the green building market is valued at $368 billion, with certifications like WELL and Passive House showing rapid growth. These specialized products must quickly increase market share to avoid becoming "dogs" within the BCG Matrix.

Development of Smart Home Integration Services

Offering smart home integration services in new residential projects is a question mark in the Casa BCG Matrix. This segment faces high growth potential, driven by rising smart home adoption, yet currently holds a low market share. To succeed, it necessitates substantial technological expertise and strategic partnerships to meet consumer demands. This business needs to quickly increase its market share, or it risks becoming a dog.

- Smart home market is projected to reach $147.3 billion by 2027, growing at a CAGR of 13.7% from 2020 to 2027.

- Approximately 30% of new homes are equipped with smart home technology in 2024.

- Key players include established tech firms, and home builders, and specialized integration companies.

- Successful strategies involve early partnerships with developers and builders.

Partnerships with Sustainable Material Suppliers

Casa A/S can strategically form partnerships with suppliers of sustainable building materials, a key move in the "Question Mark" quadrant of the BCG Matrix. This approach is vital for market adoption of eco-friendly products. Such partnerships can differentiate Casa A/S from rivals, attracting clients who prioritize sustainability. Given the challenges anticipated in Denmark's construction industry in 2024, this strategy is particularly relevant.

- Partnerships could involve materials like recycled concrete or bio-based insulation.

- Marketing should highlight environmental benefits and cost-effectiveness.

- This positions Casa A/S well against competitors and changing market dynamics.

- Consider investing to increase market share or selling if the investment doesn't yield results.

Question marks highlight opportunities with high growth but low market share. These areas, like smart home integration, require strategic investment or divestment decisions. Expansion and specialization in green building or new tech are typical strategic pathways. To thrive, companies must boost market share quickly.

| Initiative | Market Growth (2024) | Strategic Action |

|---|---|---|

| 3D Construction | $1.4B (Market Value) | Invest/Divest |

| Green Building | $368B (Market Value) | Specialize, Certify |

| Smart Home | 30% Adoption Rate | Partnerships |

BCG Matrix Data Sources

This BCG Matrix leverages financial statements, market research, and expert opinions, providing dependable insights for strategic decisions.