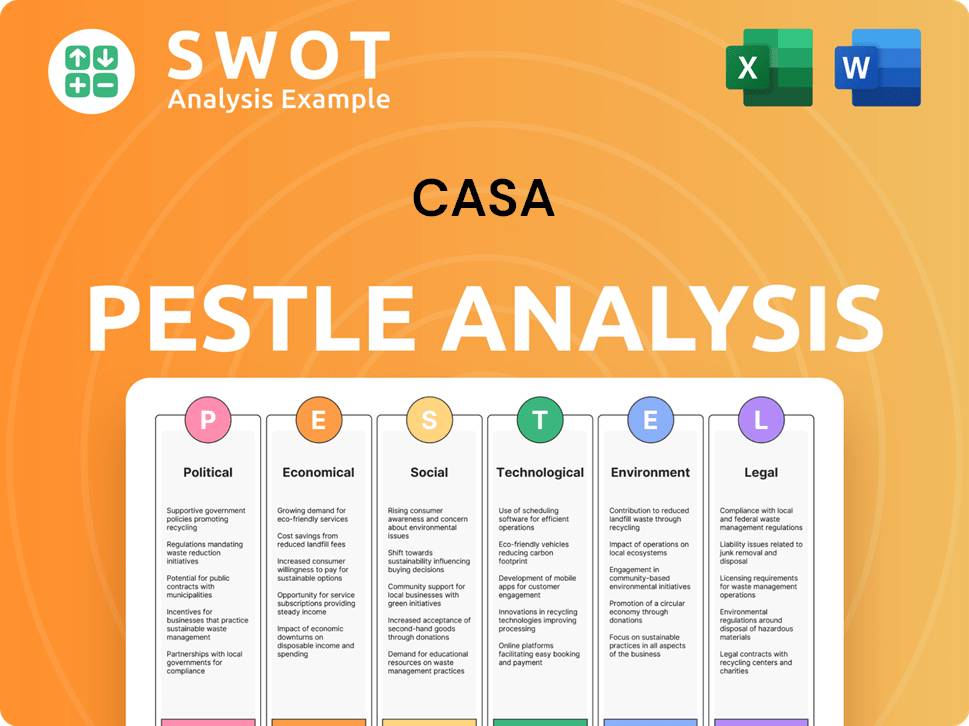

Casa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casa Bundle

What is included in the product

Helps you see how external factors shape competitive dynamics for Casa, industry and geography.

Provides a framework for easily identifying opportunities and risks impacting business decisions.

Same Document Delivered

Casa PESTLE Analysis

The file you’re seeing now is the final version—ready to download right after purchase. This Casa PESTLE analysis preview demonstrates the quality. Examine the format and details, it's the completed document! You'll receive the exact analysis presented here.

PESTLE Analysis Template

Navigate the complexities of Casa's market with our meticulously crafted PESTLE Analysis. We dissect political shifts, economic indicators, and technological advancements impacting Casa's operations. Social trends and environmental factors are also thoroughly examined. This analysis offers actionable intelligence for investors, strategists, and business leaders. Unlock valuable insights to make informed decisions, by purchasing the full version now!

Political factors

The Danish government's substantial infrastructure investments significantly shape the construction sector. The Infrastructure Plan 2035, allocating DKK 157.6 billion, fuels growth, particularly from 2026 to 2028. Projects like the Copenhagen M5 metro line exemplify these impactful initiatives. These strategic investments boost economic activity.

Political agreements are pushing for greener buildings. Stricter environmental rules, including tighter CO2 limits, start in July 2025. These changes are part of a national plan for sustainable construction. The building sector's carbon footprint must shrink. Building regulations will need updates to comply.

Denmark's political stability and robust infrastructure backing are key. This reduces political risk, which is great for companies like CASA A/S. The Danish government invested $2.5 billion in infrastructure projects in 2024. This commitment boosts investor confidence.

Public Procurement and Standard Contracts

In Denmark, public projects heavily rely on standard construction contracts like AB 18 and ABT 18. These "AB Standards" are mandatory for public authorities. The public sector significantly influences the construction market's dynamics. For 2024, public procurement in Denmark reached approximately DKK 400 billion. These standards ensure consistency and fairness in agreements.

- AB 18 and ABT 18 are key in public projects.

- Public procurement in 2024 was around DKK 400 billion.

- These standards ensure consistent practices.

Exemptions for Critical Infrastructure

Exemptions from stringent CO2 emission limits exist for crucial infrastructure, including hospitals and military facilities, reflecting a strategic approach to environmental regulations. These projects must still document their climate impact, ensuring accountability even with exemptions. This targeted approach acknowledges the essential nature of these structures while promoting environmental awareness. For example, in 2024, the U.S. government allocated $1.5 billion for climate resilience projects in critical infrastructure.

- Exemptions for hospitals and military buildings.

- Requirement to document climate impact.

- Strategic approach to environmental regulations.

- U.S. allocated $1.5 billion for climate resilience projects in 2024.

Denmark's political landscape fosters growth. Infrastructure investments, like the Infrastructure Plan 2035 (DKK 157.6 billion), drive the construction sector. Environmental rules, with tighter CO2 limits from July 2025, shape building practices.

| Political Factor | Impact | Data (2024/2025) |

|---|---|---|

| Infrastructure Investments | Boosts construction | $2.5B in 2024 infrastructure projects. |

| Environmental Regulations | Changes building practices | CO2 limits begin July 2025 |

| Political Stability | Reduces risk | Denmark has strong stability |

Economic factors

The Danish construction market faced a contraction in 2024, estimated at -2.5% in real terms. High material costs and rising interest rates, impacting affordability, are key challenges. Further contraction is predicted for 2025, though the pace may slow. A rebound is expected from 2026, fueled by infrastructure projects and renewable energy investments.

High construction costs, driven by elevated material prices and labor expenses, pose a significant challenge. In 2024, the U.S. construction materials price index rose by 1.8%, impacting project budgets. This increases costs for companies like CASA A/S, potentially affecting project profitability and feasibility. Labor costs also continue to climb, adding further pressure to construction projects.

Government investment in infrastructure and energy is a growth catalyst. The construction sector benefits from transportation and renewable energy projects. In 2024, the U.S. government allocated $1.2 trillion for infrastructure. This includes funds for roads, bridges, and clean energy initiatives, boosting construction.

Influence of Interest Rates and Inflation

High interest rates and inflation have created significant challenges for the construction sector. These economic pressures have contributed to project delays and a decrease in the issuance of construction permits. For example, the Federal Reserve's aggressive interest rate hikes in 2023, with rates reaching a range of 5.25% to 5.50%, significantly increased borrowing costs for construction projects. A stabilization of interest rates and a moderation in inflation are anticipated to foster economic recovery, potentially boosting construction activity. According to the U.S. Bureau of Labor Statistics, the inflation rate has fluctuated, with the Consumer Price Index (CPI) showing variations throughout 2024.

- Interest rates reached 5.25%-5.50% in 2023.

- Inflation has been fluctuating in 2024.

Private Residential Construction Trends

Private residential construction has been subdued, reflecting economic uncertainties. Property tax reforms and potential tax increases in urban zones may impact future residential development. These changes could affect the demand for construction services, potentially influencing investment decisions. The housing starts in the U.S. in March 2024 were at a seasonally adjusted annual rate of 1.48 million. This is 14.7% below the March 2023 rate.

- Housing starts in the U.S. in March 2024: 1.48 million.

- March 2024 rate is 14.7% below March 2023.

Economic pressures significantly affect CASA A/S, marked by fluctuating inflation in 2024 and high interest rates, reaching 5.25%-5.50% in 2023. The housing market reflects this, with U.S. housing starts in March 2024 at 1.48 million, 14.7% below March 2023.

Denmark's construction sector contracted in 2024, projected to continue in 2025 before an anticipated rebound. Elevated construction costs, including a 1.8% rise in the U.S. construction materials price index in 2024, influence project feasibility. Infrastructure spending provides potential growth catalysts.

| Economic Factor | Impact | Data |

|---|---|---|

| Inflation | Fluctuating | CPI variations in 2024 |

| Interest Rates | High Borrowing Costs | 5.25%-5.50% in 2023 |

| Housing Starts (U.S.) | Subdued | 1.48M in March 2024 (14.7% down YoY) |

Sociological factors

Societal emphasis on sustainability is increasing. Clients now prioritize green building materials and energy-efficient designs. This shift aligns with CASA's goals. Demand for sustainable practices is rising, impacting construction choices. In 2024, green building market valued at $367 billion, expected to reach $493 billion by 2025.

Denmark's aging population, with a rising old-age dependency ratio, reshapes housing needs. The proportion of those aged 65+ is projected to reach 22% by 2030. This could increase demand for senior-friendly housing and care facilities. This demographic shift opens new market segments for construction, with potential for specialized housing solutions.

A large share of Denmark's GDP and population is in major cities like Copenhagen. This urbanization fuels development, requiring new residential, commercial, and infrastructure projects. In 2024, Copenhagen saw a 2.5% population increase, driving construction demand. This presents significant opportunities for construction and related sectors. Infrastructure spending is projected to increase by 4% in 2025 to support urban growth.

Changing Living Preferences (e.g., Co-housing)

Interest in co-housing and similar living setups is growing, especially with older adults seeking community and shared resources. This shift points to evolving housing needs and could impact the types of residential projects developers undertake. For example, in 2024, co-housing projects saw a 15% rise in interest. This trend is reshaping housing markets.

- Co-housing projects saw 15% rise in interest in 2024.

- Senior citizens are a key demographic.

- Housing demands and residential projects are influenced.

Workforce Skills and Labor Shortages

Denmark's construction industry grapples with workforce skill gaps, impacting project timelines. Labor shortages are a persistent concern, necessitating proactive measures. Addressing this requires strategic initiatives to ensure a skilled workforce. This is vital for efficient project delivery and industry competitiveness.

- In 2024, the construction sector in Denmark reported a 5% increase in unfilled job vacancies.

- Approximately 30% of construction firms in Denmark have reported delays due to labor shortages.

- The Danish government has increased investment in vocational training programs by 10% in 2024.

Sustainability is vital, with the green building market valued at $367B in 2024, rising to $493B by 2025. An aging population drives demand for senior-friendly housing, with those 65+ projected to be 22% by 2030. Urbanization in cities like Copenhagen fuels development.

| Factor | Details | Impact |

|---|---|---|

| Sustainability | Green building market value | Increased construction demand. |

| Demographics | 22% aged 65+ by 2030 | Demand for senior-friendly housing. |

| Urbanization | Copenhagen's 2.5% population rise | Infrastructure and housing projects. |

Technological factors

The Danish construction sector's embrace of digital tech, including BIM and project management software, is accelerating. This shift aims to boost efficiency and data utilization. In 2024, the digital transformation market in Denmark was valued at approximately $7.5 billion, reflecting this trend. By 2025, projections estimate further expansion, with a growth rate of around 6%.

AI's potential in construction is vast, optimizing resource allocation and scheduling. Its integration streamlines processes, improving project outcomes. For example, AI-powered tools can reduce project delays by up to 20% and cut costs by 10-15%, as reported in early 2024 studies.

Technological advancements are key for sustainable construction. CASA's focus on green building materials and energy-efficient designs is crucial. The global green building market is projected to reach $817.8 billion by 2027. This growth reflects the increasing adoption of sustainable practices, which CASA aims to capitalize on.

Innovation in Construction Processes

Technological advancements significantly influence Casa's operations. Innovation in construction, such as prefabrication and modular construction, can boost efficiency and cut down on waste, potentially lowering costs by 10-20%. Adopting these technologies offers a competitive edge in the market. The global modular construction market is projected to reach $157 billion by 2025, showing rapid growth.

- Prefabrication can reduce construction time by up to 50%.

- Modular construction can decrease labor costs by 15-25%.

- Building Information Modeling (BIM) improves project management.

Data Utilization for Project Management

Digital platforms are crucial for project management, offering better data analysis. This improves insights into project progress and risk management. Data-driven decisions are key; the global project management software market is projected to reach $7.1 billion by 2025. This growth highlights the increasing reliance on technology.

- Software adoption enhances project control.

- Real-time data allows for proactive risk management.

- Improved data analysis leads to better resource allocation.

- Project management software market is growing.

Casa benefits from Denmark's digital transformation in construction. The market was $7.5 billion in 2024 and growing at 6%. AI, prefabrication, and modular construction boost efficiency, potentially cutting costs and time significantly. Adoption of Building Information Modeling (BIM) and project management software are vital for modern construction.

| Technology | Impact | Data (2024/2025) |

|---|---|---|

| Digital Transformation | Efficiency & Data Utilization | $7.5B market (2024), 6% growth by 2025 |

| AI in Construction | Resource Optimization | Reduce delays up to 20%, cost cuts of 10-15% |

| Modular Construction | Cost Reduction & Efficiency | $157B market by 2025 |

| Project Management Software | Improved Data Analysis | $7.1B market by 2025 |

Legal factors

Danish building regulations (BR18) are set for revision, introducing tougher CO2 emission limits for new builds, starting July 2025. These updates will influence design, material selection, and construction, demanding compliance from all new projects. The construction sector in Denmark accounts for approximately 30% of the country's total CO2 emissions. New regulations aim to cut these emissions significantly.

Life Cycle Assessments (LCAs) are legally mandated for new constructions, quantifying their climate impact. This requirement, crucial across the EU, mandates evaluating a building's environmental footprint from cradle to grave. For instance, in France, the RE2020 regulation underscores this by setting stringent LCA standards. This impacts design choices and material selections, pushing for sustainable practices. Specifically, buildings must meet specific CO2 emissions targets based on LCA results, as per the EU's Green Deal initiatives.

New regulations set an independent CO2 limit for construction emissions, starting July 2025. This impacts material transport and on-site activities. Companies must reduce emissions to comply. The construction industry faces increased scrutiny. This shift requires strategic emission reduction plans.

Standard Contract Law in Construction

In Denmark, construction projects operate under general contract and tort law, as there's no specific construction law. The AB Standards, such as AB 18 and ABT 18, serve as a common framework, especially for public projects. These standards help define obligations, responsibilities, and dispute resolution processes. The Danish construction market saw a total construction output of approximately DKK 340 billion in 2024.

- AB Standards are crucial for standardizing construction contracts.

- Public projects often mandate the use of AB Standards.

- Understanding contract law is vital for all construction stakeholders.

- Construction output in Denmark was around DKK 340 billion in 2024.

Environmental Protection Act and Sustainability

The Environmental Protection Act in Denmark mandates environmental considerations in construction, influencing Casa's operations. This legal framework prioritizes sustainability, urging eco-conscious practices in production and building. Compliance necessitates integrating green technologies and waste reduction strategies, impacting costs and design choices. A 2024 report showed that 75% of Danish construction firms are investing in sustainable materials to adhere to these regulations.

- Compliance with environmental regulations is essential for legal operation.

- Sustainability is a key driver for design and material selection.

- Investment in green technology is necessary for compliance.

- Waste reduction strategies will be part of the operational plan.

Starting July 2025, Denmark will enforce stricter CO2 limits via revisions to BR18 regulations impacting Casa's construction projects. Life Cycle Assessments (LCAs) are mandatory for new builds across the EU, ensuring environmental footprint evaluations for compliance, specifically impacting material and design. General contract and tort law applies, with AB Standards acting as the norm, shaping obligations, supported by Environmental Protection Act for sustainable, green building. Danish construction output was DKK 340 billion in 2024.

| Legal Aspect | Impact on Casa | Data Point |

|---|---|---|

| CO2 Emission Limits (BR18) | Affects material & design | Tougher limits from July 2025 |

| Life Cycle Assessments (LCAs) | Requires cradle-to-grave analysis | EU-wide mandate, CO2 targets. |

| Contract Law & AB Standards | Defines project obligations | DKK 340B construction output (2024) |

Environmental factors

Denmark's strict CO2 emission limits significantly impact construction. The government aims to cut emissions, affecting building practices. Stricter rules for new buildings are in effect, influencing material choices. This pushes for sustainable building designs and technologies. The construction sector faces pressure to reduce its environmental footprint.

The construction industry is increasingly prioritizing circular economy principles, emphasizing material reuse and recycling to reduce waste. Material reversibility is gaining traction, though not yet universally mandated in building codes. For example, the global construction waste market was valued at $3.5 billion in 2024, projected to reach $4.9 billion by 2029. This shift reflects growing environmental consciousness and regulatory pressures, pushing for sustainable practices.

The construction sector significantly impacts Denmark's environment. It accounts for a substantial portion of the nation's CO2 emissions and resource use. This emphasizes the responsibility of construction firms to adopt sustainable practices. The 2023 figures show construction contributes roughly 30% of Denmark's total CO2 emissions.

Promoting Sustainable Building Materials

The construction industry is increasingly prioritizing sustainability, driving the adoption of eco-friendly materials. This shift aims to minimize the environmental footprint of building projects, impacting material selection and sourcing. Using materials like wood, hemp, and straw is becoming more common to reduce carbon emissions. This trend reflects a growing demand for green building practices.

- Global green building materials market is projected to reach $497.9 billion by 2029.

- The U.S. construction industry accounts for about 40% of carbon emissions.

- Bio-based materials can sequester carbon, reducing the overall environmental impact.

Addressing Emissions from Construction Sites

Regulations are tightening on construction site emissions. These rules target CO2 from transport and on-site operations, pushing for greener practices. Construction firms must now actively cut their environmental footprint to comply. This shift impacts project costs and material choices. The industry is seeing a rise in sustainable building methods.

- Construction accounts for roughly 11% of global CO2 emissions.

- The EU aims to cut construction emissions by 55% by 2030.

- Use of low-carbon materials is projected to grow by 20% annually.

- Green building market reached $364 billion in 2024.

Denmark’s construction sector faces intense environmental scrutiny, especially regarding CO2 emissions. Stricter regulations target emission sources from transport and site operations. The focus on eco-friendly materials and practices is growing.

Construction contributes significantly to environmental impact in Denmark, pushing for sustainable building methods. This is boosted by increasing demand for green building. Globally, green building markets reached $364 billion in 2024.

| Environmental Factor | Impact | Data |

|---|---|---|

| CO2 Emissions | Construction's role in national emissions | Roughly 30% of Denmark's CO2 in 2023. |

| Green Building Market | Global market value | $364 billion in 2024. Projected to grow significantly. |

| Circular Economy | Prioritizing material reuse and recycling | Construction waste market was valued at $3.5 billion in 2024, and expected to reach $4.9 billion by 2029 |

PESTLE Analysis Data Sources

Our Casa PESTLE relies on diverse sources: governmental reports, economic indicators, and market analysis from reputable firms.