CJ Logistics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CJ Logistics Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs to quickly visualize the BCG Matrix analysis.

Preview = Final Product

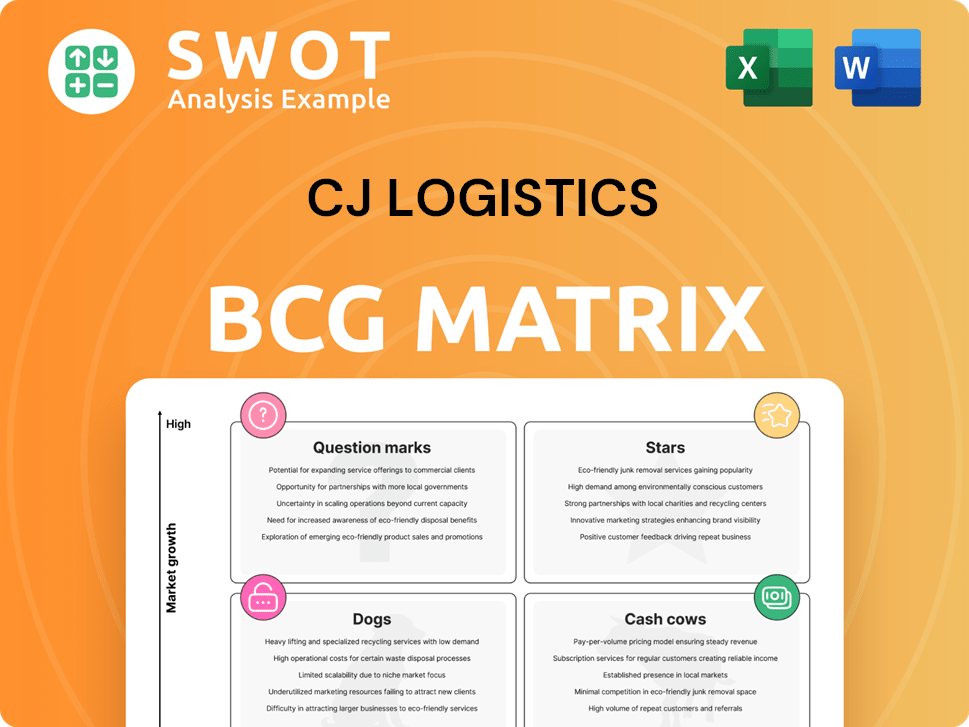

CJ Logistics BCG Matrix

The preview displays the full CJ Logistics BCG Matrix report you'll receive. After purchase, access a complete, strategic analysis tool for your use. Enjoy immediate download of this ready-to-use, professionally formatted report.

BCG Matrix Template

CJ Logistics operates in a dynamic logistics landscape, facing constant shifts in market growth. Their BCG Matrix reveals their product portfolio's performance, from market leaders to those needing strategic attention. This analysis helps understand investment needs and resource allocation strategies. Key insights emerge about their competitive positioning, providing a strategic snapshot.

The full BCG Matrix unveils detailed quadrant placements, strategic recommendations, and a roadmap to guide informed investment decisions.

Stars

CJ Logistics is expanding globally, linking regions via air, sea, and land routes. This broadens their market reach and service capabilities, potentially attracting more clients. Integrated and multimodal logistics, such as combining ocean and rail, offer diverse solutions. In 2024, CJ Logistics' revenue reached approximately $11.5 billion, reflecting its global growth.

To improve services, CJ Logistics emphasizes Technology, Engineering, Systems & Solutions (TES). TES helps optimize logistics, boosting efficiency and customer satisfaction. This focus supports operational improvements and competitive advantages. By 2024, CJ Logistics aimed to increase its overseas revenue to 50% of its total income.

CJ Logistics is boosting its e-commerce logistics, offering e-fulfillment services like storage and delivery. They use robots and AI for efficiency, drawing in e-commerce clients. Their e-Fulfillment solution promises next-day delivery for 24/7 orders. In 2024, e-commerce sales hit $1.1 trillion, driving demand for such services.

CJ Logistics is leveraging technology to boost logistics. Investments in AI, robots, and data are key. This boosts efficiency and cuts costs. Automation, like AutoStore, changes cross-border e-commerce. The Incheon Global Distribution Center is a prime example.

Strategic Partnerships

CJ Logistics actively forges strategic partnerships to broaden its service capabilities and market presence. Collaborations with entities such as Shinsegae Group and Alibaba are pivotal for managing essential delivery operations. These alliances are designed to elevate parcel volume and bolster CJ Logistics' competitive edge. In 2024, these partnerships are projected to contribute significantly to revenue growth.

- Partnerships are expected to increase parcel volume.

- These alliances will strengthen CJ Logistics' market position.

- Revenue growth is anticipated due to these collaborations.

- Strategic partnerships are a key growth strategy.

Contract Logistics

CJ Logistics' contract logistics is a "Star" in its BCG matrix, indicating high market share in a growing market. They offer comprehensive supply chain solutions for sectors like CPG and retail. This includes specialized services like temperature-controlled delivery, boosting their competitive edge. The company's revenue from contract logistics increased by 12% in 2024.

- Supply chain revenue increased by 12% in 2024.

- Offers end-to-end supply chain management.

- Serves CPG, retail, fashion, and beauty sectors.

- Expands through collaborations and consulting.

Contract logistics is a "Star" for CJ Logistics, showing strong market presence in a fast-growing area.

They provide supply chain solutions for sectors like consumer packaged goods and retail. Specialized services enhance their competitive edge.

In 2024, contract logistics revenue rose by 12%, showcasing solid performance.

| Key Metric | 2023 Performance | 2024 Performance (Projected) |

|---|---|---|

| Contract Logistics Revenue | $2.5 billion | $2.8 billion |

| Market Growth Rate | 8% | 9% |

| Market Share | 18% | 19% |

Cash Cows

CJ Logistics' integrated supply chain services, spanning transportation to warehousing, generate consistent revenue. This is because businesses depend on these services. Their approach boosts customer value via ongoing innovation. In 2024, CJ Logistics reported significant growth in its logistics revenue, showcasing the stability of this cash cow.

CJ Logistics' transportation solutions are a cash cow, offering diverse services like local and over-the-road deliveries. In 2024, CJ Logistics expanded its asset-based trucking, including refrigerated options, boosting domestic transport reliability. These services aim to cut costs and improve supply chain efficiency. The company's revenue in the transportation sector increased by 8% in the first half of 2024.

CJ Logistics excels in warehousing and distribution, a cash cow in its BCG Matrix. They manage large-scale, efficient warehouse operations globally. The company operates 300 warehouses across 46 countries. In 2024, the logistics market is valued at over $10 trillion, highlighting significant opportunities.

Global Freight Forwarding

CJ Logistics' global freight forwarding is a cash cow. They offer export and import services to 220 countries via ocean, air, and land. These services manage international shipments, including special freight categories. Strategic forwarding aligns with customer goals, offering end-to-end global solutions. In 2024, the global freight forwarding market was valued at approximately $1.1 trillion.

- Global freight forwarding connects 220 countries.

- Services include ocean, air, and land freight.

- Offers end-to-end global solutions.

- The market was valued at $1.1 trillion in 2024.

Customs Brokerage

CJ Logistics' customs brokerage is a cash cow, providing consistent revenue through efficient international shipping support. They streamline the process, reducing delays for clients. This ensures compliance with regulations, fostering client trust. In 2024, the global customs brokerage market was valued at approximately $18.5 billion.

- Provides consistent revenue.

- Reduces shipping delays.

- Ensures regulatory compliance.

- Enhances client trust.

CJ Logistics’ cash cows include transportation, warehousing, and global freight forwarding. They generate steady income due to essential services. These sectors saw growth in 2024, reflecting their stability and importance.

| Service | Market Value (2024) | Key Benefit |

|---|---|---|

| Transportation | Increased by 8% (H1 2024) | Reliable Delivery |

| Warehousing | $10T (Global Market) | Efficient Operations |

| Freight Forwarding | $1.1T | Global Reach |

Dogs

If CJ Logistics uses outdated technology, those areas are dogs in its BCG matrix. Maintaining this tech could be a cash drain, demanding constant upkeep. Upgrading the technology might be necessary. In 2024, CJ Logistics's tech spending was approximately $150 million, a 5% increase from 2023, signaling efforts to modernize.

Underperforming overseas subsidiaries of CJ Logistics could be categorized as dogs in a BCG matrix if their earnings recoveries lag. Restructuring is vital to boost performance. For example, in 2024, some international segments saw slower growth, reflecting global challenges. This necessitates strategic adjustments. Data from 2024 shows international revenue growth varied significantly by region.

Services like parcel delivery, where CJ Logistics competes fiercely and sees declining market share, are potential dogs. These services, facing strong rivals like Coupang, may need major investment or could be divested. In 2023, Coupang surpassed CJ Logistics in parcel delivery market share, a key indicator. CJ Logistics’ operating profit fell 15.9% YoY in Q3 2023, reflecting these challenges.

Inefficient Processes

Inefficient processes at CJ Logistics, particularly those lacking automation, can be categorized as dogs. These areas often need process re-engineering and automation to boost performance and reduce costs. Continuous improvement and innovation are crucial for driving efficiency and cost reductions. For 2024, CJ Logistics' operating margin faced pressure, decreasing to 3.1% due to global economic uncertainties and increased labor costs.

- Areas with manual data entry and outdated systems.

- Processes with high error rates and rework.

- Lack of real-time visibility in supply chains.

- Inefficient warehouse operations and inventory management.

Non-Strategic Business Units

Non-strategic business units, or "dogs," at CJ Logistics represent areas not central to its strategy. These units may hinder resource allocation and growth. The goal is to streamline operations, focusing on core competencies. CJ Logistics' 2024 financial reports will likely show efforts to divest or restructure underperforming units to boost overall profitability.

- Identify underperforming units.

- Assess strategic fit.

- Consider divestiture options.

- Restructure for efficiency.

CJ Logistics' "dogs" include areas with outdated tech, costing about $150 million in 2024. Underperforming overseas units also fit, affected by global issues; 2024 saw varied regional growth. Services with declining shares, like parcel delivery, may be dogs too.

| Category | Issue | Impact |

|---|---|---|

| Technology | Outdated systems | Cash drain, need upgrades |

| International | Lagging earnings | Requires restructuring |

| Parcel Delivery | Declining market share | Needs investment or divestiture |

Question Marks

New cold storage warehouses, like the one in New Century, Kansas, launching in Q3 2025, are question marks. These ventures target the high-growth frozen food market, projected to reach $317.4 billion by 2024. Significant investment is needed to gain market share. CJ Logistics aims to meet rising demand.

Cross-border e-commerce is a question mark for CJ Logistics, with high growth potential. The company is expanding services, especially with China. Intense competition and strategic partnerships are key. CJ Logistics is expected to boost guaranteed delivery services through e-commerce platform promotions. In 2024, cross-border e-commerce grew by 15% globally.

The Elwood, Illinois logistics center, opening in the first half of 2026, fits the BCG Matrix "Question Mark" category. It demands significant capital investment, estimated around $150 million. Success hinges on strengthening US-South Korea economic relations, with trade reaching $200 billion in 2024. Advanced automation and a prime location are key to its potential growth.

Innovative Technologies and Automation

Innovative technologies and automation represent question marks for CJ Logistics within the BCG Matrix. These investments in AI-powered logistics and warehouse automation are substantial, posing both opportunities and risks. While automation promises operational efficiencies, significant upfront costs and integration hurdles exist. For instance, CJ Logistics invested $100 million in its new logistics center in 2024, integrating advanced robotics.

- AI and automation investments are high-risk, high-reward ventures.

- Implementation challenges can delay ROI and affect profitability.

- CJ Logistics' 2024 spending on tech reflects its strategic intent.

- Market acceptance and scalability are critical for success.

Pharmaceutical Logistics

CJ Logistics' foray into pharmaceutical logistics is a "question mark" in its BCG matrix. This area demands specialized systems and adherence to strict regulations, but it holds the potential for substantial returns. The company has already invested in these specialized systems, indicating a commitment to this high-value sector. Success hinges on effective execution and navigating the complexities of pharmaceutical transport. In 2024, the global pharmaceutical logistics market was valued at approximately $95 billion, with an expected CAGR of around 6%.

- Specialized systems are a key to success.

- High returns are possible, but execution is vital.

- Market size is substantial and growing.

- Regulatory compliance is critical.

Question marks for CJ Logistics require significant investment with uncertain returns.

These ventures, including cold storage and cross-border e-commerce, face high-growth potential with considerable risk.

Successful execution hinges on strategic partnerships and technological advancements. In 2024, AI in logistics saw investments surge by 20%.

| Investment Area | Market Growth (2024) | Risks |

|---|---|---|

| Cold Storage | Frozen Food Market: $317.4B | Competition, Capital Needs |

| Cross-border E-commerce | 15% Global Growth | Intense Competition |

| Pharmaceutical Logistics | $95B Market, 6% CAGR | Regulation, Specialization |

BCG Matrix Data Sources

Our CJ Logistics BCG Matrix leverages data from financial reports, industry analysis, market research, and competitive intelligence for strategic accuracy.