China Grand Automotive Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Grand Automotive Services Bundle

What is included in the product

Helps see how external factors shape China Grand's competitive dynamics.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

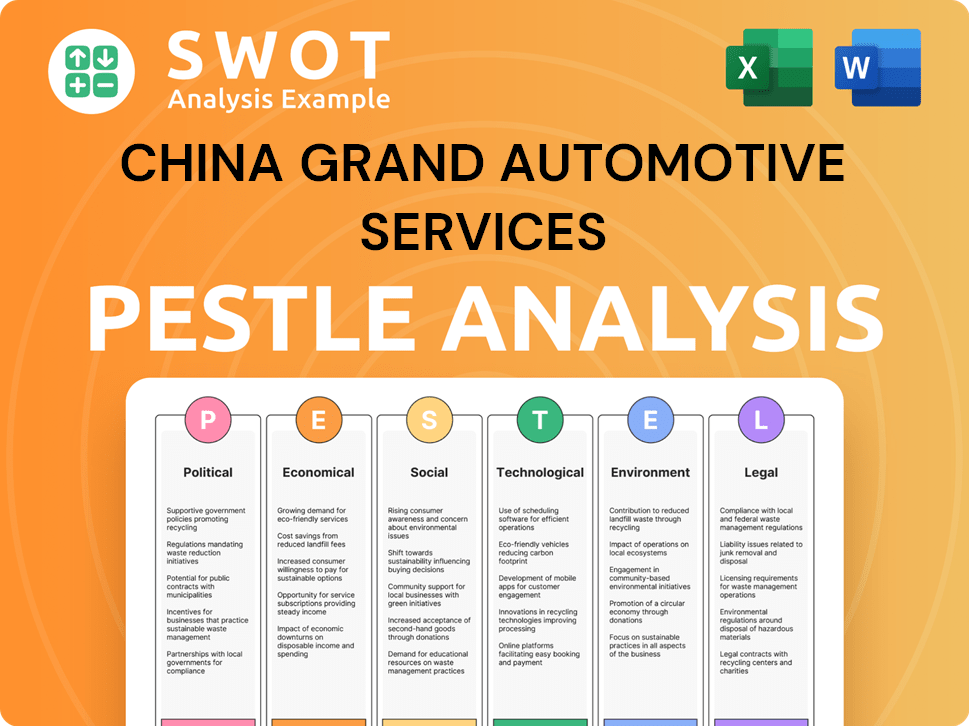

China Grand Automotive Services PESTLE Analysis

Preview our China Grand Automotive PESTLE analysis now. This comprehensive document details political, economic, social, technological, legal, & environmental factors. The format, content, and analysis presented are the exact ones you'll get.

PESTLE Analysis Template

Navigating the automotive industry's complexities requires keen awareness of external factors, and understanding these is crucial for China Grand Automotive Services' success. Our PESTLE analysis unpacks key political, economic, social, technological, legal, and environmental influences shaping its operations. Gain a comprehensive understanding of how these forces are affecting market dynamics, customer preferences, and competitive positioning. This will reveal growth opportunities and potential risks, ensuring data-driven decision-making.

Our expert-crafted report provides a deep dive into the external landscape. Get your complete PESTLE Analysis now for a detailed look!

Political factors

The Chinese government's focus on the automotive sector, especially NEVs, shapes market dynamics. In 2024, NEV sales in China reached 9.5 million units. Subsidies and tax breaks significantly boost consumer demand. These policies directly affect China Grand Automotive Services' sales, with NEVs accounting for a growing share of their revenue. Trade-in programs further influence sales volumes.

Trade tensions, including tariffs, can hinder China's vehicle exports. Although China Grand focuses domestically, global trade affects brands and market competitiveness. For instance, in 2024, the US imposed tariffs on certain Chinese EVs. These policies influence vehicle availability and prices. The EU is also considering tariffs, impacting the sector.

China's 'Made in China 2025' initiative, launched in 2015, heavily influences the automotive sector. This strategy boosts domestic innovation, particularly in electric vehicles (EVs). The government aims for EVs to make up 40% of new car sales by 2030.

This push favors domestic manufacturers, potentially increasing competition for China Grand Automotive Services. The initiative supports technological advancements, which could lead to more sophisticated vehicles.

Regulatory Environment

China's automotive regulatory environment is dynamic, impacting firms like China Grand Automotive Services. This includes stringent emission standards and safety protocols. Compliance is crucial for sales and service operations. The Chinese government's focus on electric vehicles (EVs) influences the market.

- In 2024, China's NEV sales reached 9.5 million units.

- New regulations in 2025 are expected to tighten emission controls.

- Consumer protection laws are constantly updated.

Local Government Policies

Local government policies significantly influence China Grand Automotive Services. These policies include purchase restrictions and subsidies. Regional variations necessitate strategy adaptation for its dealerships. For instance, in 2024, Shanghai offered EV subsidies. These local incentives boosted EV sales.

- Regional policies impact sales strategies.

- Subsidies affect consumer purchasing decisions.

- Adaptation to local rules is crucial.

- EV incentives boost the market.

The Chinese government's strategic emphasis on NEVs significantly impacts the automotive market. In 2024, NEV sales reached 9.5 million units. This is further bolstered by government subsidies and tax incentives. Ongoing trade policies, including potential tariffs, pose external risks to the sector.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| NEV Focus | Boosts Sales, Market Share | 9.5M NEV sales in 2024. 40% EV target by 2030. |

| Trade Policies | Impacts vehicle exports, Prices | US Tariffs on Chinese EVs (2024), EU discussions on tariffs. |

| Regulations | Compliance costs, market access | Emission standards tightened in 2025, focus on EV tech advancements |

Economic factors

China's economic growth rate directly impacts vehicle demand and consumer spending. Recently, the economy faces challenges, with growth around 5.2% in 2023. Government efforts and domestic demand strategies are crucial. China Grand's success correlates with the overall economic health.

Consumer confidence significantly influences China Grand Automotive Services. High consumer confidence, fueled by rising incomes and stable employment, encourages spending on vehicles. In 2024, China's retail sales of passenger vehicles showed fluctuations, reflecting shifts in consumer sentiment. Changes in spending habits directly affect the company's sales.

Intense competition in China's auto market has caused price wars, with manufacturers slashing prices. This squeezes profit margins for dealerships like China Grand Automotive Services. In 2024, new car prices dropped by an average of 5-7% due to these battles.

Dealerships must adjust pricing and emphasize value-added services to compete. China's auto sales in 2024-2025 are projected to grow by only 3-5%, making the competition even fiercer. This requires strategic financial planning.

Availability of Financing and Credit

Access to financing and the cost of credit are crucial for car purchases, significantly impacting consumer behavior. Interest rate adjustments and lending policy alterations directly influence vehicle affordability. In 2024, China's People's Bank maintained a benchmark lending rate of 3.45%, impacting car loan costs. China Grand Automotive Services, with its financing offerings, is highly sensitive to these financial market conditions.

- Car loan rates are influenced by the People's Bank of China's policies.

- Changes in interest rates affect consumer demand for vehicles.

- China Grand's financial performance correlates with credit market dynamics.

- Government lending policies can stimulate or restrict car sales.

Used Car Market Development

The burgeoning used car market in China presents a dynamic economic factor. Its expansion may influence the new car sales landscape, offering consumers more options. China Grand Automotive Services' involvement in this sector is significant, reflecting market shifts. The used car market's growth could impact trade-in values and consumer behavior.

- In 2024, China's used car sales volume reached approximately 18.5 million units.

- The used car market's value in China is projected to exceed $300 billion by 2025.

- China Grand Automotive Services reported a 15% increase in used car sales revenue in the first half of 2024.

China's economic stability profoundly impacts vehicle demand, with 5.2% growth in 2023. Consumer confidence shifts with income, directly influencing car sales trends in 2024.

Competition and price wars cut profit margins, car prices decreased by 5-7% in 2024. Projected auto sales growth of only 3-5% intensifies the fight, needing strategic plans.

Credit access and rates, set at 3.45% by People's Bank, heavily affect affordability and demand. China's used car market, with 18.5M sales in 2024, adds an economic dimension.

| Economic Factor | Impact | Data (2024-2025) |

|---|---|---|

| GDP Growth | Vehicle demand | 5.2% (2023), projected slow growth. |

| Consumer Confidence | Spending on cars | Fluctuating, influenced by income |

| Auto Price Competition | Profit Margins | New car prices dropped 5-7%. |

Sociological factors

China's consumers increasingly favor New Energy Vehicles (NEVs), especially BEVs. In 2024, NEV sales surged, accounting for over 30% of total vehicle sales. Environmental concerns and tech innovations fuel this trend. China Grand must adjust its offerings, potentially expanding its NEV portfolio to meet demand.

China's urbanization fuels personal transport demand. Traffic and parking pose challenges. Infrastructure, like EV charging, is key. In 2024, China's urban population hit ~65%. China Grand's locations reflect these trends. Investment in urban infrastructure reached ~$2.8T in 2024.

China's rising middle class fuels demand for vehicles. With increased disposable income, more can afford cars. This growing consumer base is a key market for China Grand Automotive. In 2024, middle-class spending rose by 6%, driving car sales.

Influence of Digitalization and Connectivity

Digitalization profoundly impacts Chinese consumers, who now demand advanced tech integration in vehicles and purchasing experiences. Online research, digital showrooms, and connected car features are becoming standard expectations. China Grand Automotive Services must digitally transform its sales and services to remain competitive, aligning with evolving consumer preferences. For instance, in 2024, over 70% of Chinese car buyers used online resources during their purchase journey.

- 70% of Chinese car buyers used online resources in 2024.

- Digital showrooms and connected car features are increasingly expected.

- China Grand needs to adopt digital transformation.

Brand Perception and Loyalty

Brand perception and customer loyalty are critical in China's automotive market. Consumers' purchasing decisions are heavily influenced by the reputation of both domestic and international automotive brands. China Grand Automotive Services' performance is directly tied to the perception and success of the brands it represents. A strong brand image leads to higher sales and customer retention.

- In 2024, brand loyalty in China's automotive sector remained significant, with repeat purchases accounting for about 30% of sales.

- International brands often face challenges due to negative perceptions in areas like after-sales service, which is a key focus for companies like China Grand.

- China Grand's success depends on how well it manages the brand image and customer experience across its dealerships.

Societal shifts profoundly impact the automotive sector. Consumers favor EVs, driven by environmental and tech advances; in 2024, NEV sales surged over 30%. Urbanization and a rising middle class boost vehicle demand, yet digital integration is vital for competition, as over 70% use online resources. Brand image and customer experience determine success.

| Factor | Impact | Data (2024) |

|---|---|---|

| NEV Adoption | Rising demand for EVs. | NEV sales share: >30% |

| Urbanization | Growth in vehicle needs; infrastructure needs | Urban pop.: ~65%; Urban spending: ~$2.8T |

| Digitalization | Tech integration; online purchase influence. | 70% buyers use online resources. |

Technological factors

Significant advancements in NEV tech, including battery tech, charging infrastructure, and vehicle performance, are transforming the automotive market in China. This rapid technological progress is a key driver of NEV adoption; in 2024, NEV sales in China reached 9.5 million units. China Grand Automotive Services must offer the latest NEV models and services to stay competitive. The NEV market share is projected to reach 40% by the end of 2025.

The rise of autonomous driving and ADAS is transforming the automotive sector. Chinese automakers are heavily investing in these technologies, with significant growth expected in 2024 and 2025. China Grand Automotive Services must adapt by offering services for vehicles with these advanced systems. This includes providing specialized training and equipment. By 2025, the ADAS market in China is projected to reach billions of dollars.

Technology drives the digitalization of automotive sales and services. Online configurations and service bookings are becoming standard. China Grand can boost efficiency, improve customer experience, and expand its reach. For instance, online car sales in China grew by 20% in 2024.

Vehicle Connectivity and Infotainment Systems

Modern vehicles in China feature advanced connectivity, including infotainment systems and smart device integration. This trend necessitates that dealerships like China Grand Automotive Services possess the technical capabilities to service these systems. The company must invest in comprehensive training for its staff to stay updated on the latest in-car technologies. This ensures they can effectively support and maintain increasingly complex vehicle systems.

- China's connected car market is projected to reach $90 billion by 2025.

- Over 80% of new vehicles sold in China feature some form of connectivity.

- Dealerships are seeing a 20% increase in service requests related to infotainment systems.

Manufacturing and Supply Chain Technology

Technological shifts in automotive manufacturing and supply chains significantly affect vehicle and part costs. Efficiency boosts in production and logistics directly influence market competitiveness. China's automotive industry saw robust growth; sales reached 26.9 million units in 2023, a 12% increase year-over-year, highlighting the impact of these advancements. China Grand Automotive Services, though a service provider, is indirectly impacted by these upstream tech developments.

- Automotive sales in China hit 26.9 million units in 2023.

- Year-over-year growth in sales was 12%.

Technological factors drive China's auto market evolution, with NEVs leading. Digital sales and services are growing rapidly, like 20% in 2024 online. Connectivity and manufacturing advances boost efficiency.

| Technology | Impact | Data |

|---|---|---|

| NEV Adoption | Market transformation | 9.5M units in 2024 sales |

| Autonomous Driving | Service adaptation | Billions market by 2025 |

| Digitalization | Efficiency & reach | 20% growth in online sales |

Legal factors

China's automotive sector faces strict legal controls on manufacturing, sales, and services. Regulations ensure fair play, product quality, and consumer protection. China Grand must comply fully to these rules in all activities. For example, in 2024, regulatory fines in the automotive sector totaled nearly $1.5 billion due to non-compliance issues.

China's consumer protection laws are crucial for vehicle buyers, covering warranties and dispute resolution. China Grand Automotive Services must strictly adhere to these laws. In 2024, the China Consumers Association received over 1 million complaints related to the automotive industry. These laws impact how China Grand handles customer issues.

China's strict environmental rules and vehicle emissions standards significantly affect the automotive industry. These regulations, like the China VI emission standard, impact the types of vehicles available. China Grand must offer compliant services. In 2024, the government increased penalties for non-compliance.

Laws on Data Security and Privacy

Data security and privacy laws are critical due to the digital nature of modern vehicles. China has strengthened its data regulations, impacting the automotive industry. China Grand Automotive Services must adhere to these rules to protect customer data. Compliance involves careful data collection, storage, and usage practices.

- China's Personal Information Protection Law (PIPL) is a key regulation.

- The Cybersecurity Law of China (CSL) also plays a significant role.

- These laws influence how companies handle customer data.

- Fines for non-compliance can be substantial, reaching millions of RMB.

Franchise and Dealership Laws

China's legal environment significantly influences China Grand Automotive Services, particularly through franchise and dealership laws. These regulations dictate the terms of agreements between manufacturers and dealerships, impacting operations directly. For example, the "Measures for the Administration of Automobile Sales" (2017) set standards for sales and service. Any updates in 2024/2025 would be crucial.

Dealership agreements, including territorial rights and performance standards, are key aspects governed by these laws. Compliance is vital for maintaining operational licenses and avoiding penalties. In 2023, the automotive industry saw over ¥4 trillion in sales, highlighting the stakes. Any adjustments in these laws can shift market dynamics.

These laws affect China Grand's ability to negotiate contracts and manage its dealer network effectively. Changes in regulations can also influence investment decisions and strategic planning. The Ministry of Commerce (MOFCOM) often updates these regulations. Consider the potential impacts of new rules regarding electric vehicle dealerships.

The legal framework dictates the rights and obligations of both manufacturers and dealers, shaping market competition. Understanding these laws is crucial for strategic planning and risk management. The industry faces changes, with new regulations on after-sales service quality. The company must stay updated to comply and thrive.

Staying compliant involves monitoring regulatory changes and adapting business practices accordingly. Non-compliance can lead to significant financial and operational consequences. The China Automobile Dealers Association (CADA) provides insights into these legal developments. Recent statistics show the industry's ongoing evolution.

China Grand must adhere to stringent laws regulating the automotive sector, focusing on fair play and consumer protection. Consumer protection laws influence how China Grand manages warranties and disputes, with over 1 million automotive-related complaints in 2024. Data security and privacy laws are also crucial due to the digital nature of modern vehicles; companies must comply with regulations like PIPL and CSL to protect customer data.

| Legal Area | Regulation Example | Impact on China Grand |

|---|---|---|

| Consumer Protection | Warranty Law | Must comply with warranty terms. |

| Data Security | PIPL, CSL | Secure customer data. |

| Dealership | "Measures for Automobile Sales" | Influence contract negotiation. |

Environmental factors

China's government enforces strict environmental policies. These include carbon emission cuts and the promotion of New Energy Vehicles (NEVs). The government's push impacts the automotive market. In 2024, NEV sales in China reached 9.5 million units. China Grand aligns with these goals, focusing on NEVs.

Air pollution remains a major challenge in China, driving stringent vehicle emission rules. These regulations, like China VI, influence the types of cars customers want and the standards China Grand Automotive Services must adhere to. The government's push for electric vehicles (EVs) is evident; in 2024, EVs accounted for over 30% of new car sales. This shift affects China Grand's vehicle offerings and investments.

The build-out of charging stations is vital for EV adoption. Consumer EV purchases are directly linked to charging station availability. China Grand Automotive Services' EV market success hinges on this infrastructure. China's charging infrastructure grew by 57.5% in 2023, with over 2.3 million public chargers. The government aims for 12 million chargers by 2025.

Sustainability in the Automotive Supply Chain

The automotive industry faces growing scrutiny regarding its environmental footprint. This extends to the supply chain, impacting material sourcing, production, and recycling. China Grand Automotive Services, though focused on sales, is connected to this ecosystem. Sustainability trends influence the industry, affecting business practices.

- China's auto sales reached 23.04 million units in 2023.

- China aims for NEV sales to reach 45% of new car sales by 2027.

Consumer Environmental Awareness

Consumer environmental awareness in China is rapidly increasing, influencing automotive choices. Demand for NEVs and fuel-efficient vehicles is surging. China Grand Automotive Services benefits from this shift toward greener options.

- NEV sales in China surged in 2024, with approximately 9.5 million units sold.

- Consumer preference for EVs is rising due to government incentives and environmental concerns.

- China's commitment to carbon neutrality by 2060 further boosts the NEV market.

China’s stringent environmental policies significantly impact the automotive sector, driving the shift towards NEVs. The government's commitment to carbon neutrality by 2060 fuels NEV market growth. China Grand aligns with this green shift.

Air quality regulations and consumer preferences are key, promoting fuel-efficient vehicles and EVs, influencing offerings and investments. The build-out of charging infrastructure directly affects EV adoption.

| Aspect | Impact | Data |

|---|---|---|

| NEV Sales | Increase demand | 9.5M units in 2024 |

| Charging Stations | Influence EV adoption | 2.3M public chargers in 2023 |

| Emission Standards | Dictate compliance | China VI regulations |

PESTLE Analysis Data Sources

The China Grand Automotive Services PESTLE analysis utilizes data from governmental statistics, market reports, and industry publications. This includes data from both international and domestic institutions.