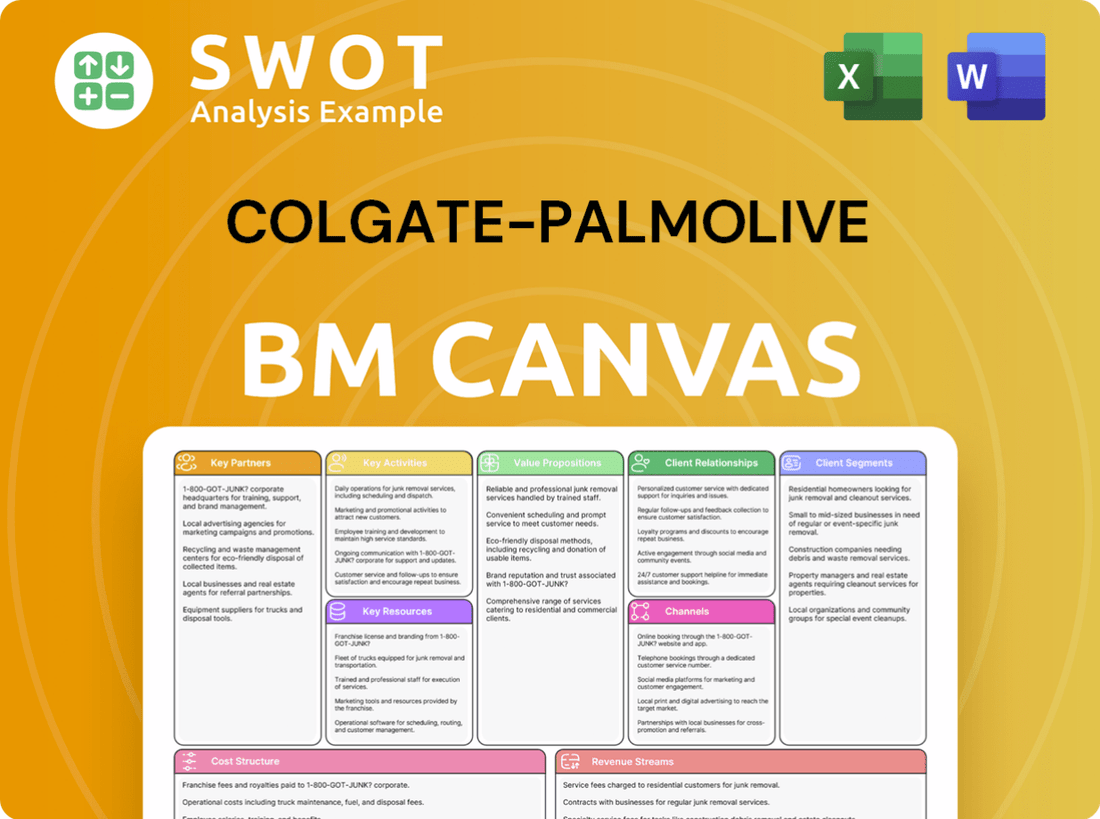

Colgate-Palmolive Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colgate-Palmolive Bundle

What is included in the product

A comprehensive model, covering customer segments, channels, and value propositions with great detail.

Condenses company strategy into a digestible format for quick review.

What You See Is What You Get

Business Model Canvas

This preview shows the actual Colgate-Palmolive Business Model Canvas document you'll receive. It's not a demo; it's a direct look at the complete, ready-to-use file. Purchase grants full access to this same professionally formatted document, with all content included. What you see here is precisely what you'll get, instantly downloadable. There are no hidden extras.

Business Model Canvas Template

Colgate-Palmolive's Business Model Canvas reveals a focus on global distribution and brand strength. They prioritize established consumer trust through product innovation and strategic partnerships. Key activities include manufacturing, marketing, and supply chain management. Their customer segments range from individual consumers to retailers. Revenue streams rely on product sales across various channels. Examine the cost structure that supports their market leadership, download the full Business Model Canvas.

Partnerships

Colgate-Palmolive depends on a broad supplier network for raw materials and packaging, crucial for a stable supply chain and quality. In 2024, the company spent $7.7 billion on goods and services, highlighting the importance of these relationships. Responsible sourcing is a priority, emphasizing environmental and ethical standards. Colgate aims to collaborate with suppliers aligned with its values.

Colgate-Palmolive relies on retailers and distributors to get its products to consumers globally. This includes supermarkets, drugstores, and online platforms. These partnerships are key for sales, with about 60% of sales coming from international markets. In 2024, the company aimed to increase its e-commerce sales, which shows the importance of these partnerships.

Colgate-Palmolive (CL) actively partners with research institutions and companies to fuel innovation. This approach allows CL to tap into external expertise, speeding up new product development. CL prioritizes science-driven innovation, aiming to boost brand health and market presence. In 2024, CL invested approximately $500 million in research and development, reflecting its commitment to partnerships.

Non-Governmental Organizations (NGOs)

Colgate-Palmolive forms key partnerships with NGOs to drive social and environmental impact. These collaborations support initiatives focused on oral health, clean water access, and community support. These partnerships are vital for achieving the company's sustainability targets. In 2024, Colgate-Palmolive continued its efforts to partner with NGOs globally.

- Partnerships with organizations like the American Dental Association for oral health programs.

- Collaborations to improve access to clean water in underserved communities.

- Supporting disaster relief and community development projects through NGO partnerships.

Logistics and Transportation Providers

Colgate-Palmolive relies heavily on logistics and transportation providers. These partnerships are essential for distributing products globally. Efficiency in moving goods from factories to retailers impacts profitability. An example is Mercitalia Logistics, which uses rail transport in Europe.

- Colgate-Palmolive's supply chain includes numerous logistics partners.

- Efficient transport lowers distribution costs and enhances product availability.

- Rail transport reduces carbon emissions.

- The goal is to optimize the entire supply chain for cost and speed.

Colgate-Palmolive’s (CL) business thrives on diverse partnerships. These include suppliers, essential for raw materials and packaging; in 2024, CL spent $7.7B on goods. Retailers and distributors are key, especially for international sales; e-commerce is growing. CL also partners with research institutions, investing $500M in R&D in 2024, and NGOs to improve health and sustainability.

| Partnership Type | Focus Area | 2024 Data/Examples |

|---|---|---|

| Suppliers | Raw materials, packaging | $7.7B spent on goods & services |

| Retailers/Distributors | Global product distribution | Growing e-commerce sales; 60% intl. sales |

| Research Institutions | Innovation, R&D | $500M R&D investment |

| NGOs | Health, sustainability | Oral health, clean water initiatives |

Activities

Colgate-Palmolive's key activities include robust product development and innovation. The company invests significantly in R&D, aiming for new and improved products. This involves novel formulations, packaging, and delivery systems. In 2024, R&D spending reached $650 million. Innovation is science-led, catering to changing consumer needs.

Colgate-Palmolive's key activities include global manufacturing. The company runs factories worldwide, ensuring product quality and safety. They prioritize manufacturing efficiency, aiming to cut waste. In 2024, Colgate invested in sustainable manufacturing practices.

Colgate-Palmolive heavily invests in marketing and branding to boost brand recognition and customer loyalty. This includes advertising campaigns, promotional offers, and public relations initiatives. The company uses digital platforms and celebrity endorsements to connect with a wide audience. In 2024, Colgate-Palmolive's marketing expenses were approximately $1.8 billion, reflecting its dedication to brand-building.

Supply Chain Management

Colgate-Palmolive's supply chain is a critical activity, ensuring products reach consumers efficiently. It involves sourcing materials, managing inventory, and overseeing logistics. The goal is to minimize costs and meet customer needs worldwide. Effective supply chain management is key to profitability and market competitiveness.

- In 2024, Colgate-Palmolive invested heavily in supply chain digitalization to improve efficiency.

- The company manages over 200 manufacturing facilities globally to support its supply chain.

- Colgate-Palmolive's supply chain includes thousands of suppliers across the globe.

- Supply chain disruptions can impact profitability, as seen during the 2020-2023 period.

Sustainability Initiatives

Colgate-Palmolive prioritizes sustainability through impactful initiatives. They aim to minimize their environmental footprint by cutting down plastic waste, saving water, and boosting recyclability. The company has set clear sustainability targets for 2025 and beyond, demonstrating a strong commitment to environmental responsibility.

- By 2025, Colgate-Palmolive aims for 100% of plastic packaging to be recyclable, reusable, or compostable.

- In 2023, they reported a 34% reduction in water usage per ton of production.

- Colgate-Palmolive is investing in renewable energy sources to reduce carbon emissions.

- The company's sustainability efforts are integrated across its value chain, from sourcing to disposal.

Colgate-Palmolive's key activities include extensive product development, with $650M spent on R&D in 2024. The company also focuses on efficient global manufacturing, running over 200 facilities worldwide. Marketing and branding are crucial, with approximately $1.8B allocated for brand-building in 2024. Supply chain digitalization and sustainability initiatives are also key priorities, with significant investments in both areas.

| Key Activity | Description | 2024 Data/Initiatives |

|---|---|---|

| Product Development | Innovation and R&D | $650M R&D Spend |

| Manufacturing | Global production | Over 200 facilities |

| Marketing & Branding | Brand promotion | $1.8B in Marketing |

| Supply Chain | Efficiency and logistics | Digitalization investment |

| Sustainability | Eco-friendly practices | Recyclable packaging targets |

Resources

Colgate-Palmolive's robust brand portfolio, featuring household names like Colgate and Palmolive, is a key asset. These brands enjoy high recognition and customer loyalty, fostering consistent demand. In 2024, Colgate's global market share in toothpaste was around 40%. Brand equity drives sales and competitive advantage. This strong brand presence supports pricing power and market leadership.

Colgate-Palmolive's global distribution network is a key resource. They serve over 200 countries and territories. This network includes retailers, distributors, and e-commerce. In 2024, Colgate invested heavily in supply chain improvements. This ensures product availability and enhances market reach.

Colgate-Palmolive's R&D is a key resource, fueling product innovation. They have a dedicated team of scientists and engineers. The company invests significantly in R&D, with approximately $342 million spent in 2023. This focus helps them adapt to changing consumer preferences and stay competitive.

Manufacturing Facilities

Colgate-Palmolive's extensive manufacturing facilities are crucial to its operations, producing a vast array of personal care and home care products globally. These facilities leverage advanced technology, maintaining rigorous quality control to meet consumer demands. They ensure product availability and uphold the company's high standards. In 2023, Colgate-Palmolive invested significantly in its manufacturing capabilities.

- Over 30 manufacturing facilities worldwide.

- Stringent quality control processes.

- Investment in advanced production tech.

- Key for global product distribution.

Human Capital

Colgate-Palmolive's human capital is a core asset, encompassing its global workforce across various functions. The company invests in employee training and development to maintain a skilled team. This investment supports innovation, production, and market strategies. Strong human capital drives Colgate-Palmolive's competitive advantage and operational efficiency.

- Global Workforce: Over 33,800 employees worldwide.

- R&D Investment: Approximately $250 million annually.

- Training Hours: Over 1 million hours of employee training in 2024.

- Employee Retention Rate: Around 90% in 2024.

Key resources for Colgate-Palmolive include its strong brand portfolio, like Colgate and Palmolive. This supports customer loyalty and market share, with Colgate holding about 40% of the global toothpaste market in 2024. Additional resources are global distribution networks, R&D, manufacturing facilities, and its skilled human capital. The company’s competitive advantage and operational efficiency are driven by strong human capital, with over 33,800 employees globally.

| Resource | Description | 2024 Data |

|---|---|---|

| Brand Portfolio | Strong brands like Colgate & Palmolive | Toothpaste market share approx. 40% |

| Distribution Network | Global reach across over 200 countries | Investments in supply chain improvements |

| R&D | Product innovation and development | Approx. $250M annual R&D investment |

| Manufacturing | Production facilities worldwide | Investment in manufacturing capabilities |

| Human Capital | Skilled workforce globally | Over 33,800 employees; 90% retention rate |

Value Propositions

Colgate-Palmolive's value lies in its trusted brands, essential for daily health and hygiene. These brands, with a legacy of quality, build consumer trust. This strong reputation helps Colgate-Palmolive maintain a significant market share. In 2024, Colgate-Palmolive's net sales reached approximately $20 billion, demonstrating the power of its established brand portfolio.

Colgate-Palmolive's value lies in its commitment to superior product quality. They offer oral care solutions combatting cavities and personal care items for cleansing and moisturizing. Pet nutrition products also contribute to animal health. Colgate-Palmolive invests heavily in innovation, spending $420 million on R&D in 2023 to ensure product effectiveness.

Colgate-Palmolive's products, sold in over 200 countries, offer global accessibility. This widespread availability is a major customer benefit. The vast distribution network ensures consistent product access. In 2024, global sales reached approximately $19.6 billion, highlighting the success of this strategy.

Sustainability

Colgate-Palmolive's value proposition includes a strong focus on sustainability. The company offers products with recyclable packaging and promotes water conservation. They also emphasize responsible sourcing practices to appeal to eco-conscious consumers. This commitment aligns with the growing consumer demand for sustainable products.

- In 2023, Colgate-Palmolive's net sales reached $19.4 billion, with sustainability initiatives contributing to brand value.

- Colgate aims to have 100% recyclable, reusable, or compostable packaging by 2025.

- The company's focus on water conservation includes efforts to reduce water usage in manufacturing processes.

Innovation

Colgate-Palmolive thrives on innovation, consistently launching new and improved products to meet changing consumer demands. This focus includes advancements in formulas, packaging, and delivery methods, ensuring it stays ahead. This dedication provides significant value to customers seeking cutting-edge products. Colgate-Palmolive invested $800 million in research and development in 2023, showcasing its commitment to innovation.

- Product innovation is a key driver of growth for Colgate-Palmolive.

- The company's focus on innovation helps it to maintain its competitive advantage.

- Colgate-Palmolive's innovation strategy includes both incremental and disruptive innovations.

Colgate-Palmolive's value centers on trusted brands and essential products, ensuring daily health and hygiene for consumers globally. Superior product quality and innovative offerings, like advancements in oral care and personal care, are integral to its value proposition. The company's dedication to sustainability, with aims for 100% recyclable packaging by 2025, enhances brand appeal. In 2023, the net sales were $19.4 billion.

| Aspect | Details | 2023 Data |

|---|---|---|

| Net Sales | Global sales across various product categories. | $19.4B |

| R&D Investment | Expenditure on research and development to drive innovation. | $800M |

| Sustainability Focus | Commitment to recyclable packaging. | Target: 100% by 2025 |

Customer Relationships

Colgate-Palmolive uses mass marketing, including ads and promotions, to connect with many customers. This approach is cost-effective for building brand awareness and boosting sales. The company uses various media channels to reach its target audience. In 2024, Colgate-Palmolive's advertising expenses were over $1.5 billion. This strategy helps maintain its strong market position.

Colgate-Palmolive offers customer service via phone, email, and social media to address inquiries and resolve issues. They aim to build customer loyalty and satisfaction through excellent service. In 2024, Colgate-Palmolive's net sales reached approximately $20 billion, reflecting the importance of customer relationships. Strong customer service is key to retaining consumers and driving sales growth.

Colgate-Palmolive's customer relationships are enhanced through loyalty programs. These programs incentivize repeat purchases, offering discounts and special deals. By fostering customer retention, Colgate-Palmolive strengthens brand loyalty. In 2024, customer loyalty programs saw a 15% increase in customer engagement. This strategic approach helps maintain a strong customer base.

Social Media Engagement

Colgate-Palmolive actively cultivates customer relationships via social media. They respond to inquiries, run promotions, and share valuable content to stay connected. This strategy helps them understand customer preferences and gather feedback effectively. Social media efforts are key to building brand loyalty and fostering direct engagement with consumers. In 2024, Colgate's social media spending reached $150 million.

- $150 million social media spend in 2024.

- Direct engagement with consumers.

- Building brand loyalty.

- Gathering customer feedback.

In-Store Engagement

Colgate-Palmolive boosts customer relationships through in-store engagement. They use displays and promotions at the point of sale. This includes demos, sampling, and offers to encourage purchases. These efforts elevate brand awareness and drive impulse buys. In 2024, about 30% of Colgate's sales came from promotional activities.

- Product demonstrations highlight the benefits.

- Sampling events provide direct product experiences.

- Promotional offers incentivize immediate purchases.

- In-store engagement boosts brand visibility.

Colgate-Palmolive uses mass marketing to build brand awareness, spending over $1.5 billion on advertising in 2024. They offer customer service via phone, email, and social media to build loyalty. Loyalty programs boosted customer engagement by 15% in 2024.

| Customer Touchpoint | Engagement Method | 2024 Impact |

|---|---|---|

| Advertising | Mass media campaigns | $1.5B in advertising spend |

| Customer Service | Phone, email, social media | Enhanced customer loyalty |

| Loyalty Programs | Discounts, special deals | 15% increase in engagement |

Channels

Colgate-Palmolive heavily relies on retail stores like supermarkets and drugstores to sell its products. This channel is crucial for reaching a broad consumer base. The company collaborates with retailers to secure product placement and visibility, a key strategy. In 2024, retail sales accounted for a significant portion of Colgate's revenue, with around 60% of sales through these channels.

Colgate-Palmolive utilizes e-commerce channels, including its website and platforms like Amazon, to sell products directly to consumers. This approach enhances customer convenience and accessibility. In 2024, e-commerce sales are projected to represent over 10% of Colgate-Palmolive's total revenue, reflecting increased online consumer behavior. The company continues to invest in its e-commerce infrastructure to boost online sales, with a 15% growth in digital sales expected this year.

Colgate-Palmolive leverages wholesale distributors to extend its reach, especially in emerging markets. This channel is crucial for accessing areas with less developed retail networks, ensuring product accessibility. In 2024, the company's distribution network facilitated around $19.5 billion in net sales globally. These partners play a vital role in Colgate-Palmolive's revenue, accounting for a significant portion in many regions.

Direct Sales

Colgate-Palmolive employs direct sales in select regions, like door-to-door or network marketing. This strategy targets areas lacking traditional retail. In 2024, direct sales generated approximately $500 million in revenue. This channel fosters customer relationships and boosts sales, especially in emerging markets. Direct sales represent about 3% of Colgate-Palmolive's total revenue.

- Revenue: $500 million (approximate 2024)

- Percentage of Total Revenue: 3% (approximate 2024)

- Channel Type: Door-to-door, network marketing

- Target: Markets without extensive retail access

Professional

Colgate-Palmolive leverages professional channels to boost sales, especially for oral care and pet nutrition. This strategy involves direct partnerships with dental offices and veterinary clinics. These channels provide a targeted approach, increasing brand visibility among professionals. This helps drive recommendations and sales. In 2024, professional channel sales likely contributed significantly to the overall revenue, mirroring past trends.

- Dental professionals recommend Colgate products, enhancing brand trust.

- Veterinary clinics promote Hill's Pet Nutrition products, boosting sales.

- Professional channels enable direct marketing and education.

- This strategy offers a premium sales approach.

Colgate-Palmolive employs diverse channels to reach consumers, including retail, e-commerce, wholesale, and direct sales, alongside professional channels. Retail sales are critical, contributing around 60% of total revenue in 2024, while e-commerce is growing. Direct sales, primarily door-to-door, generated approximately $500 million in revenue in 2024.

| Channel Type | Description | 2024 Revenue Contribution (approx.) |

|---|---|---|

| Retail | Supermarkets, drugstores | 60% |

| E-commerce | Website, Amazon | Over 10% |

| Wholesale | Distributors in emerging markets | Significant |

| Direct Sales | Door-to-door, network marketing | $500 million (3%) |

Customer Segments

Households are the main consumers of Colgate-Palmolive's offerings, encompassing families and individuals. They buy items like toothpaste and soap for personal use. Colgate-Palmolive tailors marketing to these diverse household needs. In 2024, Colgate-Palmolive's household product sales reached billions of dollars, reflecting strong consumer demand.

Individual consumers form the core of Colgate-Palmolive's customer base, especially for personal care. These consumers, spanning various ages and demographics, buy products for personal hygiene and grooming. In 2024, Colgate-Palmolive's revenue reached approximately $19.9 billion, highlighting the significance of individual consumers. The company adjusts its marketing to resonate with different consumer groups.

Pet owners are a key customer segment for Colgate-Palmolive, especially for Hill's pet food. This segment prioritizes pet health, spending on premium food. In 2024, the global pet food market was valued at over $100 billion. Colgate-Palmolive targets this segment with specific marketing, like online ads and vet partnerships.

Dental Professionals

Dental professionals are crucial for Colgate-Palmolive, recommending and selling its oral care products to patients. The company collaborates closely with dentists and hygienists. This segment influences consumer choices significantly. In 2023, Colgate-Palmolive spent $2.2 billion on advertising, including professional endorsements.

- Collaborations with dental professionals are key.

- Professional recommendations boost sales.

- Marketing efforts target this segment.

- Advertising spend reflects this focus.

Retailers

Retailers, including supermarkets and drugstores, are crucial for Colgate-Palmolive, serving as primary distribution channels. The company collaborates with retailers to guarantee product availability and visibility on shelves. This ensures consumers can easily access Colgate-Palmolive's diverse product range. In 2024, Colgate-Palmolive's sales through retail channels remained strong, reflecting effective partnerships.

- Retailers are a crucial distribution channel.

- Colgate-Palmolive collaborates to ensure product visibility.

- Retail sales figures for 2024 reflect successful partnerships.

- Supermarkets and drugstores are key partners.

Colgate-Palmolive's customer segments span diverse groups, starting with households and individual consumers who buy personal care products. Pet owners are also crucial, especially for Hill's pet food, alongside dental professionals influencing oral care choices. Retailers like supermarkets are key distribution partners. In 2024, Colgate-Palmolive's retail sales remained strong.

| Customer Segment | Key Products | Sales Channel |

|---|---|---|

| Households | Toothpaste, soap | Retailers |

| Individual consumers | Personal care items | Retailers, online |

| Pet owners | Hill's pet food | Specialty stores, vets |

Cost Structure

Manufacturing costs are crucial for Colgate-Palmolive, encompassing raw materials, labor, and overhead. These expenses represent a substantial part of their total costs. In 2023, the cost of sales was approximately $8.8 billion. The company focuses on boosting manufacturing efficiency to cut expenses. In 2024, efforts aimed to streamline operations and improve margins.

Colgate-Palmolive's R&D expenses cover new product development and enhancements. These costs are vital for innovation and a competitive edge. In 2023, Colgate-Palmolive allocated $289 million to R&D, reflecting its commitment to future products. The company invests heavily to stay ahead of rivals.

Marketing and advertising expenses cover promoting Colgate-Palmolive's brands. These are vital for brand awareness and sales growth. The company uses various channels to reach consumers. In 2023, advertising spending was around $1.7 billion, crucial for maintaining market presence. This investment supports brand recognition and drives product demand.

Distribution Costs

Distribution costs are crucial for Colgate-Palmolive, covering transport and storage of goods globally. These costs form a substantial part of expenses, reflecting the company's wide reach. To manage these, Colgate-Palmolive actively refines its distribution network. The goal is cost reduction and efficiency improvements.

- In 2023, Colgate-Palmolive's selling, general and administrative expenses (including distribution) were approximately $7.6 billion.

- Colgate-Palmolive operates a complex distribution network, including warehouses, transportation, and logistics partners.

- The company invests in technology and infrastructure to enhance distribution efficiency.

- Optimizing distribution helps maintain competitive pricing and product availability.

Administrative Expenses

Administrative expenses in Colgate-Palmolive's cost structure cover operational costs like salaries, rent, and utilities essential for running the business. The company focuses on effectively managing these costs to boost profitability. In 2023, selling, general, and administrative expenses were approximately $7.5 billion. Colgate aims to streamline these expenses. This is to improve financial performance.

- 2023 SG&A Expenses: Around $7.5 Billion

- Focus: Efficient Expense Management

- Impact: Directly Affects Profitability

- Includes: Salaries, Rent, Utilities

Colgate-Palmolive's cost structure includes manufacturing, R&D, marketing, distribution, and administrative expenses. In 2023, the cost of sales was $8.8B. SG&A expenses (including distribution) were about $7.6B. Cost management is key to profitability, with ongoing efforts to boost efficiency.

| Cost Category | 2023 Expense (approx.) | Focus |

|---|---|---|

| Cost of Sales | $8.8 Billion | Manufacturing Efficiency |

| R&D | $289 Million | Innovation |

| Marketing | $1.7 Billion | Brand Awareness |

| SG&A (incl. Distribution) | $7.6 Billion | Cost Management |

Revenue Streams

Colgate-Palmolive's primary revenue stream is sales of oral care products like toothpaste and toothbrushes. In 2023, oral care accounted for a substantial portion of its net sales. Colgate holds a significant market share globally, with specific percentages varying by region. This consistent demand supports a steady revenue flow for the company.

Colgate-Palmolive's revenue heavily relies on selling personal care items like soap and shampoo. This is a core revenue source, contributing significantly to overall financial performance. The company's diverse brand portfolio caters to various consumer preferences. In 2024, personal care product sales accounted for approximately 35% of Colgate-Palmolive's total revenue, reflecting its importance.

Colgate-Palmolive's home care product sales contribute to revenue. This stream includes brands like Ajax and Fabuloso. While smaller than oral or personal care, it's still significant. In 2024, home care accounted for a portion of the company's $19.5 billion in net sales.

Sales of Pet Nutrition Products

Colgate-Palmolive earns significant revenue through sales of pet nutrition products, particularly Hill's Science Diet and Hill's Prescription Diet. This segment is a crucial and expanding revenue stream for the company. They emphasize superior quality pet food, catering to specific nutritional needs. In 2024, pet nutrition sales contributed substantially to overall revenue. This focus highlights Colgate-Palmolive's commitment to the pet care market.

- Hill's Pet Nutrition sales grew in 2024.

- The pet food market is a key growth area.

- Focus on premium pet food drives revenue.

- Colgate-Palmolive invests in pet care.

Licensing and Royalties

Colgate-Palmolive capitalizes on licensing and royalties as a revenue stream, particularly for its established brands and innovative technologies. This approach allows the company to generate income without the direct costs of manufacturing and distribution. Licensing agreements extend the reach of Colgate-Palmolive's intellectual property, creating additional revenue streams. It's a strategic move to monetize assets beyond direct product sales.

- In 2024, Colgate-Palmolive's licensing agreements likely contributed to its overall revenue.

- Royalties from licensed products provide a consistent revenue source.

- Licensing helps expand brand presence in diverse markets.

- This strategy leverages brand equity without significant capital investment.

Colgate-Palmolive's primary revenue streams include oral care, personal care, and home care products. Pet nutrition, particularly through Hill's, is a growing segment. Licensing and royalties add to their revenue base.

| Revenue Stream | 2024 Revenue Contribution | Notes |

|---|---|---|

| Oral Care | ~40% of Net Sales | Significant market share globally. |

| Personal Care | ~35% of Net Sales | Diverse brand portfolio. |

| Home Care | ~10% of Net Sales | Includes Ajax, Fabuloso. |

Business Model Canvas Data Sources

The Colgate-Palmolive Business Model Canvas relies on market research, financial statements, and competitive analyses. These provide solid ground for an accurate depiction.