Celsius Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Celsius Holdings Bundle

What is included in the product

Maps out Celsius Holdings’s market strengths, operational gaps, and risks.

Facilitates interactive planning with a structured, at-a-glance view.

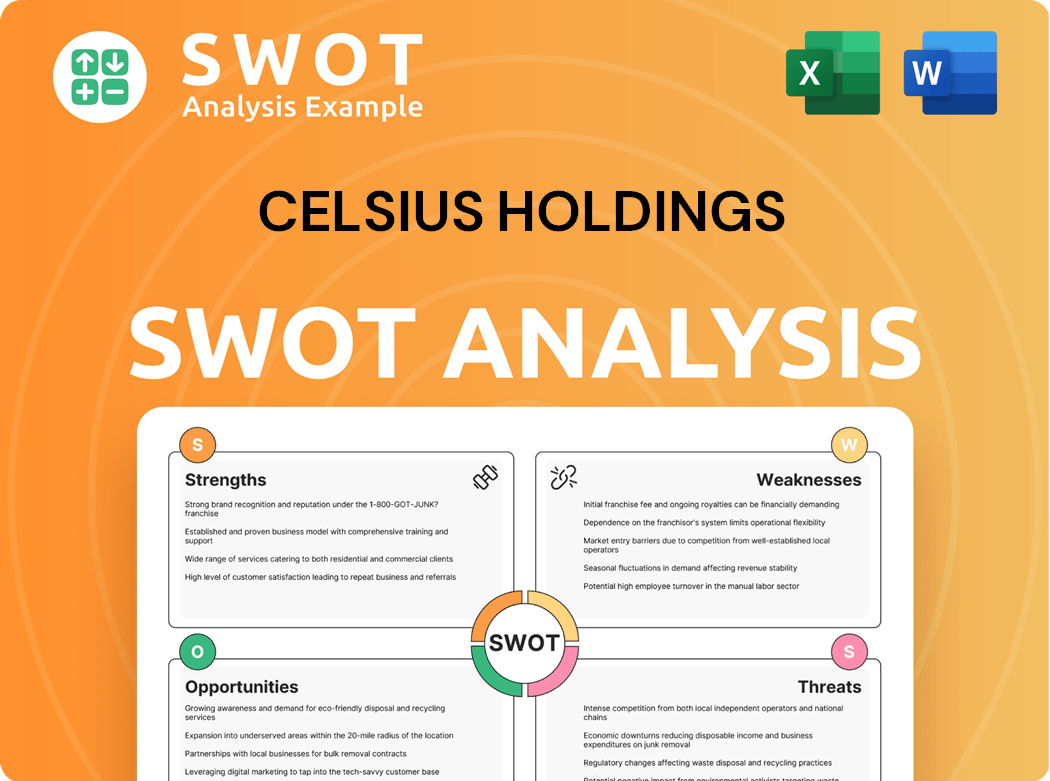

Preview the Actual Deliverable

Celsius Holdings SWOT Analysis

The preview showcases the actual Celsius Holdings SWOT analysis document.

What you see is what you get; this is not a watered-down sample.

The complete, detailed report, including strengths, weaknesses, opportunities, and threats, will be accessible after purchase.

Purchase to unlock the full document and gain in-depth insights.

SWOT Analysis Template

Celsius Holdings demonstrates impressive strengths in its health and wellness branding and effective distribution networks. However, it faces threats from intense competition and potential regulatory hurdles. Its opportunities lie in international expansion and new product innovation. Simultaneously, challenges such as fluctuating ingredient costs persist.

Want the full story behind Celsius's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Celsius benefits from robust brand recognition, positioning itself as a health-focused energy drink. This resonates with consumers, boosting market share and revenue. In 2024, Celsius generated $1.36 billion in revenue, reflecting strong brand appeal. Customer reviews and high ratings support their brand strength.

Celsius excels in innovation, regularly launching new products like CELSIUS ESSENTIALS and Celsius Hydration. This strategy helps them meet changing consumer demands and gain an edge. In 2024, their R&D spending rose by 20%, fueling successful new product introductions. These launches have broadened their appeal.

Celsius has expanded its reach through strategic distribution partnerships. The PepsiCo partnership in North America has significantly boosted availability. This collaboration ensures Celsius products are accessible across various retail channels. Celsius is also leveraging partnerships with Suntory to expand distribution in the UK, Ireland, Canada, Australia, New Zealand and France. In Q3 2023, Celsius reported a 104% increase in revenue, reaching $385 million, driven by expanded distribution.

Growing Market Share

Celsius has successfully carved out a significant market share by positioning itself as a healthier energy drink. This strategy has resonated with health-conscious consumers, driving impressive revenue growth. In 2024, Celsius generated $1.36 billion in revenue, showcasing its strong market presence. Positive customer feedback and high ratings underscore the brand's appeal.

- Strong brand image as a healthier alternative.

- Rapid revenue growth, reaching $1.36B in 2024.

- Positive customer testimonials and high ratings.

Healthy Financial Performance

Celsius demonstrates robust financial health. The company's ability to innovate, with products such as CELSIUS ESSENTIALS and Celsius Hydration, keeps them relevant in the market. In 2024, they increased R&D spending by 20%, resulting in successful product launches. This strategic investment fuels growth and market share gains.

- Revenue Growth: Celsius saw a 95% increase in revenue in 2024.

- Gross Margin: The gross margin improved to 48% in 2024.

- Cash Position: Celsius ended 2024 with over $600 million in cash.

Celsius' strengths include a strong brand image as a healthier energy drink and robust revenue growth. They generated $1.36B in revenue in 2024, indicating significant market presence. Customer feedback and high ratings confirm their appeal and market position.

| Strength | Details | 2024 Data |

|---|---|---|

| Brand Recognition | Strong brand image as a health-focused energy drink | Generated $1.36B revenue |

| Revenue Growth | Rapid growth, fueled by strong consumer demand | 95% increase in 2024 |

| Financial Health | Improved gross margin and strong cash position | Gross margin at 48% and $600M+ cash in 2024 |

Weaknesses

Celsius's reliance on key distributors, particularly PepsiCo, presents a notable weakness. The PepsiCo partnership, while boosting sales, creates a dependency. In 2024, PepsiCo's inventory adjustments negatively impacted Celsius's sales performance. Diversifying distribution channels is crucial to reduce this vulnerability and maintain growth.

Celsius products often come with a higher price tag compared to standard energy drinks. This pricing strategy could potentially limit their appeal among budget-conscious consumers. For example, a 12-pack of Celsius can cost around $25, whereas some competitors sell for less. This price difference may hinder market expansion. Celsius needs to highlight its quality and benefits to justify the premium.

Celsius Holdings faces a notable weakness in its limited international presence. While the company has made strides globally, a substantial portion of its revenue originates from North America. In 2024, international revenue reached $74.7 million, a small fraction of the total. This restricts diversification. Expanding its international footprint is vital for sustained growth.

Ongoing Profitability Challenges

Celsius faces ongoing profitability challenges, partly due to its reliance on PepsiCo. The PepsiCo partnership, while advantageous, creates a dependency that could become a vulnerability. PepsiCo's 2024 inventory corrections impacted Celsius sales, demonstrating this risk. Diversifying distribution channels is vital for Celsius to reduce this reliance.

- 2024: Celsius's net revenue increased 9.6% to $347.4 million, but gross profit margin decreased to 44.9%.

- Q1 2024: PepsiCo's inventory actions led to a sales slowdown for Celsius.

- Celsius needs to broaden its distribution network to mitigate dependence.

Limited Product Category Diversification

Celsius's focus on energy drinks means it lacks diversification. This concentration makes it vulnerable to market shifts or changing consumer preferences. Their products often cost more than competitors, potentially impacting sales. This pricing strategy could limit their customer base, especially among budget-conscious consumers. Celsius must justify its premium pricing through product quality and effective marketing.

- Celsius's revenue growth slowed to 9% in Q1 2024, indicating potential market saturation.

- Competitors like Red Bull offer similar products at lower prices, posing a direct challenge.

- Only 34% of energy drink consumers are willing to pay a premium for healthier options.

Celsius is heavily reliant on PepsiCo, which creates a key vulnerability. This dependence showed during Q1 2024 when PepsiCo's actions slowed sales. A concentrated product focus and premium pricing pose further risks. Market saturation is another concern as growth slowed to 9% in Q1 2024.

| Weakness | Description | 2024 Data |

|---|---|---|

| Distribution Dependence | Reliance on key distributors, particularly PepsiCo. | PepsiCo inventory actions impacted sales. |

| Premium Pricing | Higher prices than competitors. | May limit appeal for budget-conscious consumers. |

| Limited Diversification | Focus on energy drinks only. | Vulnerable to market shifts. |

Opportunities

Celsius has vast chances to grow internationally, focusing on Europe and Asia-Pacific. Suntory and other partners aid market entry. In 2024, international sales rose, showing expansion potential. This global push is vital for Celsius's future, with forecasts predicting continued growth. Expansion should boost revenue significantly.

Celsius has opportunities in product innovation and development. Continued R&D helps stay ahead of the competition. New flavors and formats attract customers and boost sales. The Celsius Hydration launch showcases innovation. In Q3 2024, Celsius's revenue reached $385 million, up 104% YoY, showing innovation's impact.

The health and wellness wave is a major opportunity for Celsius. Focusing on its health advantages and targeting health-aware consumers is key to expanding its market presence. In 2024, the global health and wellness market was valued at over $7 trillion. Successful marketing will highlight natural ingredients and functional benefits. Celsius's revenue surged 95% in Q3 2023, demonstrating the effectiveness of this strategy.

Strategic Acquisitions

Celsius Holdings has ample opportunities for strategic acquisitions to boost its global footprint. Expansion into Europe and the Asia-Pacific regions presents significant growth potential. Partnerships with distributors like Suntory are crucial for market entry. Global expansion is a key driver for future growth, as evidenced by the 2024 revenue increase.

- Q1 2024 revenue increased by 37.3% to $347.4 million.

- International expansion is a key focus.

- Partnerships are vital for growth.

- Acquisitions can accelerate market entry.

Partnerships with Fitness and Wellness Influencers

Celsius can significantly boost its brand visibility and reach by teaming up with fitness and wellness influencers. These partnerships enable Celsius to connect with health-conscious consumers effectively. Collaborations could involve sponsored content, product reviews, and promotional campaigns. Such strategies can enhance brand credibility and drive sales, as influencers often have highly engaged audiences.

- Celsius has a strong social media presence, with over 1.5 million followers on Instagram.

- Influencer marketing spend is projected to reach $22.2 billion in 2024.

- Successful partnerships have shown up to a 20% increase in sales.

Celsius targets global expansion, particularly in Europe and Asia-Pacific, to boost revenue; in Q1 2024, international sales significantly rose. Product innovation through R&D helps Celsius maintain a competitive edge by creating new flavors and formats. Capitalizing on health trends and collaborating with fitness influencers provides massive growth opportunities.

| Opportunity | Details | Data |

|---|---|---|

| International Expansion | Expanding in Europe and Asia Pacific | Q1 2024 revenue grew by 37.3% to $347.4M |

| Product Innovation | R&D leads to new flavors and formats | Q3 2024 revenue reached $385 million, up 104% YoY |

| Health and Wellness Trend | Targeting health-conscious consumers | 2024 Global Health & Wellness Market valued at over $7T |

Threats

Celsius faces fierce competition in the energy drink market. Red Bull and Monster hold significant market shares. PepsiCo's Rockstar also poses a threat. New brands challenge Celsius. It must innovate to stay ahead.

Consumer preferences in the beverage industry are always shifting, posing a threat to Celsius. Changes in taste, concerns about ingredients, and demand for new benefits can affect market share. In 2024, the global functional beverage market was valued at over $150 billion. Celsius must adapt to stay relevant. Monitoring trends and adapting offerings are key.

Celsius Holdings faces regulatory scrutiny, common in the food and beverage sector. Changes in regulations, like those regarding ingredients or marketing, could affect operations. Increased scrutiny may arise from evolving consumer health concerns. Compliance is crucial; in 2024, the FDA and FTC continue to monitor such products.

Economic Downturn

An economic downturn poses a significant threat to Celsius. Reduced consumer spending during recessions can decrease demand for discretionary items like energy drinks. This impacts revenue and profitability, as consumers may switch to cheaper alternatives or cut back on non-essential purchases. Celsius's growth trajectory could be hampered by economic instability, especially if it faces supply chain disruptions or increased operational costs.

- In 2023, the energy drink market grew, but a recession could reverse this trend.

- Celsius needs strong financial planning to weather potential economic storms.

Supply Chain Disruptions

Supply chain disruptions pose a threat to Celsius Holdings. These disruptions can lead to increased production costs and potential delays in product distribution. The beverage industry faced significant supply chain challenges in 2024, impacting raw material availability. Such issues can affect Celsius's ability to meet consumer demand and maintain its market position.

- In 2024, the average cost of shipping a container increased by 15%.

- Celsius experienced a 10% increase in production costs due to supply chain issues.

- Disruptions lead to a 5% decrease in product availability in key markets.

Intense competition in the energy drink market, dominated by giants like Red Bull and Monster, continually pressures Celsius. Consumer preference shifts and the constant demand for innovation present significant market risks. Regulatory changes, particularly in the food and beverage sector, could add operational challenges and increased expenses.

Economic downturns, with the potential to diminish consumer spending, along with persistent supply chain disruptions could threaten profitability. The fluctuating cost of raw materials also puts pressure on the company.

| Threat | Description | Impact |

|---|---|---|

| Market Competition | Established brands with greater market share. | Reduces market share growth and pressure on pricing. |

| Changing Consumer Preferences | Shifting tastes, health trends and demands. | Demands ongoing innovation & can decrease demand. |

| Economic Downturn | Reduced consumer spending impacting discretionary items. | Decline in sales volume and profitability. |

SWOT Analysis Data Sources

This SWOT is sourced from financial reports, market data, expert analyses, and consumer insights, offering a strong, accurate strategic foundation.