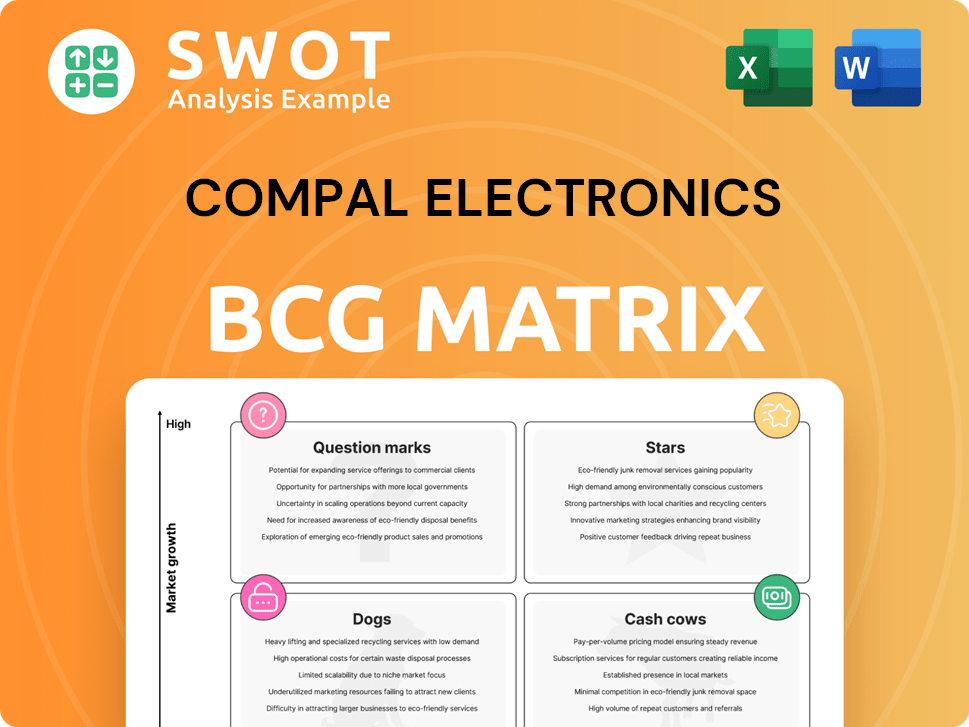

Compal Electronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compal Electronics Bundle

What is included in the product

Compal's BCG Matrix details Stars, Cash Cows, Question Marks, and Dogs, offering investment strategies.

Export-ready design for quick drag-and-drop into PowerPoint: Compal's BCG Matrix allows effortless integration into presentations.

What You’re Viewing Is Included

Compal Electronics BCG Matrix

The Compal Electronics BCG Matrix preview is identical to the final document you'll receive. This is the complete, ready-to-use report, formatted for easy analysis and presentation post-purchase. No hidden content or changes—what you see here is what you get, immediately downloadable. Buy it once, and the full version is yours.

BCG Matrix Template

Compal Electronics operates in a dynamic tech landscape. This partial look into its BCG Matrix reveals potential areas of strength and challenge. Understanding its Stars, Cash Cows, Dogs, and Question Marks is crucial. Explore this framework to assess its product portfolio's strategic value. Uncover the opportunities for maximizing returns and mitigating risks. Buy the full BCG Matrix to receive a detailed Word report + a high-level Excel summary. It’s everything you need to evaluate, present, and strategize with confidence.

Stars

Compal's AI server business, particularly those using NVIDIA MGX, is highly promising. The automotive electronics sector, fueled by ADAS and EVs, offers high growth. Both require substantial investment for market leadership. In 2024, Compal's revenue was $35.6B, a 5.2% increase.

Compal Electronics' 5G applications are a "Star" in its BCG matrix. Compal's active role in 5G O-RAN trials and AI RAN solutions cements its leadership. The growing need for better connectivity allows Compal to capture a bigger market share. Investments in 5G infrastructure are key for continued expansion. In 2024, the 5G infrastructure market is expected to reach $41.2 billion.

Compal's Smart Healthcare Solutions, a "Star" in its BCG matrix, focuses on high-growth areas. This includes partnerships with hospitals and AI-driven medical solutions. The global telehealth market, valued at $62.4 billion in 2023, is projected to reach $370.7 billion by 2030, showing massive growth. Compal must invest in R&D to maintain its competitive edge.

High-Performance GPU Server Platforms

The launch of Compal's server platforms, leveraging NVIDIA's MGX architecture, places them firmly in the high-performance computing arena. Given the booming AI and HPC markets, these platforms are poised to generate substantial revenue. In 2024, the global AI server market is estimated at $20 billion, showcasing the growth potential. Continued innovation in this sector is crucial for maintaining a competitive edge.

- NVIDIA's data center revenue grew by 400% year-over-year in Q4 2023, highlighting the demand for high-performance computing solutions.

- Compal's strategic focus on advanced server platforms aligns with the increasing demand for AI and HPC applications.

- The global HPC market is projected to reach $49.3 billion by 2025, presenting a significant opportunity for Compal.

Strategic Shift Initiatives

Compal Electronics' strategic shift towards higher profit margins and non-PC products is showing positive outcomes. The company is focusing on increasing profitability and optimizing its product mix to strengthen its market position. Strategic investments in new growth pillars, like AIoT and automotive electronics, are key for long-term success. In 2024, Compal's revenue from non-PC products grew by 15%.

- Revenue from non-PC products grew by 15% in 2024.

- Focus on profit enhancement and product mix optimization.

- Strategic investments in AIoT and automotive electronics are crucial.

- Aim for sustained growth beyond traditional PC and smartphone markets.

Compal's "Stars" include 5G applications, Smart Healthcare, and high-performance computing platforms. These segments are in high-growth markets. Significant investments are necessary to maintain their leading positions.

| Star Category | Market Growth Rate (2024) | Compal's Strategy |

|---|---|---|

| 5G Infrastructure | 12% | Invest in R&D, expand market share |

| Smart Healthcare | 22% | Partnerships, AI-driven solutions |

| AI Servers | 18% | Leverage NVIDIA MGX, innovation |

Cash Cows

Notebook computers, a key product for Compal, generate substantial revenue through partnerships with brands like Lenovo, HP, and Dell. The notebook market's maturity doesn't diminish Compal's established market share, ensuring a consistent income stream. In 2024, the global notebook market is valued at approximately $100 billion. Compal's focus on efficiency and cost management further boosts its profitability in this segment.

Compal Electronics' tablet manufacturing is a cash cow, despite market competition. The tablet sector's stable revenue comes from education and commercial use. In 2024, tablet sales reached approximately $50 billion globally. Innovation and cost control are key to maintaining its market position.

Compal's supply chain management services are a cash cow, offering stable profits. Its manufacturing and logistics expertise provides value to clients. Efficiency and reliability boost its partner reputation. In 2024, the global supply chain market was worth over $17 trillion. Compal's focus on these services generated a 10% revenue increase in Q3 2024.

Established ODM Partnerships

Compal Electronics benefits from established ODM partnerships, acting as a steady cash cow. These relationships with global brands secure a consistent revenue stream. The foundation of these partnerships is trust and reliability, which helps to ensure ongoing business. Maintaining strong relationships and delivering high-quality products are critical for sustaining this position. In 2024, Compal's revenue was approximately $30 billion, with a significant portion derived from these established partnerships.

- Steady Revenue: Consistent income from long-term contracts.

- Brand Trust: High-quality products maintain brand loyalty.

- Market Position: Secures a strong position in the industry.

- Financial Stability: Provides a stable financial foundation.

Efficiency Optimization

Compal Electronics' strategic focus on efficiency optimization is a key driver of its cash cow status. Streamlining operations and enhancing gross margins enable the company to generate significant cash flow from established business segments. This approach is vital for sustaining profitability. Compal's commitment to operational excellence is reflected in its financial performance, with a focus on cost reduction and process improvements.

- Gross Margin: In 2024, Compal aimed to maintain or improve gross margins through operational efficiencies.

- Operational Costs: Reducing operational costs is a continuous focus.

- Process Improvements: Implementing process improvements to enhance efficiency.

- Cash Flow Generation: Optimized operations directly contribute to strong cash flow.

Compal's cash cows, including notebooks and tablets, generate stable revenue. Supply chain services and established partnerships also act as cash cows. Efficiency optimization and cost control further boost profitability.

| Cash Cow | Revenue Source | 2024 Market Value |

|---|---|---|

| Notebooks | Partnerships (Lenovo, HP, Dell) | $100 billion |

| Tablets | Education, Commercial Use | $50 billion |

| Supply Chain | Manufacturing, Logistics | $17+ trillion |

Dogs

Compal's low-margin electronics manufacturing, a "Dog" in the BCG matrix, demands strategic action. These ventures consume resources with limited profit potential. For instance, in 2024, the operating margin for contract electronics manufacturers (CEMs) like Compal remained under 5%. Divesting or restructuring can boost profitability. This strategic shift aligns with optimizing resource allocation.

Dogs in Compal Electronics' BCG matrix include product lines that barely break even, or generate minimal profit. These lines drain resources without significant financial return. For example, in 2024, some older laptop models might fit this category. Divesting these could free up capital. In 2024, Compal's net profit margin was around 1.5%.

Products with low growth and declining market share are classified as dogs. These products rarely generate significant returns. Turnaround plans can be costly. Divestiture or discontinuation is often the best option. For example, a specific Compal Electronics' product line saw a 15% drop in market share in 2024.

Cash Traps

Cash traps in Compal Electronics' BCG matrix represent business units or products that consume significant financial resources without generating proportional returns. These units often require substantial investment to maintain, diverting capital from more profitable areas. Compal should carefully assess these cash traps, considering divestiture to free up resources. Reallocating capital to Stars or Question Marks could boost overall performance, as demonstrated by companies like Foxconn, which strategically shifts resources based on market analysis.

- Identified cash traps might include older product lines with declining market share.

- Divestiture could involve selling these units or discontinuing them.

- Reinvesting freed capital in high-growth areas can increase profitability.

- Example: In 2024, Compal's net profit margin was approximately 1.5%.

Products with High Turnaround Costs

In Compal Electronics' BCG matrix, "Dogs" represent products with high turnaround costs and low potential. These products should be avoided due to their drain on resources and limited success prospects. For example, in 2024, Compal's revenue was $34.6 billion, and focusing on Dogs could undermine financial stability. Prioritizing areas with higher growth potential is crucial for strategic success.

- Avoid investing in products with high turnaround costs and low success chances.

- High costs and low returns drain resources.

- Compal Electronics' 2024 revenue was $34.6 billion.

- Focus on areas with higher growth potential.

Dogs in Compal's BCG matrix are low-growth, low-share products needing strategic action. These products often have thin margins; for instance, CEMs like Compal saw margins below 5% in 2024. Divesting can free up capital. In 2024, Compal's revenue was $34.6B.

| Characteristic | Impact | Example (2024 Data) |

|---|---|---|

| Low Growth | Limited Returns | Some product lines |

| Low Market Share | Resource Drain | Older Laptop models |

| Turnaround Costs | Financial Strain | Revenue: $34.6B |

Question Marks

Compal's wearable devices are question marks in its BCG matrix. The wearable market is competitive, requiring differentiation. Compal must invest in R&D and marketing. Global wearables market revenue was about $80 billion in 2023. To gain market share, strategic investments are crucial.

Emerging automotive technologies, fitting the "Question Mark" category, include advancements like autonomous driving systems and advanced driver-assistance systems (ADAS). These areas boast high growth potential, with the global autonomous vehicle market projected to reach $60.3 billion by 2024. However, they demand substantial investment and face uncertain outcomes. Strategic partnerships are vital for navigating these complex technologies.

New 5G applications present a "question mark" for Compal. These nascent areas, like advanced IoT, could drive high growth. Yet, significant upfront investment is needed, and profitability isn't guaranteed initially. Compal's 2024 financials reveal a need for strategic funding in these ventures. Partnerships will be key for navigating this risky but promising landscape.

AI PCs

AI PCs show promise, but Compal's market share might be modest. The AI PC market is projected to reach $160 billion by 2027. High growth potential exists, but substantial investment is needed to compete. Strategic moves are crucial to boost market share and establish a strong position.

- Market size: Expected to hit $160B by 2027.

- Investment: Requires significant spending on R&D and marketing.

- Strategy: Focus on boosting market share.

Smart Home Integration

Compal's venture into smart home integration is currently positioned as a question mark in its BCG matrix. This reflects the company's investments in a growing market where its presence is still developing. To move from a question mark to a star, Compal requires strategic actions. These include focusing on product development and forming partnerships to gain more market share.

- Market Growth: The smart home market is rapidly expanding, with projections estimating it to reach $195.3 billion by 2027.

- Compal's Strategy: Investments in R&D and strategic alliances are essential for Compal to compete effectively.

- Competitive Landscape: Key players like Amazon and Google dominate, posing challenges.

- Financial Impact: Successful moves in smart home could boost revenue and market valuation.

Compal's ventures in AI PCs are question marks in its BCG matrix, indicating high growth potential, but they require substantial investment. The AI PC market, projected to reach $160 billion by 2027, demands strategic action to increase market share. Effective strategies involve significant investment in R&D and marketing.

| Aspect | Details | Financial Impact |

|---|---|---|

| Market Size | Projected to hit $160B by 2027 | High potential for revenue growth |

| Investment | Requires substantial spending on R&D and marketing | Affects profitability and cash flow |

| Strategy | Focus on boosting market share | Increases valuation if successful |

BCG Matrix Data Sources

Compal's BCG Matrix relies on financial filings, market analysis, and competitor data for a comprehensive assessment.