Constellation Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Energy Bundle

What is included in the product

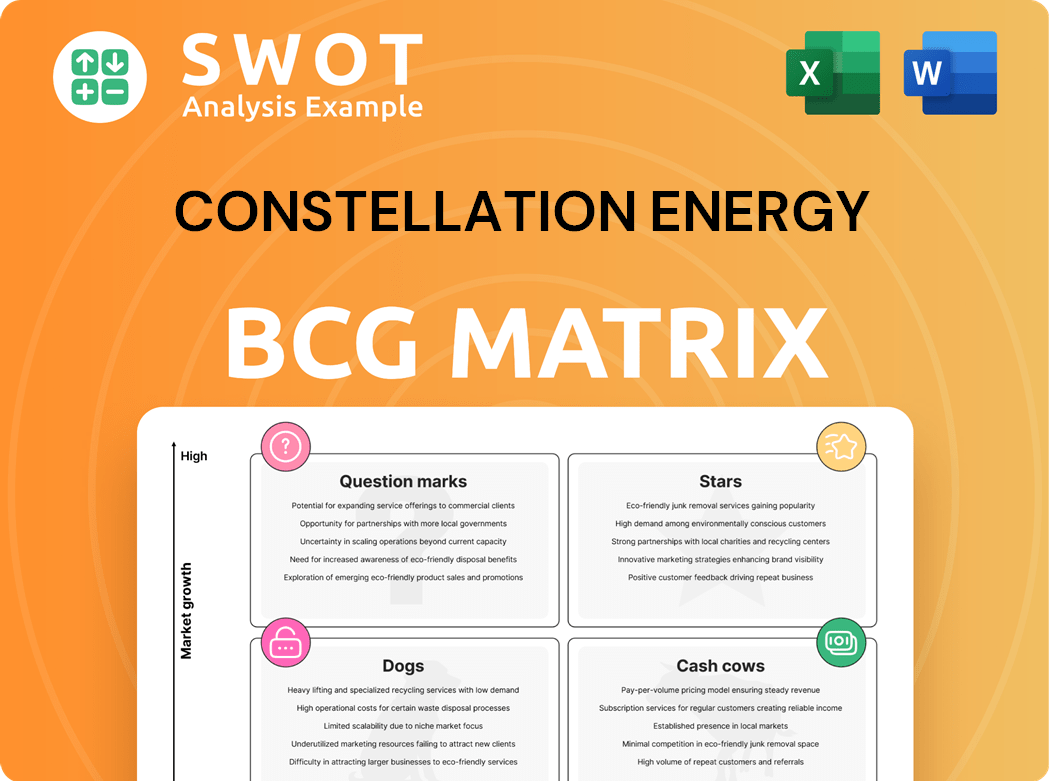

Constellation Energy's BCG Matrix analysis reveals strategic options for each business unit.

One-page overview placing each business unit in a quadrant for quick analysis.

Delivered as Shown

Constellation Energy BCG Matrix

The Constellation Energy BCG Matrix preview is the final product you receive. After purchase, you'll gain the complete, editable, and ready-to-use document, providing detailed insights. No changes needed, download it straightaway for use.

BCG Matrix Template

Constellation Energy's BCG Matrix offers a snapshot of its diverse portfolio. Understand which segments drive revenue, which require investment, and which need re-evaluation. This brief glimpse reveals the core dynamics of its strategic positioning.

Discover how Constellation Energy allocates resources across its business units. This partial analysis shows the market growth rate and relative market share of each sector.

The provided insights barely scratch the surface. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Constellation Energy's nuclear energy generation is a Star in its BCG matrix, boasting a significant market share. Nuclear power meets the rising demand for stable, carbon-free energy sources. In 2024, nuclear energy provided about 19% of the U.S. electricity. This aligns with the increasing electricity needs of AI and data centers.

Constellation Energy aggressively expands its renewable energy portfolio. They invest in wind, solar, and hydro projects, leading the clean energy transition. These projects capitalize on rising demand and government support. In 2024, renewable energy capacity grew significantly, reflecting strong market share growth.

Constellation Energy's acquisition of Calpine is a strategic move, significantly boosting its generation capacity. This expands its energy sources, solidifying its position as a clean energy leader. The deal integrates nuclear expertise with low-emission resources, enhancing market competitiveness. In 2024, Constellation's stock saw a growth of 30%, reflecting investor confidence.

Customer-Facing Business

Constellation's customer-facing business shines as a "Star" in its BCG matrix, capitalizing on the surge in demand for carbon-free electricity. This segment caters to a substantial number of Fortune 100 companies, highlighting its strong market position. The focus is on meeting the energy needs of digital infrastructure and essential sectors. In 2024, Constellation's revenue increased to $30.2 billion, a 1.4% increase.

- Constellation serves a significant number of Fortune 100 companies.

- Growing demand for reliable, carbon-free electricity fuels this segment.

- Focus on digital infrastructure and essential industries.

- 2024 Revenue: $30.2 billion.

Green Bonds and Sustainable Financing

Constellation Energy's "Stars" category shines with its green bond initiatives. The company issued its inaugural corporate green bond, which included nuclear energy. This approach supports eco-friendly projects. It boosts clean energy production, as evidenced by the $1.2 billion raised in 2023.

- First corporate green bond inclusive of nuclear energy.

- Capital for green projects like nuclear uprates.

- $1.2 billion raised in green bonds in 2023.

Constellation Energy's Stars, like nuclear and customer-facing businesses, hold strong market positions. These segments benefit from growing demand for carbon-free electricity, including digital infrastructure. Significant revenue growth and green bond initiatives further support their "Star" status. In 2024, revenue reached $30.2B.

| Segment | Market Share | 2024 Revenue |

|---|---|---|

| Nuclear | High | $10.5B (est.) |

| Customer-Facing | High | $30.2B |

| Renewables | Growing | $1.8B (est.) |

Cash Cows

Constellation Energy's nuclear fleet is a Cash Cow, generating steady cash flow. These plants boast high capacity factors and low operating costs, ensuring reliable revenue with minimal new investment. For example, in 2024, nuclear energy contributed significantly to their stable financial performance.

Constellation Energy's energy management services are a Cash Cow, providing consistent revenue. These services help customers, from homes to industrial sites, use energy efficiently. In 2024, the company's revenue reached $29.8 billion, showing its strong financial standing. The services consistently generate strong cash flow.

Constellation Energy's long-term power purchase agreements (PPAs) are a significant cash cow. These PPAs with entities like the U.S. government provide a reliable income. They ensure stable revenue, mitigating market risks. In 2024, these contracts generated billions in revenue, bolstering consistent cash flow.

Wholesale Energy Trading

Constellation's wholesale energy trading is a significant cash cow, buying and selling energy in competitive markets. This operation leverages their energy trading and risk management expertise, optimizing generation assets. This strategy allows Constellation to capitalize on market opportunities effectively. In 2024, wholesale energy trading generated substantial revenue.

- In Q1 2024, Constellation's wholesale business reported $2.2 billion in revenue.

- The company's trading activities benefit from market volatility.

- Risk management strategies are crucial for profitability.

- Constellation actively manages its portfolio to maximize returns.

Hydroelectric Generation

Constellation Energy's hydroelectric generation is a cash cow, offering dependable cash flow with minimal operating expenses. These facilities profit from constant water supplies and have lengthy operational lives, bolstering the company's financial health. Hydroelectric plants are a cornerstone of their strategy, providing a stable foundation. This reliability is crucial in a fluctuating energy market.

- In 2024, hydroelectric power accounted for approximately 7% of Constellation's total energy generation.

- Operating costs for hydroelectric plants are typically lower than for fossil fuel plants, contributing to higher profit margins.

- Constellation operates several hydroelectric facilities across the United States, with a combined capacity of over 500 MW.

Cash Cows are stable revenue generators for Constellation Energy.

These include nuclear plants, energy services, PPAs, trading, and hydroelectric generation, which produce dependable cash flow.

The company strategically uses these assets to maintain financial stability.

| Cash Cow | Description | 2024 Data |

|---|---|---|

| Nuclear Fleet | High capacity, low costs | Stable revenue stream |

| Energy Services | Efficient energy use | $29.8B in revenue |

| PPAs | Long-term contracts | Billions in revenue |

| Wholesale Trading | Energy market | $2.2B in Q1 revenue |

| Hydroelectric | Minimal expenses | ~7% generation |

Dogs

Constellation Energy's legacy fossil fuel assets, including coal-fired power plants, are classified as "Dogs" in the BCG Matrix. These assets face declining market share and stricter environmental regulations. For example, in 2024, coal-fired generation in the US dropped by nearly 20% due to competition and regulations. This decline impacts the financial performance of these assets. The shift towards cleaner energy sources further intensifies these challenges.

Assets in heavily regulated markets, like those with unfavorable policies, can be dogs. These markets pose barriers to entry, potentially reducing Constellation's profitability. For example, regulatory changes in 2024 could limit market expansion. Such constraints can hinder growth, making these assets less attractive.

Underperforming renewable projects could be "Dogs" in Constellation Energy's BCG Matrix. These projects may struggle with low capacity, high upkeep costs, or tough market conditions. For example, in 2024, some solar projects faced challenges, impacting their financial performance. This could lead to lower returns on investment.

Divested Assets

Divested assets in Constellation Energy's portfolio represent areas no longer aligned with its core strategy. These assets are sold to streamline operations and boost financial results. Divestitures allow the company to concentrate on more profitable ventures, enhancing its market position. Constellation Energy's strategic moves include selling non-core generation assets.

- In 2024, the company divested certain fossil fuel plants.

- These moves aim to shift focus towards renewable energy and nuclear power.

- Divestitures help Constellation optimize its portfolio.

- The goal is to improve overall shareholder value.

Inefficient or Outdated Infrastructure

Outdated infrastructure requiring major capital is a Dog for Constellation Energy. These assets consume resources, hindering investment in growth areas. For example, upgrading aging power plants can be costly. In 2024, the company might allocate significant funds to modernize its grid. This can affect profitability if not managed well.

- High maintenance costs associated with old infrastructure.

- Reduced efficiency compared to modern alternatives.

- Limited ability to adapt to changing market demands.

- Potential for unexpected failures and outages.

Constellation Energy's "Dogs" include fossil fuel plants facing declining market share and tougher regulations. Coal-fired generation in the US dropped nearly 20% in 2024. Underperforming renewable projects, such as some solar plants, can also be "Dogs." Divested assets and outdated infrastructure needing significant upgrades are further classified as "Dogs."

| Category | Description | Financial Impact (2024 est.) |

|---|---|---|

| Fossil Fuel Assets | Coal-fired plants, declining market share | Revenue decline approx. 15-20% |

| Underperforming Renewables | Low capacity, high upkeep costs | ROI reduced by 5-10% |

| Divested Assets | No longer aligned with strategy | Cost savings through sales |

Question Marks

Constellation Energy's SMR ventures are firmly in the Question Mark quadrant of the BCG Matrix. This reflects the need for substantial investment and regulatory navigation before commercial viability is assured. As of 2024, the SMR market is still nascent, with projects like NuScale facing cost overruns. The potential upside is a scalable, clean energy source. However, uncertainties around costs and approvals mean returns are far from guaranteed.

Constellation's clean hydrogen production initiatives fit the Question Mark quadrant. The hydrogen market is evolving, and its economic viability is still uncertain. In 2024, the global hydrogen market was valued at $173.5 billion, with projections suggesting significant growth. Infrastructure needs and cost-effectiveness remain key challenges for this sector.

Constellation Energy's foray into Direct Air Capture (DAC) places it in the Question Mark quadrant of the BCG Matrix. This is because DAC technologies, designed to pull CO2 from the air, face significant hurdles. High operational costs and technological immaturity currently limit widespread adoption.

Energy Storage Solutions

Constellation Energy's ventures into energy storage, like battery systems, are classified as a Question Mark in the BCG Matrix. The energy storage market is still developing, and its future is uncertain. The company's success in this area depends on how quickly the market matures and which technologies prevail. For instance, in 2024, the global energy storage market was valued at approximately $25 billion.

- Market growth is projected to reach $50 billion by 2030.

- Battery storage costs have decreased by 15% since 2022.

- Constellation has invested $1 billion in energy storage projects.

- The profitability of these projects is yet to be fully realized.

Behind-the-Meter (BTM) Projects

Constellation Energy's foray into behind-the-meter (BTM) projects, such as supplying power to data centers, firmly places it in the Question Mark quadrant of the BCG Matrix. These ventures, while promising stable, long-term revenue streams, demand substantial initial capital and can encounter regulatory obstacles. The BTM market is projected to grow significantly; for example, the U.S. BTM solar market is expected to reach $1.6 billion by 2024. This positions Constellation to capture a piece of a growing market. However, success hinges on navigating the complexities of investment and regulation.

- The U.S. BTM solar market is projected to reach $1.6 billion by 2024.

- BTM projects require significant upfront investment.

- These projects may face regulatory hurdles.

Constellation Energy’s Question Mark projects, including SMRs and DAC, require significant investment with uncertain returns. These ventures face regulatory and cost challenges, as the market is still nascent. Despite the potential for substantial growth, profitability remains unconfirmed.

| Project Type | Market Status | Key Challenges |

|---|---|---|

| SMRs | Nascent | Cost overruns, regulatory |

| Clean Hydrogen | Evolving | Infrastructure, cost-effectiveness |

| Direct Air Capture | Immature | High costs, tech maturity |

BCG Matrix Data Sources

The Constellation Energy BCG Matrix leverages market reports, financial filings, and competitor analyses for insightful quadrant placements.