CK Infrastructure Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

What is included in the product

Tailored analysis for CK Infrastructure's product portfolio, highlighting key strategic moves.

Printable summary optimized for A4 and mobile PDFs, allowing quick summaries of diverse investment sectors.

Preview = Final Product

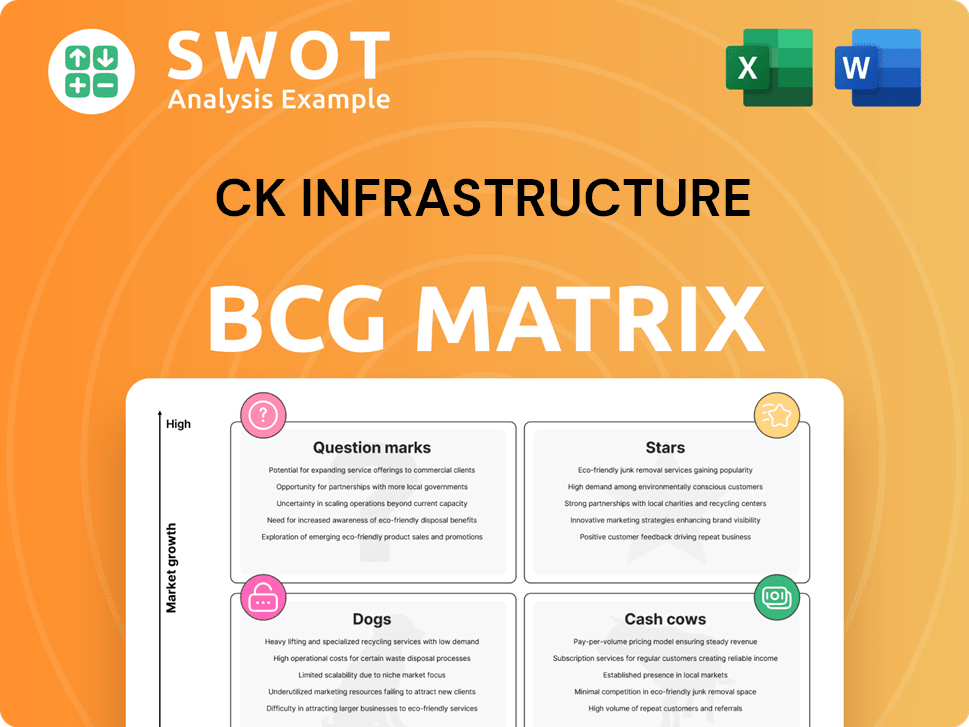

CK Infrastructure BCG Matrix

The CK Infrastructure BCG Matrix preview mirrors the final, purchased document. This is the exact report—no extra content or watermarks—ready for immediate strategic insights. It's designed for professional use and detailed market analysis, ready for download. You’ll get the complete file, fully formatted, after your purchase.

BCG Matrix Template

CK Infrastructure's BCG Matrix reveals a dynamic portfolio. Examining its strategic units reveals stars, cash cows, question marks, and dogs. This provides a snapshot of its diverse investments and growth potential. Identifying these positions aids understanding of resource allocation. Strategic planning is key, especially amid fluctuating market conditions.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

CK Infrastructure's renewable energy investments are a growth area. They've acquired wind farms and solar assets. These projects in the UK and Europe get government incentives. Stable revenue comes from long-term contracts. In 2024, renewable energy contributed significantly to their portfolio.

CK Infrastructure's UK regulated utilities, such as UK Power Networks, are a cornerstone of its portfolio. These assets benefit from stable regulatory environments and long-term contracts. In 2024, UK Power Networks reported a solid financial performance, reflecting the predictability of its cash flows. Efficient asset management and expansion further boost profitability. The UK utilities segment contributed significantly to overall revenue, showcasing its importance.

CK Infrastructure's acquisition of Phoenix Energy in Northern Ireland showcases a strategic move into gas distribution. This sector offers stable returns, supported by regulatory frameworks. In 2024, Phoenix Energy's market share and predictable cash flows contributed to CKI's portfolio. Further investment could boost this position.

Strategic Acquisitions

CK Infrastructure's strategic acquisitions, like UK Renewables Energy and UK Power Networks Services, boost immediate revenue. These moves strengthen its global position, creating more fundraising options for future large-scale investments. Such acquisitions are key to the company's growth and leadership within the infrastructure market. In 2024, CK Infrastructure's revenue reached HK$63.9 billion, highlighting the financial impact of these strategic decisions.

- UK Renewables Energy and UK Power Networks Services acquisitions.

- Enhances global standing.

- Provides additional fundraising channels.

- Contributes significantly to the company's growth.

Waste Management Services

CK Infrastructure's waste management services, including waste-to-energy projects, are a strong suit. These initiatives support sustainability and boost revenue. Growing environmental focus suggests rising demand and investment in this area. Expanding waste management capabilities aligns with global sustainability targets.

- In 2024, the global waste management market was valued at approximately $2.1 trillion.

- Waste-to-energy projects generate electricity and reduce landfill waste, with the market expected to grow significantly.

- CK Infrastructure's investments in waste management reflect a commitment to environmental responsibility and long-term profitability.

- The waste management sector offers stable, predictable revenue streams, making it attractive for investors.

CK Infrastructure's Stars in the BCG Matrix are characterized by high growth potential and market share. These are often newer ventures or expanding segments. They require significant investment to maintain their competitive edge, such as the UK Renewables Energy acquisition. In 2024, these sectors showed strong growth potential.

| Category | Examples | Characteristics |

|---|---|---|

| Stars | Renewable Energy, UK Renewables Energy | High growth, high market share; require substantial investment. |

| Market Share (%) | Varies by project; aim to expand market presence. | Investment, strategic acquisitions like UK Renewables. |

| Growth Rate | Significant; exceeding market averages in some segments. | Capital-intensive; focus on expansion, market leadership. |

Cash Cows

Hong Kong's concrete business is a cash cow for CK Infrastructure, providing stable revenue. The construction sector's consistent demand ensures reliable cash flow generation. In 2024, the construction output value was approximately HK$260 billion. Maximizing production and market share are vital for sustained profitability in this segment.

Transportation infrastructure, like toll roads, bridges, and tunnels, is a cash cow. These assets generate reliable revenue, often backed by long-term contracts and predictable traffic. For example, in 2024, the global toll road market was valued at over $300 billion, showing consistent demand. Efficient maintenance and toll adjustments boost profitability.

Water treatment facilities, a core asset for CK Infrastructure, offer stable, long-term revenue via contracts with municipalities and industries. With water scarcity rising, demand for efficient treatment is poised to grow, particularly in regions like Australia, where infrastructure spending is projected to reach $300 billion by 2025. Investing in tech and capacity expansion strengthens this position. For 2024, the global water treatment market is estimated at $300 billion.

Power Plants

CK Infrastructure's power plants, especially those with long-term contracts, are solid cash cows. These plants, operating in established markets, generate predictable income due to stable demand. Their operational efficiency and adherence to contracts are key to maintaining profitability. For instance, in 2024, the power segment contributed significantly to the company's revenue.

- Reliable income from mature markets.

- Focus on operational efficiency.

- Adherence to long-term contracts.

- Significant revenue contribution in 2024.

Household Infrastructure

Household infrastructure, including utilities for homes, is a cash cow. These investments provide consistent revenue due to steady demand and long-term contracts. The sector benefits from stable regulation and low customer turnover, ensuring predictable cash flows. For example, in 2024, the U.S. residential electricity sector generated over $160 billion in revenue. Maintaining high service quality and managing operational costs are crucial for profitability.

- Residential electricity revenue in the U.S. in 2024: over $160 billion.

- Household infrastructure characterized by steady demand and long-term contracts.

- Stable regulatory environments support predictable cash flows.

- Focus on service quality and cost management to maximize profitability.

Cash cows provide dependable revenue in established markets.

CK Infrastructure's power plants and household infrastructure, like utilities, are examples. Focusing on operational efficiency and contract adherence ensures profitability.

These segments, offering steady income, are key for the company's financial health.

| Segment | Characteristics | 2024 Data |

|---|---|---|

| Power Plants | Long-term contracts, stable demand | Significant revenue contribution |

| Household Infrastructure | Steady demand, long-term contracts | U.S. residential electricity: over $160B |

| Transportation Infrastructure | Toll roads, bridges, and tunnels | Global toll road market value: over $300B |

Dogs

The Canadian portfolio of CK Infrastructure saw a 19% profit decline, primarily due to Canadian Power's reduced profits and new tax charges. This decline signals potential underperformance, classifying these assets as "Dogs" in the BCG Matrix. Considering the 2024 financial data, these assets might need restructuring. A detailed assessment of long-term viability is crucial, especially considering market shifts.

Projects in highly regulated markets, like infrastructure in the UK, can be risky. Political shifts and economic volatility, as seen with recent inflation, can greatly affect returns. Increased compliance costs, a 10% rise in the UK, and changing regulations make it hard to maintain profits. Divestment might be the best option to avoid losses.

Outdated tech in infrastructure leads to inefficiencies and higher costs. These assets can lose market share against modern rivals. Consider that in 2024, 30% of infrastructure projects globally faced delays due to tech issues. Upgrading or selling these assets may boost the portfolio.

Assets with Declining Demand

Assets in sectors with declining demand, like traditional energy, can struggle to bring in revenue. Reduced use and more competition from new tech hurt these assets. Repurposing or selling them off might be needed to avoid losses. For example, in 2024, coal use dropped by 10% due to renewable energy growth.

- Declining demand affects revenue generation.

- Reduced utilization and increased competition are key issues.

- Repurposing or divestment can help reduce losses.

- Coal use decreased by 10% in 2024 due to renewables.

Inefficiently Managed Projects

Inefficiently managed projects within CK Infrastructure's portfolio can significantly underperform. These projects often face cost overruns and delays, diminishing their profitability. For example, a 2024 study showed that infrastructure projects with poor management experienced a 20% average cost increase. To mitigate these issues, CK Infrastructure might need to divest or implement stricter management.

- Cost Overruns: Infrastructure projects often exceed budgets.

- Delays: Poor management leads to project timeline extensions.

- Profitability: Inefficiency significantly impacts returns.

- Divestment: A potential strategy to improve portfolio performance.

In CK Infrastructure's BCG matrix, "Dogs" represent underperforming assets. These assets face declining demand, outdated tech, or inefficient management. Strategies include repurposing, selling, or restructuring to boost returns. 2024 data highlights these challenges.

| Issue | Impact | 2024 Data |

|---|---|---|

| Demand Decline | Lower Revenue | Coal use down 10% |

| Outdated Tech | Higher Costs | 30% projects delayed |

| Poor Management | Cost Overruns | 20% cost increase |

Question Marks

Investments in emerging markets, like those in Southeast Asia, fit the "question mark" category due to their high growth potential combined with considerable political and economic risks. For example, in 2024, infrastructure spending in emerging markets is projected to reach $3.3 trillion, reflecting the potential rewards and inherent challenges. These ventures necessitate thorough due diligence and continuous monitoring to manage uncertainties effectively. Strategic alliances and risk management tools are vital, as demonstrated by the trend of infrastructure projects increasingly involving public-private partnerships (PPPs), which accounted for over 15% of infrastructure investment in 2023.

New waste-to-energy tech, like those utilizing plasma gasification, are question marks in CK Infrastructure's BCG matrix. These ventures, despite high growth potential, face unproven track records and require substantial upfront capital, with project costs often exceeding $200 million. Successful implementation hinges on specialized technical skills and adaptive management strategies, crucial for navigating the complex regulatory landscape and operational challenges. The global waste-to-energy market was valued at $38.07 billion in 2023, projected to reach $56.13 billion by 2028.

Innovative water treatment solutions are question marks in CK Infrastructure's BCG Matrix, showing high growth potential with uncertain market acceptance. These solutions need big R&D investments to prove their worth and scalability. Strategic partnerships and pilot projects are key to gaining market traction. For example, in 2024, the global water treatment market was valued at over $70 billion, with a projected CAGR of 6-8% over the next five years.

Early-Stage Renewable Energy Technologies

Early-stage renewable energy technologies, like hydrogen production and advanced energy storage, represent high-growth opportunities but come with considerable risks. These areas demand substantial investment in research and development to address technical hurdles and reach market readiness. Government incentives and strategic alliances are vital for these ventures. For instance, in 2024, global investment in hydrogen projects was around $10 billion, showcasing the financial commitment.

- Hydrogen production projects saw approximately $10 billion in global investment in 2024.

- Energy storage technologies still face cost and efficiency challenges.

- Government support, such as tax credits, is crucial for early-stage projects.

Expansion into New Geographies

Expansion into new, high-growth geographic markets represents "question marks" for CK Infrastructure. These ventures involve venturing into areas with potentially high returns but uncertain market knowledge. Thorough market analysis and adaptation to local cultures are critical for success. Strategic alliances and local expertise are essential for market entry and brand recognition.

- CK Infrastructure's ventures in new markets require significant upfront investment.

- Market research is crucial to understanding local consumer behavior.

- Partnerships with local entities can mitigate risks.

- Adaptation of business models to local customs is essential.

Question marks in CK Infrastructure's BCG Matrix are characterized by high growth potential and significant uncertainty. Investments in new technologies like plasma gasification and innovative water treatment solutions require substantial capital and R&D. Expansion into emerging markets and new geographies also falls under this category, demanding strategic risk management.

| Aspect | Details | Data (2024) |

|---|---|---|

| Market Growth | High growth potential | Waste-to-energy market: $38.07B |

| Investment Needs | Significant capital required | Hydrogen projects: ~$10B globally |

| Risk Factors | Uncertainty in market adoption | Water treatment CAGR: 6-8% |

BCG Matrix Data Sources

The CK Infrastructure BCG Matrix utilizes comprehensive data from financial statements, market reports, and expert assessments to determine accurate positioning.