Casey's General Stores Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casey's General Stores Bundle

What is included in the product

BCG Matrix analysis of Casey's: strategic insights on product portfolio.

Printable summary optimized for A4 and mobile PDFs so everyone understands the stores' positioning.

What You See Is What You Get

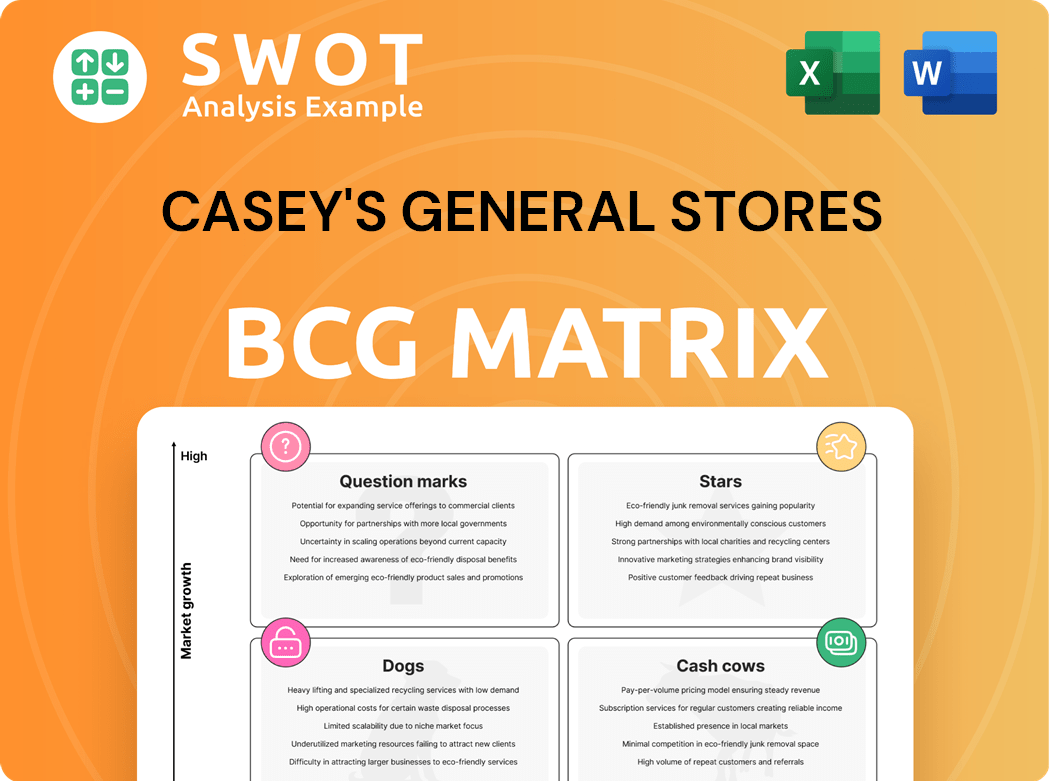

Casey's General Stores BCG Matrix

The preview you see is the complete BCG Matrix report you'll receive after purchase. It's fully formatted for immediate use, without watermarks or placeholder content. This professional-grade document allows for instant integration into your strategic planning efforts. Download the full version and get straight to work.

BCG Matrix Template

Casey's General Stores likely has a diverse product portfolio, from pizza to gas. Its BCG Matrix could reveal which offerings are high-growth "Stars" generating profits. Identifying "Cash Cows" like fuel, which generate steady income, is key. Understanding "Dogs" and "Question Marks" helps optimize resource allocation.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Casey's expansion strategy places it in the "Stars" quadrant of the BCG matrix. Aggressive store growth, including the Fikes acquisition, fuels revenue. In Q3 2024, they opened 44 new stores and aim for 500 by 2026. This positions them for high market share and growth, with expansion into new states.

Prepared food and dispensed beverages are a star for Casey's, fueling inside sales. Innovations boost customer traffic and margins. This segment is a key differentiator. In fiscal year 2024, inside sales grew, driven by these offerings.

Casey's Rewards, a loyalty program, is a "Star" in its BCG Matrix. It has a large membership base, increasing customer frequency and spending. Personalized marketing is enabled by the program. In 2024, Casey's saw loyalty members account for a significant portion of sales. Data-driven targeted promotions enhance customer engagement.

Fuel Sales with Strong Margins

Casey's fuel sales are a key revenue source, known for strong margins. They adeptly balance volume and margin, optimizing gross profit using pricing and procurement tools. The sales of renewable fuel credits (RINs) boost fuel gross profit, enhancing profitability. In Q1 2024, fuel gallons sold increased by 2.6%, with a fuel margin of 39.7 cents per gallon.

- Fuel sales are a major revenue driver with robust margins.

- Pricing and procurement tools optimize gross profit.

- Renewable fuel credits (RINs) increase fuel gross profit.

- Q1 2024: fuel margin of 39.7 cents per gallon.

Strategic Acquisitions

Casey's strategically acquires businesses like CEFCO, boosting its market presence. These moves quickly increase its size and reach, creating synergy. They often target smaller chains or individual locations. In 2024, Casey's completed the acquisition of 67 stores.

- Acquisition of 67 stores in 2024.

- Focus on smaller chains and single sites.

- Immediate scale and geographic expansion.

- Opportunities for synergy realization.

Casey's has demonstrated consistent revenue growth in the "Stars" quadrant of its BCG matrix. Prepared foods and beverages are a key differentiator, driving inside sales. Fuel sales also contribute substantially, with effective margin management and renewable fuel credits enhancing profitability.

| Metric | 2024 Data | Impact |

|---|---|---|

| Inside Sales Growth | Increased | Drives customer traffic |

| Fuel Margin (Q1 2024) | 39.7 cents per gallon | Supports profitability |

| New Store Openings (Q3 2024) | 44 | Expands market share |

Cash Cows

Casey's thrives in rural markets with less competition, ensuring steady revenue. Their established stores generate robust cash flow. In 2024, same-store sales grew, demonstrating their ability to build loyalty. These markets contribute significantly to Casey's financial stability, a key cash cow characteristic.

Inside sales at Casey's, especially in groceries and general merchandise, are a major revenue source. Their private label products offer value, boosting sales. In Q3 2024, inside sales grew 7.6%. Strong beverage sales, including a 9.7% increase in non-alcoholic drinks, also help.

Casey's General Stores, a "Cash Cow" in its BCG Matrix, prioritizes operational efficiency and cost management. They reduced same-store labor hours by 1.8% in Fiscal Year 2024. Implementing technology streamlined processes. Optimized procurement improves supply chain efficiency. These actions boosted gross profit margin to 36.6% in 2024.

Pizza and Bakery Offerings

Casey's pizza and bakery items are cash cows, being a significant revenue source. As the fifth-largest pizza chain, these offerings boost store traffic and margins. Innovation, like new menu items, keeps customers engaged. In 2024, these segments contributed substantially to overall sales.

- Pizza and bakery are high-margin products.

- They attract customers, driving store traffic.

- Casey's regularly introduces new menu items.

- These offerings are a key part of the business strategy.

Self-Distribution Network

Casey's General Stores' self-distribution network is a cash cow, providing a strong competitive advantage. This network allows efficient supply chain management and cost control. Their distribution centers support expansion, ensuring product availability and consistent pricing. The company's three centers currently supply all stores.

- In fiscal year 2024, Casey's reported over $16 billion in total revenue.

- Casey's operates over 2,400 stores.

- The self-distribution network helps maintain gross profit margins.

- The network's efficiency supports their strategy for same-store sales growth.

Casey's General Stores' financial strategy focuses on operational efficiency. The company’s strong financial position and cash flow are a result of their strategic focus. In 2024, Casey’s saw impressive sales and margin improvements, further solidifying their "Cash Cow" status.

| Key Metric | 2023 | 2024 |

|---|---|---|

| Total Revenue ($B) | 15.1 | 16.4 |

| Gross Profit Margin (%) | 36.0 | 36.6 |

| Same-Store Sales Growth (%) | 4.4 | 3.6 |

Dogs

Some Casey's stores, mainly those in competitive urban spots, might face profitability challenges due to stiff competition and elevated costs. These stores could have low market share and growth, making them potential divestiture targets. In 2024, Casey's store count was around 2,500. Locations where Casey's can't stand out from rivals could also be categorized as dogs.

Commodity automotive products like motor oil and windshield wipers are "dogs" for Casey's General Stores. These items typically have low profit margins and move slowly. In 2024, such products contributed minimally to overall revenue. They struggle against specialized auto part stores and online competitors, impacting profitability.

Casey's outdated stores struggle with customer appeal and sales. These locations often miss modern amenities like updated tech and expanded food choices. Without EV chargers, these stores face challenges as EV adoption grows. In 2024, Casey's aims to remodel stores, focusing on customer experience.

Weak Performance in Certain Geographic Locations

In Casey's BCG Matrix, areas with weak performance are considered dogs. These may include locations where Casey's struggles to compete or hasn't adapted to unique customer preferences. Declining local economies can also impact performance, classifying these areas as dogs.

- In 2024, Casey's saw a 3.4% same-store sales increase in fuel.

- The company's total revenue in Q1 2024 was $3.9 billion.

- Areas of concern are regions with high competition from other convenience stores.

- Economic downturns in specific states could lead to lower sales.

Unsuccessful New Product Launches

Unsuccessful new product launches at Casey's General Stores can be categorized as dogs in the BCG matrix. These launches often fail to gain traction, facing tough competition. Products that don't align with Casey's brand image also struggle. For instance, a 2024 study showed that 30% of new convenience store product introductions fail within a year.

- Poor sales performance indicates a dog.

- Competition impacts new product success.

- Brand mismatch hinders product adoption.

- Failure rates in the convenience sector are high.

Dogs in Casey's BCG matrix include underperforming stores, often in competitive areas. Automotive products with low margins and slow sales also fall into this category. Poor new product launches add to the "dogs".

| Category | Description | Impact |

|---|---|---|

| Store Locations | Competitive or outdated locations. | Lower sales, reduced profitability. |

| Product Lines | Slow-moving, low-margin items. | Minimal revenue contribution. |

| New Products | Unsuccessful product introductions. | Missed sales targets, brand mismatch. |

Question Marks

Casey's expansion into new markets, like Texas, Florida, Alabama, and Mississippi, places it in the "Question Mark" category of the BCG matrix. These markets offer growth prospects but also pose challenges, including adjusting to local tastes and competition. To succeed, Casey's must invest in marketing. In 2024, Casey's reported total revenues of $16.7 billion, reflecting its growth efforts.

New food and beverage product introductions, like those from Casey's Innovation Summit, are question marks in their BCG matrix. These innovations could boost sales and draw in new customers. However, there's a risk of market mismatch. Casey's must closely track these product performances, adjusting strategies as needed. In 2024, Casey's saw a 7.7% increase in inside sales, showing the potential of these new products.

Casey's Access, Casey's General Stores' retail media network, is a question mark in the BCG Matrix. This initiative, relatively new, aims to boost revenue by using customer data for advertising. Success hinges on attracting advertisers and running effective campaigns. In Q3 2024, Casey's saw a 10.2% increase in total revenues.

Electric Vehicle (EV) Charging Infrastructure

Casey's EV charging investments are question marks. Demand is currently low, making returns uncertain. Future growth pace is unclear, requiring careful monitoring. They are cautiously watching EV trends before major spending. This approach helps avoid stranded assets.

- 2024: US EV sales up, but charging infrastructure lags.

- Casey's footprint analysis crucial for strategic charging placement.

- Monitoring EV adoption rates essential for investment timing.

- Focus on adaptable charging tech to mitigate obsolescence risk.

Partnerships with Delivery Services

Partnerships with delivery services fit into the "Question Mark" quadrant of Casey's BCG matrix. These collaborations can boost Casey's market reach and cater to customer convenience. However, they also involve revenue sharing and possible brand experience dilution. The success hinges on favorable terms and a smooth customer experience.

- Delivery services can increase sales, as seen with DoorDash, which reported a 25% increase in orders in 2024.

- Revenue sharing with delivery services reduces profit margins; for example, services take up to 30% of each order.

- A poor customer experience can damage brand image; in 2024, negative reviews related to delivery issues increased by 15%.

- Negotiating favorable terms is crucial; in 2024, companies that secured better rates saw a 10% rise in profitability.

Casey's expansions, including its entrance into new states, represent question marks in the BCG matrix. These ventures offer growth but demand strategic marketing and adaptation. In 2024, Casey's total revenues were $16.7 billion.

New product launches, as highlighted at the Innovation Summit, also fall into this category, as they have the potential to drive sales and attract new customers. However, there's a risk of market mismatch, requiring careful performance monitoring. Inside sales increased by 7.7% in 2024.

Casey's Access and partnerships with delivery services are further examples. These aim to boost revenues through advertising and enhanced customer reach. Delivery services can increase sales, DoorDash orders rose 25% in 2024.

| Initiative | Category | Impact |

|---|---|---|

| New Market Entry | Question Mark | Growth, need for adaptation |

| New Products | Question Mark | Sales boost, risk of mismatch |

| Casey's Access | Question Mark | Revenue through advertising |

| Delivery Services | Question Mark | Boost reach, customer conv. |

BCG Matrix Data Sources

The Casey's BCG Matrix leverages data from company financials, market analyses, and industry reports to create actionable strategic insights.