Casey's General Stores Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casey's General Stores Bundle

What is included in the product

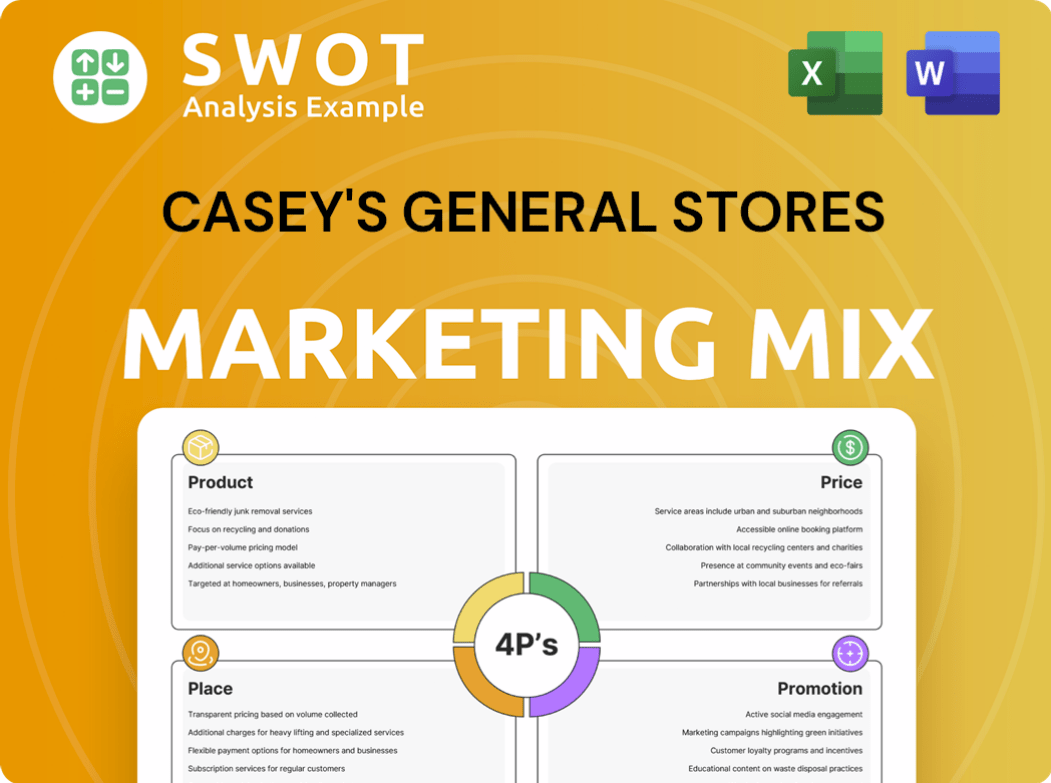

A deep dive into Casey's 4Ps: Product, Price, Place, and Promotion, grounded in their real-world marketing tactics.

Summarizes the 4Ps, offering a clear snapshot of Casey's marketing, eliminating confusion.

Full Version Awaits

Casey's General Stores 4P's Marketing Mix Analysis

The analysis you are viewing is the complete Casey's General Stores 4Ps Marketing Mix document.

This isn't a truncated version or a watered-down preview.

What you see is precisely what you’ll download immediately after your purchase.

Rest assured, this is the final, ready-to-use analysis.

Buy confidently knowing it’s the full document!

4P's Marketing Mix Analysis Template

Casey's General Stores expertly balances convenience with quality, focusing on satisfying customer needs. Their product strategy emphasizes fresh food and gas station essentials, making them a one-stop shop. Competitive pricing and strategic locations solidify their place in the market. Targeted promotions drive foot traffic and build loyalty.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Casey's excels in prepared foods, notably pizza, a major differentiator. They are the fifth-largest pizza chain nationally. Their menu includes donuts, sandwiches, and drinks, aiming for restaurant quality. In Q3 2024, prepared food & dispensed beverage sales increased by 7.1%. This segment is a key driver of store traffic and profitability.

Fuel is a crucial product for Casey's, a convenience store chain, with gasoline being a core offering. Self-service fuel is available to cater to customers' needs. Fuel sales are a significant revenue stream. In Q3 2024, fuel sales were $3.3 billion, demonstrating its importance.

Casey's offers a mix of grocery and convenience items, catering to local needs. They stock snacks, drinks, dairy, health, beauty, and automotive products. This strategy generated $17.7 billion in total revenue in fiscal year 2024. The company's focus on in-store sales drives profitability.

Private Label Offerings

Casey's General Stores strategically enhances its product mix through private-label offerings. This strategy fortifies its competitive edge and fosters customer loyalty by providing unique products. Private labels often carry higher profit margins compared to national brands, boosting overall profitability. In fiscal year 2024, Casey's saw a 7.8% increase in total revenue, partly due to successful private-label sales.

- Differentiation: Unique products distinguish Casey's from competitors.

- Customer Loyalty: Exclusive offerings encourage repeat purchases.

- Profitability: Higher margins improve financial performance.

- Revenue Growth: Private labels contribute to overall sales.

New Innovation

Casey's General Stores prioritizes product innovation to stay competitive. Their Innovation Summit highlights this commitment, selecting new brands for their stores. This approach ensures offerings remain fresh and appealing to customers. In 2024, Casey's saw a 6.5% increase in same-store sales, partly due to new product introductions.

- Innovation Summit selects new brands.

- Focus on fresh and relevant offerings.

- 6.5% increase in same-store sales in 2024.

Casey's offers prepared foods, especially pizza, and is a major player in the pizza market. They sell fuel and a mix of grocery and convenience items. Private-label offerings drive differentiation and enhance profit margins. Casey's emphasizes innovation with new brands, contributing to sales growth.

| Product | Key Feature | 2024 Performance |

|---|---|---|

| Prepared Foods | Pizza and other items | 7.1% Q3 sales increase |

| Fuel | Self-service gasoline | $3.3B Q3 sales |

| Grocery/Convenience | Snacks, drinks, etc. | $17.7B FY2024 revenue |

| Private Label | Unique brand offerings | 7.8% total revenue growth in FY2024 |

Place

Casey's strategically locates stores in small towns and rural areas, mainly in the Midwest and South. This approach lets them become a community hub, especially where options are scarce. In 2024, over 60% of Casey's stores were in towns with populations under 5,000, boosting local presence.

Casey's is growing its store count by buying existing convenience stores and constructing new ones. This strategy is crucial for boosting their market share. In fiscal year 2024, they acquired 60 stores and opened 77 new ones. They aim to add over 100 stores annually. This expansion boosts revenue and brand recognition.

Casey's General Stores strategically focuses its operations, with a strong presence in the Midwest. As of early 2024, Iowa, Missouri, and Illinois host a substantial number of Casey's locations. This concentration highlights their deep-rooted history and market dominance in these key states. For example, in 2023, approximately 40% of Casey's revenue came from these core states.

Self-Distribution Network

Casey's self-distribution network is key to its supply chain. This approach helps the company control costs and maintain product availability. It also allows Casey's to quickly respond to local market demands. For instance, in fiscal year 2024, Casey's reported over 3,200 stores, many served by its distribution network.

- Reduces reliance on third-party distributors.

- Improves inventory management.

- Enhances control over product quality.

- Supports rapid response to local needs.

Omnichannel Presence

Casey's General Stores is actively building an omnichannel presence to enhance customer experience. This means customers can engage and buy products via physical stores, online platforms, and their mobile app. This strategy boosts convenience and accessibility for its customer base. In Q3 2024, digital sales increased by 25% demonstrating the success of this approach.

- Online and app ordering options.

- In-store pickup capabilities.

- Loyalty program integration across all channels.

- Personalized promotions.

Place involves store location and expansion. They focus on small towns. In 2024, acquisitions and new builds drove store count growth. They strategically build a presence via multiple channels.

| Aspect | Details | 2024 Data |

|---|---|---|

| Location Focus | Small towns and rural areas | Over 60% stores in under 5,000 population towns. |

| Store Growth | Acquisitions and new construction | 60 stores acquired, 77 new stores opened |

| Omnichannel | Physical, online, and mobile presence | Digital sales up 25% in Q3 2024 |

Promotion

Casey's utilizes Casey's Rewards to boost customer retention. This loyalty program lets customers earn points on purchases. Points are redeemable for fuel discounts, other items, or school donations. In fiscal year 2024, Casey's saw a 6.1% increase in inside sales, partly due to the program.

Casey's General Stores excels with targeted promotions. They use discounts and BOGO deals to boost sales. Customer data helps personalize these offers. In Q3 2024, promotions boosted same-store sales by 3.7%. This strategy drives customer engagement.

Casey's leverages digital and social media for customer engagement. They use platforms to boost awareness of offerings and announce promotions. In Q1 2024, digital ad spend increased by 15%, reflecting its importance. Social media campaigns highlight deals, driving traffic to stores. This strategy aligns with the growing trend of online marketing.

Retail Media Network (Casey's Access)

Casey's General Stores' "Casey's Access" retail media network is a key promotional element. It lets brands advertise to Casey's customers across in-store, online, and at the pump platforms. This approach expands promotional opportunities and partnerships. It leverages customer data for targeted ads.

- Casey's reported Q3 2024 revenue of $4.2 billion.

- Digital sales increased by 14.6% in Q3 2024, highlighting the importance of online advertising.

- Casey's operates over 2,400 stores, providing a large advertising reach.

Seasonal and Themed Campaigns

Casey's uses seasonal and themed campaigns to boost customer engagement and sales. These promotions, tied to holidays or specific products, create excitement and attract customers. For instance, they often promote their popular pizza during relevant seasons. This strategy aligns with their goal to increase same-store sales.

- In Q1 2024, same-store sales increased by 3.3%.

- Pizza sales are a significant driver of revenue growth.

Casey's employs a multi-faceted promotion strategy. They leverage their loyalty program, Casey's Rewards, and personalized discounts. Digital marketing, including their retail media network, boosts visibility and sales. The company reported $4.2B revenue in Q3 2024, proving successful promotion.

| Promotion Tactics | Description | Impact |

|---|---|---|

| Casey's Rewards | Loyalty program; earn points. | 6.1% increase in inside sales (FY24). |

| Targeted Promotions | Discounts & BOGO offers. | 3.7% boost in same-store sales (Q3 2024). |

| Digital & Social Media | Online ads, social campaigns. | Digital sales up 14.6% (Q3 2024). |

Price

Casey's General Stores uses competitive pricing, especially for fuel and convenience items. They actively track competitors to set prices that draw in customers. In Q3 2024, fuel sales accounted for roughly 65% of their revenue. This strategy is crucial for maintaining their market share. Dynamic adjustments based on market data are key.

Casey's General Stores emphasizes value, especially with prepared foods. They offer quality items like pizza and bakery goods at accessible prices. This strategy attracts customers seeking affordable options. In fiscal year 2024, prepared food and fountain drinks sales were a significant contributor to total revenue, representing over 15% of the total sales. This demonstrates the success of their value-driven approach.

Casey's Rewards program influences pricing by giving members fuel discounts, boosting loyalty through price advantages. In Q3 2024, Casey's saw a 5.7% increase in inside sales, partly due to rewards. The program's success is evident, with over 6.6 million active members as of November 2024. This strategy helps maintain customer loyalty.

Dynamic Fuel Pricing

Casey's leverages technology for dynamic fuel pricing, adjusting prices swiftly based on real-time market conditions and local competition. This strategy helps Casey's stay competitive and maximize profitability in a volatile market. In Q3 2024, fuel sales accounted for $3.2 billion, with an average margin of 30.1 cents per gallon. Dynamic pricing contributes significantly to these margins.

- Real-time adjustments based on market data.

- Competitive pricing in local areas.

- Fuel sales in Q3 2024: $3.2 billion.

- Average fuel margin in Q3 2024: 30.1 cents/gallon.

Pricing Policies and Negotiation Leverage

Casey's leverages its size and self-distribution network to negotiate favorable terms with suppliers, impacting its cost of goods sold (COGS). This negotiation strength allows for competitive pricing. In Q3 2024, Casey's reported a gross profit margin of 36.5%, which reflects effective cost management. This capability is key to maintaining profitability and market share.

- Negotiation power lowers COGS.

- Q3 2024 gross profit margin: 36.5%.

- Impacts pricing strategies.

Casey's employs a strategic pricing approach focused on competitiveness and value. They use real-time market data to adjust prices dynamically. Competitive pricing for fuel, like the $3.2B fuel sales in Q3 2024, supports their market position.

| Pricing Aspect | Description | Impact |

|---|---|---|

| Fuel Pricing | Dynamic, based on market data & competition. | Maintains margins, Q3 2024 average 30.1 cents/gallon. |

| Value Pricing | Competitive pricing on convenience items & prepared food. | Attracts customers; prepared food sales over 15% FY24. |

| Rewards Program | Fuel discounts through Casey's Rewards. | Boosts loyalty; over 6.6M active members in Nov 2024. |

4P's Marketing Mix Analysis Data Sources

Our 4P analysis of Casey's draws on store locators, SEC filings, official marketing, and industry reports to give reliable data. We also include up-to-date advertising and e-commerce data.