Cogent Communications PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cogent Communications Bundle

What is included in the product

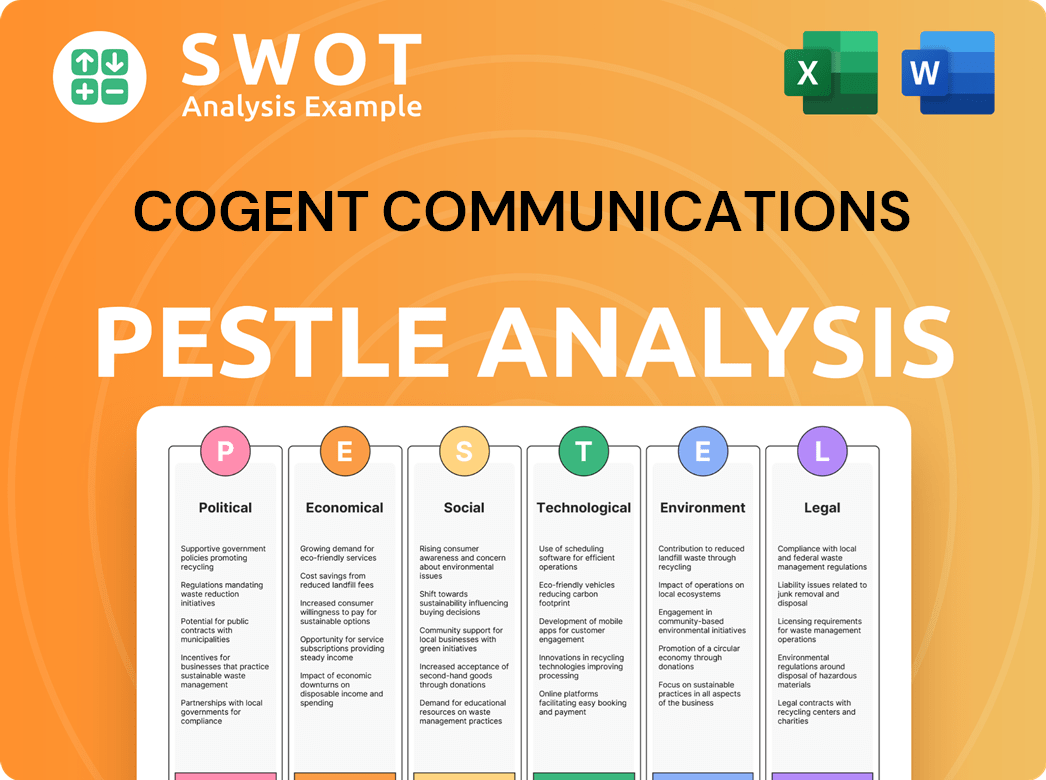

Examines Cogent's external factors across political, economic, social, technological, environmental, and legal aspects.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Cogent Communications PESTLE Analysis

The preview demonstrates Cogent Communications' PESTLE analysis, highlighting its comprehensive market evaluation. You’ll find a detailed examination of political, economic, social, technological, legal, and environmental factors. This complete document is ready for download right after your purchase.

PESTLE Analysis Template

Navigate Cogent Communications's external landscape. Our PESTLE analysis provides key insights into the forces shaping its strategy. Uncover political, economic, social, technological, legal, and environmental factors. Use our research to understand market dynamics, anticipate risks, and capitalize on opportunities. Get the full report for comprehensive analysis and actionable intelligence.

Political factors

Cogent's performance is heavily influenced by government regulations. Changes in net neutrality, infrastructure rules, and trade agreements directly affect its market access. For example, the FCC's actions on broadband could alter Cogent's service offerings. Regulatory bodies like the EU's BER play a key role. In 2024, regulatory compliance costs rose by 5%, impacting profitability.

Cogent Communications faces geopolitical risks due to its global presence. Trade tensions and political instability in various regions can disrupt network operations. For instance, in 2024, the company's investments in politically unstable areas decreased by 15%. Government surveillance concerns could also impact data security and operational costs. These factors affect expansion and investment strategies.

Cogent Communications, as a key internet infrastructure provider, faces stringent regulations focused on safeguarding against cyber threats. The U.S. government, for example, has increased cybersecurity spending, with over $11 billion allocated in 2024. Compliance mandates substantial investments in robust security protocols, potentially affecting operational costs. These measures aim to protect critical networks, ensuring service continuity, which is essential for Cogent's operations.

International Relations and Cross-Border Operations

Cogent Communications, operating globally, is significantly influenced by international relations. Political tensions and trade agreements directly affect its cross-border data transfers and network operations. For instance, the ongoing geopolitical issues in Europe could lead to regulatory changes impacting Cogent's services there. These factors can introduce both risks and opportunities, influencing expansion strategies and operational costs.

- 2024: Cogent reported a revenue of $1.5 billion.

- 2025: Projected revenue growth is estimated at 5% to 7%, with international markets playing a key role.

- Cross-border data flow regulations are expected to become stricter in several regions by the end of 2025.

Spectrum Allocation Policies

Spectrum allocation policies, though not directly impacting Cogent, can affect demand. Strong 5G and future wireless tech require robust fiber backhaul, indirectly boosting Cogent's services. In 2024, the global 5G market was valued at $100 billion, expected to reach $667 billion by 2029. This growth fuels the need for Cogent's fiber infrastructure.

- 5G market value in 2024: $100 billion.

- Projected 5G market value by 2029: $667 billion.

- Fiber backhaul is essential for 5G expansion.

Cogent's global presence exposes it to geopolitical instability impacting operations, with investments in unstable regions down 15% in 2024. Cybersecurity regulations increased, costing over $11B in 2024; affecting operational costs and security protocols. International relations shape cross-border data and network operations. Strict data flow regs expected by 2025.

| Political Factor | Impact | Data |

|---|---|---|

| Geopolitical Risk | Disruption of network operations | Investments down 15% in 2024 in unstable areas |

| Cybersecurity Regulations | Increased operational costs | US spent $11B+ on cybersecurity in 2024 |

| International Relations | Influence on data transfer | Stricter regulations by late 2025 |

Economic factors

Global economic conditions significantly influence Cogent's business. A strong global economy typically boosts demand for internet services, encouraging business expansion and higher spending. Conversely, economic slowdowns can curb this demand, affecting Cogent's revenue. For instance, in 2023, global GDP growth was around 3%, impacting the tech sector.

Inflation significantly impacts Cogent Communications' operational costs. Rising prices for equipment and energy, essential for network infrastructure, directly increase expenses. In Q1 2024, the U.S. inflation rate was around 3.5%, potentially affecting Cogent's profitability. Managing these costs through strategic pricing and efficiency is crucial for maintaining margins.

Cogent, with its international presence, faces currency exchange rate risks. Fluctuations affect the translation of foreign revenues into USD. For example, in Q1 2024, currency impacts were noted in earnings reports. These shifts can influence reported financial performance.

Competition and Pricing Pressures

The telecommunications sector is fiercely competitive, featuring numerous providers with comparable offerings. This intense competition places significant pressure on pricing, potentially affecting Cogent's ability to boost or sustain its service revenue. Cogent's revenue in Q1 2024 was $158.6 million, a decrease from $159.3 million in Q1 2023, showing the pricing challenges. The company faces challenges from rivals, especially in its core markets.

- Pricing pressures can limit Cogent's revenue growth.

- Competition forces Cogent to innovate and reduce costs.

- Strategic pricing is critical for maintaining market share.

- The rise of alternative providers further intensifies competition.

Investment in Infrastructure

Investment in digital infrastructure, including fiber optic networks and data centers, is crucial for Cogent Communications. This investment directly impacts demand for their services. Government initiatives and private sector spending on these projects create market opportunities. For instance, in 2024, global spending on data center infrastructure reached approximately $200 billion.

- Data center spending is projected to rise further in 2025, driven by AI and cloud computing.

- Government infrastructure bills in various countries are allocating funds to improve digital networks.

- These investments boost bandwidth demand, benefiting Cogent's business model.

Economic factors play a key role in Cogent Communications' performance. Global economic growth impacts demand, with stronger economies generally boosting internet service needs.

Inflation affects operational expenses, increasing costs for equipment and energy, which directly impacts profitability. Currency exchange rate fluctuations also present risks, influencing the translation of foreign revenues.

Cogent’s success hinges on managing these economic dynamics, like strategic pricing amid competition and investing in crucial digital infrastructure. Consider the telecommunication sector where overall revenue for the sector grew by 2.8% in Q1 2024.

| Economic Factor | Impact on Cogent | Recent Data |

|---|---|---|

| Global Growth | Affects Service Demand | Global GDP growth in 2024 (est.): 3.1% |

| Inflation | Increases Costs | U.S. inflation rate (Q1 2024): 3.5% |

| Currency Fluctuations | Impacts Revenue | USD relative volatility impacted financials in Q1 2024 |

Sociological factors

The increasing reliance on the internet significantly boosts demand for Cogent's services. Businesses now depend heavily on the internet, alongside the rise of remote work and digital services. This trend fueled a 5.4% increase in Cogent's revenue in Q1 2024, reaching $166.3 million. The continued need for high-speed internet access and network services makes this a critical market driver.

Cogent Communications' strategy heavily relies on urbanization, focusing on major metropolitan areas for network deployment and customer acquisition. Urbanization trends directly impact Cogent's ability to expand its network and reach a wider customer base. Denser urban environments offer greater potential for on-net connections, boosting service efficiency and customer value. In 2024, urban populations globally continue to rise, with significant growth expected in regions where Cogent operates, such as North America and Europe, increasing its market opportunities.

Efforts to bridge the digital divide affect regulations. This creates opportunities or obligations for providers. For instance, in 2024, the FCC allocated billions for broadband expansion. This aims to connect underserved areas. Digital inclusion initiatives may also drive new service demands.

Changing Work Patterns

The rise of remote and hybrid work models significantly reshapes corporate network demands. Cogent Communications must adjust its services to support these new work arrangements. Businesses now prioritize reliable, high-speed connectivity to facilitate seamless remote operations. This shift influences infrastructure investments and service offerings.

- In 2024, 60% of U.S. companies reported offering hybrid work options.

- Global spending on remote work technologies is projected to reach $70 billion by 2025.

- Demand for cloud-based services, supporting remote work, increased by 25% in 2024.

Customer Expectations for Service Quality and Reliability

Customer expectations for service quality and reliability are soaring. Cogent Communications must deliver high-quality, reliable internet services with low latency to satisfy customers. Failure to meet these expectations could lead to customer churn and damage the company's reputation. In 2024, the average customer satisfaction score for internet service providers was 78 out of 100, highlighting the importance of quality.

- Customer satisfaction scores are a critical metric.

- Reliability and low latency are non-negotiable.

- Reputation is crucial for customer retention.

Sociological factors greatly shape Cogent Communications' operational landscape. Remote work and digital reliance increase demand for its services. Urbanization impacts network deployment, with growth expected in key regions. Customer expectations for service quality are also critical for success.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Internet Dependence | Boosts service demand. | Revenue increased 5.4% in Q1 2024; remote work tech spending: $70B by 2025. |

| Urbanization | Influences network expansion. | Urban pop. continues rising; Focus on North America & Europe |

| Customer Expectations | Demands high reliability. | Avg. ISP satisfaction score: 78/100 in 2024; 60% companies use hybrid models. |

Technological factors

Ongoing fiber optic advancements boost bandwidth and speed, vital for Cogent. In Q1 2024, Cogent's revenue hit $162.9 million, driven by robust network performance. Keeping pace with tech ensures a competitive edge; in 2024, global fiber optic spending is projected to reach $12.5 billion.

Cloud computing's expansion fuels demand for robust network infrastructure. Data centers, crucial for cloud services, rely on high-speed connectivity. Cogent Communications benefits from this, providing essential network solutions. The global data center market is projected to reach $600 billion by 2025, increasing Cogent's opportunities.

The rise of SDN, NFV, and edge computing reshapes network infrastructure. Cogent must evolve its network to stay competitive. In 2024, the global SDN market was valued at $17.6 billion. Edge computing is projected to reach $250.6 billion by 2027. These changes impact Cogent's service delivery and investment strategies.

Cybersecurity Threats and Solutions

Cogent Communications faces heightened cybersecurity threats, demanding ongoing investment in advanced protective measures. The company must continually adapt to evolving digital risks to safeguard its network and customer information. Technological advancements are crucial for staying ahead of cybercriminals. In 2024, cybersecurity spending is projected to reach $215 billion globally.

- Ransomware attacks increased by 13% in Q1 2024.

- Cybersecurity market expected to grow to $345 billion by 2026.

- Cogent utilizes advanced firewalls and intrusion detection systems.

Development of 5G and Future Wireless Technologies

The advancement of 5G and the anticipated arrival of 6G significantly influence Cogent Communications, despite its primary focus on wireline services. These technologies drive the need for robust fiber backhaul infrastructure, creating opportunities for Cogent to connect wireless towers and related infrastructure. The global 5G infrastructure market is projected to reach $75.8 billion in 2024 and is expected to grow to $168.6 billion by 2030. This expansion increases the demand for high-capacity data transport solutions, such as those offered by Cogent.

- 5G infrastructure market expected to reach $168.6B by 2030.

- Increased demand for fiber backhaul.

- Opportunities to provide connectivity to wireless towers.

Fiber optic enhancements drive Cogent's network capabilities. Cloud computing boosts demand for Cogent's services, supported by data center growth. The firm adapts to SDN and edge computing advancements.

| Aspect | Impact | Data (2024/2025) | |

|---|---|---|---|

| Fiber Optics | Enhances network speed | Global spending: $12.5B (2024) | Revenue: $162.9M (Q1 2024) |

| Cloud Computing | Increases network demand | Data center market: $600B (2025) | - |

| 5G/6G | Drives fiber backhaul needs | 5G market: $75.8B (2024), $168.6B (2030) | - |

| Cybersecurity | Requires continuous investment | Spending: $215B (2024) | Ransomware attacks increased by 13% in Q1 2024 |

Legal factors

Cogent Communications faces diverse telecommunications regulations globally. These regulations involve licensing, interconnection, and service quality standards. Compliance costs and regulatory changes can impact operations. For instance, in 2024, regulatory fines totaled $2.5 million. Such factors affect Cogent's operational costs. Ongoing changes require continuous adaptation.

Cogent Communications must adhere to data protection and privacy laws like GDPR and CCPA. These regulations, which have seen updates in 2024, require strict data handling practices. Non-compliance can lead to hefty fines; for example, GDPR fines can reach up to 4% of annual global turnover.

Net neutrality debates and regulatory changes significantly influence internet traffic management, directly affecting companies like Cogent. In 2024, ongoing discussions about content prioritization and data throttling could reshape Cogent's service delivery models. The Federal Communications Commission (FCC) continues to monitor these issues, with potential impacts on peering agreements and network infrastructure investments. Any shift in net neutrality rules could alter Cogent's operational costs and competitive landscape, particularly concerning data transit pricing. In 2025, the industry anticipates further regulatory clarity, which will be crucial for Cogent's strategic planning.

Antitrust and Competition Law

Cogent Communications operates within a landscape shaped by antitrust regulations designed to prevent monopolies and foster competition in the internet transit market. These laws scrutinize mergers, acquisitions, and market behaviors that could stifle competition or harm consumers. For example, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the US regularly review such activities. In 2023, the FTC challenged several mergers.

- The European Commission has also been active, fining companies billions of euros for antitrust violations in recent years.

- Cogent's pricing strategies and service agreements are under constant review to ensure they do not violate antitrust laws.

- Competition is fierce, with major players like Lumen and Verizon vying for market share.

- The company must comply with regulations in various jurisdictions, increasing compliance costs.

Infrastructure Siting and Environmental Regulations

Cogent Communications faces legal hurdles tied to infrastructure and environmental rules. These involve environmental impact assessments and permits for fiber optic cable and data center builds. Compliance costs can be high, affecting project timelines and budgets, which is a challenge. Delays due to regulatory approvals can impede expansion plans, impacting revenue.

- Environmental regulations vary by region, creating complexity.

- Permitting processes can be lengthy and expensive.

- Non-compliance leads to penalties and operational disruptions.

Cogent navigates multifaceted global telecoms laws, which included $2.5M in regulatory fines during 2024, impacting operational costs and necessitating continuous adjustments. Compliance with data privacy laws, like GDPR and CCPA, remains critical. The FCC's evolving stance on net neutrality, and related infrastructure investments, will influence transit costs and competitive dynamics, demanding adaptive strategic planning for 2025. Antitrust regulations closely scrutinize market practices.

| Aspect | Details | Impact |

|---|---|---|

| Regulatory Fines | $2.5M in 2024 | Increased operational expenses |

| GDPR Fines | Up to 4% of global turnover | Significant financial risk |

| Antitrust scrutiny | FTC and DOJ reviews | Impact on mergers and pricing |

Environmental factors

Telecommunications networks, including data centers, are major energy consumers. The industry faces increasing pressure to boost energy efficiency and cut carbon emissions. In 2024, data centers globally used around 2% of the world's electricity. Cogent's energy use is under scrutiny as environmental concerns grow. They must adapt to regulations and investor demands for sustainability.

Electronic waste (e-waste) disposal and recycling are critical environmental concerns. Cogent Communications, like other tech companies, must address this. The global e-waste generation in 2023 was 62 million metric tons. Effective e-waste management is vital for sustainability. It also ensures regulatory compliance.

Climate change significantly affects infrastructure. Extreme weather events, like hurricanes and floods, threaten physical networks, demanding robust designs and disaster recovery plans. For example, in 2024, the U.S. faced over $100 billion in damages from climate-related disasters. Such events disrupt services and increase operational costs. Cogent must invest in climate resilience to protect its assets and ensure service continuity.

Sustainability Reporting and ESG Standards

Cogent Communications faces growing pressure to disclose its environmental impact due to the rising importance of ESG factors. Investors and stakeholders increasingly scrutinize companies' environmental performance, pushing for detailed sustainability reports. The demand for transparency is fueled by regulatory changes and investor preferences, impacting Cogent's operations. In 2024, ESG assets reached approximately $40 trillion globally, highlighting the financial significance of these factors.

- The Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) are key frameworks for ESG reporting.

- In 2024, companies are facing more pressure to disclose carbon emissions.

- Investors are increasingly using ESG ratings to make investment decisions.

Resource Depletion (e.g., rare earth minerals)

Cogent Communications, like other tech companies, faces environmental challenges due to resource depletion. The production of its network equipment depends on materials, including rare earth minerals, whose supply chains are under pressure. Sustainable sourcing and material efficiency are increasingly important for the company's environmental strategy. These factors can impact operational costs and supply chain resilience.

- The global demand for rare earth elements is projected to reach $21.5 billion by 2030.

- Companies are exploring recycling programs to reduce reliance on virgin materials.

- Material efficiency efforts can lead to cost savings and reduce waste.

Cogent must boost energy efficiency given data centers' high energy use; in 2024, data centers consumed roughly 2% of the world's electricity.

E-waste and its management remain a critical concern; global e-waste generation in 2023 totaled 62 million metric tons.

Climate change poses major risks through extreme weather, necessitating disaster recovery plans to handle the increasing climate-related damages, which cost the U.S. over $100 billion in 2024.

ESG factors grow, pushing Cogent to report on its environmental effects due to heightened investor and stakeholder scrutiny; globally, ESG assets neared $40 trillion in 2024.

| Environmental Factor | Impact on Cogent | Relevant Data (2024/2025) |

|---|---|---|

| Energy Consumption | Operational Costs, Regulatory Compliance | Data centers used 2% of global electricity in 2024; efficiency is crucial. |

| E-Waste | Disposal Costs, Brand Reputation | 62 million metric tons of e-waste globally in 2023; drives need for recycling. |

| Climate Change | Infrastructure Damage, Service Disruptions | US climate disasters cost over $100B in 2024; requires disaster plans. |

| ESG Reporting | Investor Relations, Transparency | ESG assets globally about $40 trillion in 2024; needs sustainability reports. |

PESTLE Analysis Data Sources

This Cogent analysis synthesizes data from financial reports, industry publications, and regulatory updates.