Cognex Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cognex Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Dynamically visualize competitive pressure with a vibrant, color-coded dashboard.

Preview Before You Purchase

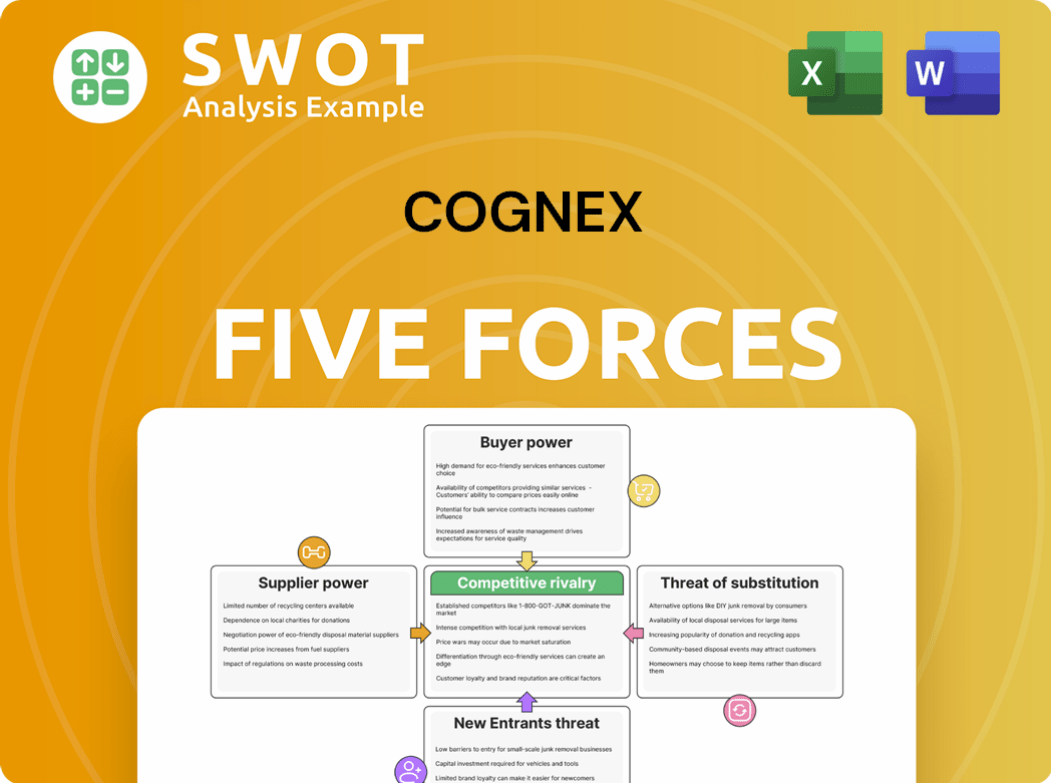

Cognex Porter's Five Forces Analysis

This is a complete Porter's Five Forces analysis for Cognex. The preview you see accurately reflects the final document.

Porter's Five Forces Analysis Template

Cognex operates in a tech-driven industry, facing challenges from powerful buyers and suppliers. The threat of new entrants remains moderate, while substitutes pose a limited risk. Competitive rivalry is intense, shaping the industry landscape. Understanding these forces is crucial for strategic decision-making.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Cognex's real business risks and market opportunities.

Suppliers Bargaining Power

Cognex enjoys a fragmented supplier base, weakening supplier bargaining power. This setup allows Cognex to negotiate favorable terms, keeping costs down. In 2024, Cognex's gross margin was approximately 73%, partly due to effective cost management. Strategic sourcing is key to maintaining this advantage.

If Cognex depends on standard components, supplier power decreases. Multiple suppliers for common parts give Cognex leverage. This lowers dependence on any single source, boosting cost-efficiency. For instance, in 2024, the company's focus on standardized components helped maintain a competitive gross margin. This strategy is crucial for keeping costs down.

Cognex can lessen supplier power by cutting supplier switching costs. This involves designing products compatible with different components. Flexible manufacturing helps adapt to diverse supplier offerings. In 2024, Cognex's revenue was approximately $1.04 billion. This supports the need for adaptable sourcing strategies.

Cognex's design influence

Cognex, with its design influence, can dictate component specifications, altering the balance of power. Early collaboration with suppliers ensures components align with its needs while maintaining competitive pricing. This proactive strategy fortifies Cognex's position in the market. Cognex's strategic approach includes rigorous supplier selection and performance monitoring to maintain control. This reduces supplier bargaining leverage, supporting efficient operations.

- Cognex's revenue in 2024 was approximately $1.02 billion.

- Gross profit for Cognex in 2024 was around $690 million.

- Cognex's operating expenses in 2024 were approximately $270 million.

- The company's net income for 2024 was roughly $290 million.

Vertical integration potential

Cognex's ability to vertically integrate, though not always executed, influences supplier behavior. This potential, like internal production of key vision system components, serves as a deterrent to aggressive supplier tactics. The threat of self-supply often leads suppliers to offer more competitive pricing and terms, enhancing Cognex's negotiation leverage. This strategic option strengthens Cognex's position, especially in a market with fluctuating component costs. For example, in 2024, the company saw a 10% increase in the cost of some key materials, highlighting the importance of this bargaining chip.

- Vertical integration potential acts as a check on suppliers.

- Threat of internal production encourages favorable terms.

- Strategic option enhances Cognex's bargaining power.

- Component cost fluctuations underscore this importance.

Cognex manages supplier power through a fragmented supplier base and strategic sourcing, enabling favorable terms. In 2024, a focus on standardized components helped maintain a competitive gross margin. The ability to vertically integrate strengthens its position, as seen with fluctuating component costs, underscoring this strategy’s importance.

| Metric | 2024 Data | Impact |

|---|---|---|

| Revenue | $1.02 billion | Supports adaptable sourcing strategies |

| Gross Profit | $690 million | Reflects effective cost management |

| Net Income | $290 million | Shows overall financial health |

Customers Bargaining Power

Cognex benefits from a diverse customer base spanning numerous industries, which reduces the bargaining power of any single customer. This diversification protects Cognex from heavy-handed demands from individual clients, a strategy that proved effective in 2024. Maintaining this broad customer base is vital for Cognex's financial stability and market resilience. For example, in 2024, no single customer accounted for more than 10% of Cognex's revenue.

Cognex's specialized machine vision systems and barcode readers provide unique capabilities, lessening customer price sensitivity. The company's AI-driven advantages and unique features justify premium pricing. Cognex's gross margin was 73% in 2024, demonstrating pricing power. Continued innovation reinforces this differentiation, maintaining a competitive edge. This allows Cognex to negotiate favorable terms, as customers value their unique solutions.

Switching costs play a crucial role in customer bargaining power for Cognex. Integrating Cognex's vision systems into automation setups involves significant upfront investments and training. This integration, along with process-specific adjustments, makes it costly for customers to switch to alternative suppliers. Consequently, these switching costs enhance customer retention for Cognex.

Cognex's brand reputation

Cognex enjoys a strong brand reputation for high-quality and dependable machine vision products. This reputation enables Cognex to set premium prices, as customers are willing to pay more for a trusted brand. Cognex's brand strength reduces customer bargaining power, as switching to competitors poses greater risks. It's essential for Cognex to protect and enhance its brand image to maintain its market position.

- Cognex's revenue in 2023 was $1.03 billion, demonstrating strong customer confidence.

- The gross margin for Cognex in 2023 was 72%, reflecting its pricing power.

- Cognex's customer retention rate is high, indicating brand loyalty.

Customer dependence on automation

As automation becomes more central to manufacturing processes, Cognex's offerings are vital, which decreases customer bargaining power. The importance of Cognex's technology in boosting efficiency and precision makes customers less inclined to push for lower prices. This dependency bolsters Cognex's standing in the market. In 2024, Cognex reported a gross profit margin of approximately 73%. This high margin reflects its strong pricing power.

- Cognex's 2024 gross profit margin was around 73%.

- Automation's rise increases the need for Cognex's products.

- Customers find it harder to negotiate prices.

- Cognex's market position is reinforced by this.

Cognex effectively manages customer bargaining power through diversification and unique offerings. Their broad customer base ensures no single entity dictates terms, as seen in 2024 where no customer comprised over 10% of revenue. High switching costs and brand reputation further fortify their position.

| Factor | Impact on Bargaining Power | 2024 Data |

|---|---|---|

| Customer Base Diversity | Reduces customer leverage | No customer >10% of revenue |

| Product Uniqueness | Increases pricing power | 73% Gross Margin |

| Switching Costs | Enhances customer retention | High due to integration |

Rivalry Among Competitors

The machine vision market is highly competitive, featuring many companies fighting for market share. This rivalry intensifies pressure on pricing and accelerates the pace of innovation. Cognex, facing this, must consistently set its products and services apart. In 2024, the machine vision market was valued at approximately $10 billion, with Cognex holding a significant portion. Continuous differentiation is key for Cognex to maintain its competitive position.

Cognex operates within a competitive market, facing rivals in automation. These competitors provide comparable products, increasing the competitive pressure. Keeping an eye on competitor actions is vital for Cognex. In 2024, key competitors like Keyence and Omron continue to challenge Cognex's market share.

Product differentiation is key for Cognex in the machine vision market. They must invest in research and development to stay competitive and meet customer demands. Focusing on AI and advanced features is also essential. Cognex's 2024 revenue reached approximately $900 million, reflecting its efforts in innovation.

Pricing pressures exist

Competitive rivalry can spark pricing wars, squeezing profit margins. Cognex faces this challenge in the machine vision market. To thrive, Cognex must balance competitive pricing with profitability. Offering value-added services can justify higher prices. In 2023, Cognex's gross margin was 72%, reflecting pricing pressures.

- Pricing wars can erode profit margins.

- Cognex must strategically price its products.

- Value-added services support premium pricing.

- Gross margin is a key indicator of pricing success.

Market growth drives competition

The automation market's expansion fuels competition, drawing in more players. Cognex faces increasing pressure to innovate and maintain its market position. Strategic moves like partnerships and acquisitions are vital for staying ahead. This dynamic landscape requires continuous adaptation to succeed. For example, the global industrial automation market was valued at $214.1 billion in 2023.

- Growing demand attracts new competitors, intensifying rivalry.

- Cognex needs to actively adjust to changing market conditions.

- Partnerships and acquisitions can boost competitiveness.

- The market's growth rate was approximately 8.9% in 2023.

Competitive rivalry in machine vision is intense, affecting Cognex. The market's growth attracts more competitors, increasing pressure. Pricing strategies and innovation are key for Cognex to stay ahead. In 2024, the machine vision market saw intense competition.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Market Growth | Attracts competitors | Machine vision market: $10B |

| Pricing Pressure | Erodes margins | Cognex's gross margin: 72% (2023) |

| Innovation | Key to Differentiation | Cognex revenue: ~$900M (2024) |

SSubstitutes Threaten

The threat from substitutes for Cognex is limited due to the specialized nature of machine vision systems. There aren't many direct alternatives for advanced automation. Cognex's proprietary tech offers a strong competitive edge. In 2024, the machine vision market was valued at approximately $10 billion, with Cognex holding a significant share.

Manual inspection presents a partial substitute for Cognex's machine vision, especially in smaller businesses. While cost-effective initially, manual methods lack the accuracy and speed of automated systems. Cognex's solutions are increasingly favored as precision becomes paramount. In 2024, the global machine vision market was valued at approximately $10.5 billion, with Cognex holding a significant market share.

Alternative sensing technologies, such as laser scanners and basic sensors, present a threat to Cognex. These alternatives can fulfill some functions, yet they usually lack the complexity of machine vision. Cognex's AI-driven systems offer better performance, differentiating them in the market. In 2024, Cognex's revenue was around $880 million, highlighting the importance of maintaining a competitive edge.

Software-based solutions

Software-based solutions pose a threat as advancements in image processing offer alternative approaches to machine vision, potentially disrupting Cognex's market position. To counter this, Cognex must continuously innovate and invest heavily in research and development to stay ahead. This includes a focus on artificial intelligence and machine learning to maintain its technological lead. According to a 2024 report, the global machine vision software market is projected to reach $2.5 billion by the end of the year.

- Software-based solutions offer alternative approaches.

- Cognex must continuously innovate and invest.

- AI and machine learning are crucial for staying ahead.

- The global machine vision software market is valued at $2.5 billion in 2024.

Cost-benefit considerations

Customers might choose cheaper alternatives if the benefits of advanced machine vision don't justify the cost. Cognex needs to show a clear return on investment (ROI) for its products. Highlighting long-term savings and efficiency is key to staying competitive. In 2024, the machine vision market saw increased price sensitivity, with some customers opting for less complex systems to cut costs.

- Cognex's revenue in 2024 was approximately $848 million, reflecting market pressures.

- The average ROI period for machine vision implementations can range from 1 to 3 years.

- Competitors like Keyence offer products at varying price points, intensifying the need for Cognex to justify its value.

- Efficiency gains can include up to a 20% reduction in production time with machine vision.

The threat of substitutes for Cognex is moderate, stemming from software solutions, alternative sensing tech, and manual inspections. These pose a risk if they offer sufficient performance at a lower cost, or appeal to businesses prioritizing price over advanced features.

Cognex must continuously innovate and highlight its ROI to maintain its market position, focusing on AI-driven systems and long-term savings. In 2024, the global machine vision software market reached $2.5 billion.

Customers' price sensitivity, with Cognex’s 2024 revenue around $848 million. This underscores the importance of justifying value.

| Substitute Type | Impact | Mitigation |

|---|---|---|

| Software Solutions | Image processing alternatives | AI, R&D investment |

| Manual Inspection | Lower cost, less precision | Highlight ROI, efficiency gains |

| Alternative Sensing | Functional, less complex | Focus on advanced features |

Entrants Threaten

High capital investment is a significant threat for new entrants in the machine vision market. New companies face substantial costs in research and development, manufacturing, and marketing. Cognex, with its established infrastructure, holds a competitive edge. For instance, Cognex invested $128.6 million in R&D in Q1 2024, showcasing its commitment and advantage. This large investment creates a barrier.

Developing advanced machine vision systems needs expertise in AI, optics, and software engineering. The need for skilled personnel limits entry. Cognex's deep expertise is a significant barrier. Cognex invested $70.2 million in R&D in Q3 2023, showing commitment. This reinforces its competitive advantage.

Cognex's strong brand reputation and established customer relationships act as a significant barrier to entry for new competitors. New entrants face the challenge of overcoming existing brand loyalty, which can be difficult to erode. Building trust and credibility within the machine vision market requires considerable time and financial resources. Cognex's market capitalization as of early 2024 was approximately $7.5 billion, reflecting its established market position.

Economies of scale

Cognex, as a well-established player, benefits from economies of scale in both manufacturing and distribution, offering a significant cost advantage. New entrants struggle to quickly match Cognex's operational efficiency and cost structure. This advantage is a formidable barrier, making it hard for competitors to gain a foothold. Cognex's established infrastructure and processes provide a considerable edge.

- Cognex's gross margin in 2024 was approximately 70%.

- The company's spending on research and development in 2024 was about $150 million.

- Cognex's market capitalization was roughly $7 billion in late 2024.

- The automation market is projected to grow, with an estimated CAGR of 8% through 2025.

Regulatory hurdles

Compliance with industry standards and regulations presents a significant hurdle for new entrants into Cognex's market. These requirements can be complex and costly to navigate, potentially delaying or deterring new companies. Cognex, with its established expertise in regulatory compliance, holds a competitive advantage. This experience allows Cognex to more efficiently and effectively meet these standards. It provides a smoother operational pathway compared to newcomers.

- Cognex's revenue in 2023 was $823 million.

- The company's gross profit margin was 70% in 2023.

- The company's stock price closed at $50.19 on May 17, 2024.

- Cognex's market capitalization is approximately $8.93 billion as of May 17, 2024.

New entrants face significant barriers in the machine vision market, including high capital investment for R&D and manufacturing. Cognex, with its established infrastructure, benefits from economies of scale, maintaining a strong competitive edge. Regulatory compliance also poses a challenge, favoring Cognex's expertise. Cognex's market capitalization in late 2024 was approximately $7 billion.

| Factor | Impact on New Entrants | Cognex's Advantage |

|---|---|---|

| Capital Investment | High barrier due to R&D and manufacturing costs. | Established infrastructure and substantial R&D spending ($150M in 2024). |

| Expertise | Requires expertise in AI, optics, and software, limiting entry. | Deep technical expertise and experience. |

| Brand Reputation | Difficult to overcome established brand loyalty. | Strong brand recognition and customer relationships. |

| Economies of Scale | Struggles to match operational efficiency and cost structure. | Significant cost advantage and efficient processes. Gross margin ~70% in 2024. |

| Compliance | Complex and costly to navigate regulations. | Established expertise in regulatory compliance. |

Porter's Five Forces Analysis Data Sources

Our Cognex analysis utilizes financial reports, industry surveys, competitor analysis, and market intelligence to score each competitive force.