Compal Electronics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compal Electronics Bundle

What is included in the product

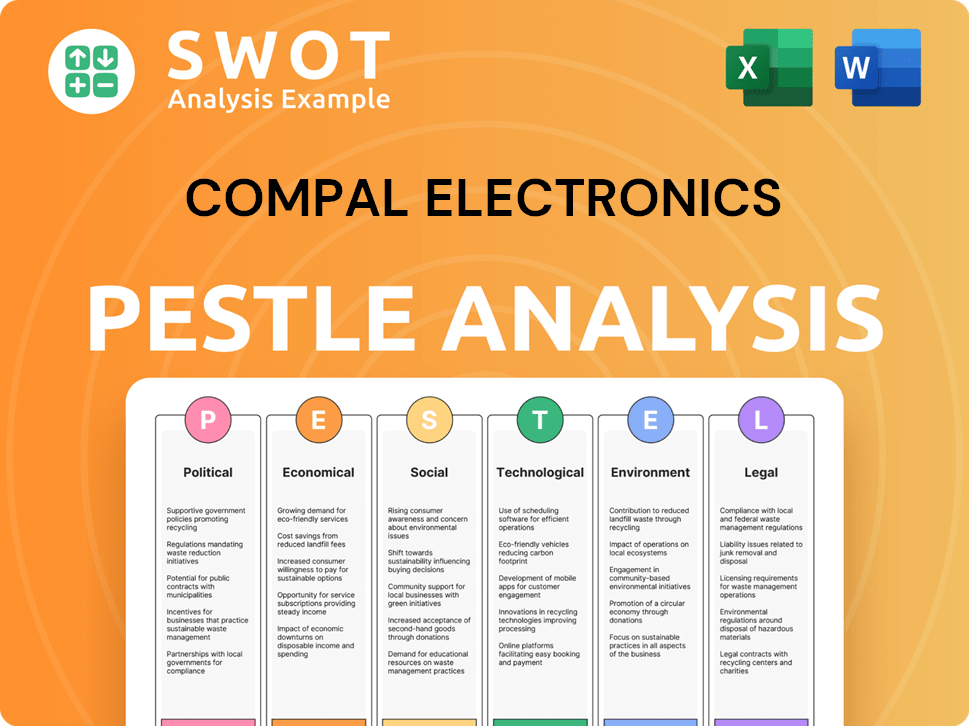

Explores how external macro-environmental factors affect Compal Electronics: Political, Economic, Social, etc.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Compal Electronics PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This is a complete PESTLE analysis of Compal Electronics.

PESTLE Analysis Template

Compal Electronics operates within a complex global environment. Our PESTLE analysis provides crucial insights into the external factors shaping its trajectory. Examine the political stability affecting supply chains and trade regulations. Understand the economic forces influencing consumer demand and investment decisions. Grasp the impact of technological advancements and social trends on product development. Dive deeper into environmental considerations and legal compliance complexities. Access the complete PESTLE analysis for a comprehensive understanding of Compal’s competitive landscape—and take decisive action!

Political factors

Geopolitical tensions, especially US-China, push Compal to diversify. This includes expanding manufacturing in Vietnam, Thailand, India, Mexico, Poland, and Brazil. In 2024, Compal's revenue was approximately $30 billion, reflecting this strategic shift. The goal is to reduce reliance on China due to potential tariffs and trade restrictions.

Government incentives are boosting local manufacturing. Compal utilizes these, such as India's 'Make in India'. This strategy allows access to new markets and potential cost reductions. In 2024, India's electronics production reached $100 billion, a rise from $75 billion in 2023, fueled by such policies.

Compal Electronics' manufacturing locations, including Vietnam, Thailand, India, Poland, and Mexico, depend on political stability. Stable environments ensure smooth operations and reliable supply chains. Political instability increases business risks. In 2024, Mexico saw a 3.2% growth in manufacturing, yet faces political uncertainties. Poland's manufacturing grew by 4.7% in 2024, benefiting from its EU membership.

Changes in Trade Agreements and Regulations

Changes in trade agreements and regulations directly affect Compal Electronics' global operations. The company, being a major player in electronics manufacturing, heavily relies on international trade for components and finished products. Fluctuations in tariffs and trade policies can significantly alter the cost structure, impacting profitability. For example, the US-China trade tensions in 2023-2024, with potential tariffs, could raise costs.

- Impact on Profitability: Increased costs from tariffs or trade barriers.

- Supply Chain Disruptions: Changes in regulations may affect the availability of components.

- Market Competitiveness: Altered pricing strategies to remain competitive.

Intellectual Property Protection Policies

Intellectual property (IP) protection is critical for Compal Electronics, a technology manufacturer. Government policies and their enforcement directly impact Compal's ability to safeguard its designs and innovations. Robust IP laws are essential to prevent the unauthorized use of Compal's technologies. In 2024, China, where Compal has significant operations, saw continued efforts to strengthen IP protection, including increased penalties for infringement.

- China's IP courts handled over 690,000 IP cases in 2024.

- The US government has also increased scrutiny of IP theft, particularly from China.

- Compal's R&D spending in 2024 was approximately $500 million, highlighting the need for IP protection.

Geopolitical shifts, like the US-China trade dynamics, drive Compal's diversification strategy, impacting manufacturing locations. Government incentives, such as 'Make in India,' shape Compal's market access and cost structures. Changes in trade agreements and IP regulations influence profitability and supply chains.

| Political Factor | Impact on Compal | 2024 Data Point |

|---|---|---|

| Trade Tensions | Cost Increases, Supply Chain Disruptions | US-China tariffs continue to evolve, impacting component costs. |

| Government Incentives | Market Access, Cost Reduction | India's electronics production reached $100B, 2024, fueled by policies. |

| IP Protection | Safeguarding Designs, R&D Investment | China handled 690K IP cases in 2024; Compal's R&D spending ~$500M. |

Economic factors

Compal's financial health is strongly tied to global economic trends and consumer spending habits. A global economic slowdown, like the one projected by the IMF with a 2.9% growth in 2024, could curb demand for electronics. Robust economic growth, potentially exceeding 3% in specific regions, could boost sales. Consumer confidence, influenced by inflation rates such as the 3.2% reported in the US in February 2024, also plays a significant role.

Inflation significantly influences Compal's costs. Rising prices for raw materials and labor directly impact its operational expenses. Currency fluctuations affect imported component costs and international sales revenue, impacting profitability. In 2024, the US inflation rate was around 3.1%. Trade policy changes have added to inflationary pressures.

The cost and availability of components are critical economic factors for Compal. Supply chain issues can cause price fluctuations and shortages. In 2024, the global electronics component market was valued at $1.6 trillion, with projections to reach $2 trillion by 2027, according to Statista. This impacts Compal's production costs.

Labor Costs and Availability

Labor costs and the availability of skilled labor are critical for Compal Electronics. The company's strategy involves diversifying production to regions with lower labor costs, a common practice in the electronics sector. This approach aims to optimize production expenses. However, access to skilled workers remains essential for manufacturing sophisticated electronics.

- In 2024, the average hourly manufacturing wage in China was around $7.50, while in Vietnam it was approximately $3.00.

- Compal has expanded its operations in Vietnam to capitalize on lower labor costs.

- The availability of engineers and technicians is essential for maintaining quality standards.

Investment in New Technologies and R&D

Compal Electronics strategically invests in R&D to capitalize on economic trends, focusing on sectors like AI, cloud servers, and automotive electronics. These investments aim to fuel revenue growth by entering new markets. For 2024, Compal's R&D spending is projected to be around $600 million, a 10% increase from 2023. This commitment aligns with the global push for technological advancements. Furthermore, Compal's revenue from these advanced sectors is expected to increase by 15% in 2025.

Compal Electronics navigates economic factors impacting profitability and growth. Global economic trends, including inflation and consumer spending, heavily influence demand. Component costs and labor expenses also play crucial roles, with strategies like shifting production to regions like Vietnam, where manufacturing wages average around $3.00 per hour in 2024.

| Economic Factor | Impact on Compal | Data Point (2024/2025) |

|---|---|---|

| Global Economic Growth | Influences Demand | IMF projects 2.9% growth in 2024. |

| Inflation | Impacts Costs & Revenue | US inflation at 3.1% in 2024. |

| Component Costs | Affects Production Costs | $1.6T electronics market in 2024. |

Sociological factors

Consumer preferences and lifestyle trends significantly shape electronics demand. Smart devices, wearables, and AI-driven products are increasingly popular. In 2024, global smart device sales reached $600 billion, growing 10% annually. Compal must update its offerings to meet these evolving needs and capture market share.

Compal relies on skilled labor for manufacturing and R&D. Regions' education levels affect productivity and innovation. Compal invests in training to ensure a skilled workforce. In 2024, Compal's training budget increased by 15% to enhance employee skills. This investment supports operational efficiency and technological advancements.

Aging populations globally are driving demand for smart healthcare. Compal's move into this sector aligns with this trend. The market for digital health is projected to reach $600 billion by 2025. This sector expansion is crucial for Compal's strategic growth. The increasing need for tech-driven healthcare boosts the company's relevance.

Urbanization and Demand for Connected Devices

Urbanization fuels demand for connected devices, including 5G applications, which Compal produces. Smart city development further boosts this demand, creating opportunities for Compal. In 2024, over 56% of the world's population lived in urban areas, a trend expected to rise. Compal's focus on 5G and smart devices aligns with this urban shift.

- Global urban population exceeded 4.5 billion in 2024.

- Smart city market size projected to reach $873.2 billion by 2026.

- 5G adoption continues to grow, with over 1.8 billion connections by late 2024.

Ethical Consumerism and Corporate Social Responsibility

Ethical consumerism significantly impacts purchasing choices. Consumers increasingly favor brands demonstrating corporate social responsibility (CSR). Compal Electronics responds by emphasizing ethical management and sustainable practices. This approach aligns with a growing market demand for responsible supply chains. In 2024, global CSR spending reached approximately $20 billion, reflecting its importance.

- Consumer demand for ethical products is rising.

- Compal's CSR efforts are in response to this trend.

- Sustainable supply chains are becoming a priority.

- CSR spending shows the growing importance.

Sociological factors such as evolving consumer preferences and global urbanization trends directly influence Compal Electronics. Ethical consumerism also impacts purchasing decisions, leading Compal to emphasize corporate social responsibility.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Consumer Trends | Drive demand for smart tech. | Smart device sales $600B in 2024 (+10%). |

| Urbanization | Boosts connected device needs. | 56% world urban, 5G connections >1.8B. |

| Ethical Consumerism | Shapes purchasing. | Global CSR spending $20B in 2024. |

Technological factors

Rapid advancements in AI and machine learning are reshaping electronics. Compal integrates AI into products like AI PCs and servers. The global AI market is projected to reach $200 billion in 2024. Compal uses AI to boost manufacturing efficiency and create new functionalities.

The evolution of 5G technology presents significant opportunities for Compal Electronics. 5G's enhanced capabilities drive demand for advanced communication devices, boosting Compal's relevance. In 2024, global 5G subscriptions reached over 1.6 billion, fueling Compal's growth in connected devices. Compal leverages 5G to meet the rising need for faster, dependable wireless connectivity, expanding its market reach.

Miniaturization and enhanced performance of electronic components are rapidly evolving. Compal must adopt these advancements to create competitive products. For example, the global market for microchips is projected to reach $600 billion by 2024. This shift enables smaller, more efficient devices, crucial for Compal's offerings.

Development of New Materials and Manufacturing Processes

Compal Electronics actively invests in new materials and manufacturing techniques to boost product quality, cut expenses, and promote eco-friendly practices. The company is focused on optimizing its production processes through the use of advanced technologies. In 2024, Compal increased its R&D spending by 15% to explore innovative solutions. These advancements can lead to more sustainable product development.

- R&D Investment: Compal's 2024 R&D spending saw a 15% increase.

- Sustainability: Focus on developing greener products.

Cybersecurity and Data Protection Technologies

Compal Electronics must prioritize cybersecurity and data protection due to increased digital connectivity and sensitive data handling. They invest in information security to safeguard their data, customer information, and supply chain. The global cybersecurity market is projected to reach $345.7 billion in 2024. This is up from $292.7 billion in 2022, showing a strong growth trend.

- 2024 Global Cybersecurity Market: $345.7 billion.

- 2022 Global Cybersecurity Market: $292.7 billion.

Technological factors heavily influence Compal's operations.

AI and machine learning, with a $200B market in 2024, are crucial for efficiency and product innovation.

5G's growth (1.6B+ subscriptions in 2024) fuels demand.

Cybersecurity is vital; the $345.7B market in 2024 highlights its importance.

| Technology Area | Market Size/Impact (2024) | Compal's Strategy |

|---|---|---|

| AI | $200 billion | Integrate AI in products, boost manufacturing efficiency. |

| 5G | 1.6B+ subscriptions | Develop advanced communication devices. |

| Cybersecurity | $345.7 billion | Invest in data protection. |

Legal factors

Compal Electronics faces the challenge of complying with international trade laws across its global operations. This includes managing import/export rules, tariffs, and trade restrictions that differ by region. For instance, adhering to U.S. tariffs on Chinese imports has been a significant factor. In 2024, the U.S. imposed tariffs on approximately $300 billion worth of Chinese goods. This compliance is crucial to avoid penalties and ensure smooth operations.

Compal Electronics must adhere to stringent product safety and compliance standards. These standards, essential for market access, cover electrical safety and electromagnetic compatibility. In 2024, failure to comply led to recalls in certain regions, impacting sales by approximately $50 million. Product certifications are crucial, ensuring legal sale and use.

Compal Electronics operates within a legal framework heavily influenced by intellectual property (IP) laws. These laws, encompassing patents, trademarks, and copyrights, are crucial for protecting Compal's innovations and brand identity. The company's legal department must actively manage and defend its IP portfolio. Recent data indicates that IP-related litigation costs for tech manufacturers can range from 2% to 5% of revenue. In 2024/2025, expect continued legal scrutiny and the need for robust IP management.

Labor Laws and Employment Regulations

Compal Electronics must strictly adhere to labor laws and employment regulations across all its operational countries. These regulations cover wages, working hours, workplace safety, and employee rights, significantly affecting HR and operational expenses. Failure to comply can lead to legal penalties and reputational damage, potentially impacting investor confidence and market access. In 2024, labor law violations cost companies an average of $250,000 per incident, highlighting the importance of compliance.

- Minimum wage laws vary significantly by country, affecting cost structures.

- Workplace safety standards compliance can require substantial investment.

- Employee benefits and rights regulations impact HR strategies.

- Compliance with regulations is essential for maintaining a positive brand image.

Environmental Regulations and Compliance

Compal Electronics faces environmental regulations impacting manufacturing, waste, and hazardous substances. Compliance is vital to avoid penalties and maintain environmental responsibility. Stricter rules may increase operational costs. Non-compliance can lead to significant fines and reputational damage.

- 2024: Increased focus on reducing e-waste.

- 2024: Compliance costs could rise by 5-7%.

- 2024: Potential fines for violations range from $100,000 to $1 million.

Compal must navigate complex international trade laws, including tariffs and import/export rules. Product safety and IP regulations are crucial, influencing market access and protecting innovations. Labor laws, minimum wages, and environmental rules also affect costs and operational strategies.

| Area | Impact | 2024/2025 Data |

|---|---|---|

| Trade | Tariffs, Restrictions | U.S. tariffs on China: ~$300B goods |

| Product Safety | Recalls, Sales | 2024 Recalls: $50M sales impact |

| Labor | Wages, Safety | Violations fines avg. $250K per incident |

Environmental factors

Climate change poses risks and chances for Compal. Supply chain disruptions from extreme weather are a key risk. Developing eco-friendly products taps into rising environmental awareness. Compal focuses on climate change mitigation and adaptation strategies. In 2024, the market for green electronics grew by 15%, presenting significant opportunities.

Resource depletion and material sourcing are key environmental factors. Compal Electronics must assess the sustainability of raw materials. The company should aim for recycled or sustainably sourced materials. This aligns with the growing demand for eco-friendly products and reduces environmental impact. In 2024, the global e-waste volume reached 62 million metric tons.

E-waste is a significant environmental challenge, and Compal addresses this by designing products with the end-of-life in mind. The global e-waste generation reached 62 million tonnes in 2022, with only 22.3% properly recycled. Compal's circular economy efforts aim to boost these figures. The company's initiatives are crucial for lessening environmental impact.

Energy Consumption and Greenhouse Gas Emissions

Compal Electronics' manufacturing processes require substantial energy, leading to greenhouse gas emissions. The company is actively working on reducing its environmental impact through several initiatives. For example, Compal has set a goal to reduce its carbon emissions by 30% by 2030.

- Energy-saving measures: Implementing energy-efficient equipment and optimizing operational practices.

- Renewable energy: Exploring and investing in renewable energy sources like solar and wind power.

- Carbon reduction targets: Setting and working towards specific targets to minimize its carbon footprint.

Water Usage and Wastewater Management

Water is essential in Compal's manufacturing, necessitating careful wastewater management to prevent pollution. The company actively monitors water use and strives to minimize consumption through various initiatives. These measures include recycling and efficient water treatment. Compal's commitment to environmental responsibility is reflected in its water management practices.

- Compal's water usage data for 2024/2025 isn't publicly available.

- However, industry benchmarks show electronics manufacturers are increasingly focused on water conservation.

- They use closed-loop systems and advanced filtration to reduce environmental impact.

Compal faces environmental impacts, including climate change and resource depletion. In 2024, the green electronics market grew by 15%, yet e-waste hit 62 million metric tons. The company focuses on reducing carbon emissions, aiming for a 30% cut by 2030.

| Factor | Impact | Mitigation |

|---|---|---|

| Climate Change | Supply chain disruptions, rising costs | Eco-friendly products, carbon reduction |

| Resource Depletion | Material sourcing sustainability challenges | Recycled materials, circular economy |

| E-waste | Environmental pollution and landfill overflow | Product design, recycling programs |

PESTLE Analysis Data Sources

The Compal Electronics PESTLE Analysis uses a combination of sources like government reports, industry publications, and economic databases.