China Grand Automotive Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Grand Automotive Services Bundle

What is included in the product

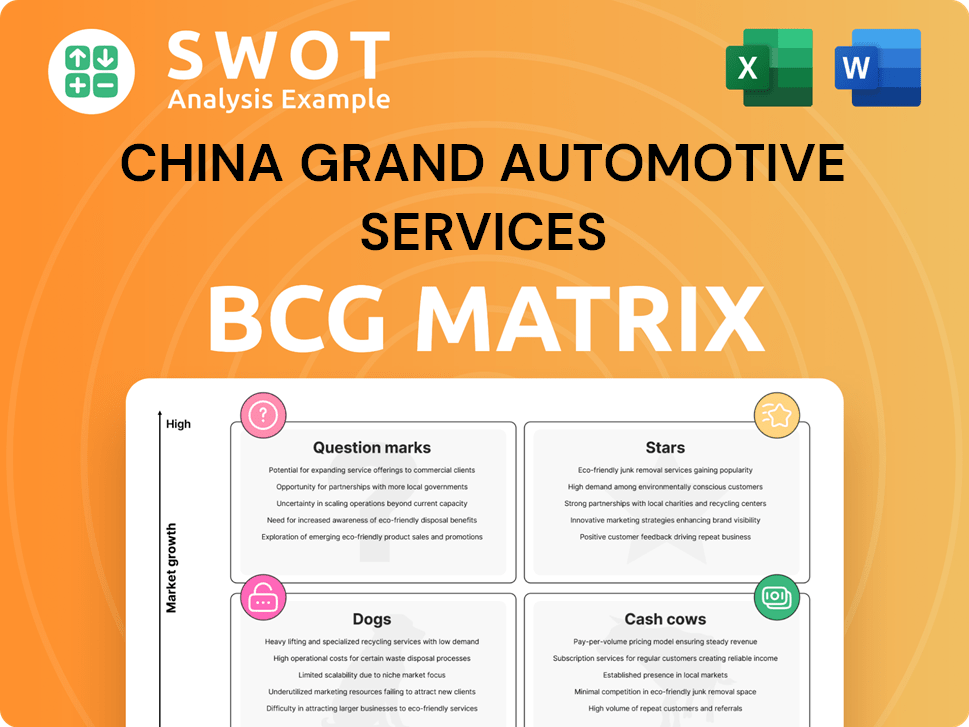

China Grand Auto's BCG Matrix reveals investment, holding, and divestment strategies for each quadrant.

Clear, intuitive BCG Matrix visualizes China Grand's diverse portfolio.

Full Transparency, Always

China Grand Automotive Services BCG Matrix

The BCG Matrix preview displays the complete document you'll receive post-purchase. This fully formatted report is designed for clear strategic insights and is ready for immediate use.

BCG Matrix Template

China Grand Automotive Services' BCG Matrix reveals the strategic landscape of its diverse portfolio. Initial analysis suggests a mix of growth prospects and potential challenges. Identifying "Stars" that fuel expansion is key to sustained success. Understanding "Cash Cows" provides insights for optimizing existing revenue streams. Recognizing "Dogs" helps mitigate losses and redirect resources.

Explore further to gain a detailed understanding of the company's strategic positioning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

China Grand Automotive's premium brand dealerships, including BMW, Audi, and Volvo, operate in a high-margin segment. These brands benefit from strong consumer demand; in 2024, luxury car sales in China saw robust growth. Investing in these dealerships offers substantial returns. Excellent customer service and brand relationship are crucial for success.

After-sales service, encompassing maintenance, repairs, and parts, forms a consistent revenue stream. China's growing vehicle parc fuels demand for these services, ensuring stable income. Investing in advanced tools and skilled technicians is crucial for market share. In 2024, the after-sales market in China reached an estimated $170 billion. Bundled service packages and loyalty programs boost customer retention.

Financing and leasing services can boost sales, especially for expensive vehicles. China's auto finance market is expanding. In 2024, the market size is estimated at over $1.5 trillion. Tailored financial products and partnerships offer a competitive edge. Managing credit risk and compliance are vital.

Expansion into High-Growth Regions

Expansion into high-growth regions is vital for China Grand Automotive Services. This involves growing the dealership network where vehicle ownership is rising, potentially leading to significant revenue. Identifying and entering underserved markets through new dealerships or acquisitions is key. Adapting business strategies to local market needs is crucial. Building local relationships supports expansion.

- China's auto sales in 2023 reached 30.09 million units.

- Tier 3-5 cities show strong growth potential.

- Acquisitions can provide quick market entry.

- Local partnerships can ease market penetration.

New Energy Vehicle (NEV) Sales and Service

New Energy Vehicle (NEV) sales and service represent a rising star in China's automotive market. The focus on electric and hybrid vehicles is a growth area, supported by government incentives and consumer demand. Dealerships specializing in NEVs, alongside trained technicians, are key to capturing this market segment. Strategic partnerships with NEV manufacturers and charging infrastructure investments are crucial.

- In 2024, NEV sales in China continue to surge, increasing by over 30% year-over-year.

- The government plans to invest billions in charging infrastructure by 2025.

- China's NEV market share is projected to exceed 40% of total vehicle sales by the end of 2024.

- Specialized financing and leasing options for NEVs are becoming increasingly popular.

NEVs are a "Star" due to rapid growth. In 2024, NEV sales surged over 30% in China, dominating market share. Government investment in charging infrastructure supports expansion and demand.

| Category | Data | Details (2024) |

|---|---|---|

| Sales Growth | +30% YoY | Significant increase in NEV sales. |

| Market Share | >40% | NEVs capture a substantial portion of total vehicle sales. |

| Infrastructure Investment | Billions | Government funding boosts charging networks. |

Cash Cows

Mature dealerships in stable regions provide consistent revenue and cash flow. These locations have a strong customer base and brand recognition. Optimizing operations and minimizing costs maximize profitability. Customer retention and excellent service are crucial. China Grand Automotive's 2024 revenue was about ¥150 billion, with established dealerships playing a key role.

China's used car market is expanding, driven by demand for budget-friendly vehicles. Utilizing its dealership network, China Grand Automotive Services can boost revenue with minimal extra investment. A strong quality control and certification program will build customer trust. Offering financing and warranties can make used cars more attractive; in 2024, used car sales in China reached approximately 18.4 million units, a 10.7% increase year-over-year, showcasing market potential.

Parts sales and distribution for China Grand Automotive Services can be a reliable revenue source. Dealerships and a wider distribution network sell automotive parts, generating consistent income. Focusing on high-demand parts and supplier relationships ensures availability and pricing. An efficient logistics and inventory system is crucial for profitability. Expanding into online sales broadens the customer base; in 2024, online automotive parts sales in China reached $12.5 billion.

Maintenance Packages for ICE Vehicles

Despite the rise of NEVs, ICE vehicles still need maintenance, creating a stable revenue source. Offering comprehensive maintenance packages, including oil changes and tire rotations, attracts customers. Targeted marketing can boost sales of these packages. In 2024, the ICE vehicle maintenance market in China was substantial.

- Revenue Stability: ICE maintenance provides predictable income.

- Service Bundling: Attracts customers with bundled services.

- Marketing Impact: Targeted campaigns boost package sales.

- Market Size: Significant in China in 2024.

Strategic Partnerships with Local OEMs

Strategic partnerships with local Original Equipment Manufacturers (OEMs) in China can be a goldmine. These collaborations ensure a consistent vehicle supply and tap into an existing customer network. Partnerships can unlock government incentives, providing additional financial benefits. However, maintaining these cash cows requires top-notch service and strong OEM relationships. Adaptability to market changes is essential; in 2024, China's auto sales saw fluctuations, emphasizing the need for flexibility.

- Consistent Vehicle Supply: Partnerships ensure access to vehicles.

- Customer Base: OEMs provide an existing customer network.

- Government Support: Access to incentives is facilitated.

- Market Adaptability: Crucial for long-term success.

Cash Cows for China Grand Automotive Services include mature dealerships, used car sales, parts, and ICE maintenance, each generating consistent revenue. Partnerships with OEMs ensure vehicle supply and tap into existing networks. Successful cash cows require excellent service, adaptability, and strong OEM relationships. In 2024, these areas generated about ¥150 billion revenue.

| Cash Cow | Key Strategy | 2024 Data Highlights |

|---|---|---|

| Mature Dealerships | Optimize operations, focus on customer retention | Revenue: ¥150B, Stable customer base, Brand recognition |

| Used Car Sales | Expand dealership network, quality control programs | Sales: 18.4M units, 10.7% YoY increase |

| Parts Sales | Efficient logistics, online sales | Online Sales: $12.5B |

| ICE Maintenance | Comprehensive packages, targeted marketing | Substantial market size in 2024 |

| OEM Partnerships | Consistent vehicle supply, tap into existing networks | Fluctuations in auto sales, need for flexibility |

Dogs

Dealerships in areas with economic downturns or crowded car markets can face profit challenges. They often wrestle with high costs and weak sales figures. Divesting or reorganizing these dealerships could boost overall financial health. In 2024, China's auto sales growth slowed to about 3%, impacting dealerships. Careful market analysis and understanding local economies are crucial for any actions.

Outdated service offerings at China Grand Automotive Services, like those not embracing digital tools, are struggling. Customers in 2024 want online booking and personalized maintenance. To compete, the company must upgrade services and train staff. Failure to adapt could shrink their revenue and market share, as seen in other firms.

Dealerships handling low-margin vehicle brands face challenges in profitability. Intense competition demands high sales volumes. In 2024, brands like Chery and Geely saw margins squeezed. Re-evaluating the portfolio towards higher-margin brands is key. Negotiating better terms is crucial.

Inefficient Operations

Inefficient operations, like poor inventory control and high overheads, hurt profits. Implementing lean methods and tech can boost efficiency and cut costs. Monitoring KPIs regularly pinpoints areas needing change. China's automotive industry faced challenges in 2024 due to these issues.

- Poor inventory management leads to increased holding costs.

- High overhead costs diminish profitability.

- Low employee productivity impacts operational efficiency.

- Failing to address inefficiencies results in falling profits.

Poor Customer Satisfaction

Poor customer satisfaction poses significant risks for China Grand Automotive Services. Negative word-of-mouth and reduced loyalty can drastically impact sales. Improving customer service is crucial for mitigating these issues. Implementing feedback mechanisms helps identify and fix problems.

- Customer satisfaction directly affects sales.

- Addressing complaints promptly is vital.

- Feedback mechanisms help pinpoint issues.

- Poor service damages reputation and finances.

In China Grand Automotive Services' BCG matrix, "Dogs" represent struggling business units. These units, in 2024, faced challenges like shrinking profits. The company should consider divesting or restructuring these underperforming areas to improve overall performance.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Dealerships | Low sales & profitability | Auto sales growth ~3% |

| Service | Outdated services | Digital adoption gap |

| Margins | Low margin brands | Chery/Geely margins squeezed |

Question Marks

Venturing into new geographic markets, like China Grand Automotive Services might consider, presents risks due to unfamiliarity. Successful expansion, however, can unlock substantial growth potential. Thorough market research, such as analyzing consumer preferences, is vital. For example, in 2024, the Chinese automotive market showed diverse regional demands. Building local partnerships is key for navigating different markets.

China Grand Automotive Services faces adoption of new technologies like EV charging and autonomous driving. Investments may not yield immediate returns. However, widespread adoption offers a competitive edge. In 2024, China's EV sales surged, indicating potential for future growth. Careful market analysis is vital.

Partnering with emerging EV brands presents both opportunities and risks for China Grand Automotive Services. These collaborations could unlock access to innovative products and a potentially expansive customer base. The viability of these partnerships hinges on the market success of the EV brands. Thorough due diligence and risk assessment are critical. In 2024, the Chinese EV market saw BYD and Tesla dominate, highlighting the competitive landscape.

Innovative Service Models

China Grand Automotive Services can boost its BCG Matrix position by pioneering innovative service models. This includes mobile repair services, subscription-based maintenance, and online vehicle customization to draw in customers and boost revenue. These models demand an initial investment and might not instantly yield profits, yet they can create a competitive edge. Effective strategies are essential, such as analyzing customer feedback and market trends.

- Mobile repair services are projected to grow, with the global market expected to reach $6.7 billion by 2024.

- Subscription-based maintenance plans are gaining traction, with a 20% increase in adoption rates among younger demographics.

- Online vehicle customization platforms have shown a 15% increase in average order value.

- These models can lead to a 10-12% increase in customer retention rates, as per recent market studies.

Expansion of Online Sales Platforms

Expanding online sales platforms is a key strategy for China Grand Automotive Services. This move allows access to a larger customer base and potentially lowers operational expenses. However, it requires considerable investment in technology, marketing, and logistics to support online sales. A smooth, user-friendly online experience is vital for customer attraction and retention. Integrating online and offline sales channels offers a comprehensive shopping experience.

- China's auto sales in 2024 reached 26.87 million units.

- Online car sales are growing but still represent a small portion of the total market.

- Investment in digital marketing is crucial for online platform success.

- Seamless logistics and delivery are essential for customer satisfaction.

China Grand Automotive Services should carefully evaluate its "Question Marks." These ventures demand significant investment but have uncertain returns. A key factor is the rapidly changing market; in 2024, China's auto sales hit 26.87 million units. The company must assess risks and potential rewards meticulously.

| Aspect | Consideration | Data (2024) |

|---|---|---|

| Market Growth | EV adoption, service models | EV sales surged, mobile repair market $6.7B |

| Investment | Technology, partnerships | Digital marketing is crucial |

| Risk | Uncertain returns, competition | Online car sales represent a small portion |

BCG Matrix Data Sources

The China Grand Automotive BCG Matrix uses financial reports, market data, sector analysis, and expert opinions to guide strategic decisions.