Constellation Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Energy Bundle

What is included in the product

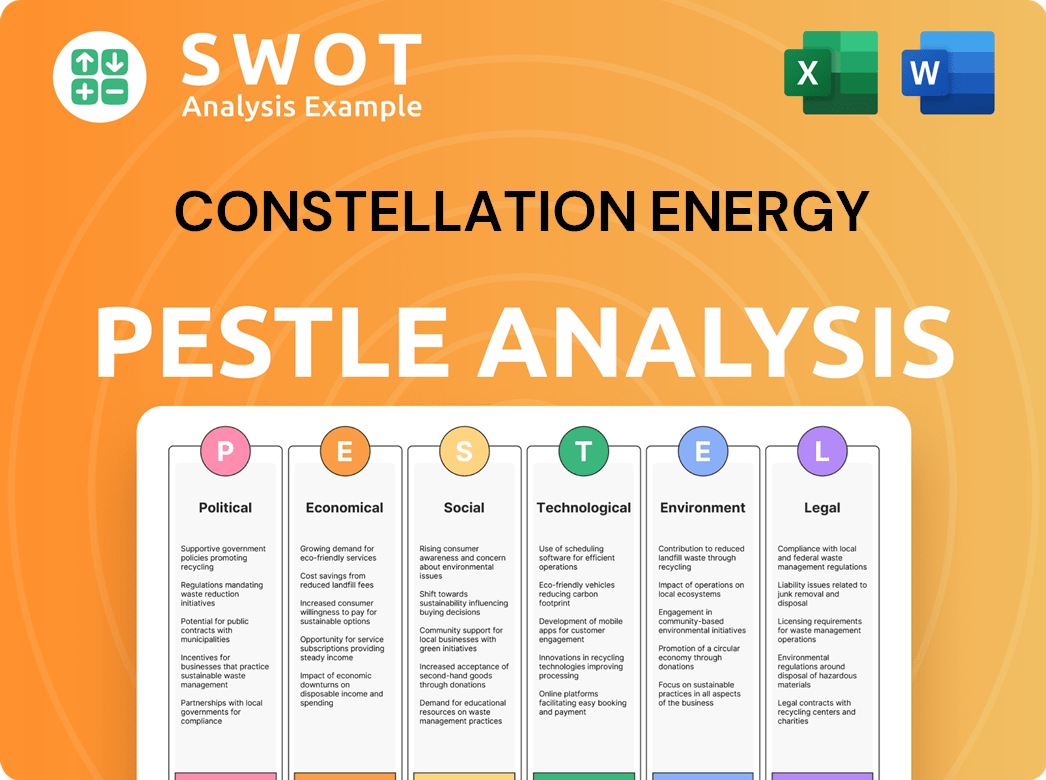

The Constellation Energy PESTLE analysis investigates macro-environmental factors: Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Constellation Energy PESTLE Analysis

Previewing the Constellation Energy PESTLE Analysis? Rest assured, this preview mirrors the complete document you’ll download.

The structure, analysis, and formatting remain identical in the purchased file.

No hidden sections or altered layouts—it’s a complete package.

Receive the exact same information for immediate application after buying.

What you see here is exactly what you'll own!

PESTLE Analysis Template

Unlock valuable insights with our in-depth PESTLE analysis of Constellation Energy. We explore political shifts, economic pressures, social trends, technological advancements, legal factors, and environmental concerns impacting their operations.

Understand how these external forces are shaping Constellation Energy's market position and future prospects. Get actionable intelligence and make data-driven decisions to refine your strategies. Download the full report now!

Political factors

Governments globally are actively promoting clean energy, especially in the U.S., to tackle climate change and boost energy security. This backing involves policies, regulations, and funding that favor firms like Constellation Energy. The Inflation Reduction Act is a prime example, aiming to accelerate clean energy deployment and support existing infrastructure. Constellation Energy's strategy aligns well, with 96% of its generation coming from carbon-free sources. In 2024, the U.S. renewable energy market is projected to grow, offering Constellation significant growth opportunities.

Nuclear energy, crucial for Constellation, faces strict federal and state regulations. Licensing, safety, and waste policies directly affect costs. For example, the Nuclear Regulatory Commission (NRC) approved the operation of Vogtle Unit 3 in Georgia in early 2024. Legislative efforts aim to ease rules for advanced reactors. The Nuclear Energy Institute reported nuclear power provided nearly 20% of U.S. electricity in 2023.

Energy policy fluctuates with political climates; bipartisan support for clean energy exists, but shifts in priorities, trade tariffs, and funding can cause uncertainty. Election outcomes and policy directions significantly impact investments in energy technologies. For example, the Inflation Reduction Act of 2022 allocated approximately $370 billion to climate and energy provisions, influencing investment trends through 2024 and 2025. These shifts directly affect companies like Constellation Energy.

Federal and State Energy Procurement

Federal and state governments are significant energy consumers, pushing for clean energy. Constellation Energy benefits from this trend, securing large contracts with government agencies. These deals align with public sector sustainability goals, ensuring revenue stability. For example, in 2024, the U.S. government aimed for 100% carbon pollution-free electricity by 2030.

- Constellation Energy secured a 15-year agreement with the U.S. General Services Administration (GSA) in 2023 to supply renewable energy.

- The company has also entered into agreements with various state governments to provide clean energy solutions.

- These contracts provide a predictable revenue stream, supporting infrastructure investments.

- The market is driven by public sector sustainability targets.

International Energy Policies and Geopolitics

Constellation Energy, though US-focused, faces global energy policy impacts. International energy transition, like the EU's Green Deal, affects markets. Geopolitical events, such as the Russia-Ukraine war, can disrupt supply chains. These factors influence energy demand and pricing; for example, natural gas prices rose by 50% in Europe in 2022.

- EU's Green Deal targets 55% emissions cut by 2030, impacting global energy strategies.

- The Russia-Ukraine war caused a 40% surge in global oil prices in early 2022.

- Global demand for critical minerals needed for renewables is expected to increase by 500% by 2050.

Political factors substantially impact Constellation Energy. Government policies globally, particularly the Inflation Reduction Act, bolster clean energy. Fluctuating policies and bipartisan support, coupled with government contracts, influence revenue. The company navigates strict nuclear regulations and international impacts, like the EU's Green Deal.

| Policy Area | Impact | Example/Data |

|---|---|---|

| Clean Energy Support | Boosts growth, investments. | IRA allocated $370B for clean energy; 2024 projections. |

| Nuclear Regulations | Affects operational costs. | NRC approvals & waste management; nearly 20% of electricity from nuclear in 2023. |

| Government Contracts | Ensures revenue stability. | US aims for 100% carbon-free electricity by 2030, deals signed with GSA. |

Economic factors

The demand for electricity is surging due to the electrification of transport and heating, alongside the energy-intensive needs of data centers and AI. This rising demand, especially for dependable, carbon-free sources, creates a major economic opportunity for Constellation Energy. In Q1 2024, Constellation reported a 13% increase in electricity sales. Nuclear energy benefits greatly from the need for constant clean power.

Significant investment in clean energy infrastructure is crucial, encompassing generation, transmission, and storage. Constellation Energy is heavily investing, with billions allocated to operations and growth, especially in nuclear and renewables. Financing mechanisms like green bonds and tax credits are vital. In 2024, the U.S. saw over $100 billion in clean energy investments.

Energy markets face volatility from weather, geopolitics, and fuel supply. Constellation Energy's financials are sensitive to energy price swings. Natural gas prices, a key fuel, have seen fluctuations. In 2024, natural gas spot prices averaged around $2.50-$3.00 per MMBtu. Constellation's portfolio helps manage these risks.

Cost of Energy Transition

The shift to clean energy demands significant capital, potentially increasing energy costs. This creates an economic balancing act between clean energy goals and affordability for consumers and businesses. Constellation's success depends on offering cost-effective clean energy options. The U.S. Department of Energy estimates $4 trillion needed for grid upgrades by 2035.

- Cost of renewable energy has decreased significantly, yet still requires substantial upfront investment.

- Government incentives and tax credits play a crucial role in easing the financial burden.

- Constellation's strategic investments in renewables and nuclear are key.

- The long-term economic benefits of clean energy transition are also important.

Economic Growth and Industrial Demand

Economic growth and industrial demand are key drivers for Constellation Energy. A robust economy, particularly with growth in energy-intensive sectors such as manufacturing and data centers, boosts electricity demand. This increased demand directly benefits energy providers like Constellation. Decarbonization efforts within these industries further fuel the need for clean energy sources.

- U.S. GDP growth in 2024 is projected around 2.5%.

- Data center electricity consumption is forecast to rise significantly by 2030.

- Manufacturing output continues to be a major consumer of electricity.

Demand for electricity is increasing, fueled by transport, heating, and data centers; Constellation benefits from this growth. Clean energy infrastructure requires huge investments, with government support critical for financial viability. Economic growth, alongside industrial and data center expansion, drives higher electricity consumption, creating opportunities.

| Economic Factor | Impact on Constellation | 2024/2025 Data |

|---|---|---|

| Electricity Demand | Higher sales, revenue | Q1 2024 electricity sales up 13%; Data center energy use growing significantly. |

| Investment in Clean Energy | Growth in operations | U.S. clean energy investments exceed $100 billion (2024); $4T grid upgrade by 2035 (DoE est.) |

| Economic Growth | Boost in electricity demand | U.S. GDP growth est. at 2.5% (2024); Manufacturing remains a significant consumer of power. |

Sociological factors

Public perception heavily influences nuclear energy's viability. Support is rising, yet safety, waste, and security concerns remain significant. A 2024 Pew Research Center study showed 47% favor nuclear energy, up from previous years. This acceptance impacts policy and project development. Public acceptance is key for Constellation's social license.

Developing new energy projects needs community engagement and acceptance. Addressing local concerns and ensuring transparency are crucial. Community solar programs boost local participation and benefits. Constellation Energy invests in community solar, with over 300 MW in 2024. This promotes local support for its projects.

Constellation Energy faces workforce challenges due to the energy transition. The company invests in training to address the skills gap in areas like renewables and grid modernization. As of Q1 2024, Constellation employed over 10,000 people. Job creation and workforce development are vital for societal well-being.

Energy Equity and Access

Ensuring equitable access to affordable and reliable energy is a critical societal challenge. The energy transition must benefit all, especially underserved communities. Constellation's initiatives in clean, affordable energy and community support are significant. In 2024, about 7.6% of U.S. households faced energy insecurity. Constellation's focus aligns with reducing these disparities.

- Energy poverty disproportionately affects low-income households and communities of color.

- Constellation's community programs aim to address energy affordability and promote sustainability.

- The company's investments in renewable energy are aimed at lowering costs and improving access.

Consumer Demand for Clean Energy Products

Consumer demand significantly shapes Constellation Energy's market, with rising awareness of sustainable products. Consumers and businesses increasingly prioritize reducing their carbon footprint. This shift fuels demand for renewable energy certificates and clean energy solutions. The trend is evident in the growth of green energy adoption.

- In 2024, the global renewable energy market was valued at $881.1 billion.

- Consumer demand for electric vehicles (EVs) directly impacts electricity consumption patterns.

- Companies are setting ambitious sustainability goals, further driving the demand for clean energy.

- The U.S. renewable energy consumption increased from 12% in 2018 to 21% in 2023.

Societal views greatly affect nuclear energy's role, with public support trending upward yet concerns about safety persisting. Local engagement is vital for project approval. The focus on affordable energy and clean initiatives addresses the impact of the social context.

| Factor | Description | Data |

|---|---|---|

| Public Perception | Influences project approval, and social license | Pew Research: 47% favor nuclear (2024) |

| Community Relations | Needed for project development & sustainability | 300 MW+ community solar (2024) |

| Equitable Energy | Ensure access & lower disparities | 7.6% U.S. households faced energy insecurity(2024) |

Technological factors

Technological advancements in nuclear reactor technology, particularly Small Modular Reactors (SMRs), are poised to reshape the energy sector. These innovations offer enhanced safety and efficiency, potentially expanding nuclear power's market reach. Constellation Energy is actively investing in these technologies and upgrading existing facilities. For example, the global SMR market is projected to reach $14.4 billion by 2030, signaling significant growth opportunities.

Development of renewable energy technologies is crucial. Solar, wind, and hydropower innovations lower costs and boost efficiency. Energy storage advancements, like batteries, are vital for integrating renewables. For example, in Q1 2024, solar capacity additions surged by 50% year-over-year. These influence Constellation's renewable asset competitiveness.

Grid modernization is crucial for integrating renewables and distributed energy. Constellation invests in digital technologies to enhance reliability. In 2024, smart grid investments reached $10 billion. These upgrades improve efficiency in energy delivery.

Hydrogen Production Technologies

Constellation Energy could find growth in clean hydrogen production, especially with nuclear or renewable energy. The rise in demand for clean hydrogen in industries and transport could utilize Constellation's carbon-free sources. The U.S. Department of Energy aims to cut the cost of clean hydrogen to $1/kg by 2030. This strategy aligns with Constellation's potential to produce and supply clean hydrogen.

- Hydrogen production costs are targeted to decrease by 80% by 2030.

- The global hydrogen market is projected to reach $280 billion by 2030.

- Constellation operates nuclear plants that could power hydrogen production.

Digitalization and Data Analytics

Digitalization, AI, and data analytics are transforming energy operations. Constellation Energy can use these tools to boost efficiency, optimize performance, and improve grid management. These technologies can enhance power plant operations, energy trading, and customer service. In 2024, the global smart grid market was valued at $36.7 billion, and is projected to reach $61.3 billion by 2029.

- AI is expected to reduce operational costs by 15-20% for energy companies.

- Data analytics can improve predictive maintenance, reducing downtime by up to 30%.

- Smart grid investments are growing at a CAGR of 10.8% between 2024 and 2029.

Constellation Energy benefits from technological advancements in nuclear energy, renewables, and grid modernization. The Small Modular Reactor (SMR) market is expected to hit $14.4B by 2030, creating expansion prospects. Digitalization, AI, and data analytics, are vital for improving operations and boosting efficiency.

| Technology Area | Market Size/Growth | Constellation Impact |

|---|---|---|

| SMR Market | $14.4B by 2030 | Enhances nuclear capabilities |

| Smart Grid Market | $61.3B by 2029 (CAGR 10.8%) | Improves grid management |

| AI in Energy | Reduces operational costs 15-20% | Boosts efficiency & optimizes |

Legal factors

Constellation Energy faces diverse legal landscapes due to its operations in both regulated and deregulated energy markets. Regulatory changes significantly affect pricing, transmission, and distribution, impacting financial performance. For example, in 2024, regulatory actions in key states like Illinois and Maryland influenced its market strategies. The company must adeptly navigate these complex legal frameworks.

Constellation Energy faces stringent environmental laws. These laws regulate emissions, waste, water use, and land use. Compliance is vital for operations and new projects. Environmental standard changes can increase costs. In 2024, the U.S. government allocated $6.2 billion for clean energy projects, impacting compliance needs.

Constellation Energy operates under strict nuclear energy licensing and safety regulations overseen by the Nuclear Regulatory Commission (NRC). Compliance involves rigorous adherence to safety protocols and managing spent nuclear fuel, significant legal obligations. In 2024, the NRC approved license renewals for several nuclear plants, reflecting ongoing compliance. The legal landscape includes evolving standards and potential liabilities.

Permitting Processes for Energy Projects

Constellation Energy faces legal hurdles in permitting new energy projects. Obtaining permits for facilities, including renewables and transmission lines, is complex. Legislative efforts aim to streamline processes to accelerate clean energy. These efforts could boost Constellation's expansion.

- Permitting delays can significantly impact project timelines and costs.

- Streamlining could reduce project lead times by months or even years.

- The Inflation Reduction Act of 2022 includes provisions that could expedite permitting for renewable energy projects.

Contract Law and Power Purchase Agreements

Constellation Energy heavily relies on legally binding contracts, especially Power Purchase Agreements (PPAs). These PPAs are crucial for its energy supply commitments, defining pricing and duration with major clients. The legal robustness of these agreements directly impacts Constellation's revenue stability and risk management. As of early 2024, approximately 75% of Constellation's revenue comes from contracted sales, underscoring the importance of these legal frameworks.

- PPAs ensure predictable revenue streams.

- Contract disputes can significantly impact profitability.

- Legal compliance is essential for operational integrity.

- Changes in regulations could affect contract terms.

Constellation Energy navigates diverse legal environments, with regulations impacting pricing and financial performance, particularly in key states. Environmental laws and regulatory actions on emissions significantly affect its operations, impacting compliance costs. Nuclear energy operations demand strict compliance with NRC regulations, evolving standards, and liability management.

Permitting hurdles and legislative streamlining are significant, influencing project timelines and costs; The Inflation Reduction Act of 2022 expedites renewable energy project permitting.

The firm depends on Power Purchase Agreements (PPAs), with these legally binding contracts, ensuring revenue stability. Around 75% of revenue came from contracted sales by early 2024, showing contract importance.

| Legal Aspect | Impact | Financial Implication (Example) |

|---|---|---|

| Market Regulation | Pricing, operations. | 2024 Regulatory changes impacting market strategies. |

| Environmental Compliance | Emission standards, costs. | U.S. allocated $6.2B for clean energy projects. |

| Nuclear Licensing | Safety protocols, compliance. | NRC approvals affect operational compliance. |

Environmental factors

Climate change is pushing the energy sector towards decarbonization, significantly impacting Constellation Energy. Global and national targets are boosting demand for renewables. Constellation, with its clean energy focus, benefits from this shift. The Inflation Reduction Act supports the transition with tax credits. In 2024, renewables grew, reflecting the urgency.

Constellation Energy's operations are significantly influenced by environmental factors, particularly the availability of natural resources. Water is crucial for cooling nuclear and hydroelectric facilities, while wind and solar are essential for renewable energy projects. For example, in 2024, the company's renewable portfolio generated 16,000 GWh of clean energy. Climate change poses a risk, potentially altering resource availability and operational efficiency.

The construction and operation of energy infrastructure, like Constellation Energy's power plants and transmission lines, significantly impacts the environment. These projects can lead to land use changes, affecting ecosystems and wildlife. Constellation Energy needs to assess and mitigate these effects to adhere to environmental regulations and maintain its operational license. For instance, in 2024, the company invested $1.5 billion in clean energy projects to reduce its carbon footprint.

Nuclear Waste Management

Nuclear waste management is a critical environmental factor for Constellation Energy, which operates a large nuclear fleet. The safe storage and disposal of spent nuclear fuel presents ongoing challenges. The U.S. currently has no permanent disposal site, and the issue involves both environmental and political considerations. Constellation must navigate these complexities to ensure compliance and minimize environmental impact.

- Spent nuclear fuel storage costs range from $200,000 to $1 million per metric ton annually.

- There are over 80,000 metric tons of spent nuclear fuel stored at commercial reactor sites in the U.S. as of 2024.

- The Nuclear Waste Policy Act of 1982 mandated a permanent disposal site, which is still pending.

Extreme Weather Events and Climate Resilience

Extreme weather, intensified by climate change, poses a growing threat to energy infrastructure's reliability. Constellation Energy must assess these risks, as seen with the 2023-2024 increase in weather-related outages. Specifically, it must invest in resilience measures for its facilities. The financial implications are substantial; for example, enhancing grid resilience can cost billions but prevent even greater losses.

- 2023 saw a 20% rise in weather-related power outages in the US.

- Estimates suggest $20-50 billion in annual costs due to climate-related grid damage.

- Investment in grid hardening can reduce outage durations by up to 40%.

Environmental factors critically shape Constellation Energy's operations.

Key issues include resource availability, climate change, and infrastructure impacts, affecting project viability.

Waste management and extreme weather pose financial and operational risks, needing robust adaptation measures. These factors directly influence profitability and compliance.

| Aspect | Impact | Data (2024-2025) |

|---|---|---|

| Renewable Energy | Drives Growth | Renewable energy investment rose 15% YOY |

| Climate Resilience | Infrastructure Protection | Grid hardening investments reached $2.8 billion |

| Nuclear Waste | Cost & Regulation | Spent fuel storage cost ~$350,000 per ton/year |

PESTLE Analysis Data Sources

The Constellation Energy PESTLE analysis draws upon reputable sources. This includes governmental, financial, and environmental reports, supplemented by industry-specific publications.