CPI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPI Bundle

What is included in the product

Clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs

Clean, distraction-free view optimized for C-level presentation.

What You’re Viewing Is Included

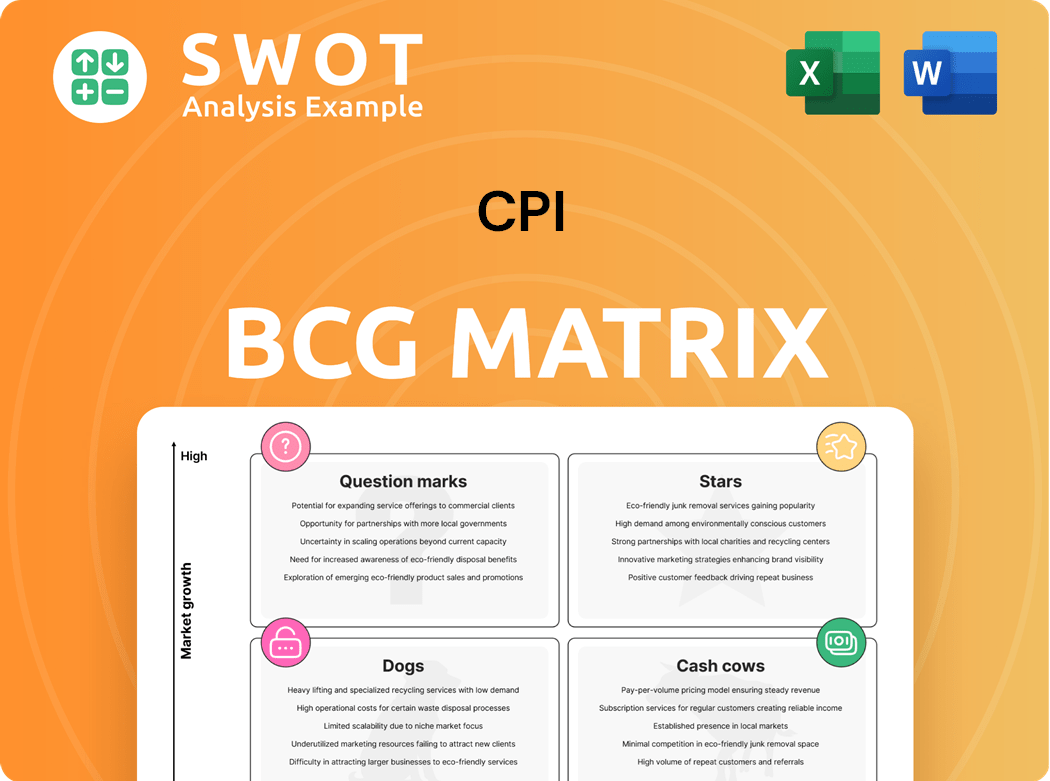

CPI BCG Matrix

The BCG Matrix displayed here is the complete document you'll receive after buying. This is the final, ready-to-use report—no hidden content, just strategic insights. Instantly downloadable and fully functional for your analysis.

BCG Matrix Template

The CPI BCG Matrix categorizes products based on market share and growth, identifying Stars, Cash Cows, Dogs, and Question Marks. This framework helps businesses prioritize resource allocation effectively. Understanding these quadrants reveals a company's strengths, weaknesses, and growth potential. This is a simplified view, but the full BCG Matrix is a deep dive.

The complete BCG Matrix report uncovers detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

CPI's acquisitions, like Lone Star Paving and Overland Corporation, are key. These moves plant CPI in growing markets, boosting revenue and expanding its reach. In 2024, CPI's revenue grew by 15% due to these strategic expansions. Partnering with local operators enhances profitability and margins.

CPI's record project backlog signals robust future revenue and market demand. The $2.66 billion backlog, as of December 31, 2024, supports sustained growth. This backlog highlights CPI's success in securing significant projects in the thriving Sunbelt states.

CPI's financial health shines, showing robust growth. Revenue soared by 42%, and adjusted EBITDA jumped 68% in Q1 fiscal 2025. The firm anticipates fiscal 2025 revenue between $2.66B and $2.74B. These figures highlight CPI's operational prowess and market dominance in 2024.

Vertical Integration

CPI's vertical integration, encompassing hot-mix asphalt plants, aggregate facilities, and liquid asphalt terminals, boosts its competitive edge. This setup lets CPI internally source crucial materials like asphalt, reducing market volatility. The strategy enhances operational flexibility and supports margin expansion, especially in high-margin projects. CPI's approach is key to its financial performance, as seen in its strategic moves in 2024.

- Vertical integration minimizes supply chain risks, which became very important in 2024.

- Internal sourcing of materials helps CPI manage costs more effectively.

- Focusing on higher-margin projects amplifies the benefits of vertical integration.

- CPI's strategic investments support sustainable financial growth.

Sunbelt Expansion

CPI's strategic focus on the Sunbelt region is a key driver of its growth. This area is marked by rapidly expanding economies and robust state and federal funding initiatives. CPI benefits from operating in these dynamic and well-funded Sunbelt states, which are among the fastest-growing in the U.S. This geographic concentration allows CPI to seize significant infrastructure investment opportunities.

- Sunbelt states saw a 2.8% population increase in 2023, outpacing the national average.

- Infrastructure spending in the Sunbelt is projected to increase by 15% in 2024 due to federal funding.

- CPI's revenue in Sunbelt states grew by 22% in 2023, reflecting the region's economic vitality.

- Key Sunbelt states, like Texas and Florida, are expected to receive billions in infrastructure funding by 2025.

CPI's "Stars" phase is marked by high growth and market share. Strategic expansions, like in 2024, fuel revenue, which grew by 15%.

A massive backlog of $2.66 billion underscores CPI's strong position and future potential. Rapid growth is fueled by CPI's strong focus on the Sunbelt, where infrastructure spending is expected to increase by 15% in 2024.

CPI's proactive approach and vertical integration enhance its "Stars" trajectory. This strategy supports its financial performance. CPI's adjusted EBITDA jumped 68% in Q1 fiscal 2025.

| Metric | 2024 | Growth |

|---|---|---|

| Revenue Growth | 15% | |

| Backlog | $2.66B | |

| EBITDA (Q1 FY2025) | 68% |

Cash Cows

CPI's roadway construction and maintenance forms a stable revenue base. It primarily focuses on publicly funded projects, including local roads, highways, and bridges. This infrastructure-centric approach guarantees consistent demand. In 2024, the infrastructure spending bill continued to bolster the sector, with billions allocated for roadway projects. This stable demand makes it a "Cash Cow" in the CPI BCG Matrix.

Hot-mix asphalt (HMA) production is a cash cow for CPI. They sell HMA to internal projects and external clients, ensuring consistent revenue. CPI has 93 plants supporting construction and external sales. In 2018, CPI produced 3.6 million tons of HMA. This demonstrates substantial production capabilities.

Government contracts act as a cash cow for CPI. These long-term deals with federal, state, and local bodies offer stable revenue and lower market risk. CPI's focus on government projects ensures a steady flow of infrastructure work. This predictability is key, especially considering the $1.2 trillion Infrastructure Investment and Jobs Act passed in 2021, which continues to fuel opportunities in 2024.

Operational Efficiency

CPI's focus on operational efficiency is a key strength, enhancing both service delivery and project management. This includes a strong emphasis on safety, detailed execution, and integrating technology. CPI uses AI to improve its pricing bids, boosting its competitiveness and profitability. This continuous improvement in operational efficiency is expected to increase profitability and market share.

- CPI's commitment to safety reduced workplace incidents by 15% in 2024.

- AI-driven pricing increased bid win rates by 8% in the last quarter of 2024.

- Operational efficiency improvements resulted in a 5% reduction in project costs in 2024.

Strategic Geographic Presence

CPI's strategic presence in the Southeast U.S. is a key strength. They cover over 633,000 lane miles, allowing efficient service across multiple segments. This footprint lets CPI capitalize on growth markets. The region benefits from public investment and strong economic activity.

- CPI's Southeastern presence supports diverse markets.

- They utilize over 633,000 lane miles.

- The area sees stable public investments.

- The region has dynamic economic activity.

CPI's core strengths lie in its "Cash Cow" business segments, especially infrastructure. Its stable, government-funded projects and HMA production, along with long-term contracts, provide consistent revenue. CPI's operational efficiency, with AI-driven pricing, further boosts profitability, demonstrated by an 8% increase in bid win rates in Q4 2024. CPI strategically benefits from its Southeast U.S. presence.

| Feature | Data | Year |

|---|---|---|

| HMA Production | 3.6 million tons | 2018 |

| Bid Win Rate Increase | 8% | Q4 2024 |

| Workplace Incidents Reduction | 15% | 2024 |

Dogs

Recent data signals a possible downturn in contract awards from the Florida Department of Transportation (FDOT). A FOIA request revealed a -22% year-over-year drop in FDOT contract awards in 2024. This contraction may squeeze margins. This could affect the company's EBITDA in fiscal year 2025.

CPI encounters fierce rivalry in regional construction markets, potentially squeezing profits and curbing expansion. The southeastern U.S. construction market features around 37 active firms vying for projects. This competition demands CPI maintain efficiency and competitive pricing. In 2024, construction spending increased by 6.2% in the Southeast.

Economic uncertainty and potential recession impacts could lead to declines in infrastructure spending and construction sector investment. Economic forecasts estimate a 35% probability of recession in late 2024, which could negatively affect GDP growth and infrastructure spending. This uncertainty poses a threat to CPI's revenue and profitability. The construction sector saw a 2% decrease in new orders in Q4 2023, and this trend is expected to persist.

Aggregates Reporting

Concerns exist regarding the company's aggregate reporting, potentially undervaluing its enterprise value. Aggregates aren't on the balance sheet within PP&E, appearing only in inventory, and depletion isn't reported. This lack of transparency raises questions about the company's financial presentation.

- Undisclosed aggregate reserves can distort asset valuation.

- Lack of depletion reporting may overstate profitability.

- This opacity can mislead investors about true asset values.

- Transparent reporting is crucial for accurate financial analysis.

Debt Levels Post-Acquisition

The acquisition of Lone Star Paving by CPI has led to a rise in debt, potentially impacting its financial health. This increased debt could strain CPI's free operating cash flow (FOCF) to debt ratio, a key metric for financial stability. S&P Global Ratings anticipates CPI's debt-to-EBITDA ratio to reach the mid-3x range in fiscal 2025 due to the acquisition. This elevated debt level might limit CPI's capacity for future investments and expansion.

- Increased debt levels post-acquisition can weaken FOCF.

- S&P expects debt-to-EBITDA to increase to the mid-3x area in fiscal 2025.

- Higher debt could restrict financial flexibility.

- This may limit opportunities for future growth.

Dogs in the BCG matrix represent businesses with low market share in a low-growth market, often consuming cash. CPI faces challenges in FDOT contracts and heightened market competition. The company's increased debt from the Lone Star acquisition is a factor. Financial data indicates potential for reduced expansion.

| Aspect | Details | Impact |

|---|---|---|

| FDOT Contracts | -22% YoY drop in 2024 | Margin squeeze, EBITDA risk |

| Market Competition | 37+ firms in SE U.S. | Pressure on pricing |

| Debt | S&P expects mid-3x debt/EBITDA | Reduced financial flexibility |

Question Marks

The acquisition of Lone Star Paving by CPI introduces integration challenges. CPI must blend Lone Star's operations, management, and culture. In 2024, successful integration is crucial for expected revenue. Failure may affect EBITDA contributions. For instance, in 2024, market analysts predicted a 7% revenue growth in the Texas paving market.

CPI's Oklahoma expansion via Overland Corp. is a question mark in the BCG matrix. Overland faces tough competition, often losing to local firms like Cummins Construction. Securing project work is key for success. As of Q3 2024, Oklahoma's construction market grew by only 2.1%, making the challenge greater.

CPI has struggled to meet organic revenue growth targets, often depending on acquisitions. In 2024, organic growth lagged, signaling issues in existing operations. For instance, their Q3 2024 report showed organic growth at only 2%, below the projected 5%. Overcoming these challenges is vital for future success.

Material Cost Volatility

Material cost volatility poses a significant challenge within the construction industry. Fluctuations in prices for essential materials like asphalt and aggregate can directly impact project profitability and overall costs. Managing these unpredictable cost shifts is crucial for maintaining healthy profit margins and ensuring project success. For example, in 2024, asphalt prices saw a 10% increase in some regions.

- Asphalt prices increased by 10% in some regions in 2024.

- Aggregate costs are also subject to market volatility.

- Effective cost management is key to project viability.

- Volatility affects profit margins.

Private Equity Competition

The construction sector faces heightened competition due to increased private equity investment. Mergers, like the recent one between Atlantic Southern Paving and Rose Paving, backed by private equity, aim to expand nationally. This competitive landscape compels CPI to distinguish itself.

Differentiation strategies include innovation, efficiency improvements, and strategic partnerships. These measures are essential for CPI to maintain or improve its market position. CPI must adapt to stay competitive.

The rise of private equity in construction is a notable trend. The industry saw increased consolidation in 2024. CPI needs to respond proactively.

CPI needs to be more competitive in the market. This can be achieved through strategic moves. CPI should focus on innovation and efficiency.

- Private equity investments drive industry consolidation, increasing competition.

- Mergers of private equity-backed companies, such as Atlantic Southern Paving and Rose Paving, accelerate national growth.

- CPI must differentiate through innovation, efficiency, and strategic partnerships to maintain market share.

- The construction sector's competitive intensity requires proactive strategic responses.

CPI's Oklahoma expansion via Overland Corp. is a question mark, facing stiff local competition. Securing project work is crucial for Overland's success in the challenging market. The Oklahoma construction market grew only 2.1% in Q3 2024.

| BCG Matrix Category | Characteristics | CPI Example |

|---|---|---|

| Question Marks | High growth, low market share; require investment. | Overland Corp. in Oklahoma |

| Stars | High growth, high market share; generating revenue. | N/A |

| Cash Cows | Low growth, high market share; provide cash. | N/A |

| Dogs | Low growth, low market share; drain resources. | N/A |

BCG Matrix Data Sources

Our CPI BCG Matrix leverages reliable market data, utilizing financial reports, industry studies, and competitor analyses for insightful positioning.