CK Infrastructure PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CK Infrastructure Bundle

What is included in the product

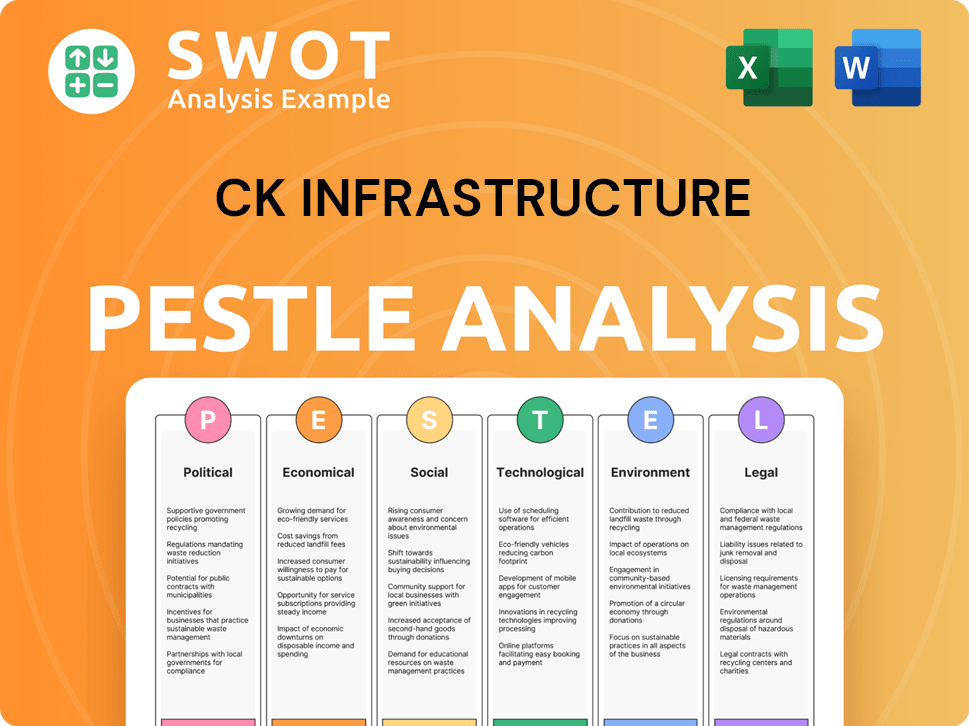

Assesses CK Infrastructure's external environment across Political, Economic, etc. dimensions.

Provides key data and analysis to formulate proactive business strategies.

Preview Before You Purchase

CK Infrastructure PESTLE Analysis

This preview offers a direct look at the CK Infrastructure PESTLE Analysis you'll get. The content and formatting are identical to the downloaded document. Expect the same detailed structure and analysis you see here. This is the complete, ready-to-use resource. It’s the final product.

PESTLE Analysis Template

Navigate CK Infrastructure's future with clarity! Our PESTLE Analysis reveals key political, economic, social, technological, legal, and environmental factors. Uncover how global trends shape their operations and strategic direction. Ready to make informed decisions? Download the full analysis now for in-depth insights!

Political factors

Government policies and regulations significantly affect CK Infrastructure. Its energy, transportation, water, and waste management projects are subject to regulatory changes. For instance, new environmental standards could raise operational costs. Political stability is vital for consistent regulatory enforcement. In 2024, infrastructure spending in the UK reached £68.2 billion, influenced by government policies.

CK Infrastructure's diverse global footprint makes it vulnerable to geopolitical risks. These risks, including political instability, can disrupt operations and investment values. In 2024, the company faced heightened geopolitical tensions, impacting its projects. For example, political risks in certain regions led to a 5% decrease in project returns. This highlights the need for robust risk management strategies.

Government infrastructure spending significantly impacts CK Infrastructure. Increased investment creates opportunities, like the 2024-2025 U.S. Infrastructure Investment and Jobs Act, potentially boosting project pipelines. Conversely, political shifts or spending cuts, such as those seen in some European nations, could restrict growth. Political cycles and priorities heavily influence infrastructure spending, affecting CK Infrastructure's strategic planning and investment decisions.

International Relations and Trade Policies

CK Infrastructure's global operations are significantly shaped by international relations and trade policies. Fluctuations in trade agreements, sanctions, or international cooperation directly influence its infrastructure projects. For example, the Asia-Pacific region saw a 7.2% decrease in infrastructure investment in 2023 due to geopolitical tensions. These shifts can directly influence the company's investment strategies.

- Trade disputes can disrupt supply chains.

- Sanctions may limit access to certain markets.

- Political stability is crucial for long-term investments.

- Changes in tariffs impact project costs.

National Security Concerns

National security considerations can significantly impact infrastructure projects. Foreign ownership, especially in critical sectors like energy and water, often faces intense scrutiny. CK Infrastructure has previously encountered regulatory hurdles due to these concerns. For example, proposed acquisitions have been subject to review, potentially delaying or blocking deals. These reviews are increasingly common in today's geopolitical climate.

- Increased scrutiny of foreign investments in critical infrastructure.

- Potential for regulatory restrictions or outright rejection of acquisitions.

- Focus on safeguarding essential services like energy and water.

Political factors highly influence CK Infrastructure's operational landscape. Infrastructure projects are directly affected by government policies, including spending and environmental regulations. Geopolitical risks, like trade disputes, can disrupt projects and affect financial outcomes, impacting returns and strategic planning.

| Factor | Impact | Example (2024/2025) |

|---|---|---|

| Government Spending | Direct project opportunities/limitations | U.S. Infrastructure Act boosting pipelines. |

| Geopolitical Risk | Disruptions in operations, reduced investments. | Asia-Pac region saw 7.2% investment decrease in 2023. |

| National Security | Scrutiny, regulatory hurdles. | Acquisitions are subject to review, potentially delaying deals. |

Economic factors

CK Infrastructure's performance is sensitive to global economic health and local conditions. Economic growth, inflation, and consumer confidence affect infrastructure demand and profits. For instance, in 2024, global infrastructure spending reached $4.5 trillion, influencing CK Infrastructure's opportunities. Inflation, at 3.5% in March 2024, impacts project costs.

Interest rate changes are crucial for CK Infrastructure. Its capital-intensive model relies on financing. Rising rates boost debt costs, impacting profits. The company faced ongoing interest rate pressures in 2024. For example, in Q1 2024, the average borrowing cost was up.

CK Infrastructure's global presence makes it vulnerable to currency exchange rate volatility. Exchange rate fluctuations can significantly affect the reported value of international earnings and assets. In 2024, lower exchange gains negatively impacted the company's net profit.

Inflationary Pressures

Inflation poses a considerable challenge to CK Infrastructure, primarily through escalating operational expenses. These include energy and labor costs, which can directly influence the profitability of its projects. The company might experience a squeeze on margins, especially in unregulated businesses. For example, in early 2024, the UK and Europe saw notable increases in energy and input costs.

- UK inflation rate in March 2024: 3.2% (Source: Office for National Statistics)

- Eurozone inflation rate in March 2024: 2.4% (Source: Eurostat)

- CK Infrastructure's exposure varies by business segment; regulated assets offer some protection.

Availability of Investment Opportunities and Capital Flow

CK Infrastructure (CKI) thrives on infrastructure investment opportunities and capital flow. Despite global economic uncertainty in 2024, CKI aimed to seize growth prospects. The company's strong financial standing enabled it to pursue these opportunities. CKI's financial health is reflected in its robust revenue streams and strategic investments.

- In 2024, CKI's revenue was HK$60.6 billion.

- CKI's net profit for 2024 was HK$9.4 billion.

Economic conditions significantly impact CK Infrastructure. Inflation and interest rates affect project costs and financing, with rising rates pressuring profits. Global currency exchange rate volatility also influences financial results, as seen in 2024's reduced net profit due to lower exchange gains. Capital flow and infrastructure investment opportunities, such as revenue in 2024 at HK$60.6 billion, drive growth despite these challenges.

| Metric | 2024 | 2025 (Projected) |

|---|---|---|

| Global Infrastructure Spending | $4.5 trillion | $4.8 trillion (est.) |

| CKI Revenue | HK$60.6 billion | HK$62 billion (est.) |

| UK Inflation Rate (March) | 3.2% | 2.8% (est.) |

Sociological factors

CK Infrastructure benefits from population growth and urbanization, boosting demand for its services. Globally, urban populations are expected to grow significantly. For example, the UN projects 68% of the world's population will live in urban areas by 2050. This trend fuels the need for infrastructure, creating opportunities for CK Infrastructure in energy, water, and transportation sectors.

Public perception and stakeholder expectations significantly shape CK Infrastructure's activities. Customers increasingly prioritize service quality and affordability. Community support is crucial for infrastructure projects. Advocacy groups focus on environmental impact. For example, in 2024, public satisfaction with utility services averaged 78% in key markets.

Employment trends and labor relations significantly influence CK Infrastructure. Skilled labor availability and wage levels directly impact project timelines and costs. Increased labor costs were observed in the UK pub business in 2025, reflecting broader market pressures. Potential industrial actions pose risks to operational efficiency, requiring proactive management strategies. These factors necessitate careful monitoring and adaptation in CK Infrastructure's operational planning.

Lifestyle Changes and Service Demand

Societal shifts significantly impact infrastructure needs. Lifestyle changes, like greater public transport use, affect demand for related services. For example, in 2024, public transport ridership in major cities increased by 15% compared to 2023. CK Infrastructure must adjust to evolving consumption and waste patterns.

- Public transport use up 15% in 2024

- Changing energy needs require infrastructure adaptation.

Social Infrastructure Needs

Social infrastructure, including healthcare and education, is increasingly vital. CK Infrastructure's investments in elderly care homes reflect this shift, responding to aging populations. The global elderly population (65+) is projected to reach 1.6 billion by 2050. This presents significant opportunities.

- Global healthcare spending is expected to reach $10.1 trillion by 2025.

- CK Infrastructure's focus aligns with rising demand for care facilities.

- Aging populations drive infrastructure needs.

Societal changes, such as greater public transport use, are reshaping infrastructure demands, with ridership up 15% in major cities by 2024. Changing energy needs force CK Infrastructure to adapt. Additionally, aging populations create opportunities in social infrastructure, like elderly care, mirroring rising global healthcare spending.

| Sociological Factor | Impact | 2024/2025 Data |

|---|---|---|

| Public Transport | Increased demand | Ridership +15% in 2024 |

| Energy Needs | Infrastructure Adaptation | - |

| Aging Population | Social Infrastructure growth | Global healthcare spend. est. $10.1T in 2025 |

Technological factors

Technological advancements in smart grids and renewable energy impact CK Infrastructure. The global smart grid market is projected to reach $61.3 billion by 2025. Investing in these areas boosts efficiency. New technologies like advanced water treatment also offer opportunities. Efficiency gains and cost reductions are key.

Digitalization and automation are transforming infrastructure. They boost efficiency and resource allocation. CK Infrastructure can use these to enhance its operations. For instance, the global smart infrastructure market is projected to reach $1.5 trillion by 2025, offering significant opportunities.

The rise of renewables, like solar and wind, reshapes energy. CK Infrastructure's investments in these areas reflect this trend. Globally, renewable energy capacity grew by 50% in 2023. This sector is projected to attract significant investment, with figures potentially exceeding $2 trillion annually by 2030.

Innovation in Waste Management and Waste-to-Energy

Technological factors significantly influence CK Infrastructure's waste management operations. Advanced sorting technologies and recycling methods are evolving rapidly, impacting the efficiency and cost-effectiveness of waste processing. Waste-to-energy technologies, such as incineration with energy recovery and anaerobic digestion, provide alternative energy sources, enhancing sustainability. These innovations present opportunities for CK Infrastructure to optimize its waste management infrastructure and develop new revenue streams.

- Global waste-to-energy market projected to reach $45.8 billion by 2028.

- Advanced recycling technologies can increase material recovery rates by up to 30%.

- Anaerobic digestion can produce biogas, reducing reliance on fossil fuels.

Cybersecurity Risks to Infrastructure

Cybersecurity threats pose a growing risk to infrastructure, given its increasing reliance on digital systems. Protecting infrastructure from cyberattacks is vital for ensuring operational reliability and security. In 2024, the global cost of cybercrime is projected to reach $10.5 trillion. Companies like CK Infrastructure must invest in robust cybersecurity measures to mitigate these risks.

- Cyberattacks on critical infrastructure increased by 40% in 2023.

- The average cost of a data breach in the infrastructure sector is $4.8 million.

- Around 70% of infrastructure companies have experienced a cyberattack.

Technological innovations affect CK Infrastructure across its operations. Smart grids and smart infrastructure markets are valued at billions, with the global smart infrastructure market reaching $1.5 trillion by 2025, impacting efficiency and operations.

Renewables are significant. Cybersecurity is crucial, with attacks up and the cost of cybercrime soaring. Cybersecurity cost is projected to be $10.5 trillion in 2024.

Waste management benefits from technology too, with waste-to-energy markets and advanced recycling. The global waste-to-energy market is predicted to hit $45.8 billion by 2028.

| Technology Area | Market Size (2025) | Key Impact |

|---|---|---|

| Smart Grid | $61.3 Billion | Boosts Efficiency |

| Smart Infrastructure | $1.5 Trillion | Digitalization Benefits |

| Waste-to-Energy | $45.8 Billion (by 2028) | Enhances sustainability, new revenue |

Legal factors

CK Infrastructure faces intricate regulatory compliance challenges across its global operations. It must adhere to diverse legal frameworks, including environmental, safety, and competition laws. In 2024, non-compliance could lead to significant financial penalties. For instance, environmental fines in the EU can reach up to 10% of annual revenue. Compliance is vital to sustain operational licenses and avoid legal repercussions.

Competition law changes in the EU and globally can impact CK Infrastructure. Stricter scrutiny of mergers and acquisitions might limit expansion opportunities. For example, the EU fined Broadcom €561 million in 2023 for anticompetitive practices. Assessments of market dominance influence strategic moves. These legal shifts affect infrastructure projects' feasibility.

CK Infrastructure's revenue heavily relies on long-term contracts. These contracts dictate pricing, service standards, and duration, impacting future earnings. The legal landscape surrounding these deals is crucial. For example, in 2024, approximately 75% of CK Infrastructure's revenue came from regulated assets, highlighting the importance of stable legal frameworks. These frameworks ensure financial predictability.

Legal Framework for Acquisitions and Disposals

The legal landscape significantly shapes CK Infrastructure's M&A and disposal strategies. International regulations, such as those in the EU and the US, require antitrust reviews. These reviews, alongside sector-specific approvals, influence deal timelines and feasibility. For example, in 2024, the European Commission blocked several mergers due to competition concerns.

- Antitrust reviews can take several months, impacting deal completion.

- Sector-specific regulations, like those in utilities, add complexity.

- Compliance costs and legal expertise are crucial for successful transactions.

- Changes in political climate can alter regulatory scrutiny.

International Law and Treaties

International laws and treaties are crucial for CK Infrastructure's global footprint. These agreements impact trade, investment protection, and environmental standards. Navigating these frameworks is vital for successful cross-border ventures. For instance, the company's investments in Europe must align with EU regulations.

- In 2024, global infrastructure investment reached $3.5 trillion, influenced by international agreements.

- Trade agreements like the CPTPP impact infrastructure projects in participating nations.

- Environmental treaties, such as the Paris Agreement, shape project sustainability requirements.

CK Infrastructure faces rigorous global legal compliance challenges, impacting its financial and operational strategies. Antitrust reviews and sector-specific regulations significantly affect its mergers and acquisitions. Revenue, primarily from regulated assets, depends on stable legal frameworks.

| Legal Area | Impact | Data |

|---|---|---|

| Environmental Compliance | Fines and penalties | EU fines: up to 10% of annual revenue |

| M&A Regulations | Deal timelines and feasibility | 2024 EU blocked mergers |

| Contractual Agreements | Revenue Predictability | 75% revenue from regulated assets |

Environmental factors

Climate change intensifies extreme weather, posing physical risks to CK Infrastructure's assets. Floods, storms, and rising sea levels threaten infrastructure like transportation and water facilities. In 2024, extreme weather caused $70 billion in US infrastructure damage. Adaptation measures and resilience investments are crucial for asset protection.

Stricter environmental rules on emissions, pollution, and waste impact CK Infrastructure, requiring investments in green tech. The company's 2024 sustainability report shows its dedication to environmental care. For example, in 2024, CK Infrastructure spent $150 million on eco-friendly projects. This includes upgrades to reduce emissions by 15% at its power plants.

The shift towards a low-carbon economy is reshaping infrastructure investments globally. CK Infrastructure is adapting, with acquisitions in renewable energy. For example, in 2024, renewable energy projects saw a 15% rise in investment. This reflects the growing emphasis on decarbonization.

Water Scarcity and Water Resource Management

Water scarcity poses a significant environmental challenge for CK Infrastructure, particularly impacting its water infrastructure ventures. The company must address water quality, ensuring its infrastructure meets stringent environmental standards. Supply reliability is crucial, requiring strategies to mitigate risks like drought. Operations must also minimize ecological harm, safeguarding aquatic ecosystems. For instance, the global water market is projected to reach $1.02 trillion by 2025, highlighting the financial implications of water management.

- Global water infrastructure spending is expected to increase by 4.5% annually through 2025.

- Investments in water treatment technologies are growing, with a focus on desalination and wastewater recycling.

- Water stress affects over 2 billion people worldwide, intensifying the need for efficient water management.

Waste Management and Circular Economy Principles

Growing environmental awareness and the shift towards circular economy models are reshaping waste management strategies globally. CK Infrastructure's focus on waste-to-energy projects is a direct response to the need for sustainable solutions. This approach not only addresses waste reduction but also generates renewable energy, contributing to lower carbon emissions. The global waste management market is projected to reach $2.4 trillion by 2028, highlighting significant growth potential.

- The waste-to-energy market is expected to grow, with investments in advanced technologies.

- Circular economy principles are increasingly integrated into waste management policies.

- CK Infrastructure's projects support both environmental and economic sustainability.

Environmental factors significantly impact CK Infrastructure through climate risks and stringent regulations. Climate change necessitates asset protection investments; 2024 saw $70B in US infrastructure damage. Adaptation to emissions rules involves green tech investments.

The shift to a low-carbon economy favors renewable energy acquisitions; 2024 saw 15% rise in green investments. Water scarcity demands efficient management. The water market will hit $1.02T by 2025.

Focusing on waste management involves sustainable solutions, such as waste-to-energy projects. Waste management market projects $2.4T by 2028.

| Aspect | Impact | Data |

|---|---|---|

| Climate Risk | Asset damage | $70B US infrastructure damage (2024) |

| Environmental Regs | Green tech investment | $150M spent (2024) on eco-projects. |

| Low-Carbon Economy | Renewable energy acquisitions | 15% investment rise (2024) |

PESTLE Analysis Data Sources

This CK Infrastructure PESTLE analyzes official government publications, financial reports, and industry databases for current insights.