Cognex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cognex Bundle

What is included in the product

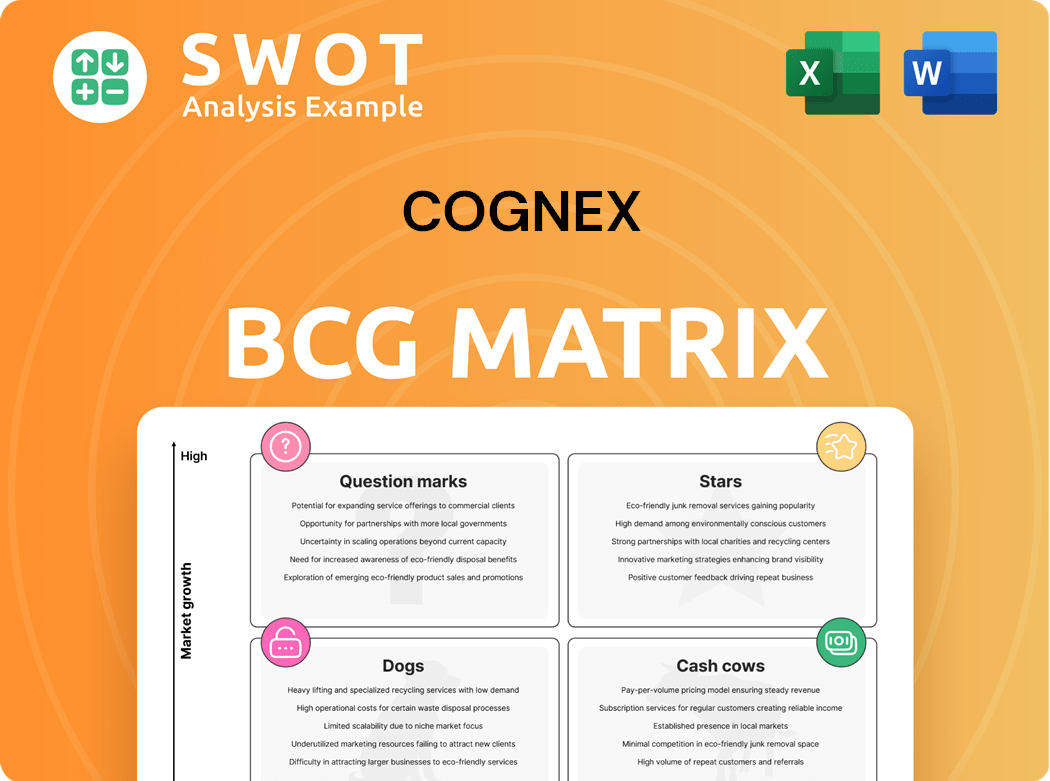

Cognex's BCG Matrix analysis outlines investment, hold, or divest decisions for each product unit.

Printable summary optimized for A4 and mobile PDFs, provides an easy-to-understand view for busy executives.

Full Transparency, Always

Cognex BCG Matrix

The BCG Matrix preview mirrors the final product you'll get. The full report, without alterations, is ready for immediate strategic planning and presentation to your team.

BCG Matrix Template

Cognex's BCG Matrix sheds light on its product portfolio, revealing growth potential and areas needing attention. See how its offerings fare—Stars, Cash Cows, Dogs, or Question Marks. Understanding this is key to informed investment decisions. But this is just a taste! Get the full BCG Matrix to unlock detailed quadrant insights, strategic recommendations, and a clear path forward.

Stars

Cognex's AI-powered machine vision is a star in its BCG Matrix. The company's AI integration boosts product capabilities and market reach. Cognex's AI focus strengthens its leadership. In 2024, Cognex's revenue was about $860 million, showing strong growth.

Cognex's logistics sector is booming, driven by automation in e-commerce and supply chains. Their solutions see strong adoption, boosting revenue significantly. In Q3 2023, Cognex's revenue was $185 million, with logistics a key contributor. Expect continued growth as demand for automation rises.

The semiconductor industry presents significant growth opportunities for Cognex. Demand is fueled by investments in high-bandwidth memory chips and increased capital expenditure. Cognex's focus on this sector is strategic, with the global semiconductor market projected to reach $580 billion in 2024. This momentum is anticipated to continue into 2025, ensuring continued investment.

Emerging Customer Initiative

Cognex's "Emerging Customer Initiative" focuses on making its products more accessible. This aims to attract new customers who may have previously found the technology too complex. The strategy has the potential to significantly boost Cognex's long-term financial performance. This expansion could be a key driver for the company's future growth.

- In 2023, Cognex reported a revenue of approximately $846 million, showing a stable market position.

- The initiative's success hinges on user-friendly product design and effective market outreach.

- Analysts predict a steady growth trajectory for Cognex, contingent on successful market penetration.

Moritex Acquisition

The Moritex acquisition by Cognex is a strategic move, broadening its market reach and positively affecting earnings per share. This integration boosts Cognex's product portfolio, fostering growth in both established and new markets. This expansion is designed to fortify Cognex's competitive standing in the industry. Cognex's revenue in Q3 2024 was $224 million, a 6% increase year-over-year, partially due to this acquisition.

- Increased Market Capabilities: Moritex expands Cognex's reach.

- Positive EPS Contribution: The acquisition benefits Cognex's financial results.

- Enhanced Product Offerings: Integration strengthens Cognex's portfolio.

- Competitive Advantage: The acquisition aims to improve Cognex's market position.

Cognex's machine vision, particularly with AI, is a star. Strong revenue growth, like the $860 million in 2024, shows its success. Expansion via acquisitions, such as Moritex, further boosts its market position.

| Feature | Details |

|---|---|

| Revenue 2024 | ~$860M |

| Q3 2024 Revenue | $224M |

| Growth YoY Q3 2024 | 6% |

Cash Cows

Cognex's core machine vision systems, a cash cow, provide consistent revenue. They hold a significant market share in established industries. Investing in these systems ensures a steady cash flow. In 2024, Cognex reported a revenue of $2.3 billion, with a substantial portion derived from these systems. This solidifies their status as a reliable source of income.

Cognex's barcode readers are cash cows, especially in manufacturing. They generate steady revenue due to Cognex's strong brand and distribution. Innovations in this tech maintain market share. In Q3 2024, Cognex reported $202 million in revenue.

Cognex's factory automation solutions, though experiencing some challenges, remain a key revenue source. These solutions leverage strong customer relationships and market position. In 2024, Cognex's revenue was approximately $800 million, demonstrating its market presence. Investments in infrastructure could boost efficiency and cash flow.

Strong Financial Position

Cognex's robust financial health is a cornerstone of its cash cow status. The company holds significant cash reserves and operates without debt, providing a solid foundation. This financial strength enables Cognex to pursue strategic investments and navigate economic downturns effectively. Cognex's dedication to sound financial management guarantees its capacity to generate cash and deliver shareholder value.

- Cash and cash equivalents totaled $785.3 million as of December 31, 2023.

- Cognex had no debt as of the end of 2023.

- Cognex's revenue for 2023 was approximately $848 million.

- The company's gross margin was about 72% in 2023.

Global Market Presence

Cognex's strong global presence solidifies its position as a cash cow. Its revenue streams are stable due to its presence in regions with manufacturing industries. This diversified geographic footprint minimizes risk and offers access to a broad customer base. Cognex's investments in international markets ensure a robust global presence. In 2024, Cognex reported that 55% of its revenue came from outside of North America.

- Revenue Diversification: Over half of Cognex's revenue comes from outside North America, showing a strong global presence.

- Market Stability: Regions with established manufacturing provide Cognex with stable revenue streams.

- Risk Mitigation: A diverse global footprint reduces overall business risk.

- Strategic Investment: Continued investment in international markets maintains a strong presence.

Cognex's cash cows, including machine vision systems and barcode readers, generate reliable revenue. These products boast strong market positions and customer loyalty. Cognex's robust financial health, with $785.3 million in cash in 2023, supports these cash cows.

| Key Metric | Data |

|---|---|

| 2024 Revenue (approx.) | $2.3 billion |

| Q3 2024 Revenue | $202 million |

| 2024 Factory Automation Revenue | $800 million |

| 2023 Gross Margin | 72% |

Dogs

The traditional automotive sector presents challenges for Cognex, with declining revenue streams. Investment cutbacks in conventional automotive manufacturing significantly affect Cognex's sales. In 2024, the sector saw a 5% drop in production volumes globally. Cognex must shift focus towards EVs and battery solutions to boost growth.

In 2024, legacy consumer electronics, like older TVs or DVD players, often face shrinking demand. These products, now "Dogs" in the BCG Matrix, struggle against newer tech. Market share declines as innovation surges, with sales potentially down 10-20% annually. Companies should consider dropping these to focus on growth areas.

Certain segments in China's market, like low-end machine vision, face tough competition and pricing pressures. Cognex might need to lower prices to keep its market share in these areas. For example, in 2024, overall industrial automation in China grew by only 5%, indicating a slowdown. Cognex needs to assess if these segments are worth the squeeze on profits.

Packaging (Specific Applications)

Specific packaging applications might be struggling with slow growth and declining profits, possibly due to new tech or shifting consumer tastes. These areas could be seeing competition from different technologies, impacting their market share. To boost Cognex's performance, the focus should shift towards high-growth packaging sectors.

- In 2024, the global packaging market is estimated at $1.1 trillion, with growth slowing to around 3-4% annually.

- Cognex's revenues from packaging-related vision systems might be under pressure from cheaper alternatives.

- Focusing on fast-growing segments like e-commerce packaging could provide better returns.

Medical (Niche Products)

Niche medical products, a "Dog" in Cognex's portfolio, face headwinds. Limited market demand, or regulatory hurdles, can stifle growth. These products may need substantial investment without assured returns. In 2024, the medical device market saw a 6.3% growth, yet niche segments lagged. A thorough evaluation of market potential and ROI is crucial.

- Limited market demand and regulatory challenges hinder growth.

- Significant investment may be needed.

- Careful assessment of potential and ROI is essential.

- 2024 medical device market growth was 6.3%.

In Cognex's BCG Matrix, "Dogs" represent struggling products. These segments face declining market share or growth challenges. They might require substantial investment with uncertain returns. Strategic decisions, such as divestiture, are crucial for optimizing Cognex's portfolio.

| Category | Characteristics | Impact |

|---|---|---|

| Examples | Legacy consumer electronics, low-end machine vision in China | Potential for revenue decline, need for strategic reassessment |

| Market Dynamics | Slow growth, high competition, and price pressure | Diminishing market share and profit margins |

| Strategic Action | Divestiture or reallocation of resources to high-growth areas. | Improved resource allocation and focus on profitable segments. |

Question Marks

AI-driven inspection of new materials is a high-growth area. Cognex's market share is currently low, reflecting the novelty of these applications. Investments are crucial for gaining market share. In 2024, the AI in computer vision market was valued at $25.4 billion.

3D vision systems in robotics represent a high-growth market for Cognex, yet its current market share is modest. The robotics vision market is projected to reach $2.8 billion by 2024, with a CAGR of 13.4% from 2024-2030. Cognex's revenue in this segment needs boosting.

Edge learning technologies are enabling customized machine vision solutions. Cognex's market share is currently low due to early adoption. In 2024, the machine vision market was valued at approximately $8.1 billion. User-friendly product development is crucial. Targeted sales efforts are vital for customer base expansion.

Solutions for Sustainable Manufacturing

Solutions for sustainable manufacturing are gaining traction, though Cognex's market share in this area is currently modest. Eco-friendly product development and marketing are crucial for market growth. This approach resonates with evolving customer values. Cognex could capitalize on the rising demand for sustainable practices.

- Sustainability in manufacturing is projected to reach $61.6 billion by 2024.

- Cognex's current market share in sustainable manufacturing is less than 5%.

- Investment in green tech increased by 15% in 2023.

- Customer preference for sustainable products has risen by 20% in the past year.

Integration with IIoT Platforms

The integration of Cognex's machine vision systems with IIoT platforms is a key opportunity for growth. However, adoption rates remain relatively low, mainly because of complex integration processes and diverse customer requirements. Strategic alliances and streamlined integration solutions are essential to boost adoption and expand market share. In 2024, the IIoT market is projected to reach \$230 billion, with machine vision playing a crucial role.

- Market penetration is currently limited due to integration complexity.

- Strategic partnerships are critical for expanding market reach.

- Simplified solutions are needed to drive adoption.

- The IIoT market is forecasted to be substantial in 2024.

Question Marks represent high-growth, low-share segments. Cognex must invest in these areas to gain market share. Key strategies involve strategic partnerships and streamlined solutions. Success depends on significant investment and market focus.

| Segment | Market Growth Rate (2024) | Cognex Market Share (2024) |

|---|---|---|

| AI in Computer Vision | Significant | Low |

| Robotics Vision | 13.4% CAGR (2024-2030) | Modest |

| Sustainability in Manufacturing | High, $61.6B (2024) | <5% |

BCG Matrix Data Sources

The Cognex BCG Matrix uses financial filings, market research, and industry analysis. We also consider competitor data for insights.