Chegg PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chegg Bundle

What is included in the product

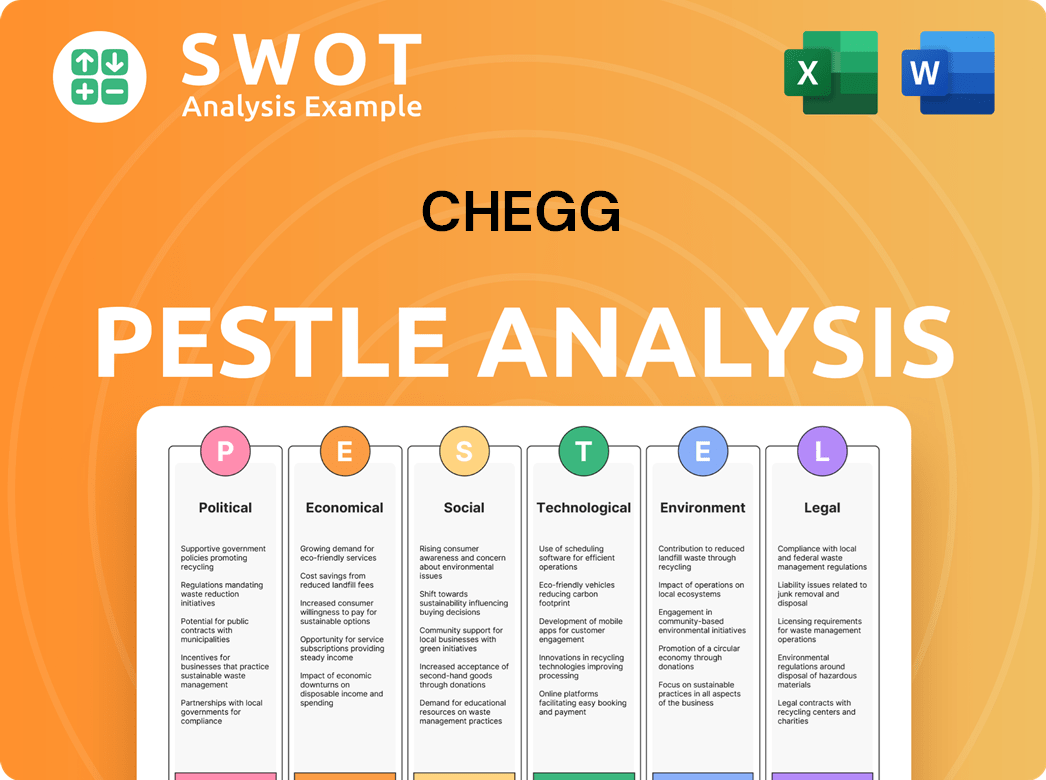

Assesses Chegg through six macro-environmental lenses: Political, Economic, Social, Tech, Environmental, and Legal.

Easily shareable, the PESTLE summary promotes swift consensus across diverse teams.

Full Version Awaits

Chegg PESTLE Analysis

Everything displayed here is part of the final product. This Chegg PESTLE Analysis preview gives you a clear view of the complete analysis. The structure and content are as shown. What you see is what you’ll be working with. Purchase and download the exact same file.

PESTLE Analysis Template

Understand the forces shaping Chegg with our PESTLE analysis. We explore political, economic, social, technological, legal, and environmental factors affecting its strategy. Uncover hidden opportunities and potential threats. Get in-depth insights and make informed decisions—download the full report today!

Political factors

Governments worldwide are updating online learning regulations, impacting platforms like Chegg. These changes cover accreditation, data privacy, and consumer protection. The U.S. may alter state authorization reciprocity, affecting Chegg's nationwide service. Adapting to these regulations requires significant operational and compliance adjustments. The global e-learning market is projected to reach $325 billion by 2025.

Government spending on education significantly impacts Chegg. Increased education budgets often boost demand for educational resources. For example, in 2024, the U.S. government allocated over $75 billion for education. Changes in student aid, like Pell Grants, influence students' spending on services like Chegg. Reduced funding could decrease Chegg's customer base.

Chegg's international operations are vulnerable to political instability, particularly in regions with geopolitical tensions. Such instability can disrupt business functions and affect supply chains. For instance, political unrest in key markets could hinder Chegg's expansion plans, impacting revenue. Recent global events highlight these risks; for example, the Russia-Ukraine war has affected numerous international businesses.

Policies on Academic Integrity

Political factors significantly shape Chegg's operations, especially regarding academic integrity policies. Governments and universities are tightening rules against AI-assisted cheating, directly impacting Chegg's services. These stricter guidelines could lead to reduced usage or necessitate modifications to Chegg's offerings to comply. For instance, in 2024, the U.S. Department of Education increased scrutiny of online learning platforms.

- Increased governmental oversight of educational platforms is expected through 2025.

- Institutions are investing more in AI-detection software.

- Chegg faces potential legal challenges related to academic misconduct.

Trade Policies and International Relations

Trade policies and international relations significantly influence Chegg's operational costs. Changes in tariffs or trade agreements directly affect the cost of physical textbook rentals, especially if sourced globally. For instance, the US-China trade tensions in 2024/2025 could increase costs. These shifts potentially squeeze profit margins.

- Tariff rates on educational materials can fluctuate, impacting Chegg's procurement costs.

- Changes in international relations can disrupt supply chains, affecting textbook availability.

- Trade agreements between countries can influence the price competitiveness of Chegg's services.

Chegg faces increased government scrutiny, impacting services and requiring adaptation to evolving educational regulations. Government spending on education and student aid directly influences Chegg's demand, affecting its customer base and financial performance. Political instability and trade policies introduce operational risks, potentially increasing costs and disrupting supply chains for Chegg's international operations.

| Political Factor | Impact on Chegg | Data/Example (2024/2025) |

|---|---|---|

| Regulation | Compliance costs & operational changes. | U.S. e-learning market projected to $325B by 2025. |

| Government Funding | Affects demand and customer spending. | US gov. allocated over $75B for education in 2024. |

| Trade Policies | Impacts operational costs (textbook rentals). | US-China trade tensions impacting textbook sourcing. |

Economic factors

Student loan debt affects affordability, potentially limiting access to educational resources. High debt levels can drive students towards cheaper options. In Q1 2024, student loan debt reached $1.76 trillion. This increases demand for Chegg's lower-cost services like rentals and digital options.

Inflation can significantly impact disposable income, affecting students and families' ability to afford services like Chegg. The U.S. inflation rate was 3.5% in March 2024. Higher prices make consumers more price-conscious. This can influence Chegg's pricing and subscriber growth, particularly in an environment where educational costs are already high.

Overall economic growth and employment rates significantly impact educational choices. A strong economy often boosts enrollment, while recessions can decrease it. For example, the U.S. unemployment rate in March 2024 was 3.8%, influencing education demand. Conversely, a downturn might lead to less spending on additional learning.

Currency Exchange Rate Fluctuations

For Chegg, currency exchange rate fluctuations pose a risk to its international revenue. A stronger U.S. dollar can reduce the value of Chegg's foreign earnings. This directly affects the reported financial performance of the company. The impact is especially noticeable in regions with significant Chegg user bases.

- In 2024, a 5% adverse currency movement could decrease Chegg's revenue by $10 million.

- Chegg's international revenue accounted for 15% of total revenue in the last fiscal year.

Investment in EdTech Sector

Investment in the EdTech sector is a key economic factor. The level of investment mirrors investor confidence. Despite some funding plateaus, overall market growth persists. In 2024, global EdTech investments reached approximately $18 billion. This signifies opportunities for growth and innovation. The sector's ability to attract capital is vital for Chegg's future.

- Global EdTech investments were about $18 billion in 2024.

- Market growth indicates continued opportunities.

Student loan debt affects affordability, influencing choices. The US student loan debt reached $1.76T in Q1 2024. Inflation, at 3.5% in March 2024, impacts disposable income and Chegg’s pricing. Overall economic growth (3.8% unemployment) and EdTech investments, ~$18B in 2024, are vital.

| Economic Factor | Impact on Chegg | Data Point (2024) |

|---|---|---|

| Student Debt | Affects affordability; shifts demand | $1.76T (Q1 US student debt) |

| Inflation | Impacts pricing and subscriptions | 3.5% (March US Inflation) |

| Economic Growth | Influences enrollment and spending | 3.8% (March US Unemployment) |

| EdTech Investment | Drives market growth and opportunity | $18B (Global EdTech) |

Sociological factors

Student demographics are changing, with more diverse backgrounds and needs. Online and hybrid learning models are gaining popularity, shifting how students access resources. Chegg must adapt its services to match these evolving preferences. In 2024, online learning grew by 15%, showing this shift's importance.

The surge in online learning significantly expands Chegg's digital market reach. This trend, accelerated by the pandemic, saw over 70% of US higher education institutions offering online courses in 2024. Chegg's revenue from subscription services reached $230 million in Q3 2024, showing growth. Challenges include maintaining student engagement and ensuring academic integrity in virtual settings. Chegg is investing in AI to combat cheating.

Students now expect personalized learning, a trend boosting demand for adaptive tools. Chegg meets this need via its platform. In 2024, the personalized learning market was valued at $4.2 billion. Projections indicate it will reach $8.7 billion by 2028, showing significant growth potential.

Concerns about Academic Integrity and Cheating

The surge in online learning and accessible digital tools has intensified worries about academic honesty and cheating. This societal shift impacts educational institutions, compelling platforms like Chegg to address these issues. Chegg must balance providing resources with ensuring ethical usage to maintain trust and credibility. In 2024, a study revealed a 30% increase in reported academic integrity violations.

- Chegg's 2024 revenue was $740.5 million, highlighting its market presence.

- The company faces the challenge of preventing misuse of its services.

- Institutions are implementing stricter policies to combat academic dishonesty.

- Chegg is under pressure to innovate its integrity measures.

Demand for Skills-Based Education and Career Advancement

Societal demand increasingly prioritizes skills-based education over traditional degrees for career advancement, creating opportunities for companies like Chegg. This shift is driven by the need for specialized skills in rapidly evolving industries. Chegg can capitalize on this trend by expanding its skills-based learning tools and career exploration resources, targeting a market seeking practical, job-ready knowledge. In 2024, the global e-learning market was valued at $325 billion and is projected to reach $1 trillion by 2030. This underscores the potential for Chegg's skills-focused offerings.

- The global e-learning market was valued at $325 billion in 2024.

- Projected to reach $1 trillion by 2030.

The demand for skills-based education is on the rise, reshaping educational priorities, with a growing preference for job-ready skills over traditional degrees. Chegg can capitalize on this by offering skills-focused tools and career resources. In 2024, the e-learning market was worth $325 billion, projecting to reach $1 trillion by 2030.

| Sociological Factor | Impact on Chegg | Data (2024-2025) |

|---|---|---|

| Shift to Skills-Based Learning | Increased demand for practical, job-ready skills, opportunities for Chegg | E-learning market: $325B (2024), $1T by 2030 |

| Online Learning Growth | Expanded market reach and user base. | Online learning grew by 15% (2024); Subscription revenue of $230M (Q3 2024). |

| Academic Integrity Concerns | Requires maintaining ethical usage and credibility, need to adapt measures. | 30% rise in integrity violations reported. |

Technological factors

AI is revolutionizing education, offering personalized learning and automating tasks. Chegg leverages AI, yet faces challenges from instant-answer tools. In 2024, the AI in education market was valued at $1.3 billion, expected to reach $3.5 billion by 2029. This impacts Chegg's Q&A services.

The integration of AI by search engines, like Google, to offer direct answers poses a challenge for Chegg. This could potentially reduce the need for users to visit Chegg's site. For example, in 2024, Google's AI-driven search features displayed direct answers for 40% of educational queries. This shift might affect Chegg's traffic and subscriber numbers.

The EdTech sector is rapidly evolving, with new platforms and tools emerging frequently. Chegg needs to continually update its technology to stay ahead. In 2024, the global EdTech market was valued at over $120 billion. This growth necessitates Chegg's ongoing tech investments.

Increased Use of Mobile Devices and Internet Accessibility

The surge in mobile device usage and expanding internet access significantly boosts Chegg's reach. This technological shift enables students worldwide to access educational resources anytime, anywhere. Chegg's digital learning platforms directly benefit from this trend, increasing user engagement and accessibility. The global smartphone penetration rate reached 68% in 2024, and is projected to hit 74% by 2028, fueling digital learning growth.

- Over 68% of the global population uses smartphones (2024).

- Internet access continues to expand, especially in developing countries.

- Chegg's mobile app downloads and usage are steadily increasing.

Data Analytics and Learning Management Systems (LMS)

Chegg's ability to analyze data on student behavior and integrate with Learning Management Systems (LMS) is crucial. This data-driven approach helps Chegg improve its offerings and personalize the learning experience. The integration with institutional platforms could provide a competitive edge. Data analytics in education is expected to reach $4.5 billion by 2025.

- Personalized learning experiences enhance student engagement.

- Integration with LMS platforms provides streamlined access.

- Data-driven insights enable Chegg to refine its services.

AI advances in education challenge Chegg, with direct answers reducing site visits. The EdTech market, exceeding $120 billion in 2024, demands continuous tech investment. Smartphone penetration (68% in 2024) and expanding internet access fuel digital learning growth.

| Technology Aspect | Impact on Chegg | Data/Statistic (2024) |

|---|---|---|

| AI Integration | Challenges Q&A, personalization | $1.3B AI in education market |

| Search Engine AI | Reduced site visits | 40% queries get direct answers |

| Mobile and Internet | Increased reach and access | 68% smartphone penetration |

Legal factors

Chegg must adhere to stringent data privacy laws like GDPR and FERPA, which mandate strong data protection. In 2024, the education sector saw a 25% rise in data breaches, emphasizing the need for robust security. Chegg's compliance costs are significant, with penalties for non-compliance potentially reaching millions. These factors influence Chegg's operational strategies.

Chegg, as an educational content provider, heavily relies on intellectual property. They must adhere to copyright laws to protect their content and avoid legal issues. Recent data shows a 15% increase in copyright infringement cases in the education sector. Compliance is vital to maintain operations and avoid costly legal battles.

Chegg faces legal obligations under consumer protection laws. These laws mandate transparency in service terms, pricing, and refunds. In 2024, the Federal Trade Commission (FTC) continued to enforce regulations on online service providers. Chegg’s compliance ensures fair practices for its users.

Legal Challenges and Litigation

Chegg confronts legal issues, including a suit against Google over search traffic. Litigation can disrupt operations, finances, and reputation. In Q1 2024, Chegg's legal expenses were reported. These challenges can lead to financial strain.

- Lawsuits can affect stock prices and investor confidence.

- Chegg must allocate resources to legal defense and settlements.

- Negative publicity from lawsuits can damage brand perception.

Regulations on Distance Education Providers

Chegg must navigate complex legal landscapes, especially regarding distance education regulations. These regulations cover state authorizations, impacting where Chegg can offer its services, alongside student enrollment reporting, which is crucial for compliance. Non-compliance can lead to significant fines and operational restrictions, affecting Chegg’s ability to expand and serve its student base effectively. The U.S. Department of Education and state-level agencies actively monitor these areas. In 2024, educational institutions faced over $1 billion in fines for non-compliance with federal regulations.

- State Authorization: Chegg must comply with individual state requirements to offer educational services.

- Student Data Privacy: Adherence to data privacy laws, such as FERPA, is essential for protecting student information.

- Advertising Standards: Compliance with truth-in-advertising laws is necessary to avoid misleading claims.

- Accessibility: Ensuring services are accessible to students with disabilities is a legal requirement.

Chegg's legal environment involves data privacy, intellectual property, and consumer protection laws. In 2024, compliance costs in education rose significantly due to stringent regulations. Recent reports showed an increase in legal challenges impacting stock prices and operations.

| Legal Area | Issue | Impact |

|---|---|---|

| Data Privacy | GDPR, FERPA compliance | Costly; potential penalties |

| Intellectual Property | Copyright adherence | Avoid lawsuits |

| Consumer Protection | Transparency, refunds | FTC regulations |

Environmental factors

Digital technologies, while reducing paper use, significantly boost energy consumption and e-waste. Data centers alone consume about 2% of global electricity, a figure that's rising. Chegg, operating digitally, must address its tech infrastructure's environmental impact. Consider that the e-waste recycling rate in the US is around 15-20% as of 2024.

Sustainability is gaining traction in education, pushing for eco-friendly practices. This shift impacts companies like Chegg. In 2024, the global green building materials market was valued at $362.3 billion and is projected to reach $650.7 billion by 2032. This could drive demand for Chegg's sustainable digital offerings.

E-waste from digital learning devices is an environmental concern. Globally, e-waste generation reached 62 million metric tons in 2022. The digital learning environment, though not directly handling e-waste, is indirectly connected. Proper e-waste management is crucial for sustainability.

Energy Consumption of Data Centers

Chegg's data centers are energy-intensive, impacting the environment. These facilities support its online learning platform. The digital learning sector's environmental footprint is a growing concern.

- Data centers globally consume about 1-2% of the world's electricity.

- The carbon footprint of digital services is rising, prompting sustainability efforts.

Shift from Physical to Digital Textbooks

Chegg benefits from the shift towards digital textbooks, contributing to environmental sustainability. This transition lessens the need for paper, printing, and transportation, thereby lowering the carbon footprint. The digital format supports broader environmental goals, making learning greener. In 2024, the e-textbook market is expected to reach $3.1 billion.

- Reduced carbon emissions from transportation and production.

- Decreased deforestation due to lower paper demand.

- Increased energy efficiency in digital distribution.

- Supports corporate social responsibility initiatives.

Chegg's digital operations significantly affect the environment through energy consumption and e-waste from data centers. Globally, e-waste reached 62 million metric tons in 2022. The digital shift offers environmental benefits like reduced paper use.

| Environmental Factor | Impact | 2024 Data/Projection |

|---|---|---|

| Energy Consumption | Data centers require significant power. | Data centers consume 1-2% of global electricity. |

| E-waste | Digital devices generate electronic waste. | E-waste generation: 62 million metric tons (2022). US e-waste recycling 15-20% (2024). |

| Sustainability Trends | Demand for eco-friendly digital practices grows. | Green building materials market: $362.3 billion (2024), projected to $650.7B (2032). |

PESTLE Analysis Data Sources

The Chegg PESTLE Analysis draws upon financial reports, governmental data, market research, and technological forecasts.