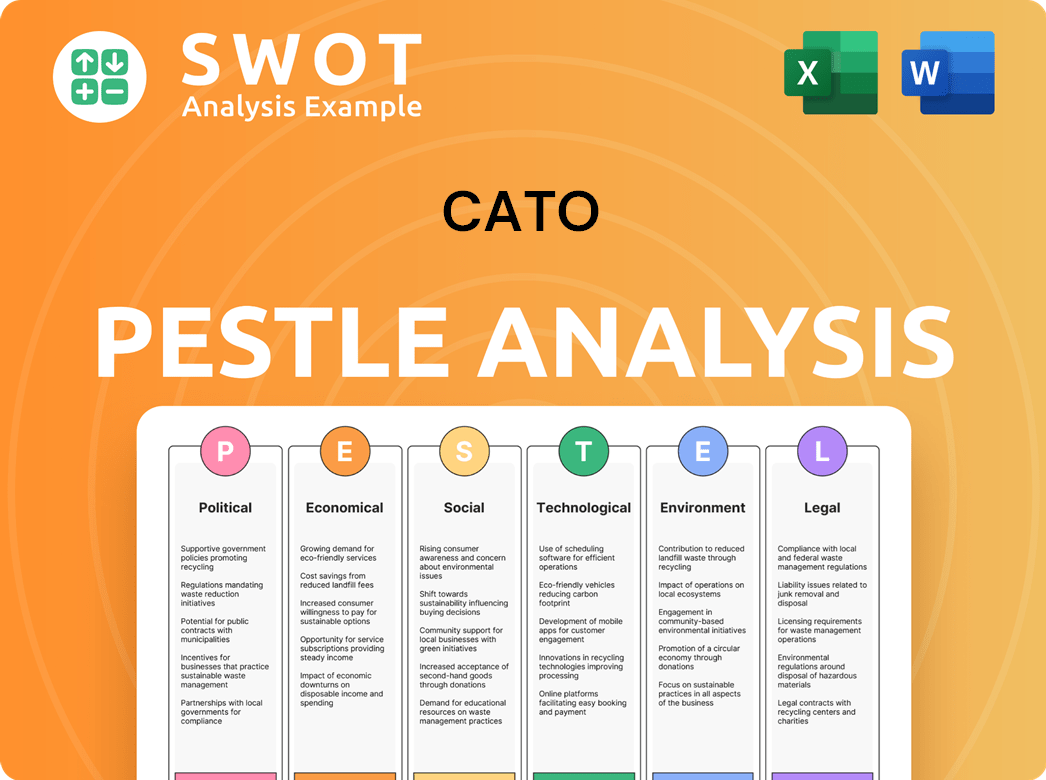

Cato PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cato Bundle

What is included in the product

Uncovers how macro factors impact The Cato across Political, Economic, Social, Tech, Environmental, and Legal areas.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Same Document Delivered

Cato PESTLE Analysis

The Cato PESTLE analysis you see here? That’s precisely what you’ll download after purchasing.

There are no hidden elements, only the fully realized, detailed assessment.

The comprehensive structure and all its contents are immediately available post-purchase.

This ready-to-use document ensures a smooth start for your evaluation.

Get this precise and practical resource with one simple click.

PESTLE Analysis Template

Navigate Cato's market with confidence. Our PESTLE analysis illuminates key external factors impacting its business. Discover the political, economic, social, technological, legal, and environmental forces at play. Uncover potential threats and opportunities for strategic advantage. Download the full analysis to gain comprehensive insights and enhance your decision-making. Actionable intelligence awaits you!

Political factors

Government trade policies, especially tariffs, significantly influence sourcing costs for Cato. As of 2024, import tariffs on women's apparel average about 15.9%, potentially affecting Cato's expenses. These tariffs range from 11.3% to 32.7% depending on the clothing category. Changes in these tariffs or trade agreements could substantially alter Cato's sourcing costs and strategic decisions.

Minimum wage legislation, at both federal and state levels, directly impacts labor costs for businesses. The federal minimum wage is $7.25, but many states set higher rates. As of 2024, the average state minimum wage is approximately $10.40 per hour. Rising minimum wages increase payroll expenses, especially for retailers with many physical locations.

Consumer protection is vital in retail, with bodies like the FTC setting the rules. These rules cover advertising, pricing, and product safety. Retailers must comply, or face fines and legal troubles. For example, in 2024, the FTC issued over $100 million in civil penalties for consumer protection violations.

Geopolitical stability can impact supply chains

Geopolitical instability significantly impacts supply chains. Global tensions create uncertainty, disrupting international networks that retailers depend on. This can lead to delays and higher shipping costs, affecting inventory. For instance, in 2024, disruptions increased shipping costs by up to 15%.

- Increased shipping costs by up to 15% in 2024 due to disruptions.

- Geopolitical tensions cause uncertainty, affecting supply chains.

- Delays and higher costs impact inventory availability.

Policy uncertainty affects business and consumer confidence

Policy uncertainty significantly impacts business and consumer confidence. Unclear government policies on stimulus, taxes, and trade can make businesses hesitant to invest. This caution can lead to decreased consumer spending, affecting sales forecasts. In 2024, the US saw a dip in consumer confidence due to economic policy debates.

- Consumer spending decreased by 0.5% in Q2 2024 due to policy uncertainty.

- Business investment slowed by 2% in sectors affected by trade policy changes.

Government trade policies, like tariffs, affect sourcing costs. For example, import tariffs on women's apparel in 2024 averaged 15.9%. Political instability increases supply chain risks, impacting inventory and potentially shipping costs, which rose up to 15% in 2024 due to global issues.

| Political Factor | Impact | 2024 Data |

|---|---|---|

| Trade Policies | Affect Sourcing Costs | Apparel tariffs ~15.9% |

| Geopolitical Instability | Supply Chain Disruptions | Shipping costs up 15% |

| Policy Uncertainty | Impacts Confidence & Spending | Consumer spending dipped by 0.5% in Q2 |

Economic factors

Cato Corporation's sales are closely tied to consumer discretionary spending. Inflation and wage growth directly affect customers' ability to spend on fashion. In Q1 2024, consumer spending showed resilience despite economic concerns. The company's revenue is therefore sensitive to these economic shifts.

Persistent inflation impacts retailers' costs (raw materials, freight) and consumer purchasing power. Although easing, inflation influences consumer confidence and spending. For example, US inflation was 3.5% in March 2024. Higher costs may squeeze margins; reduced purchasing power can hurt demand.

High interest rates, even with expected decreases in 2025, affect consumer credit and business financing. For example, the Federal Reserve's current rate hikes impact consumer spending. Businesses face higher borrowing costs, potentially slowing investments. In 2024, the average interest rate for a 30-year fixed mortgage was around 7%, influencing consumer decisions.

Overall economic growth forecasts provide market context

Overall economic growth forecasts offer a crucial context for market analysis. The anticipated economic growth rate signals the retail market's general health. Forecasts for 2025 project continued GDP expansion, though at a potentially slower pace, which impacts employment and consumer confidence, vital for retail performance.

- 2024 US GDP growth is estimated at 2.1%.

- 2025 projections anticipate a slowdown, around 1.5-1.8%.

- Consumer confidence, a key indicator, was at 102.9 in March 2024.

- Unemployment rates remained low, at 3.8% as of March 2024.

Labor market conditions affect employment and wages

A robust labor market, marked by low unemployment and consistent wage increases, is essential for boosting consumer expenditure. Currently, the labor market demonstrates resilience, yet fluctuations in employment figures and compensation levels directly affect the financial stability of Cato's core customers, influencing their ability to spend freely. Recent data from early 2024 shows the unemployment rate hovering around 3.9%, indicating a stable job market. Wage growth, though moderating, remains positive, with average hourly earnings up 4.3% year-over-year as of March 2024. These trends are crucial for Cato's financial performance.

- Unemployment Rate (Early 2024): Approximately 3.9%

- Wage Growth (March 2024): Average hourly earnings up 4.3% year-over-year

- Impact: Influences consumer spending and financial stability

Economic factors significantly influence Cato's performance. Inflation and interest rates affect consumer spending and business costs, potentially squeezing margins. While the labor market shows resilience, slowing GDP growth in 2025 might impact consumer confidence.

| Factor | Data (2024) | Forecast (2025) |

|---|---|---|

| Inflation | 3.5% (March) | Moderate easing expected |

| GDP Growth | 2.1% (est.) | 1.5-1.8% (projected) |

| Interest Rates | Avg. 7% (mortgage) | Potential decreases |

Sociological factors

Consumer shopping habits are changing, with more people choosing online shopping and mobile commerce. In 2024, e-commerce sales hit $1.1 trillion, showing a 10% increase from the previous year. Retailers need to adapt by investing in e-commerce to stay competitive. Omnichannel experiences are also vital, as 73% of consumers use multiple channels when shopping.

Consumers increasingly favor sustainable and ethical products, impacting purchasing decisions. A 2024 survey showed 60% of consumers would pay more for ethically sourced goods. Retailers, like Cato, must show environmental and social responsibility. This attracts and retains customers. Demonstrating commitment is key.

Social media heavily influences fashion trends, with platforms like Instagram and TikTok driving rapid shifts in style. Social commerce is booming; in 2024, it's projected to reach $1.2 trillion globally. Retailers must use these channels to market, build brands, and boost sales. This digital shift demands adaptable strategies.

Generational differences in preferences require targeted strategies

Generational differences significantly shape consumer behaviors. Younger generations, like Gen Z, often prioritize values such as sustainability and ethical sourcing, influencing their purchasing choices. Retailers must adapt to these preferences by offering eco-friendly products and transparent supply chains. This shift requires updated marketing to resonate with different age groups. Understanding these nuances is key for brand relevance.

- Gen Z's spending power is projected to reach $33 trillion globally by 2030.

- Millennials are the largest consumer group, with $2.5 trillion in spending annually in the US.

- 40% of Gen Z consumers prefer brands that align with their values.

- Sustainable products have seen a 20% increase in sales over the past year.

Customer experience is increasingly important across channels

Consumers now highly value personalized and smooth shopping experiences across all channels. Retailers are investing in improving the customer journey through engaging in-store elements, personalized online recommendations, and integrated omnichannel services. This focus aims to build customer loyalty and boost sales figures. For instance, in 2024, 73% of consumers preferred brands offering personalized experiences.

- 73% of consumers prefer personalized experiences.

- Retailers invest in customer journey.

- Omnichannel services are integrated.

- Goal: Build loyalty and boost sales.

Sociological factors greatly influence consumer behavior. Online shopping, like e-commerce which hit $1.1 trillion in 2024, and the desire for ethical products shape retail trends. Social media also drives trends, with social commerce nearing $1.2 trillion. Adaptability to diverse preferences and personalized experiences are essential for success.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| E-commerce | Dominates shopping | $1.1T in 2024, 10% growth. |

| Ethical Sourcing | Influences buying | 60% of consumers prefer. |

| Social Media | Drives trends | Social commerce ~ $1.2T. |

Technological factors

E-commerce is booming, with online sales projected to jump. Non-store retail sales are forecast to reach $1.2 trillion in 2025. For Cato, a strong online presence is key.

Cato needs to enhance its e-commerce platforms. This ensures they can grab a slice of the expanding online market.

Boosting online sales complements its physical store network. It's a strategic move to cater to changing consumer habits.

This strategy is vital for Cato's growth and competitiveness in the evolving retail landscape of 2025.

AI is revolutionizing retail. Personalization is key, with AI offering tailored recommendations. Operational efficiency improves via AI, managing inventory and enhancing customer service. Investment in AI is soaring; the global AI in retail market is projected to reach $22.3 billion by 2025.

Cato is integrating technology to boost in-store experiences. Interactive displays and tech-enhanced fitting rooms are becoming common. In 2024, retail tech spending is projected to reach $27.9 billion. These innovations aim to attract customers. They provide unique value, potentially increasing sales.

Robust IT security and infrastructure are critical

Robust IT security and infrastructure are crucial for Cato, given its digital presence and customer data handling. Investments in solutions like SASE are growing; the SASE market is projected to reach $14.8 billion in 2024. This ensures data protection and operational efficiency. Cato must prioritize these technologies to stay competitive.

- SASE market projected at $14.8B in 2024.

- Focus on data protection and compliance is vital.

- Reliable network infrastructure is essential.

Automation improves efficiency in logistics and operations

Automation is transforming retail operations, with implementations in warehousing and inventory management. These technologies aim for cost savings and increased productivity. For instance, the global warehouse automation market is projected to reach $43.6 billion by 2025. The adoption of cashierless stores is also growing.

- Warehouse automation market forecast for $43.6 billion by 2025.

- Automation drives cost savings and improves process accuracy.

- Cashierless stores are a growing trend.

Technological advancements reshape Cato's strategy. E-commerce is essential, with projected non-store sales reaching $1.2 trillion in 2025. AI-driven personalization and operational efficiencies are vital, the AI in retail market at $22.3B by 2025.

Investment in retail tech is surging; expect $27.9B in 2024. Cybersecurity is critical, with the SASE market valued at $14.8B in 2024. Automation in warehousing boosts productivity, with a market forecast of $43.6B by 2025.

| Technology Area | Market Size (2024/2025) | Impact on Cato |

|---|---|---|

| E-commerce | $1.2T (Non-store sales projected for 2025) | Essential for growth, online presence. |

| AI in Retail | $22.3B (2025 projection) | Personalization, operational efficiency. |

| Retail Tech Spending | $27.9B (2024 projected) | Enhanced in-store experiences. |

Legal factors

Retailers must comply with consumer protection laws enforced by the Federal Trade Commission (FTC). These laws cover advertising accuracy, fair pricing, and product safety. For example, in 2024, the FTC issued over $100 million in civil penalties for consumer protection violations. Non-compliance leads to fines and reputational harm.

Data privacy is paramount; regulations like GDPR and CCPA affect how retailers handle data. Recent data breaches have cost companies millions in fines and reputational damage. Compliance involves secure data storage and transparent usage practices. In 2024, the global data privacy market was valued at $7.8 billion, expected to reach $15.2 billion by 2029.

Retail businesses must adhere to federal and state labor laws, covering minimum wage, work hours, and benefits. Minimum wage changes significantly influence operational costs and HR. In 2024, several states increased minimum wage; for instance, California's rate rose to $16 per hour. Compliance is crucial to avoid legal penalties.

International trade agreements and tariffs influence sourcing legalities

Compliance with international trade agreements and tariff structures is legally mandatory for retailers importing goods. For example, in 2024, the U.S. imposed tariffs on $300 billion worth of Chinese goods. Businesses must adapt sourcing strategies to align with these regulations. Changes, such as new tariffs, necessitate legal adherence.

- U.S. tariffs on Chinese goods affected various sectors, including electronics and textiles.

- Businesses must monitor trade policy updates to ensure compliance.

- Failure to comply can result in penalties and legal issues.

Securities regulations and shareholder rights impact corporate governance

Cato Corporation, as a publicly traded entity, faces securities regulations mandating transparent financial reporting and adherence to corporate governance standards. These regulations, enforced by bodies like the SEC, dictate how the company communicates with shareholders. Legal disputes, such as those concerning business practices or financial disclosures, can lead to significant financial and reputational risks. In 2024, the median cost of settling a securities class action in the U.S. was around $22.5 million.

- SEC regulations require detailed financial disclosures, impacting operational transparency.

- Shareholder lawsuits can lead to significant financial liabilities.

- Compliance costs include legal and accounting fees.

- Non-compliance can result in hefty penalties and damage to reputation.

Legal factors heavily influence retail operations, with consumer protection laws, such as those enforced by the FTC, requiring adherence to advertising standards and product safety; the FTC issued over $100 million in civil penalties in 2024. Data privacy, critical under GDPR and CCPA, necessitates secure data handling; the global data privacy market was valued at $7.8 billion in 2024, expected to reach $15.2 billion by 2029. Labor laws dictate minimum wage, work hours, and benefits. International trade agreements also affect sourcing strategies; for example, in 2024, the U.S. imposed tariffs on $300 billion worth of Chinese goods. As a public entity, Cato must comply with SEC regulations.

| Legal Factor | Impact | 2024 Data/Example |

|---|---|---|

| Consumer Protection | Advertising accuracy, fair pricing | FTC issued over $100M in penalties |

| Data Privacy | GDPR, CCPA compliance | $7.8B market, to $15.2B by 2029 |

| Labor Laws | Minimum wage, work hours | CA wage at $16/hr |

Environmental factors

Consumer demand for sustainable practices is surging. This shift influences buying decisions, compelling companies to adopt eco-friendly approaches. A 2024 study showed 73% of consumers would pay more for sustainable goods. Retailers face pressure to showcase environmental responsibility. This trend impacts brand perception and market share.

Retailers face increasing pressure for sustainable, ethical supply chains. Transparency is key, covering raw materials, manufacturing, and transport. A 2024 report showed 70% of consumers prefer sustainable brands. This drives regulatory compliance and meets consumer demand. Companies are investing to avoid reputational and financial risks.

Proper waste management and recycling are now standard. Cato can improve its environmental footprint by diverting textile waste from landfills. The global waste management market was valued at $384.8 billion in 2023 and is projected to reach $551.8 billion by 2030. Effective recycling boosts Cato's public image.

Climate change and extreme weather pose operational risks

Climate change presents significant operational risks for retailers. More extreme weather events can disrupt store operations, impacting foot traffic and potentially leading to property damage. Supply chain logistics are also vulnerable, which can cause delays and increased costs. Retailers must develop strategies to mitigate these climate-related risks to ensure business continuity.

- In 2024, extreme weather events caused an estimated $100 billion in damages across the US.

- Supply chain disruptions due to weather increased operating costs for retailers by up to 15%.

- Over 60% of consumers are more likely to shop at retailers with sustainable practices.

Environmental regulations may increase compliance burdens

Evolving environmental regulations present significant challenges for retailers. Compliance with rules on emissions, waste, and product materials can lead to increased operational costs. Retailers must invest in strategies to adapt to and manage these environmental demands. Failure to comply can result in fines or operational restrictions.

- Environmental regulations costs have increased by 15% in 2024.

- Companies face a 10% profit margin reduction due to environmental compliance.

- Non-compliance penalties average $50,000.

Environmental factors significantly influence Cato. Consumer demand and stringent regulations underscore the need for sustainable operations. Retailers must manage waste and mitigate climate risks.

| Aspect | Impact | Data |

|---|---|---|

| Consumer Behavior | Increased demand for sustainable goods | 73% of consumers willing to pay more (2024) |

| Supply Chain | Pressure for sustainable, ethical practices | 70% prefer sustainable brands (2024) |

| Waste Management | Boost public image | $551.8B projected market (2030) |

PESTLE Analysis Data Sources

Cato's PESTLE relies on diverse sources like gov. publications, economic indicators, and market analyses, providing accurate and relevant insights.