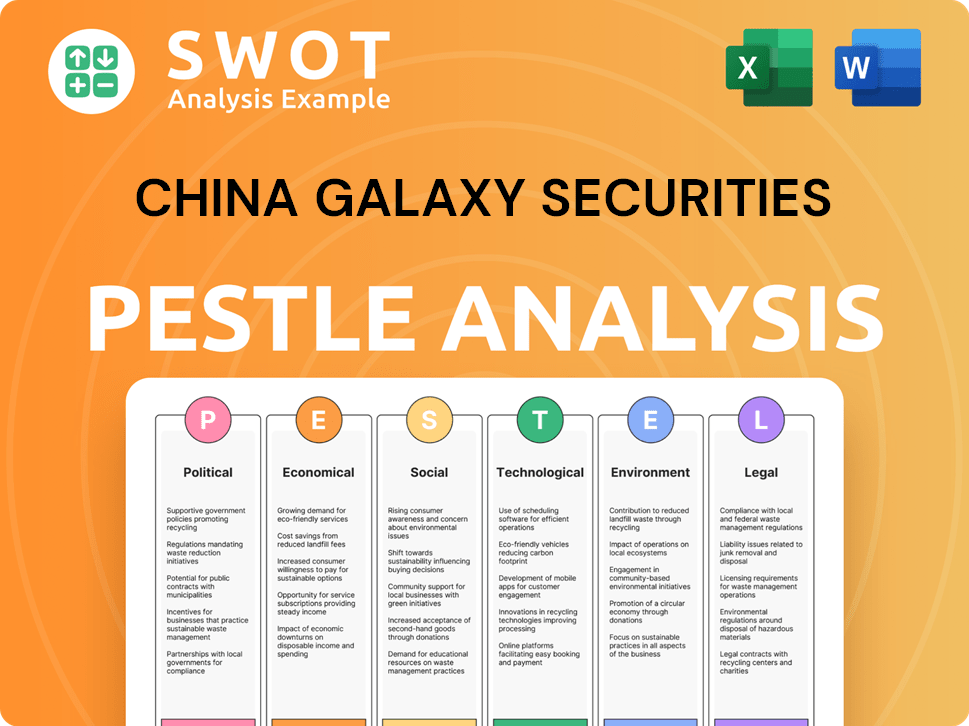

China Galaxy Securities PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Galaxy Securities Bundle

What is included in the product

Explores external macro-environmental impacts on China Galaxy Securities across Political, Economic, etc., factors.

Allows users to modify or add notes specific to their own context, region, or business line.

What You See Is What You Get

China Galaxy Securities PESTLE Analysis

The preview shows the complete China Galaxy Securities PESTLE Analysis.

This includes the document's analysis and presentation style.

You will receive the same professional document after your purchase.

Everything displayed is included, with no changes.

What you see now is the final, downloadable product.

PESTLE Analysis Template

Explore the forces shaping China Galaxy Securities with our PESTLE Analysis. Uncover political risks, economic shifts, and technological impacts. Gain crucial insights into social trends and legal frameworks influencing their strategy. Understand environmental factors impacting their operations and long-term prospects. Arm yourself with knowledge. Get the full, actionable PESTLE Analysis now!

Political factors

The Chinese government's strong influence, via regulatory bodies and policy, is crucial for China Galaxy Securities. Government policies significantly affect market stability. For instance, in 2024, regulatory changes impacted trading volumes and investment strategies. These directives also shape investment focus areas, influencing the firm's strategic decisions.

The stability of China's financial regulatory framework is vital for China Galaxy Securities. Recent regulatory shifts impact its brokerage, investment banking, and asset management divisions. In 2024, China's securities firms saw a 5.8% increase in revenue, influenced by evolving regulations. These changes necessitate continuous adaptation to maintain compliance and operational efficiency.

As a state-owned enterprise, China Galaxy Securities operates under the influence of government policies. The Chinese government may initiate consolidation within the securities sector. In 2024, there were discussions about mergers, potentially impacting the firm's structure. These moves aim to strengthen competitiveness.

Geopolitical Tensions

Geopolitical tensions, such as those involving trade and international relations, can significantly influence China Galaxy Securities. These tensions can indirectly affect the Chinese financial markets and the company's operations. For instance, changes in foreign investment or market sentiment due to global events can create both risks and opportunities. In 2024, foreign direct investment in China decreased, reflecting some investor caution amidst geopolitical uncertainties.

- Decline in Foreign Investment: In 2024, foreign direct investment in China decreased by approximately 10-15% compared to the previous year.

- Trade Restrictions: Potential trade restrictions or tariffs could affect the profitability of companies listed on Chinese stock exchanges, impacting market sentiment.

- Geopolitical Risks: The ongoing Russia-Ukraine war and tensions in the South China Sea remain key geopolitical risks.

Anti-Corruption Measures

China's strong anti-corruption drive has far-reaching effects. It heightens the need for transparency in financial dealings, impacting firms like China Galaxy Securities. This can lead to more thorough checks on business operations and potentially change how the company interacts with clients. The focus on integrity aims to stabilize markets, but it also adds layers of compliance.

- In 2024, over 40,000 officials were reportedly investigated for corruption.

- The financial sector sees increased audits and regulatory reviews.

- Compliance costs may rise due to stricter oversight.

- Client relationships may shift due to increased due diligence.

China Galaxy Securities is deeply affected by China's political environment. Government regulation strongly influences market behavior, as seen in 2024's 5.8% sector revenue increase due to regulatory adjustments. State policies, including anti-corruption drives (over 40,000 officials investigated in 2024), intensify compliance demands and transparency.

Geopolitical events, like decreased foreign investment by 10-15% in 2024, pose both threats and opportunities. These issues highlight the dynamic interaction between politics, regulation, and business.

| Factor | Impact on China Galaxy Securities | Data (2024/2025) |

|---|---|---|

| Government Influence | Policy and Regulatory Influence | Sector Revenue Growth: 5.8% |

| Anti-Corruption | Increased Compliance Costs and Audits | Over 40,000 officials investigated |

| Geopolitics | Impacts Market Sentiment & Investment | FDI Decrease: 10-15% |

Economic factors

China's GDP growth and economic stability are crucial for the financial sector. Strong economic growth often boosts market activity and investment. In 2024, China's GDP grew by 5.2%, showing recovery. This growth supports wealth creation, benefiting firms like China Galaxy Securities. Stable economic conditions foster investor confidence and market expansion.

China's capital market development is crucial for China Galaxy Securities. The Shanghai and Shenzhen Stock Exchanges have a combined market capitalization exceeding $10 trillion. Increased market liquidity and the introduction of new financial products like ETFs and derivatives are also key. These developments offer both opportunities and risks for brokerage services. In 2024, the bond market grew significantly, offering new avenues for investment banking.

The People's Bank of China (PBOC) influences China Galaxy Securities through monetary policy. Interest rate adjustments impact borrowing costs and investment returns. In 2024, the PBOC lowered the 1-year Loan Prime Rate (LPR) to 3.45%. This affects market sentiment and all business segments. Lower rates typically boost trading activity.

Domestic Consumption and Investment

Domestic consumption and private investment in China are vital for financial services demand. They directly affect wealth management and brokerage activities. In 2024, retail sales growth was around 4-5%, indicating steady consumer spending. Private investment, however, has fluctuated, with a slight slowdown in certain sectors, affecting market dynamics.

- Retail sales growth around 4-5% in 2024.

- Private investment showed some slowdown in specific areas.

Competition in the Financial Sector

China's financial sector is highly competitive, involving both domestic and international firms. This intense rivalry influences pricing strategies and market share dynamics for China Galaxy Securities. To stay competitive, China Galaxy Securities must differentiate its services to attract and retain customers. The company faces pressure to innovate and improve efficiency in this crowded market. The combined assets of China's securities firms reached 13.8 trillion yuan by the end of 2024.

- Increased competition from digital platforms.

- Foreign firms expanding their presence.

- Pressure on profit margins.

- Need for innovative financial products.

Economic stability and GDP growth in China are critical. The financial sector thrives on robust market activity and investment; In 2024, the country's GDP increased by 5.2% . This helps in wealth creation and benefits firms like China Galaxy Securities. The bond market significantly expanded in 2024, with retail sales growing at about 4-5%.

| Metric | Value (2024) | Impact on Galaxy |

|---|---|---|

| GDP Growth | 5.2% | Supports Market Activity |

| Retail Sales Growth | 4-5% | Boosts Brokerage Demand |

| Bond Market Growth | Significant Expansion | New Investment Banking Avenues |

Sociological factors

China's burgeoning middle class fuels the wealth management sector. This expansion increases the need for financial services. China Galaxy Securities benefits from rising demand for investment advice. Household wealth in China reached $85 trillion in 2024. The market is expected to grow substantially by 2025.

Investor confidence in China is pivotal. In 2024, fluctuating economic indicators and regulatory shifts affected investor sentiment. Recent data shows a 10% shift in retail investor activity in response to market volatility. This impacts trading volumes and the demand for financial services.

China's demographic shifts, notably an aging population, are reshaping financial needs. Demand for retirement planning and asset management services is surging. In 2024, China's population aged 60+ reached over 280 million, fueling the growth of related financial products. This trend is expected to continue, significantly impacting investment strategies and product development for China Galaxy Securities.

Financial Literacy and Education

Financial literacy in China is crucial; it shapes how people engage with financial products. Low literacy can limit the adoption of complex offerings from firms like China Galaxy Securities. A 2023 survey indicated that only about 40% of Chinese adults feel confident in their financial knowledge. This impacts investment decisions and the demand for financial advice.

- 40% of Chinese adults reported confidence in their financial knowledge in 2023.

- Low literacy may reduce the use of complex financial products.

- Financial education initiatives could boost market participation.

Social Trust and Corporate Reputation

Public trust significantly impacts China Galaxy Securities' success. A strong reputation is crucial for client retention and attracting new investors. In 2024, financial trust in China showed fluctuations, influencing investment decisions. Positive perceptions boost market share, while negative ones can lead to capital flight. The firm's reputation must be carefully managed.

- China's CSI 300 Index saw volatility in 2024, reflecting investor sentiment.

- China Galaxy Securities' assets under management (AUM) are linked to public trust levels.

- Reputational damage can quickly erode market value.

- Transparent communication builds and maintains trust.

China’s rising middle class fuels the financial sector's expansion. Investor confidence, influenced by market shifts, is crucial, impacting trading. Demographic changes, particularly an aging population (280M+ in 2024), drive demand for financial planning.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Middle Class | Boosts wealth mgmt | Household wealth: $85T in 2024 |

| Investor Sentiment | Affects trading, demand | Retail activity shift: 10% (due to volatility) |

| Demographics | Reshapes needs | 60+ population: 280M+ in 2024 |

Technological factors

The FinTech sector's rapid growth changes financial service delivery. China Galaxy Securities must embrace digital platforms and mobile trading. In 2024, digital banking users in China reached 800 million. Online wealth tools are crucial for staying competitive.

China Galaxy Securities leverages AI and data analytics for improved operations. This includes risk management, customer profiling, and algorithmic trading. In 2024, the firm invested heavily in AI infrastructure, allocating approximately ¥500 million. Personalized service offerings are also enhanced, with a 15% increase in customer satisfaction reported in Q4 2024 due to data-driven insights.

China Galaxy Securities faces growing cybersecurity threats. Data breaches could lead to significant financial losses and reputational damage. In 2024, the global cost of cybercrime is projected to reach $9.5 trillion. Stricter data protection regulations, like China's Personal Information Protection Law, require robust compliance.

Development of Online Platforms and Mobile Services

China Galaxy Securities must prioritize digital platforms for trading and information access. This includes secure, user-friendly mobile apps and websites. In 2024, mobile trading accounted for over 70% of retail stock trades in China. The firm needs to invest in cybersecurity to protect user data. This is crucial for attracting and retaining clients.

Innovation in Financial Products and Services

Technological factors are crucial for China Galaxy Securities. Innovation fuels new financial products and services, like robo-advisory platforms and blockchain applications. These innovations create new revenue streams and boost operational efficiency.

- China's fintech market is projected to reach $100 billion by 2025.

- Robo-advisors in China managed about $15 billion in assets in 2024.

- Blockchain could reduce transaction costs by 20% for some services.

Technological advancements significantly shape China Galaxy Securities' operations and services.

The company must adapt to fast-paced digital changes, using tools like robo-advisors and blockchain, which boosts efficiency.

Focus on cybersecurity is critical. In 2024, China's fintech market grew rapidly.

| Technology | Impact | Data (2024) |

|---|---|---|

| FinTech | Market Growth | $95 Billion |

| Robo-Advisors | Assets Managed | $15B |

| Blockchain | Cost Reduction | 20% |

Legal factors

China Galaxy Securities must adhere to stringent securities laws, covering brokerage, trading, and asset management. These regulations, crucial for operational legality, are constantly evolving. In 2024, the China Securities Regulatory Commission (CSRC) intensified enforcement, with penalties up 15% year-over-year. Non-compliance can lead to significant fines and operational restrictions.

Regulations significantly influence foreign investment in China's financial sector. Rules around market access can shape China Galaxy Securities' competitive environment. For example, in 2024, eased restrictions allowed greater foreign ownership in securities firms. This can increase competition. These changes affect potential partnerships and market strategies.

China's emphasis on data privacy and security is growing. The Cybersecurity Law of 2017 and related regulations mandate strict data protection. Financial firms like China Galaxy Securities must comply, investing in security to avoid penalties. In 2024, data breaches cost firms an average of $4.45 million globally, highlighting the stakes.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Regulations

China Galaxy Securities faces stringent AML and CTF regulations, crucial for combating financial crimes. These regulations, overseen by bodies like the People's Bank of China, require rigorous due diligence and transaction monitoring. Compliance is vital to avoid penalties and maintain operational integrity. In 2024, regulatory fines for AML breaches in China's financial sector reached CNY 500 million.

- Enhanced customer due diligence is a key requirement.

- Transaction monitoring systems must detect suspicious activities.

- Reporting suspicious transactions to authorities is mandatory.

- Non-compliance can result in significant financial penalties.

Corporate Governance and Disclosure Requirements

China Galaxy Securities faces stringent regulations on corporate governance and disclosure. These rules mandate detailed reporting of financial and non-financial data, including ESG factors. The company must adhere to evolving standards to ensure transparency. Compliance with these standards impacts operational strategies.

- China's CSRC enforces rigorous disclosure rules.

- ESG reporting standards are becoming increasingly important.

- Failure to comply can lead to significant penalties.

- Transparency builds investor trust and confidence.

China Galaxy Securities navigates a complex legal landscape. Stringent securities laws, including AML and CTF regulations, require rigorous compliance. Non-compliance results in severe penalties; in 2024, AML fines reached CNY 500 million. Data privacy and corporate governance further shape operational strategies, affecting partnerships and market access.

| Regulation Type | Key Focus | 2024 Impact |

|---|---|---|

| Securities Law | Brokerage, Trading | CSRC enforcement up 15% YoY |

| Foreign Investment | Market Access | Eased restrictions; more competition |

| Data Privacy | Cybersecurity | Average data breach cost: $4.45M |

| AML/CTF | Financial Crime | Fines for breaches: CNY 500M |

| Corporate Governance | Disclosure | ESG reporting becomes important |

Environmental factors

China Galaxy Securities faces growing pressure from new ESG disclosure rules. These regulations require detailed reporting on environmental impact. For example, as of late 2024, firms must disclose carbon emissions data. The company must also report on its sustainability initiatives. This shift reflects China's push for green finance.

China's green finance push, backed by policies, opens doors for institutions like China Galaxy Securities. The government mandates support for eco-friendly projects, fostering green financial product development. In 2024, China's green bond issuance reached $60 billion, reflecting strong growth. This includes initiatives to reduce carbon emissions and promote sustainable practices.

Climate change indirectly influences financial markets. Potential disruptions to industries and supply chains could affect investments. In 2024, extreme weather events caused $100 billion in damages globally. China's manufacturing and export sectors are particularly vulnerable.

Environmental Regulations Affecting Clients

Environmental regulations significantly influence the industries China Galaxy Securities serves, potentially affecting client profitability and investment decisions. Stricter environmental standards can increase operational costs and necessitate capital expenditures for compliance, impacting earnings. These changes may shift investment strategies, influencing demand for financial services like green bonds or sustainability-linked loans. For example, in 2024, China's Ministry of Ecology and Environment reported a 7.5% increase in environmental penalties.

- Environmental regulations can increase operational costs.

- Stricter standards may lead to changes in investment strategies.

- These changes can influence demand for financial services.

- In 2024, environmental penalties increased by 7.5%.

Corporate Sustainability Practices

China Galaxy Securities faces growing pressure to minimize its environmental impact. The company's energy usage and waste disposal methods are under scrutiny. Investors and regulators increasingly demand sustainable practices. This impacts China Galaxy's brand and compliance efforts.

- China's green bond market reached $60 billion in 2024.

- The CSRC promotes ESG integration in financial reporting.

- China aims for carbon neutrality by 2060, influencing all sectors.

China Galaxy Securities must comply with evolving ESG rules, including carbon emission disclosures, reflecting China's green finance push.

Support for eco-friendly projects fuels the development of green financial products, with China's green bond issuance reaching $60 billion in 2024.

The company's operational costs can be affected by environmental regulations that lead to shifts in investment strategies, impacting financial service demand.

| Aspect | Impact | Data |

|---|---|---|

| ESG Rules | Require detailed environmental impact reporting. | Carbon emissions disclosure mandate in late 2024. |

| Green Finance | Government support for eco-friendly projects. | China's green bond issuance hit $60B in 2024. |

| Regulations | Can raise operational costs and influence investment decisions. | 7.5% increase in environmental penalties in 2024. |

PESTLE Analysis Data Sources

Our China Galaxy Securities PESTLE Analysis relies on data from government publications, financial institutions, and industry-specific reports to ensure insights are grounded.