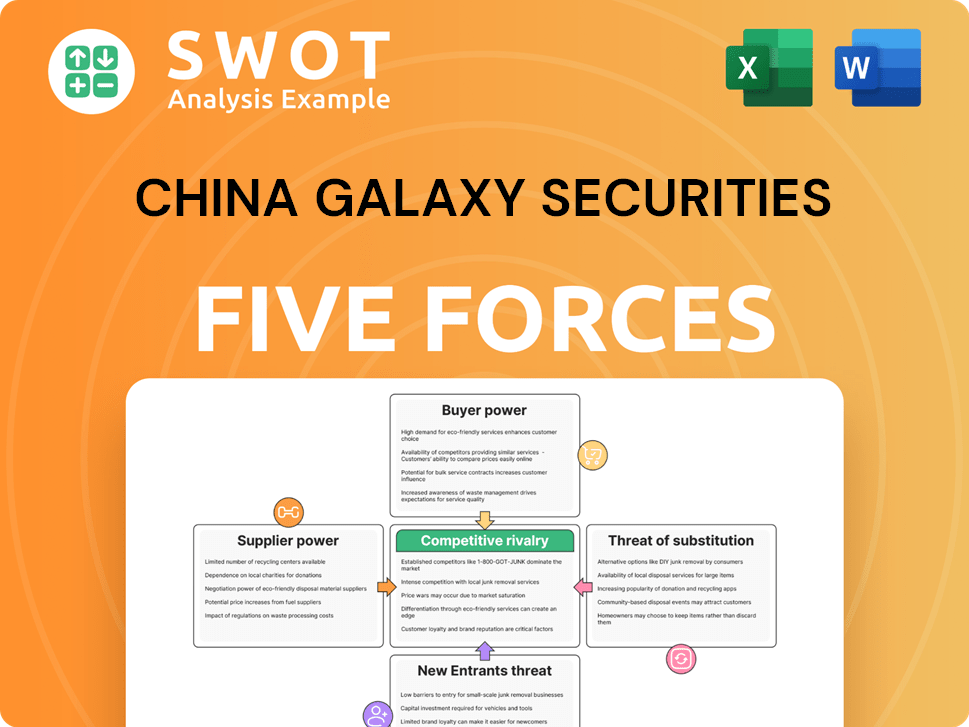

China Galaxy Securities Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Galaxy Securities Bundle

What is included in the product

Analyzes China Galaxy Securities' competitive forces, supplier & buyer power, & entry barriers.

Customize competitive pressure levels based on your data and evolving market trends.

What You See Is What You Get

China Galaxy Securities Porter's Five Forces Analysis

This is the complete analysis of China Galaxy Securities using Porter's Five Forces. It explores competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. The presented analysis provides a detailed examination of each force impacting the company's strategic position. This document offers insights into market dynamics and competitive pressures. The preview is the exact document you will receive after purchasing.

Porter's Five Forces Analysis Template

China Galaxy Securities faces intense competition within the dynamic Chinese financial market. Its bargaining power of suppliers is moderate, influenced by the availability of technology and regulatory compliance. The threat of new entrants remains significant, fueled by digital innovation and foreign investment. Buyer power is high, given diverse investment options and market information access. Substitute products and services, particularly fintech offerings, pose a constant threat. Understand how these forces shape the company; unlock the full Porter's Five Forces Analysis to explore China Galaxy Securities’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The financial services industry in China, including China Galaxy Securities, struggles with a shortage of qualified personnel. This limited supply boosts the bargaining power of recruitment agencies and training providers. In 2024, the average salary for financial analysts in China rose by 8%, reflecting this demand. China Galaxy Securities needs to focus on employee development to retain talent, which may increase operational costs.

China Galaxy Securities heavily depends on tech vendors for its core operations. This reliance includes trading platforms, risk management, and cybersecurity. If a few vendors control these key technologies, they gain significant bargaining power. For instance, in 2024, cybersecurity spending in China reached $11.5 billion, highlighting vendor influence.

Access to real-time data is crucial for China Galaxy Securities' operations. Providers such as Bloomberg and Refinitiv hold considerable sway, offering comprehensive data services. In 2024, Bloomberg's revenue was approximately $13.3 billion. Negotiating deals and using other data sources can help manage costs. The financial data market is highly competitive, with prices for data subscriptions varying widely.

Regulatory Compliance Costs

China Galaxy Securities faces increased costs due to regulatory compliance. Specialized legal and consulting services for financial regulations drive up expenses. Firms with expertise in Chinese regulations charge substantial fees, impacting profitability. Building internal compliance teams offers a cost-saving approach. In 2024, compliance costs for financial institutions in China rose by approximately 15%.

- Compliance costs are increasing for China Galaxy Securities.

- Specialized services are needed.

- Internal expertise can reduce costs.

- Compliance costs rose by 15% in 2024.

Software Licensing Fees

The financial sector, including China Galaxy Securities, depends on software licensing for operations. Software vendors can wield substantial power through these agreements. In 2024, the global software market is projected to reach $750 billion. China Galaxy Securities can negotiate enterprise-wide licenses to lower expenses. Open-source alternatives also provide cost-saving opportunities.

- Software licensing costs can represent a significant portion of IT budgets, with some financial institutions spending over 10% of their IT budget on software licensing.

- Enterprise-wide licensing deals can provide discounts of up to 20-30% compared to individual licenses.

- The open-source software market is growing rapidly, with a 2024 projected market size of $40 billion.

China Galaxy Securities deals with powerful suppliers in various areas. Recruitment agencies' bargaining power is high due to the talent shortage, with salaries up 8% in 2024. Tech vendors, offering core technologies, also hold sway; cybersecurity spending in China hit $11.5B in 2024. Data providers like Bloomberg and Refinitiv have significant influence, too.

| Supplier Type | Impact on CG Securities | 2024 Data |

|---|---|---|

| Recruitment Agencies | High; talent scarcity | Analyst salaries +8% |

| Tech Vendors | High; core tech reliance | Cybersecurity spend: $11.5B |

| Data Providers | High; data dependency | Bloomberg Revenue: $13.3B |

Customers Bargaining Power

Both individual and institutional clients of China Galaxy Securities exhibit price sensitivity, readily moving to rivals with more attractive brokerage fees or interest rates. To stay competitive, China Galaxy Securities must balance pricing with value-added services. In 2024, the brokerage market saw a shift, with average commission rates decreasing by 10-15%. Differentiating services and cultivating robust client relationships help mitigate price sensitivity.

China Galaxy Securities faces increased customer bargaining power as clients seek personalized financial services. This trend necessitates investments in technology and expert advisors. The firm must customize its offerings to retain clients and compete effectively. In 2024, the wealth management sector in China saw a 15% rise in demand for tailored financial plans.

Customers of China Galaxy Securities possess considerable bargaining power due to readily available financial information. Online platforms and research tools provide clients with data for informed decisions, reducing dependence on the firm. In 2024, the firm saw a 15% increase in online trading accounts, highlighting this shift. China Galaxy Securities must offer top-tier services to maintain its value proposition.

Switching Costs are Low

Switching costs in the financial services sector are low, allowing clients to easily switch to competitors. This puts pressure on firms like China Galaxy Securities to maintain client satisfaction. To retain clients, China Galaxy Securities needs to focus on strong client retention strategies. For instance, in 2024, the average customer churn rate in the brokerage industry was about 5%.

- Client satisfaction initiatives are crucial to reduce churn.

- Loyalty programs can incentivize customers to stay.

- Personalized service builds stronger client relationships.

- Proactive communication addresses client concerns promptly.

Rise of Robo-Advisors

The rise of robo-advisors has significantly increased the bargaining power of customers by offering lower-cost alternatives to traditional financial advisors. China Galaxy Securities can leverage this by integrating robo-advisory services to attract and retain clients. This hybrid approach can cater to diverse client needs, especially those with smaller portfolios, enhancing competitiveness. Data from 2024 shows a 20% increase in robo-advisor adoption among millennials.

- Robo-advisors offer cost-effective solutions.

- Hybrid models can attract and retain clients.

- Millennials are increasingly adopting robo-advisors.

- China Galaxy Securities can adapt to this trend.

China Galaxy Securities faces strong customer bargaining power, driven by price sensitivity and easy switching to competitors. Clients are informed and seek personalized services, increasing demand for tailored financial plans. To retain clients, China Galaxy Securities must focus on value-added services and client satisfaction initiatives.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Average commission rates decreased 10-15% |

| Personalization | Increasing Demand | 15% rise in demand for tailored plans |

| Switching Costs | Low | Average churn rate ~5% |

Rivalry Among Competitors

China's securities market is fiercely competitive, with approximately 140 firms. This rivalry drives price wars and aggressive underwriting. China Galaxy Securities needs to differentiate. Consider mergers and acquisitions for market share. In 2024, the top 10 firms controlled about 60% of the market.

The brokerage market in China is fragmented, heightening competition. This is despite efforts to consolidate the industry. To succeed, China Galaxy Securities should concentrate on niche markets. Focusing on specialized services or client segments can offer a competitive advantage. The top 10 brokers held about 60% of the market share in 2024.

China Galaxy Securities faces pricing pressures, as firms lower fees to attract clients, squeezing profit margins. Aggressive underwriting and low fees heighten risks; for example, in 2024, the securities industry saw decreased profitability due to fee compression. Balancing competitive pricing with sustainable profitability is crucial for survival. The firm must monitor its pricing strategy. The securities industry's net profit decreased by 3% in 2024.

Regulatory Scrutiny

Regulatory scrutiny adds pressure to China Galaxy Securities, especially as regulators monitor competition and underwriting standards. Compliance is essential to avoid penalties, impacting operational costs and profitability. In 2024, the China Securities Regulatory Commission (CSRC) increased oversight, focusing on risk management. Maintaining high ethical standards and transparency builds client trust, vital in a regulated market.

- CSRC intensified inspections in 2024, leading to increased compliance costs.

- Non-compliance can result in significant fines and operational restrictions.

- Transparency and ethical practices are key for maintaining investor confidence.

- Stringent regulations can limit strategic flexibility and market expansion.

Consolidation Trend

The Chinese securities industry is witnessing a consolidation trend, with larger firms merging to enhance scale and operational efficiency. China Galaxy Securities might need to explore strategic mergers to stay competitive. Integrating acquired entities can unlock synergies and reduce overall costs. This approach is crucial in a market where the top 10 brokers account for over 70% of the market share. Such moves are vital to navigate the evolving regulatory landscape and intensify competition.

- Market consolidation is driven by the need for economies of scale.

- Strategic mergers can lead to improved market positioning.

- Integration efforts can generate cost savings and operational efficiencies.

- Regulatory changes encourage larger, more robust entities.

China Galaxy Securities competes in a crowded market with about 140 firms. Intense rivalry drives pricing wars, and pressures margins. The top 10 brokers held approximately 60% of the market share in 2024.

Regulatory scrutiny, particularly from the CSRC, intensifies. Compliance costs are increasing. Non-compliance results in severe penalties.

The industry is consolidating, with strategic mergers as a key strategy. Consolidation enhances scale. In 2024, mergers were frequent.

| Aspect | Detail | 2024 Data |

|---|---|---|

| Market Share (Top 10 Brokers) | Percentage of market controlled | ~60% |

| Industry Profitability | Net profit change | -3% |

| CSRC Oversight | Regulatory focus | Increased Risk Management |

SSubstitutes Threaten

Direct online trading platforms pose a significant threat to China Galaxy Securities. These platforms provide a direct alternative to traditional brokerage services, appealing to tech-savvy investors. To compete, China Galaxy Securities needs to enhance its online offerings. For instance, in 2024, platforms like Futu and Tiger Brokers saw a substantial increase in user activity, showcasing the demand for sophisticated online trading tools. Investing in user-friendly interfaces and advanced tools is crucial to attracting and retaining clients.

Robo-advisors, offering automated investment advice at lower costs, pose a threat to traditional brokerage services. In 2024, the assets under management (AUM) by robo-advisors globally reached approximately $1.5 trillion. China Galaxy Securities could integrate robo-advisory services. A hybrid model combining human expertise with automated advice could cater to a wider client base, potentially mitigating this threat.

Fintech firms are rapidly launching innovative financial products, offering alternatives to traditional services. China Galaxy Securities faces the challenge of adapting to these fintech advancements to stay competitive. Embracing fintech, through partnerships or acquisitions, can broaden service portfolios and access new customer segments. For instance, the Chinese fintech market reached $3.5 trillion in 2024, highlighting the urgency for traditional firms to evolve.

Passive Investment Options

The proliferation of passive investment options, such as exchange-traded funds (ETFs), poses a significant threat to traditional asset management. These low-cost alternatives compete directly with actively managed funds, potentially diminishing demand for services offered by firms like China Galaxy Securities. To mitigate this threat, China Galaxy Securities can expand its ETF offerings, providing investors with more passive investment choices. This strategic move allows the firm to capture a broader market segment and meet the evolving investor preferences, balancing active and passive investment solutions.

- The global ETF market reached $11.6 trillion in assets under management in 2023.

- In 2024, ETFs saw record inflows, indicating their growing popularity.

- China Galaxy Securities can increase its market share by offering competitive ETFs.

- Diversifying into both active and passive funds can protect against shifts in investor behavior.

Alternative Investments

Alternative investments pose a threat, as options like real estate and private equity can divert funds from traditional securities. China Galaxy Securities could counter this by broadening its investment offerings. This expansion could attract clients seeking higher returns and diversification, especially given the volatility in the stock market. In 2024, the private equity market in China saw significant growth, with deal values reaching billions of dollars, highlighting the appeal of these alternatives.

- Diversification: Alternative investments provide a way to spread risk.

- Higher Returns: These can potentially offer better returns than traditional investments.

- Market Volatility: The stock market's ups and downs push investors toward alternatives.

- China's PE Growth: The private equity market's rise in China shows strong appeal.

Alternative investment products challenge China Galaxy Securities by drawing funds away from traditional securities. To counter this, the firm can diversify its offerings to include real estate and private equity. In 2024, the appeal of alternatives increased as shown by the growing private equity market in China.

| Threat | Impact | Mitigation |

|---|---|---|

| Alternative Investments | Diversion of funds | Expand offerings |

| Real estate, private equity | Attract diverse clients | Increase returns, diversification |

| PE market growth (2024) | High deal values | Adapt to market |

Entrants Threaten

The securities industry is capital-intensive, demanding significant financial resources. This high barrier limits the number of potential new competitors. China Galaxy Securities leverages its substantial capital base, enhancing its market position. In 2024, the securities industry's capital requirements remained a key entry deterrent. Established firms like China Galaxy Securities thus face a reduced threat from new entrants.

China's stringent financial regulations pose a significant barrier to new entrants. Obtaining licenses and approvals is complex, increasing the time and cost for new firms. Regulatory compliance is a major hurdle, as shown by the 2024 financial sector oversight. China Galaxy Securities leverages its expertise in navigating these regulations, giving it a competitive advantage.

China Galaxy Securities, like other established financial institutions, enjoys significant brand loyalty. This existing brand recognition and client trust are substantial barriers for new competitors. Building such brand equity requires considerable time and financial investment, which discourages new entrants. China Galaxy Securities can use its established brand to retain market share. In 2024, brand loyalty continues to be a key differentiator in the competitive landscape of the securities industry.

Economies of Scale

Established firms like China Galaxy Securities enjoy economies of scale, creating a barrier for new competitors. Large-scale operations enable China Galaxy Securities to offer more competitive pricing, a key advantage. In 2024, China's securities firms continue to expand, with total assets reaching an estimated $1.7 trillion USD. Strategic investments in technology and operational efficiency further bolster cost advantages. This allows China Galaxy Securities to maintain profitability even with lower per-unit costs, a tough challenge for new entrants.

- Competitive pricing is a key advantage.

- Total assets reached an estimated $1.7 trillion USD in 2024.

- Technology and operational efficiency investments are crucial.

Access to Distribution Channels

New entrants face significant hurdles accessing distribution channels in the financial services sector. Established firms, like China Galaxy Securities, benefit from their extensive networks of branches and online platforms. These existing channels provide a direct route to clients, offering a competitive advantage. China Galaxy Securities can leverage its established presence to maintain and strengthen its market position against new competitors. Expanding these channels and forming strategic partnerships can further improve market reach and client acquisition.

- China's brokerage industry is highly competitive, with over 100 firms, intensifying the need for strong distribution.

- China Galaxy Securities has a vast network of branches across China, providing a physical presence and direct client access.

- Digital platforms are crucial; China Galaxy Securities likely invests in online trading and mobile apps for wider distribution.

- Strategic partnerships, such as with fintech companies, can broaden distribution channels and reach new customer segments.

The securities industry's high capital requirements and stringent regulations significantly deter new firms. China Galaxy Securities, benefiting from its strong capital base and regulatory expertise, faces a reduced threat. Brand loyalty and economies of scale further fortify its market position, making it challenging for new entrants to compete effectively.

| Barrier | Impact | 2024 Data |

|---|---|---|

| Capital Intensity | Limits new entrants | Industry assets ~$1.7T USD |

| Regulatory Compliance | High entry costs | Complex licensing processes |

| Brand Loyalty | Competitive advantage | Established client trust |

Porter's Five Forces Analysis Data Sources

This analysis uses company filings, industry reports, and financial databases to understand China Galaxy Securities' competitive position. We incorporate regulatory data.