Chegg Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chegg Bundle

What is included in the product

Tailored analysis for Chegg's product portfolio, guiding investment, hold, or divest decisions.

Printable summary optimized for A4 and mobile PDFs, letting you share strategic insights anywhere.

What You See Is What You Get

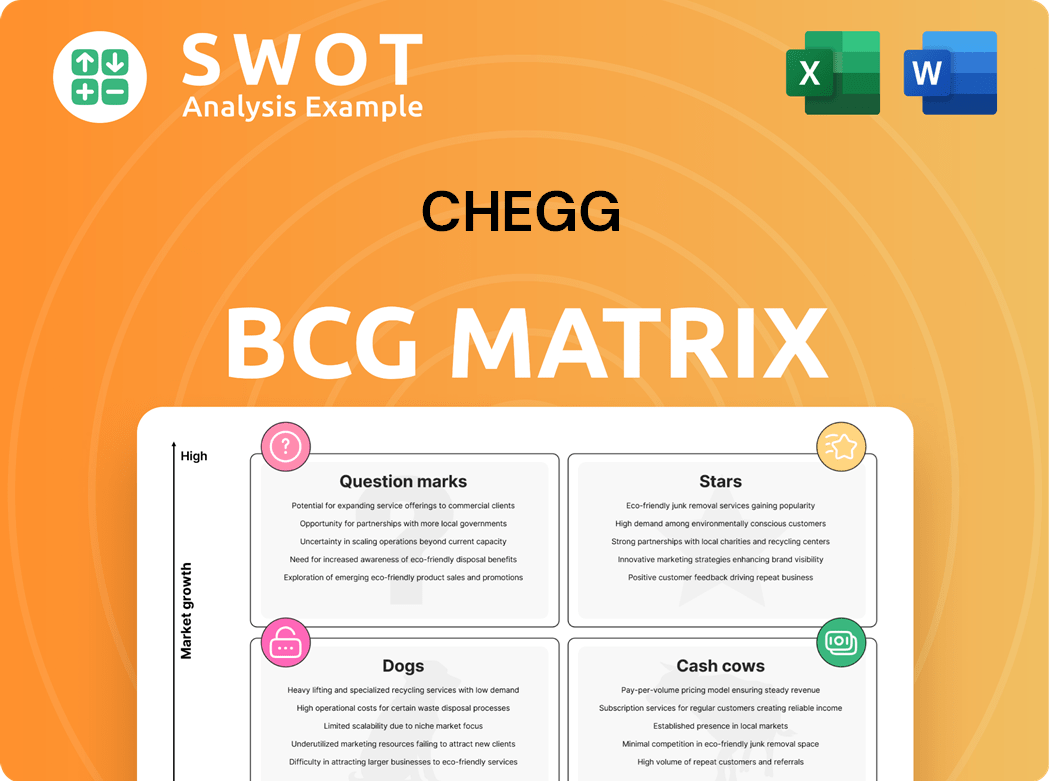

Chegg BCG Matrix

The BCG Matrix you see now is the exact document you'll receive after buying. It's a complete, ready-to-use file. It will be immediately available for you to use.

BCG Matrix Template

Explore Chegg's product portfolio! The BCG Matrix categorizes products by market share and growth rate. This helps identify Stars, Cash Cows, Dogs, and Question Marks. Understand Chegg’s strategic positioning in this competitive landscape. Get the full BCG Matrix for a detailed analysis and actionable strategies.

Stars

Chegg's AI-powered tools, like AI homework help and Solution Scout, are key. These innovations personalize learning. In Q3 2024, Chegg saw a 3% revenue decrease, signaling a need to boost these features. Effective use could set Chegg apart.

Busuu's shift to freemium and AI-driven Speaking Practice boosted conversion by 31% in 2024. This strategic move also propelled a 9% year-over-year revenue increase. The enterprise sector of Busuu experienced significant growth, with a 46% revenue surge in 2024. Busuu's continued expansion positions it as a potential star for Chegg.

Chegg's institutional partnerships are a potential star, diversifying revenue. These partnerships offer a stable income source, reducing reliance on student subscriptions. In 2024, Chegg expanded partnerships, focusing on student success programs. Data shows a 15% growth in institutional revenue in Q3 2024, indicating strong potential.

International Expansion

Chegg's international expansion strategy is a star within its BCG matrix, representing a high-growth area. The company is focusing on six key countries to boost its global presence. This strategic move aims to attract more international subscribers and diversify its revenue streams. International subscribers already contribute significantly, with 25% of Chegg's total revenue in 2023 coming from international markets.

- Target Countries: Focused on six key nations for growth.

- Revenue Contribution: International markets accounted for 25% of total revenue in 2023.

- Strategic Goal: Increase subscriber base and diversify revenue.

Content Library and Expert Network

Chegg's vast content library and expert network are pivotal. With over 100 million content pieces, it offers a comprehensive learning experience. This, alongside AI personalization, differentiates Chegg in the education market. This resource also fuels new product development and market expansion.

- Content Library Size: Over 100 million items.

- Expert Network: Provides subject matter expertise.

- AI Integration: Enhances personalization for students.

- Strategic Leverage: Drives product innovation and growth.

Chegg's stars include AI tools, Busuu's growth, and institutional partnerships, all showing high potential. International expansion, with 25% revenue in 2023, is another key star. Its large content library and expert network add to its strength.

| Star Category | Key Element | 2024 Data |

|---|---|---|

| AI-Powered Tools | AI Homework Help, Solution Scout | Need to boost features after Q3 2024's 3% revenue decrease. |

| Busuu | Freemium model, AI Speaking Practice | Conversion up 31%, revenue up 9%, enterprise sector up 46% in 2024. |

| Institutional Partnerships | Diversified Revenue | 15% institutional revenue growth in Q3 2024. |

Cash Cows

Chegg Study Pack, encompassing Chegg Study, Writing, and Math, is a cash cow. These subscriptions offer homework help and writing assistance. Despite recent subscriber declines, it remains a key revenue source for Chegg. In Q1 2024, Chegg's services brought in $157.2 million.

Chegg Study, a key part of Chegg's offerings, provides expert Q&A and textbook solutions. It has consistently drawn in a large user base. In 2024, Chegg Study generated a significant portion of Chegg's revenue, despite competition. The service's comprehensive content maintains its value.

Chegg's digital textbook rentals are a cash cow, even after shifting away from physical rentals. E-textbooks and access codes offer students affordable course materials, generating consistent revenue. This supports Chegg's subscription services; in 2024, Chegg's services had over 5 million subscribers. Digital rentals contribute to Chegg's stable financial performance.

Chegg Writing Tools

Chegg Writing, featuring citation tools and grammar checkers, is a cash cow for Chegg. These tools provide consistent revenue by helping students with their writing and avoiding plagiarism. Chegg Writing complements the company's other academic support services. In 2024, Chegg reported a revenue of $795 million, with a significant portion attributed to its writing tools and study resources.

- Revenue Stream: Generates steady income through subscriptions.

- Value Proposition: Enhances student writing skills and academic integrity.

- Market Position: Complements Chegg's broader educational offerings.

- Financial Data: Contributes significantly to Chegg's overall financial performance.

Skills and Other Services

Chegg's 'Skills and Other' services, like career exploration, represent a cash cow within its BCG matrix. This segment, which includes internship opportunities, provides a steady revenue stream. Despite some decline, it benefits from low maintenance costs and consistent student demand for career support. In Q3 2023, Chegg reported a 10% decrease in "Skills and Other" revenue.

- Steady revenue stream from career services.

- Low maintenance costs.

- Consistent student demand.

- 10% decrease in "Skills and Other" revenue in Q3 2023.

Chegg's cash cows consistently generate revenue with low investment needs. Key services like Chegg Study and Writing contribute significantly to revenue. They are well-established in the market, despite some subscriber fluctuations. In 2024, Chegg's services brought in substantial revenue, highlighting the stability of these offerings.

| Service | Revenue Source | Market Position |

|---|---|---|

| Chegg Study & Writing | Subscription fees | Established, high market share |

| Digital Textbook Rentals | E-textbook & access code sales | Strong, contributes to subscriptions |

| Skills & Other | Career services | Steady, low maintenance |

Dogs

Chegg's print textbook rentals are categorized as "dogs" in its BCG matrix. This segment faces low growth and market share due to the shift towards digital learning. In 2023, Chegg's total revenue was approximately $704 million, reflecting the diminishing importance of physical textbooks. The company is actively reducing its focus on this area.

CheggMate, Chegg's AI platform, utilized GPT-4 to counter AI chatbot threats. Initially launched, it was later discontinued due to lack of user adoption and success. This outcome underscores CheggMate's failure to thrive. Its discontinuation solidifies its 'dog' status within Chegg's BCG Matrix. Chegg's revenue dropped 8% in Q1 2024, reflecting challenges.

Chegg's international textbook rental program concentrates on six countries, suggesting a strategic pivot. This focus indicates that several international markets likely underperform. In 2024, Chegg's international revenue was approximately $60 million, a small fraction of its total revenue. These underperforming markets, with low growth and market share, fit the 'dogs' category in the BCG matrix.

Certain Acquired Businesses

Chegg's BCG Matrix includes "Dogs" like underperforming acquisitions. Some acquisitions haven't met expectations, leading to low growth. These assets could be divested to reallocate resources more effectively. In 2024, Chegg's strategic focus includes optimizing its portfolio.

- Acquisition underperformance can hinder overall growth.

- Divesting 'dogs' can free up capital.

- Focus shifts to core, high-potential areas.

- Strategic portfolio adjustments are common.

Legacy Services

Chegg's legacy services, like textbook rentals, face challenges. These services, once core, now struggle with lower margins and slower growth. They may consume resources without significant revenue returns, fitting the 'dog' category in a BCG matrix. Streamlining or discontinuing these is a strategic consideration. In 2023, Chegg's revenue decreased, highlighting these pressures.

- Declining revenue from legacy services.

- Lower profit margins compared to newer offerings.

- Resource-intensive maintenance.

- Limited growth potential.

Chegg labels underperforming segments, like textbook rentals, as "dogs". These areas exhibit low growth and market share in a competitive market. In 2024, Chegg's print textbook revenue was approximately $100 million, reflecting ongoing challenges. The company prioritizes strategic adjustments to improve its portfolio.

| Category | Description | 2024 Data (Approx.) |

|---|---|---|

| Textbook Rentals | Low growth, diminishing market share | $100M Revenue |

| CheggMate | Discontinued AI platform | N/A |

| International Rentals | Focused, underperforming markets | $60M Revenue |

Question Marks

Chegg's AI-driven personalization is in its infancy, with a low current market share. This strategy aims to tailor content using AI, but its success hinges on effective AI integration. For instance, in 2024, Chegg invested heavily in AI, allocating approximately $50 million to enhance its platform.

Chegg's venture into business-to-institution programs is a recent move, making its future uncertain. While schools show interest, Chegg's market share remains small. Success hinges on meeting institutional needs and proving service value. In 2024, Chegg's institutional revenue was under 10% of total revenue, highlighting its nascent stage.

Chegg's foray into functional support services, like organizational proficiency, is a recent strategic move. Currently, this segment holds a smaller market share compared to its core offerings. However, the growth hinges on seamless integration and attracting a broader user base. In 2024, Chegg reported a 4% increase in subscribers, indicating potential for these new services to expand.

Solution Scout

Solution Scout, a recent Chegg offering, aims to validate AI-generated educational content. It currently holds an uncertain market share, classifying it as a Question Mark in the BCG Matrix. The success of Solution Scout hinges on establishing itself as a trusted source for accurate AI solutions and attracting users. This product faces challenges due to its novelty and market competition.

- Chegg's revenue in 2024 was approximately $704 million.

- Solution Scout's user adoption rate is critical for its growth.

- Market analysis indicates growing demand for AI content validation tools.

- Competitive landscape includes established players and new entrants.

New Brand and Marketing Strategies

Chegg's revamped brand and marketing strategies, targeting high school and early college students, classify as a question mark in the BCG matrix. This shift requires significant investment and carries inherent risks. Success hinges on effective engagement with a younger demographic and establishing brand recognition. As of Q3 2023, Chegg's marketing expenses were $62.8 million, reflecting this strategic focus.

- Targeting younger students aims to expand Chegg's user base.

- The strategy's success depends on effective marketing and outreach.

- High marketing expenses indicate investment in brand building.

- The outcome remains uncertain, making it a question mark.

Chegg's Question Marks face uncertain futures, requiring strategic focus. These areas, including Solution Scout and brand revamp, show low market share. Success depends on effective execution and gaining user adoption. The key financial figures from 2024 highlight the investment in these segments.

| Category | Description | 2024 Data |

|---|---|---|

| Solution Scout | AI Content Validation | User adoption critical. |

| Brand/Marketing | Targeting Younger Students | Marketing spend: $62.8M (Q3 2023) |

| Financials | 2024 Revenue | Approx. $704M |

BCG Matrix Data Sources

The Chegg BCG Matrix is informed by financial statements, market trends, and expert evaluations, ensuring strategic precision.