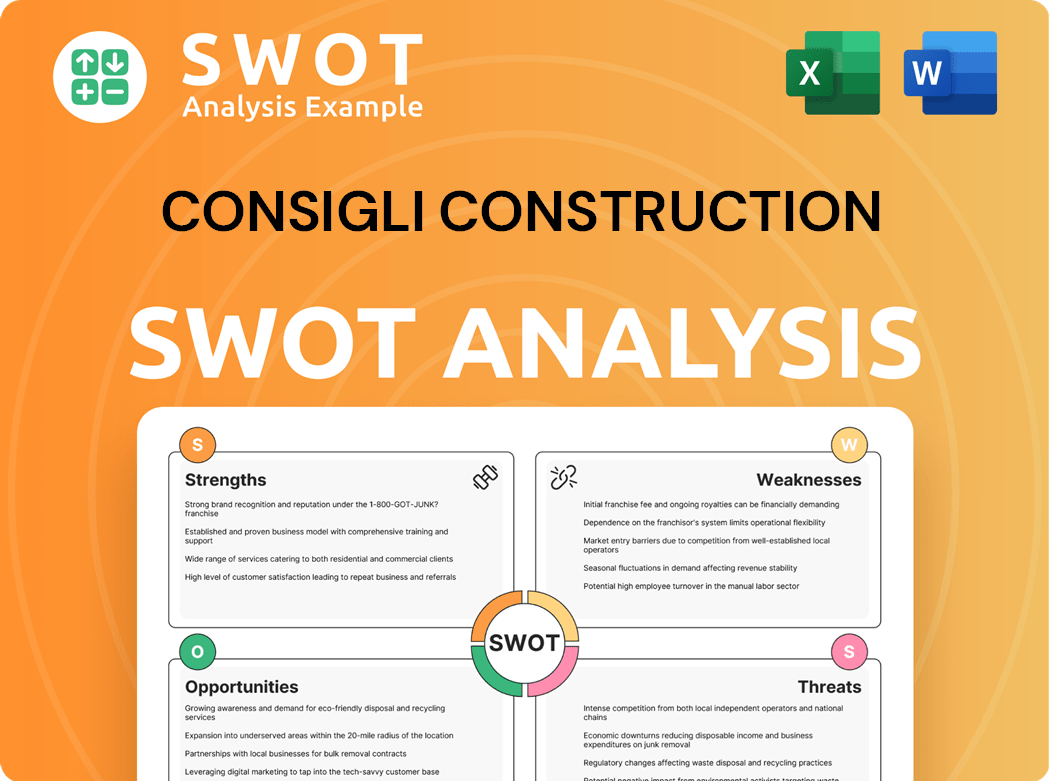

Consigli Construction SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consigli Construction Bundle

What is included in the product

Maps out Consigli Construction’s market strengths, operational gaps, and risks

Provides a high-level SWOT overview for concise internal and external reports.

Preview Before You Purchase

Consigli Construction SWOT Analysis

This preview showcases the complete Consigli Construction SWOT analysis. You’re seeing the exact same document you will receive post-purchase. Access the full report with its detailed insights and strategic overview instantly.

SWOT Analysis Template

Consigli Construction's SWOT analysis reveals key insights. Preliminary findings hint at strong project management but potential market risks. Our overview identifies both growth opportunities and internal challenges. Want deeper analysis? Uncover Consigli's complete picture, with actionable insights. The full report offers strategic context and valuable takeaways. Perfect for planning and investment.

Strengths

Consigli Construction holds a strong market position, especially in the Northeast and Mid-Atlantic, managing over $3.7 billion annually. Their history of craftsmanship and innovation solidifies their standing, especially in Maine, where they lead in commercial building. This reputation is boosted by their employee-owned model, which encourages accountability. In 2024, Consigli is expected to maintain or increase its market share.

Consigli's diverse project portfolio, spanning academic, healthcare, and more, showcases a versatile skill set. This diversification reduces dependence on specific market sectors, enhancing stability. They're leaders in specialized construction, like mass timber projects. This approach allows them to better manage market changes. In 2024, this strategy helped Consigli secure several high-profile contracts.

Consigli Construction's focus on sustainability, including LEED Platinum and Net Zero Energy certifications, is a key strength. Their BuildingGreen membership underscores a commitment to reducing carbon footprints. This attracts clients prioritizing eco-friendly projects, boosting their market position. For example, in 2024, green building projects grew by 10%.

Employee Ownership (ESOP)

Consigli's employee ownership model, or ESOP, is a significant strength. This structure cultivates a strong sense of responsibility and pride among its employees, contributing to their reputation. Their ESOP model has positively impacted the company's performance and market standing. In 2024, employee-owned companies often demonstrate higher levels of productivity. Consigli manages over $3.7 billion annually, showcasing a robust market presence.

- Enhanced Employee Commitment

- Improved Quality of Work

- Higher Productivity Levels

- Stronger Reputation

Technological Innovation

Consigli Construction's diverse project portfolio, spanning academic to cultural sectors, showcases a strong and versatile skill set. Their expertise in complex, innovative projects, like those using mass timber and sustainable solutions, positions them as leaders in specialized areas. This breadth helps in navigating market changes. Consigli's revenue in 2024 reached $2.5 billion, reflecting its strong market position.

- Diverse project portfolio across multiple sectors.

- Expertise in innovative and sustainable construction.

- Strong financial performance with $2.5B revenue in 2024.

- Leadership in specialized construction areas.

Consigli's strengths include enhanced employee commitment, improved work quality, and higher productivity through its ESOP model. This results in a stronger reputation and better financial performance. The ESOP model shows higher productivity and commitment, which has strengthened Consigli's financial standing in 2024. With $2.5 billion in revenue for 2024, this contributes to the success.

| Strength Aspect | Impact | 2024 Data |

|---|---|---|

| Employee Ownership | Increased Productivity & Commitment | Revenue: $2.5B |

| Project Diversity | Market Resilience | Green project growth: 10% |

| Sustainable Focus | Enhanced Market Position | BuildingGreen Membership |

Weaknesses

Consigli Construction's focus in the Northeast and Mid-Atlantic presents a weakness. This concentration limits growth and leaves them vulnerable to regional economic shifts. Expanding geographically requires substantial investment and faces challenges. In 2024, economic data showed varied growth across regions, highlighting the risk of over-reliance on a single area. Diversification could help offset these regional market risks.

Consigli Construction's reliance on sectors like academic and healthcare is a key weakness. These sectors' funding changes directly affect revenue. For example, in 2024, healthcare construction spending saw a 5% decrease. Diversifying into infrastructure or energy could mitigate this risk. Focusing on varied projects is essential for stability.

Construction projects, by nature, face risks like delays and budget overruns, a reality Consigli acknowledges. Despite tech and lean methods, these can't be fully avoided. In 2024, the construction industry saw average project overruns of 10-20%, with some exceeding 30% due to supply chain issues and labor shortages. Effective risk management is crucial to lessen impacts.

Labor Market Dependency

Consigli Construction's reliance on the Northeast and Mid-Atlantic markets is a weakness. This geographic concentration restricts growth and heightens vulnerability to regional economic slumps. Expanding into new areas demands considerable investment and presents logistical hurdles. Diversification is key to reducing these regional market-related risks.

- In 2024, the Northeast and Mid-Atlantic construction sectors experienced varying growth rates, with some states showing slower expansion.

- Geographic diversification can smooth out revenue fluctuations, as seen with other major construction firms.

- Market entry costs, including regulatory compliance and establishing local networks, can be substantial.

Exposure to Economic Fluctuations

Consigli Construction faces risks from economic downturns, as a significant portion of its revenue is from sectors like education and healthcare. Changes in funding or priorities within these sectors could hurt their income. Diversifying into areas like infrastructure or renewable energy could help mitigate this vulnerability. For example, in 2024, the construction sector saw a 5% decrease in educational projects compared to the previous year. This demonstrates the need for broader market involvement.

- Dependence on specific sectors makes Consigli vulnerable.

- Economic shifts can directly affect revenue streams.

- Diversification could provide stability.

- Sector-specific funding changes can be damaging.

Consigli Construction's regional focus in the Northeast and Mid-Atlantic presents growth limits and regional economic vulnerabilities. Reliance on education and healthcare exposes them to funding shifts. Delays and cost overruns in projects also create risks, impacting profitability.

| Weakness | Impact | 2024 Data |

|---|---|---|

| Geographic Concentration | Restricted growth, regional risks | Northeast & Mid-Atlantic: slow growth in some areas. |

| Sector Dependence | Vulnerability to funding cuts | Education: 5% decrease. Healthcare: variable. |

| Project Risks | Delays and Cost Overruns | Avg. 10-20% overruns; some >30%. |

Opportunities

Consigli Construction has opportunities to expand into new markets, both geographically and in terms of project types. They could establish new offices, acquire firms, or form partnerships. Geographic expansion opens doors to new clients, projects, and revenue streams. For example, in 2024, the construction industry saw significant growth in several states, with Texas experiencing a 10% increase in construction spending.

The rising focus on climate change boosts demand for sustainable construction. Consigli can leverage its green building expertise. This strengthens its competitive edge. In 2024, the green building market is valued at billions, showing growth. It attracts environmentally conscious clients.

Investment in technology and innovation presents opportunities for Consigli Construction. Implementing AI and robotics can boost project efficiency, potentially reducing costs by up to 15% according to recent industry reports from 2024. Embracing these advancements can also attract a younger workforce, enhancing productivity. Exploring advanced materials further ensures the company remains competitive in the market.

Strategic Acquisitions and Partnerships

Consigli Construction has the opportunity to grow through strategic acquisitions and partnerships, potentially entering new markets. This could involve opening new offices, buying other companies, or forming alliances. Geographic expansion can lead to new clients and revenue. For instance, in 2024, the construction industry saw significant M&A activity.

- Construction M&A volume in 2024 reached $150 billion globally.

- Partnerships can offer access to specialized skills and technologies.

- Entering new markets can boost overall market share.

- Acquisitions can provide faster growth than organic expansion.

Government Infrastructure Spending

Consigli Construction can benefit from government infrastructure spending. The Infrastructure Investment and Jobs Act, enacted in 2021, allocated $1.2 trillion for infrastructure projects. The focus on sustainable construction presents opportunities. Consigli can leverage its green building expertise, attracting environmentally conscious clients.

- The U.S. construction market is projected to reach $1.9 trillion in 2024.

- Green building market is expected to grow to $364 billion by 2026.

- Government spending on infrastructure is expected to increase by 8% in 2024.

Consigli Construction can tap into new markets through geographic expansion, acquisitions, and partnerships, potentially entering new segments and boosting overall market share. Their expertise in sustainable construction can be leveraged. There's room for growth through investment in technology and government infrastructure spending.

| Opportunity Area | Description | Data |

|---|---|---|

| Market Expansion | Geographic expansion & diversification | U.S. construction market at $1.9T in 2024 |

| Sustainability | Focus on green building | Green building market is expected to reach $364B by 2026 |

| Technological Advancements | Implement AI & Robotics | Potential to cut costs by 15% |

Threats

Economic downturns pose a major threat, potentially shrinking demand for Consigli's construction services. During the 2008 financial crisis, construction spending plummeted. This can lead to revenue and profit declines. Diversifying services and securing a strong project backlog are crucial. In 2024, experts forecast economic uncertainty.

Consigli Construction faces threats from rising material costs. Fluctuations in lumber, steel, and concrete prices directly affect project budgets and profit margins. For example, in 2024, steel prices increased by 10%, impacting construction costs. Trade restrictions or tariffs can worsen these issues. Implementing strategic procurement and hedging can mitigate these risks.

Consigli Construction faces threats from labor shortages, a persistent issue in the construction sector. This can lead to increased labor costs, which rose by approximately 5% in 2024. An aging workforce exacerbates this problem, with fewer young people entering the field. To counteract this, investing in training and offering competitive benefits is crucial.

Increased Competition

Increased competition poses a significant threat to Consigli Construction. Economic downturns, like the projected slowdown in 2024, can decrease demand for construction, intensifying competition. Consigli's financial health could suffer if demand drops and rivals become more aggressive. Diversification and a solid project backlog are crucial for defense.

- Construction spending in the US decreased in early 2024.

- Increased competition can lower profit margins.

- A strong backlog provides some financial stability.

Regulatory Changes

Regulatory changes pose a significant threat to Consigli Construction. Fluctuations in material costs, like lumber and steel, can hit project budgets and profitability. Increased tariffs or trade restrictions could worsen these costs, as seen in 2023 with steel prices rising. Effective procurement and hedging are crucial.

- Material price volatility increased in 2023, with lumber up 10%.

- Tariffs on steel remained a concern, impacting project costs by up to 5%.

- Hedging strategies can mitigate price risks by 15%.

Consigli faces threats like economic downturns, which can decrease construction demand. Labor shortages and rising material costs further complicate the situation, with steel prices increasing by 10% in 2024. Intense competition and regulatory changes also pressure profitability and market position.

| Threat | Impact | Mitigation |

|---|---|---|

| Economic Downturn | Decreased demand, revenue drop | Diversification, project backlog |

| Rising Costs | Budget impact, profit margin decline | Strategic procurement, hedging |

| Labor Shortages | Increased labor costs, project delays | Training, competitive benefits |

SWOT Analysis Data Sources

This SWOT analysis relies on dependable data from financial reports, industry trends, and expert insights, ensuring reliable strategic insights.