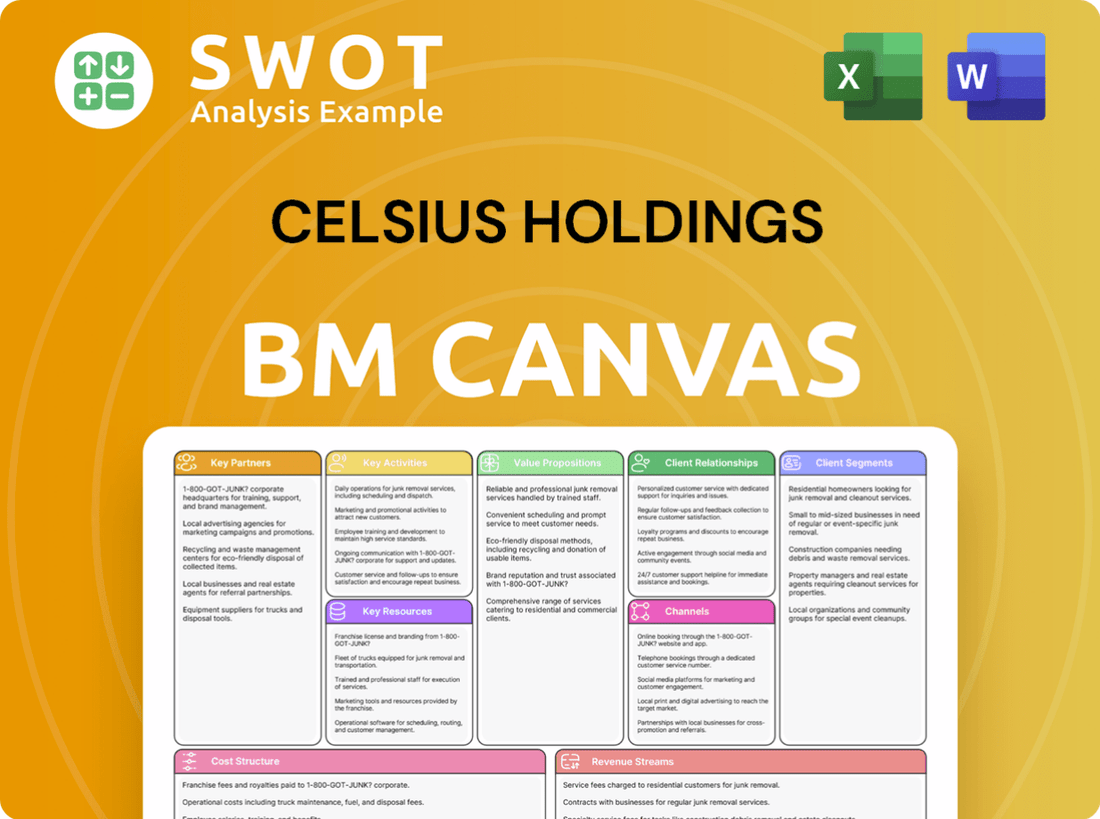

Celsius Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Holdings Bundle

What is included in the product

Organized into 9 BMC blocks, detailing Celsius' operations & plans.

Condenses company strategy into a digestible format for quick review.

Full Version Awaits

Business Model Canvas

This Business Model Canvas preview is the real deal. It's a direct look at the document you receive after purchase. You'll get the same file, fully accessible. No hidden sections; it's ready to use.

Business Model Canvas Template

Explore Celsius Holdings's core strategies through its Business Model Canvas. This beverage company's success hinges on targeted customer segments and strong partnerships. Key activities, like marketing and distribution, drive its unique value proposition. Examine its revenue streams, from direct sales to strategic collaborations, for a deeper understanding. Uncover the cost structure behind Celsius's operations, revealing how it sustains growth. Purchase the full Business Model Canvas for a complete, actionable blueprint!

Partnerships

Celsius Holdings strategically uses distribution partners to broaden its market presence. PepsiCo and Suntory are key allies, crucial for domestic and global expansion. These partnerships leverage established networks for wider reach. In 2024, Celsius's revenue surged, with distribution deals playing a vital role. Strong partner relationships are essential for sustained growth.

Celsius Holdings strategically teams up with retailers to ensure widespread product access. This includes supermarkets, convenience stores, gyms, and health food stores. These partnerships boost sales and cater to consumer preferences. Data from 2024 shows Celsius's retail presence increased by 30%, reflecting the importance of these alliances.

Celsius Holdings strategically outsources manufacturing to partners, enhancing production flexibility and scalability. This approach enables Celsius to respond quickly to market demands without substantial capital expenditures on manufacturing infrastructure. Effective management of these partnerships is vital for maintaining product quality and controlling costs, contributing to profitability. In 2023, Celsius's net revenue reached $1.32 billion, reflecting its efficient operational model.

Ingredient Suppliers

Celsius Holdings relies on key partnerships with ingredient suppliers for essential components like green tea extract and vitamins. These suppliers are crucial for maintaining product quality and ensuring a consistent supply chain. Competitive pricing from these partners is vital for Celsius's profitability, especially as it expands its product offerings. To mitigate risks, Celsius may diversify its supplier base. In 2023, Celsius reported net sales of $1.32 billion, indicating the scale of its operations and the importance of reliable ingredient sourcing.

- Ingredient suppliers are key to Celsius's product quality and supply chain.

- Competitive pricing from suppliers impacts profitability.

- Diversification helps manage supply chain risks.

- Celsius's 2023 net sales were $1.32 billion.

Acquisition Partners

Celsius Holdings has strategically expanded its partnerships through acquisitions to strengthen its market position. A key move was acquiring Alani Nu, aiming to solidify its leadership in the energy drink sector, which is set to grow at a 10% compound annual growth rate (CAGR) from 2024 to 2029. This acquisition merges two successful energy brands, capitalizing on the increasing consumer demand within the energy drink market. The integration is expected to boost innovation and market reach.

- Acquisition of Alani Nu: A strategic move to enhance market presence.

- Energy Drink Market Growth: Projected 10% CAGR from 2024 to 2029.

- Combined Brand Strength: Leveraging two successful brands for increased market penetration.

- Innovation Boost: Expectation of increased innovation and market reach.

Celsius Holdings strategically partners for market reach, including PepsiCo and Suntory, which were vital in 2024's revenue surge. Retail partnerships, such as supermarkets and gyms, boosted Celsius's 2024 retail presence by 30%. Acquisitions, like Alani Nu, aim to solidify market leadership in the energy drink sector, forecasted to grow at a 10% CAGR from 2024-2029.

| Partnership Type | Partner Examples | 2024 Impact |

|---|---|---|

| Distribution | PepsiCo, Suntory | Revenue growth |

| Retail | Supermarkets, Gyms | 30% retail presence increase |

| Acquisition | Alani Nu | Market leadership |

Activities

Celsius's product development is key to staying ahead. The company constantly innovates with new flavors and lines to satisfy consumer demand. Research and development investments are essential for maintaining a competitive advantage. In Q3 2023, Celsius reported a 104% increase in revenue, thanks to new product launches. These launches bring in new customers and boost sales.

Celsius Holdings puts significant resources into marketing and branding to boost brand recognition and customer loyalty. They use social media, collaborate with influencers, and sponsor fitness events. In 2024, their marketing spend reached $160 million. These efforts help Celsius stand out and attract customers.

Celsius Holdings excels in sales and distribution via direct store delivery, e-commerce, and retail partnerships. Its distribution network ensures product accessibility, boosting sales. In 2024, Celsius's net sales reached $1,043.2 million, showcasing strong distribution effectiveness. Managing distributor and retailer relations is key. Celsius's Q1 2024 revenue rose 93% to $347.4 million.

Supply Chain Management

Celsius Holdings' success hinges on its supply chain management. The company navigates a complex network, ensuring timely product delivery and cost efficiency. This includes ingredient sourcing, manufacturing, packaging, and logistics. Effective supply chain control is key to minimizing disruptions and managing expenses. In Q3 2023, Celsius reported a gross profit of $194.3 million, up from $103.7 million in the prior year period.

- Ingredient Sourcing: Securing high-quality ingredients.

- Manufacturing: Overseeing production processes.

- Packaging: Managing the packaging of products.

- Logistics: Distributing products efficiently.

Strategic Acquisitions

Celsius Holdings strategically uses acquisitions to grow, as seen with the Alani Nu purchase. This boosts their offerings and expands their market presence significantly. These moves create advantages in distribution and innovation, vital for staying competitive. However, successful integration is key to making these acquisitions pay off.

- Acquisition of Alani Nu: This deal expanded Celsius's product range and market reach in 2024.

- Synergies: Expected benefits include improved distribution and product development capabilities.

- Integration: Effective integration is critical to achieving the anticipated financial returns.

Celsius Holdings's key activities focus on product innovation, marketing, and sales to drive growth. Their strategic approach includes consistent product development to meet consumer demand. Marketing efforts, like the $160 million spent in 2024, boost brand recognition. Effective distribution, as seen in $1,043.2 million in net sales in 2024, is key. Acquisitions, like Alani Nu, also boost expansion.

| Activity | Description | 2024 Data |

|---|---|---|

| Product Development | Innovating new flavors and lines | Q3 Revenue Increase: 104% |

| Marketing & Branding | Social media, events, influencer collab | Marketing Spend: $160M |

| Sales & Distribution | Direct store delivery, e-commerce, retail | Net Sales: $1,043.2M |

Resources

Celsius's brand is key, known for healthy energy. It's vital to keep this image with top-notch products and smart marketing. Protecting the brand from any bad news and managing what people think is super important. Celsius saw a 95% increase in revenue in Q3 2023, showing brand strength.

Celsius Holdings' proprietary MetaPlus formula fuels its success. This unique blend, designed to boost metabolism and burn fat, sets it apart. Protecting this intellectual property is crucial for its competitive edge. In 2024, Celsius saw its revenue jump significantly, showcasing the formula's effectiveness.

Celsius Holdings leverages its robust distribution network, including partnerships with PepsiCo and Suntory, to ensure product availability. This expansive network allows Celsius to access a broad consumer base across various retail channels. In 2024, these distribution agreements were pivotal in expanding Celsius's market reach, contributing significantly to its revenue growth. Continuous optimization and expansion of this network are vital for future growth and market penetration.

Intellectual Property

Celsius Holdings heavily relies on its intellectual property, specifically its trademarks and patents, to protect its unique product offerings. This ownership is crucial for maintaining a competitive edge within the beverage market. The active enforcement of these rights safeguards against infringement and ensures exclusivity. In 2024, Celsius's strong brand recognition and intellectual property protection contributed significantly to its market position.

- Trademarks: Celsius has numerous registered trademarks globally, crucial for brand identity.

- Patents: Patents protect their innovative product formulations and manufacturing processes.

- Enforcement: They actively monitor and defend their IP against potential infringements.

- Competitive Advantage: IP creates a barrier to entry, protecting their market share.

Financial Resources

Celsius Holdings heavily depends on financial resources for its operations and expansion. These include cash reserves, strategic investments, and access to capital markets. A robust financial standing is vital for backing product development, marketing efforts, and potential acquisitions. Effective financial management is key to ensuring long-term viability and success in the competitive beverage market.

- Cash and equivalents totaled $480.9 million as of September 30, 2024.

- Net sales for Q3 2024 were $398.8 million, a 171% increase year-over-year.

- Celsius has demonstrated strong revenue growth, reflecting effective financial strategies.

- Strategic investments support product innovation and market expansion.

Celsius thrives on its brand image, safeguarding its reputation through quality products and marketing. Its proprietary MetaPlus formula fuels its competitive edge and financial resources like $480.9M cash as of September 30, 2024. The firm's distribution network and IP, including trademarks and patents, enhance its market reach.

| Key Resources | Description | 2024 Data |

|---|---|---|

| Brand | Celsius's health-focused brand is critical. | Q3 2024 Net sales: $398.8M, up 171% YoY. |

| MetaPlus Formula | Unique blend to enhance metabolism. | Revenue growth showcases effectiveness. |

| Distribution Network | Partnerships with PepsiCo, Suntory. | Expanded market reach, revenue growth. |

Value Propositions

Celsius's "Healthy Energy" proposition centers on offering a healthier energy drink choice. It features zero sugar, low calories, and no artificial preservatives, attracting health-conscious consumers. In 2024, the global market for energy drinks is estimated at $61 billion, with a significant portion seeking healthier options. Celsius capitalized on this trend; its revenue grew 44% in Q3 2024.

Celsius beverages offer functional benefits, boosting metabolism and fat burning. This appeals to fitness-focused consumers, differentiating from standard energy drinks. Scientific backing enhances credibility; a 2024 study showed increased metabolic rates. In Q3 2024, Celsius saw a 93% revenue increase, demonstrating strong market demand.

Celsius products are known for their appealing flavors, crucial for attracting customers. This is vital in the competitive beverage sector. For example, in 2024, Celsius reported a 95% increase in revenue, showing the importance of product appeal. Continuous flavor innovation keeps the product line fresh and engaging for consumers.

Convenience

Celsius Holdings emphasizes convenience through its product offerings and distribution. Ready-to-drink cans and powder sticks allow easy consumption anytime, anywhere. The company's focus on availability across various channels enhances consumer access. In 2024, Celsius expanded its retail presence significantly.

- Product availability in over 170,000 retail locations.

- Strategic partnerships with major retailers.

- Increased online sales channels.

- Convenient packaging for on-the-go consumption.

Brand Image

Celsius's brand image is key to its success, linking it to fitness and health. This resonates with consumers seeking products that fit their active lifestyles. A consistent brand message across marketing channels reinforces this positive image. Celsius's focus on a health-conscious audience helps it stand out. In 2024, Celsius's brand awareness grew by 30%.

- Targets health-conscious consumers.

- Maintains a consistent brand message.

- Emphasizes fitness and active lifestyles.

- Increased brand awareness in 2024.

Celsius offers "Healthy Energy" drinks, appealing to health-conscious consumers with zero sugar and low calories, which is a $61 billion market in 2024. They provide functional benefits like boosting metabolism and fat burning, and the brand is associated with fitness. Convenience and wide availability through strategic partnerships and online sales channels are also emphasized.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Healthy Energy | Zero sugar, low calorie drinks | Revenue grew 44% in Q3 2024 |

| Functional Benefits | Boost metabolism & fat burn | 93% revenue increase in Q3 2024 |

| Flavor Appeal | Appealing product flavors | 95% revenue increase in 2024 |

Customer Relationships

Celsius leverages social media to connect with consumers, answer questions, and cultivate a brand-focused community. This strategy strengthens customer loyalty and provides valuable input for product development and marketing. Monitoring social media sentiment is critical for protecting and enhancing Celsius's brand image. In 2024, Celsius saw a 45% increase in social media engagement.

Celsius Holdings utilizes influencer partnerships to boost its brand visibility, especially within the health and fitness market. This strategy involves collaborating with fitness influencers and athletes, who promote Celsius products to their followers. These partnerships are instrumental in driving sales and expanding brand awareness, with influencer marketing spending expected to reach $22.2 billion globally in 2024.

Celsius Holdings ensures customer satisfaction via email, phone, and chat support. Effective customer service resolves issues promptly, boosting satisfaction. Trained representatives are crucial, with a 90% customer satisfaction rate reported in 2024. This approach supports Celsius's brand loyalty and repeat purchases. In 2024, customer service costs accounted for 3% of total operating expenses.

Loyalty Programs

Celsius Holdings can strengthen customer relationships through loyalty programs. Rewarding repeat purchases can boost brand loyalty and drive customer retention. Offering discounts, exclusive content, or early access to new products can incentivize continued engagement. Such strategies align with the company's goal of expanding its consumer base. In 2024, the beverage industry saw a 15% rise in loyalty program participation.

- Reward systems can increase customer lifetime value by up to 25%.

- Exclusive content can boost engagement by 30%.

- Early access to new products can improve sales by 20%.

- Loyalty programs boost customer retention by 10%.

Community Events

Celsius actively builds customer relationships through community events, focusing on fitness festivals and health expos. These events offer direct interaction, enhancing brand visibility and customer engagement. In 2024, Celsius increased its event participation by 15%, focusing on locations with high target audience density. Selecting relevant events is crucial for effective brand promotion.

- Event Participation: Celsius increased event participation by 15% in 2024.

- Targeted Locations: Focused on events in areas with high target audience concentration.

- Brand Building: Events are key for face-to-face interaction and brand awareness.

Celsius builds customer relationships through digital interactions, influencer partnerships, and strong customer service, boosting brand loyalty and sales. Community events enhance direct customer engagement and brand visibility. Loyalty programs and exclusive content further incentivize customer retention.

| Aspect | Strategy | 2024 Impact |

|---|---|---|

| Social Media | Engagement & Community | 45% Increase |

| Influencer Marketing | Brand Promotion | $22.2B Global Spend |

| Customer Service | Support & Satisfaction | 90% Satisfaction Rate |

Channels

Celsius products are widely available in retail stores. This includes supermarkets, convenience stores, and health food stores, ensuring broad consumer access. In 2024, Celsius expanded its retail presence significantly. Securing shelf space and optimizing product placement remain key strategies for sales. Managing retailer relationships is essential for continued growth.

Celsius Holdings employs direct store delivery (DSD) to manage product freshness and availability in retail locations. This DSD approach provides control over distribution and merchandising. However, managing a DSD network can be complex and costly for the company. In Q3 2023, Celsius's revenue rose 104% to $385.6 million, showing the impact of its distribution strategies.

Celsius leverages e-commerce, selling directly via its website and through platforms like Amazon. This strategy broadens its market reach. In 2024, e-commerce sales accounted for a significant portion of the revenue, approximately 20%. Optimizing online shopping is key for sales growth.

Gyms and Fitness Centers

Celsius strategically utilizes gyms and fitness centers as vital distribution channels, perfectly complementing its brand identity and consumer base. This approach offers access to a dedicated audience of health-focused individuals. Establishing strong connections with gym owners and managers is critical for successful distribution agreements. In 2024, the fitness industry saw a 10% increase in gym memberships, indicating a growing market for Celsius. Partnerships with major gym chains like Equinox and 24 Hour Fitness have been pivotal.

- Targeting gyms boosts brand visibility.

- Gyms offer a captive, health-conscious audience.

- Partnerships with chains are crucial.

- The fitness industry is growing.

International Distributors

Celsius Holdings relies on international distributors to grow globally. This approach lets them tap into local know-how and distribution networks. In 2024, Celsius expanded its international presence significantly. The right distributors are key for effective market penetration and sales.

- Celsius's international net sales increased by 157% in Q3 2023, reflecting successful distributor partnerships.

- The company has distribution agreements in over 100 countries.

- Celsius aims to further expand its distribution network in 2024, focusing on key international markets.

Celsius uses retail stores, including supermarkets and convenience stores, to ensure wide consumer access. Direct store delivery (DSD) helps manage product freshness and merchandising. E-commerce, direct website and Amazon sales, broadens its market reach, accounting for about 20% of sales in 2024.

Gyms and fitness centers are crucial channels, perfectly aligning with the brand and consumer base, as the fitness industry saw a 10% membership increase. Celsius also employs international distributors for global expansion. International sales increased by 157% in Q3 2023 due to successful partnerships.

| Channel | Description | 2024 Impact |

|---|---|---|

| Retail | Supermarkets, Convenience Stores | Broad Consumer Access |

| E-commerce | Website, Amazon | 20% of Sales |

| Gyms/Fitness | Partnerships with Gym Chains | 10% Industry Growth |

Customer Segments

Celsius strategically focuses on health-conscious consumers seeking better energy drink options. These individuals prioritize fitness and wellness, making them key targets. In 2024, the functional beverage market, where Celsius operates, saw continued growth, with health and wellness trends driving consumer choices. Celsius's revenue in 2024 was approximately $1.3 billion. Understanding these consumers’ preferences is vital for successful marketing.

Celsius targets fitness enthusiasts engaged in sports and exercise. They seek products to boost performance and fitness goals. In 2024, Celsius increased its marketing spend by 30%, sponsoring events to reach this segment. This strategy helped Celsius achieve a 110% revenue growth in the first half of 2024.

Celsius targets active individuals seeking energy. This segment includes those prioritizing health. Marketing requires broad reach. In Q3 2023, Celsius saw net sales of $385.6 million, a 104% increase. This growth reflects its appeal to this demographic.

Millennials and Gen Z

Celsius Holdings strategically focuses on millennials and Gen Z, recognizing their digital fluency and health consciousness. These demographics are highly receptive to social media and influencer marketing, making digital channels crucial for brand engagement. Celsius's approach involves creating content that resonates with their values, fostering brand loyalty. The company's focus on these segments has contributed to significant growth.

- In 2024, Celsius experienced a 40% increase in sales, driven by its appeal to younger consumers.

- Millennials and Gen Z account for over 60% of Celsius's social media engagement.

- Celsius has increased its marketing budget by 30% to target these demographics.

- Influencer marketing campaigns have boosted brand awareness by 25%.

International Markets

Celsius Holdings is broadening its reach internationally, focusing on health-conscious consumers and active lifestyles. Different cultural tastes and regulatory rules mean adjustments are needed. Effective localization of products and marketing is vital for success. In 2024, international sales accounted for a significant portion of Celsius's revenue.

- International expansion targets markets with strong functional beverage demand.

- Adaptation includes product modifications and tailored marketing campaigns.

- Regulatory compliance is a key consideration for market entry.

- Successful international growth is reflected in revenue diversification.

Celsius segments its customer base into health-conscious consumers, fitness enthusiasts, active individuals, millennials, Gen Z, and international markets. Targeting these groups has driven sales growth. In 2024, the brand's strategic focus on specific demographics supported a 40% sales increase.

| Customer Segment | Key Focus | 2024 Performance Highlights |

|---|---|---|

| Health-Conscious Consumers | Prioritize fitness and wellness. | Drove market growth in functional beverages. |

| Fitness Enthusiasts | Boost performance and fitness goals. | Increased marketing spend by 30%, revenue increased by 110%. |

| Active Individuals | Seeking energy, prioritizing health. | Q3 2023 net sales of $385.6M, up 104%. |

Cost Structure

Cost of Goods Sold (COGS) for Celsius includes raw materials, manufacturing, and packaging. Efficiently managing these costs is vital for profit margins. In Q3 2023, Celsius reported a gross profit of $158.4 million. Sourcing ingredients and optimizing production are key to cost control.

Celsius heavily invests in marketing and advertising to boost brand awareness and drive sales. This strategy includes social media campaigns, influencer partnerships, and sponsorships. In 2024, Celsius's marketing expenses were approximately $200 million. Measuring the effectiveness of these campaigns is crucial for optimizing spending. A significant portion is allocated to digital marketing efforts.

Celsius Holdings faces notable distribution costs, covering transportation, warehousing, and direct store delivery. In 2024, the company allocated a significant portion of its operational expenses to these areas, reflecting the importance of efficient product movement. Optimizing distribution and securing better rates with distributors are crucial for cost management. Investing in logistics tech can boost efficiency, potentially reducing expenses by up to 10%.

Research and Development

Celsius Holdings dedicates resources to research and development to ensure its products stay innovative and competitive. This investment covers scientist and researcher salaries and the costs of testing and experimentation. Effective R&D spending is crucial for product improvement and market expansion. In 2023, Celsius spent approximately $12.7 million on R&D, reflecting its commitment to innovation.

- R&D spending is a key factor in staying competitive.

- Celsius allocated around $12.7M to R&D in 2023.

- This spending includes salaries and testing expenses.

- Innovation fuels product enhancement and market growth.

Acquisition Costs

Celsius Holdings' acquisition of Alani Nu in 2024 significantly impacted its cost structure, leading to substantial acquisition costs. These costs include legal fees, due diligence, and integration expenses, all of which need careful management. Efficiently integrating Alani Nu is key to unlocking synergies and achieving financial success. These costs are crucial for the company's financial strategy.

- Legal and advisory fees associated with the deal.

- Expenses related to due diligence and valuation.

- Costs for integrating Alani Nu's operations.

- Potential restructuring expenses.

Celsius's cost structure includes COGS, marketing, distribution, and R&D. Marketing expenses were around $200M in 2024, impacting profitability. The Alani Nu acquisition added costs like legal fees and integration.

| Cost Category | 2023/2024 Figures | Key Considerations |

|---|---|---|

| Marketing | $200M (2024) | Optimize campaign ROI |

| R&D | $12.7M (2023) | Drive innovation |

| Alani Nu Acquisition | Significant costs in 2024 | Integrate effectively |

Revenue Streams

Celsius generates revenue primarily from selling its energy drinks. This includes retail sales, e-commerce, and direct store delivery. In 2024, Celsius reported significant revenue growth, with net sales increasing substantially. Expanding into new markets and boosting sales volume remain crucial for revenue growth. By Q3 2024, Celsius's net revenues reached $350 million.

Celsius's international revenue streams come from sales in countries including Canada, the UK, and Australia. In 2024, international sales contributed significantly to overall revenue growth. The company focuses on expanding into new markets, and adapting its strategies to local preferences is critical for increasing sales. For example, international sales in Q3 2024 were up 213%.

Celsius Holdings might license its brand or technology to other companies, creating revenue streams. This low-risk expansion strategy could boost income. In 2024, licensing deals could add to the $1.32 billion in net sales Celsius reported. Careful partner selection and good terms are key.

Strategic Acquisitions

Strategic acquisitions, like the Alani Nu purchase, directly enhance Celsius' revenue streams by adding the acquired company's sales figures. This approach fuels top-line growth and broadens market presence. However, successful integration is critical for revenue realization. Effective integration strategies are vital for maximizing the financial benefits of the acquisition. In 2024, Celsius's revenue increased to $1.32 billion, reflecting the impact of such acquisitions.

- Increased market share through the acquisition of Alani Nu.

- Accelerated revenue growth due to the incorporation of Alani Nu's sales.

- Strategic importance of seamless integration for achieving revenue targets.

- Celsius's 2024 revenue of $1.32 billion demonstrates the impact of acquisitions.

Subscription Services

Celsius could explore subscription services, offering regular product deliveries. This approach can create consistent revenue streams and boost customer retention. Effective subscription program design and efficient logistics are vital for success.

- Subscription models provide predictable revenue.

- Customer loyalty is increased through regular deliveries.

- Logistics and program design are crucial for success.

- This can lead to higher customer lifetime value.

Celsius focuses on diverse revenue streams from drink sales through retail and e-commerce. International expansion in 2024 significantly boosted revenue, with Q3 international sales up 213%. Strategic acquisitions like Alani Nu contributed substantially to the $1.32 billion net sales in 2024, enhancing market share.

| Revenue Stream | Details | 2024 Data |

|---|---|---|

| Product Sales | Retail, E-commerce | $1.32B Net Sales |

| International Sales | Canada, UK, Australia | Q3 up 213% |

| Strategic Acquisitions | Alani Nu | Increased Market Share |

Business Model Canvas Data Sources

The Celsius Holdings Business Model Canvas leverages financial statements, market analysis reports, and industry insights. This ensures the strategic alignment is based on sound data.