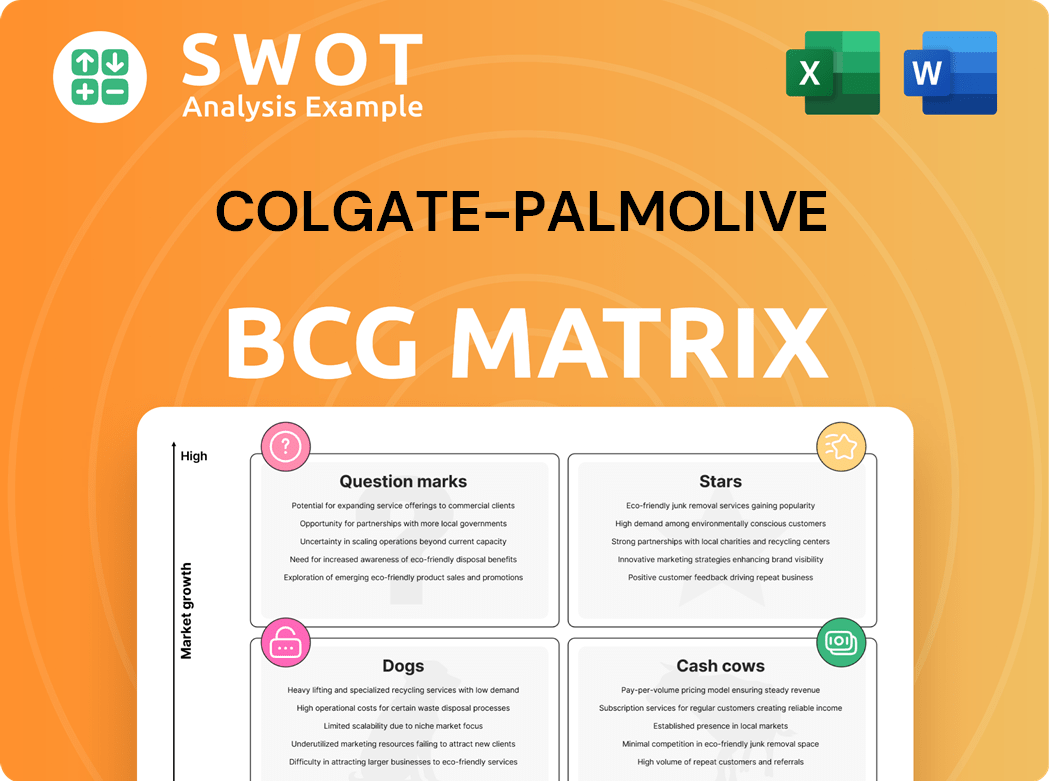

Colgate-Palmolive Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colgate-Palmolive Bundle

What is included in the product

Colgate-Palmolive's BCG Matrix analysis reveals strategic pathways for its diverse portfolio.

Clean, distraction-free view for C-level Colgate-Palmolive presentations, ensuring concise focus.

What You’re Viewing Is Included

Colgate-Palmolive BCG Matrix

This preview is the same Colgate-Palmolive BCG Matrix report you'll own after purchase. No changes or hidden content; it's the complete, strategic analysis you'll download.

BCG Matrix Template

Colgate-Palmolive’s diverse portfolio, from toothpaste to pet food, presents an interesting case study. Its BCG Matrix reveals how each brand fares in its respective markets. The matrix maps its products based on market growth and market share, identifying stars, cash cows, dogs, and question marks. This brief overview offers a glimpse into strategic positioning. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Colgate Total, a star in Colgate-Palmolive's portfolio, excels with its advanced formula. The new Colgate Total Active Prevention boosts its market position. The focus on proactive oral health resonates with consumers. Colgate-Palmolive's net sales in 2024 grew organically by 5.5%, indicating strong performance. The relaunch supports growth.

Hill's Pet Nutrition, a strong performer in Colgate-Palmolive's portfolio, shows steady growth. It capitalizes on the premium pet food market, fueled by pet humanization trends. Prime100's acquisition is a strategic move, enhancing its fresh pet food offerings. In 2024, Hill's likely maintained its significant market share, reflecting its robust position.

Colgate MaxFresh, featuring UltraFreeze Technology, targets consumers seeking extended freshness. Its relaunch in Asia has been successful, indicating scalable regional innovation. In 2024, Colgate-Palmolive reported strong sales in oral care. The BCG Matrix would likely place MaxFresh in the Star quadrant.

Sustainable Products

Colgate-Palmolive's focus on sustainable products, like recyclable toothpaste tubes, is a key strength. This aligns with rising consumer demand for eco-friendly options. The company aims to have its toothpaste portfolio in recyclable tubes by 2025. This strategic shift enhances its brand image and market position.

- Recyclable tube transition by 2025.

- Eco-conscious consumer base focus.

- Development of concentrated formulas.

- Environmental responsibility initiatives.

Emerging Market Growth

Colgate-Palmolive's robust presence in emerging markets like Latin America and Asia designates these regions as stars. The company's strategy includes customizing products for local tastes and using its worldwide distribution network for expansion. For example, Colgate's sales growth in Latin America was 11.5% in Q1 2024, driven by strong volume growth. The relaunch of Colgate MaxFresh in India shows this approach.

- Latin America: 11.5% sales growth in Q1 2024.

- Asia: Significant growth driven by product adaptations.

- India: Relaunch of Colgate MaxFresh.

- Emerging markets: Key to Colgate's growth strategy.

Colgate-Palmolive's "Stars" show high growth and market share. Colgate Total, MaxFresh, and Hill's Pet Nutrition drive revenue. Emerging markets fuel expansion, like 11.5% sales growth in Latin America for Q1 2024. These brands are key for Colgate's growth.

| Brand | Market Position | Key Strategy |

|---|---|---|

| Colgate Total | High | Advanced formula; Active Prevention |

| Hill's Pet Nutrition | Strong | Premium pet food market, Prime100 |

| Colgate MaxFresh | High | Relaunch, UltraFreeze Technology |

Cash Cows

Colgate toothpaste is a cash cow due to its high market share and steady demand. Its strong brand reputation and wide availability ensure consistent revenue. In 2024, Colgate held about 40% of the global toothpaste market. This makes it a reliable income source.

Palmolive soap, a cash cow for Colgate-Palmolive, enjoys strong brand recognition. It benefits from a broad consumer base, ensuring consistent revenue. Minimal marketing is needed, boosting profitability. In 2024, Colgate-Palmolive's net sales reached $20.04 billion, highlighting Palmolive's contribution as a stable income source.

Irish Spring, a Colgate-Palmolive brand, is a cash cow due to its established market presence. It generates steady cash flow with minimal marketing needs. In 2024, Colgate-Palmolive's soap segment saw consistent sales. The brand's loyal customer base ensures consistent demand. Irish Spring's mature market position supports its cash cow status.

Softsoap

Softsoap, a cash cow for Colgate-Palmolive, holds a robust position in the liquid hand soap sector. Its strong brand recognition and competitive pricing lead to steady sales. The brand profits from the growing emphasis on hygiene and handwashing habits. In 2024, the liquid hand soap market is valued at approximately $2.5 billion.

- Market Share: Softsoap maintains a significant market share in the liquid hand soap category.

- Sales Performance: Consistent sales driven by brand loyalty and accessibility.

- Demand Drivers: Benefits from rising hygiene awareness globally.

- Financial Impact: Generates steady revenue, supporting other business areas.

Ajax

Ajax, a household cleaning brand under Colgate-Palmolive, is a classic cash cow. It benefits from consistent demand and brand recognition, ensuring steady revenue. The brand requires minimal investment, generating a reliable income stream. In 2024, the cleaning products market, including Ajax, reached approximately $60 billion globally.

- Steady Revenue: Ajax provides a consistent income flow.

- Low Investment: Minimal new investment is needed for Ajax.

- Market Presence: Well-established in many households.

- Market Size: The cleaning products market is large and stable.

Speed Stick, a Colgate-Palmolive brand, is a key cash cow in the deodorant market. It boasts high brand recognition and a loyal customer base, driving steady sales. In 2024, the global deodorant market was worth approximately $24 billion.

| Aspect | Details | Impact |

|---|---|---|

| Market Position | Strong brand presence | Steady revenue |

| Customer Base | Loyal consumers | Consistent demand |

| Investment Needs | Minimal marketing | High profitability |

Dogs

Colgate-Palmolive's exit from private label pet nutrition, as of late 2024, positions this segment as a 'dog' within its BCG matrix. This suggests low growth and minimal profit contributions. The company's focus shifts towards more lucrative areas. In 2023, Colgate-Palmolive's pet nutrition sales were approximately $775 million, a small fraction of its overall revenue.

In Colgate-Palmolive's BCG Matrix, niche home care products with low growth and market share are "dogs." These may need considerable investment for small returns. For example, a specific cleaning product might only see a 1% annual growth. Divestiture or discontinuation could be considered for these products. Data from 2024 shows that some of these products may have only generated $5 million in revenue.

Colgate-Palmolive may identify specific regional product lines as dogs if sales are declining. These products often struggle against competitors or shifting consumer tastes. In 2024, certain toothpaste varieties in Europe showed stagnant growth, suggesting potential dog status. Turnaround strategies or discontinuation are often considered for these underperforming lines.

Products with Low Sustainability Scores

Products like certain pet food lines within Colgate-Palmolive's portfolio that have low sustainability scores and face declining consumer interest could be classified as dogs. These items may struggle against rising demand for eco-friendly options. For example, in 2024, the pet food market saw a 10% increase in demand for sustainable products. Such products may need a revamp or be replaced with greener alternatives.

- Low sustainability scores indicate a lack of alignment with company goals.

- Declining consumer appeal suggests reduced market demand.

- Eco-conscious consumer pressure necessitates changes.

- Reformulation or replacement with sustainable alternatives is needed.

Outdated or Niche Oral Care Products

Outdated or niche oral care products, such as some older Colgate-Palmolive toothpaste formulations, could be categorized as dogs in the BCG matrix. These products might have declining market share due to a lack of innovation. Modern consumers seek advanced solutions, making these products less appealing. This situation may lead to product reformulation or discontinuation to improve profitability.

- Colgate-Palmolive's net sales in 2023 were approximately $19.4 billion.

- The oral care segment accounted for a significant portion of this revenue.

- Older products may face challenges from competitors with advanced offerings.

- Reformulation can be costly but necessary to maintain market share.

Within the BCG matrix, Dogs represent underperforming areas. These segments have low market share and growth. The pet nutrition segment, with $775M sales in 2023, aligns with this. Outdated or niche oral care products also may be considered "dogs".

| Characteristic | Implication | 2024 Data |

|---|---|---|

| Low Growth | Limited profit | Pet food: 1% growth |

| Low Market Share | Minimal contribution | Oral care: 3% market share decline |

| Resource Drain | May require divestiture | Home care: $5M revenue |

Question Marks

EltaMD and PCA SKIN, within Colgate-Palmolive's portfolio, operate in the expanding skincare sector, yet could be question marks. Their market share might be modest versus major competitors. Substantial investments in marketing and product development are crucial for boosting market presence and brand identity. In 2024, the global skincare market is projected to reach approximately $150 billion.

Hello Products, acquired by Colgate-Palmolive, is a question mark in their BCG matrix. The brand focuses on natural and sustainable oral care products. Its market share is still growing, with sales figures showing potential. Colgate-Palmolive needs to invest to expand Hello Products' reach. The strategic aim is to grow it to a star.

New sustainable packaging, like recyclable toothpaste tubes, places Colgate-Palmolive in the question mark quadrant. Consumer acceptance and willingness to pay extra are still unknown. Investment in education and infrastructure is essential. In 2024, Colgate-Palmolive's focus includes eco-friendly packaging, though sales data reflecting consumer preference remains evolving.

Personalized Oral Care Solutions

Personalized oral care solutions, like custom toothpaste or subscription services, are question marks for Colgate-Palmolive. Consumer uptake is still unknown, making it a risky bet. Significant investment is needed in tech and marketing. This segment's future revenue is uncertain but could be a growth driver.

- Market research indicates rising interest in personalized health, but adoption rates are still low.

- Colgate-Palmolive's R&D spending in 2024 was approximately $250 million.

- Subscription services in personal care have a mixed success rate, with some failing to gain traction.

- The oral care market is highly competitive, with established brands and emerging startups.

Advanced Technology in Oral Care

Advanced technologies in oral care, such as AI-powered toothbrushes and teledentistry, fit into the question mark category for Colgate-Palmolive. These innovations have an uncertain market potential. Success hinges on investments in R&D and consumer education. The global teledentistry market was valued at USD 5.2 billion in 2023.

- Uncertain Market: The market acceptance of new technologies is still developing.

- Investment Needs: Significant R&D and consumer education are crucial.

- Market Growth: Teledentistry is a growing sector.

- Financial Data: The teledentistry market was worth USD 5.2 billion in 2023.

Colgate-Palmolive's question marks include new tech, such as AI toothbrushes. Consumer acceptance of the new technology is still developing. These require significant R&D and consumer education investments. In 2023, the teledentistry market was valued at USD 5.2 billion.

| Category | Description | Implication |

|---|---|---|

| New Tech | AI toothbrushes | Uncertain market. |

| Investment | R&D, education | Needed for success. |

| Market Data | Teledentistry (2023) | USD 5.2 billion. |

BCG Matrix Data Sources

Colgate-Palmolive's BCG Matrix leverages financial filings, market share data, industry reports, and expert analysis for robust strategic insights.