CJ Logistics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CJ Logistics Bundle

What is included in the product

Analyzes CJ Logistics’s competitive position through key internal and external factors

Ideal for executives needing a snapshot of CJ Logistics' strategic positioning.

Preview the Actual Deliverable

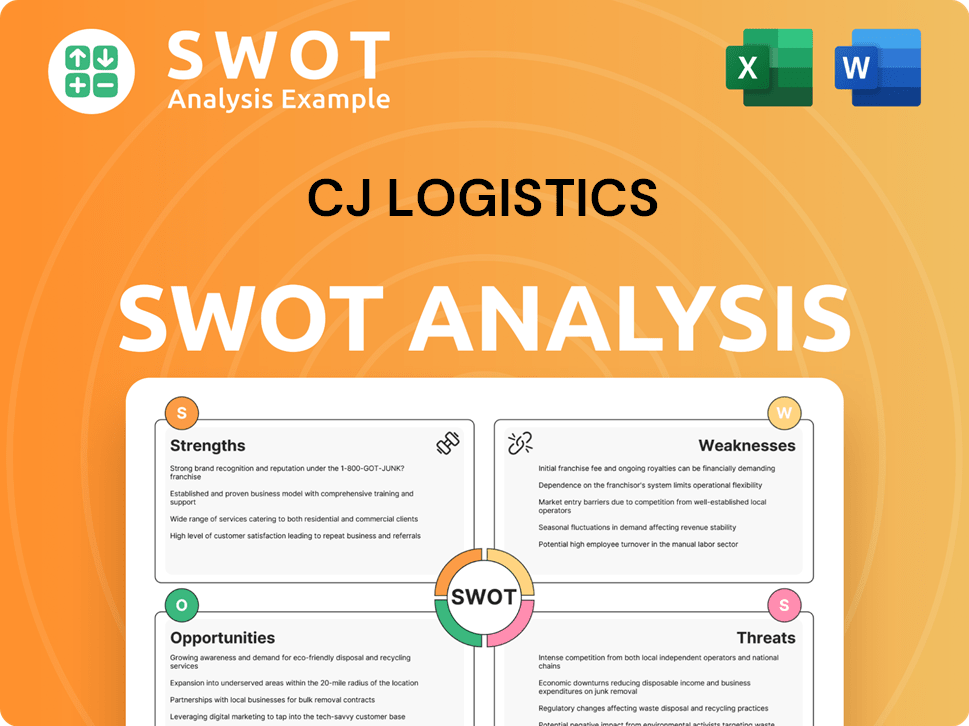

CJ Logistics SWOT Analysis

The content displayed here is a direct preview of the comprehensive CJ Logistics SWOT analysis.

This is the exact document you will receive after completing your purchase, so there's no need for second guessing!

It provides detailed insights to inform your strategic planning.

What you see now is exactly what you’ll download after you've purchased the report.

No changes, no extras - just a detailed look!

SWOT Analysis Template

Our initial glance reveals CJ Logistics' core strengths: a robust global network & tech-driven solutions. Weaknesses hint at potential vulnerabilities & competitive pressure. Opportunities emerge in burgeoning e-commerce & emerging markets. However, threats include geopolitical risks & volatile fuel costs. Want deeper insights? Purchase the full SWOT analysis for actionable strategies.

Strengths

CJ Logistics has a strong market position, especially in areas like India's Full Truck Load (FTL) segment. Their extensive presence and large truck network support this. This leading position allows them to use their size and existing connections to their advantage. In 2024, CJ Logistics saw a 7.8% revenue increase in its global logistics operations.

CJ Logistics boasts a vast network and infrastructure. This includes numerous warehouses and a large fleet. In 2024, their global network spanned over 150 countries. This facilitates comprehensive logistics solutions. Their revenue in 2024 was around $10 billion.

CJ Logistics prioritizes technological innovation, investing in advanced systems like automation and a private 5G network. This focus improves operational efficiency and productivity. These investments support future growth. In 2024, CJ Logistics allocated $300 million to tech upgrades.

Strategic Partnerships and Client Relationships

CJ Logistics' strong alliances and client relationships are a key strength. The company has built solid partnerships with major players like Alibaba and Shinsegae. These collaborations are crucial for securing substantial business and broadening market reach. The company's strategic partnerships are expected to boost its global logistics network, with an estimated revenue increase of 10% in the next fiscal year.

- Partnerships with major e-commerce platforms and businesses.

- Expected revenue increase of 10% in the next fiscal year.

- Collaborations with Alibaba, Shinsegae, Naver, and BNSF.

Integrated Supply Chain Solutions

CJ Logistics' strength lies in its integrated supply chain solutions. They provide a wide array of services, including transportation, warehousing, and e-fulfillment. This comprehensive approach lets them offer clients complete logistics solutions, improving supply chains and boosting efficiency. In 2024, CJ Logistics' revenue reached approximately $11.4 billion, reflecting the success of their integrated services.

- Comprehensive Service Portfolio: Offers a full suite of logistics services.

- Efficiency: Streamlines supply chains for clients.

- Revenue Growth: Shows the effectiveness of their integrated model.

- One-Stop Solutions: Simplifies logistics for clients.

CJ Logistics holds a strong market position, benefiting from an extensive network. Strategic alliances with companies like Alibaba amplify its reach. Investment in advanced tech enhances operational efficiency and supports growth. Its integrated supply chain solutions boosted revenue to $11.4 billion in 2024.

| Strength | Details | Data (2024) |

|---|---|---|

| Market Position | Strong presence in key markets | 7.8% revenue increase (Global) |

| Network and Infrastructure | Large warehouses, global reach | Network in over 150 countries |

| Tech Innovation | Investments in automation, 5G | $300M tech upgrade allocation |

| Strategic Alliances | Partnerships with key businesses | 10% expected revenue increase |

| Integrated Solutions | Full suite of logistics services | $11.4B revenue |

Weaknesses

CJ Logistics faces fierce competition in logistics. The market, including road freight and parcel delivery, is crowded. This can squeeze prices and market share. Continuous efforts are needed to stay ahead. In 2024, the global logistics market was valued at $10.6 trillion, with intense competition driving down profit margins.

CJ Logistics faces significant working capital demands due to its extensive logistics operations. This need arises from funding transportation, warehousing, and managing inventory. In 2024, the logistics sector saw working capital pressures. This can affect the company's liquidity and financial flexibility.

CJ Logistics' profitability could be affected by tight margins. Some analyses suggest its profit margins are low compared to sales, potentially limiting overall profitability. While there's been progress in certain areas, boosting and sustaining profitability is tough in this cost-driven sector. In 2024, the operating margin was around 3.5%, indicating room for improvement.

Pressure on Delivery Rates

CJ Logistics faces pressure on delivery rates, as evidenced by fluctuations in its parcel delivery performance. The average delivery rate has shown volatility, influenced by competitive pressures and market shifts. Maintaining or improving delivery rates is crucial for sustaining revenue and profitability in the logistics sector. Strategies to protect rates and enhance financial performance are essential for CJ Logistics.

- Delivery rate fluctuations due to market competition.

- Impact of stagnant rates on revenue.

- Need for strategies to protect financial performance.

Underperforming Overseas Operations

CJ Logistics faces challenges with underperforming overseas operations, which have seen sluggish earnings recoveries. This impacts the company's global operating profit, requiring strategic interventions. Restructuring these international units is crucial for consistent growth. In 2024, international sales accounted for about 40% of total revenue, highlighting the importance of improving these areas.

- Slower earnings recovery in some overseas subsidiaries.

- Impact on overall global operating profit.

- Need for restructuring or performance improvement.

- International sales account for 40% of total revenue in 2024.

CJ Logistics struggles with intense market competition, impacting pricing and profit margins, where the global logistics market was worth $10.6T in 2024.

High working capital demands, especially with extensive operations, are a challenge; it affects liquidity.

They also grapple with underperforming international operations needing strategic fixes. International sales are 40% of total revenue in 2024. Profitability faces the challenge of 3.5% of operating margins.

| Weakness | Impact | 2024 Data/Insight |

|---|---|---|

| Market Competition | Squeezed Prices, Lower Margins | $10.6T Global Logistics Market |

| High Working Capital | Liquidity & Financial Flexibility | Focus on operational costs. |

| Profitability | Low operating margins | Operating margin was 3.5% |

Opportunities

The expanding e-commerce sector fuels parcel volume growth, creating opportunities for logistics providers. CJ Logistics' focus on rapid delivery, such as 7-day services, capitalizes on this trend. In 2024, e-commerce sales hit $1.1 trillion, a 7.5% rise, driving demand for efficient delivery. This expansion aligns with CJ Logistics' strategic goals.

CJ Logistics can expand in North America and Vietnam. Demand is growing in these regions, fueled by manufacturing and e-commerce. For example, Vietnam's e-commerce market is expected to reach $29 billion by 2025. Investing in new facilities can boost revenue.

CJ Logistics can capitalize on AI and advanced analytics, which is projected to boost the global logistics market to $12.2 trillion by 2025. This includes enhanced demand forecasting, with a 15-20% accuracy improvement. Blockchain can optimize supply chain transparency, cutting costs by 10-15%. Automation, with a 25% efficiency gain, will drive new service offerings.

Development of New Strategic Partnerships

CJ Logistics can capitalize on opportunities by forging new strategic partnerships. Collaborations with e-commerce platforms and retailers can unlock new business avenues and boost market share. These alliances can increase parcel volume, expand service offerings, and improve market reach. In 2024, CJ Logistics aimed to increase its global network, focusing on strategic alliances.

- Partnerships with e-commerce platforms can expand service offerings.

- Joint ventures can lead to increased parcel volume.

- Strategic alliances can improve market reach.

- CJ Logistics aimed to expand its global network in 2024.

Increasing Demand for Specialized Logistics

CJ Logistics can capitalize on the growing need for specialized logistics. This includes cold chain solutions, which are critical for pharmaceuticals and food. Project cargo handling, essential for oversized industrial components, also presents opportunities. The global cold chain market is projected to reach $804.8 billion by 2027. Expanding into these areas can boost revenue and competitiveness.

- Growing demand for cold chain solutions.

- Opportunities in project cargo handling.

- Market expansion and diversification.

- Potential for increased revenue.

E-commerce growth and rapid delivery services create significant chances for CJ Logistics, as evidenced by the $1.1 trillion in e-commerce sales in 2024. Expansion in North America and Vietnam, where e-commerce is booming (e.g., $29B market by 2025), provides further growth potential. Strategic partnerships and capitalizing on advanced technologies (AI) will boost profitability.

| Opportunity | Description | Impact |

|---|---|---|

| E-commerce Growth | Leveraging the growth of e-commerce, projected to be $1.1 trillion in 2024 | Increased parcel volume, 7-day delivery services |

| Geographical Expansion | Entering new markets like North America and Vietnam, and their corresponding revenues. | Revenue growth in targeted regions. |

| Technological Advancement | Using AI and advanced analytics, blockchain technology, and automation to optimize logistics operations, with a target to enhance the market to $12.2 trillion by 2025 | Improve efficiency, cut costs, and improve new services, which is reflected in the boost of financial standings |

Threats

CJ Logistics faces fierce competition. Established firms and tech startups are vying for market share. Amazon's logistics expansion intensifies pressure. This competitive landscape threatens profitability. The parcel delivery sector sees the most intense battles.

CJ Logistics faces economic sensitivity, with slowdowns or spending changes affecting shipment volumes. Economic factors and lower volumes from major clients can pressure revenue and margins. In 2024, global trade volume growth slowed, impacting logistics demand. For instance, a 2% decrease in global trade could significantly cut CJ Logistics' earnings.

CJ Logistics faces growing cybersecurity risks due to increased tech use and data handling. In 2024, the logistics sector saw a 30% rise in cyberattacks. Data breaches and ransomware pose significant threats to operations. Protecting data and systems is vital for maintaining customer trust and avoiding financial losses, with potential costs from breaches averaging $4.45 million globally in 2024.

Potential for Adverse Regulatory Changes

CJ Logistics faces threats from adverse regulatory changes. Changes in transportation regulations, trade policies, and labor laws could increase costs. Evolving standards for autonomous vehicles pose another challenge. The logistics industry must navigate these shifts carefully. For example, the US Department of Transportation proposed new safety regulations in 2024.

- Increased compliance costs can affect profitability.

- Adaptation to new technologies requires significant investment.

- Trade policy changes can disrupt supply chains.

- Labor law updates may impact workforce management.

Operational Challenges and Disruptions

CJ Logistics faces operational threats stemming from its complex network. Labor disputes and tech reliability issues pose risks. Efficient working capital management is crucial. Disruptions can hurt service quality. In 2024, the logistics industry saw a 10% rise in labor-related disruptions.

- Labor disputes can halt operations.

- Tech failures may cause delays.

- Inefficient capital use affects profitability.

- Disruptions degrade customer service.

CJ Logistics confronts market competition and economic slowdowns that threaten profitability. Cybersecurity risks, regulatory changes, and operational disruptions also loom. In 2024, global logistics saw a 30% rise in cyberattacks, and a 10% increase in labor-related disruptions, pressuring margins.

| Threats | Impact | 2024/2025 Data |

|---|---|---|

| Competition | Profitability squeeze | Intensified competition in parcel delivery. |

| Economic Sensitivity | Revenue & Margin Pressure | 2% decrease in global trade could cut earnings. |

| Cybersecurity Risks | Operational & Financial Loss | Average data breach cost $4.45M (2024). |

SWOT Analysis Data Sources

This SWOT analysis uses reliable data like financial reports, market analysis, and industry research for accurate and trustworthy strategic assessments.