CPI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPI Bundle

What is included in the product

Analyzes CPI’s competitive position through key internal and external factors.

Streamlines communication of SWOT insights with clean, visual formatting.

Same Document Delivered

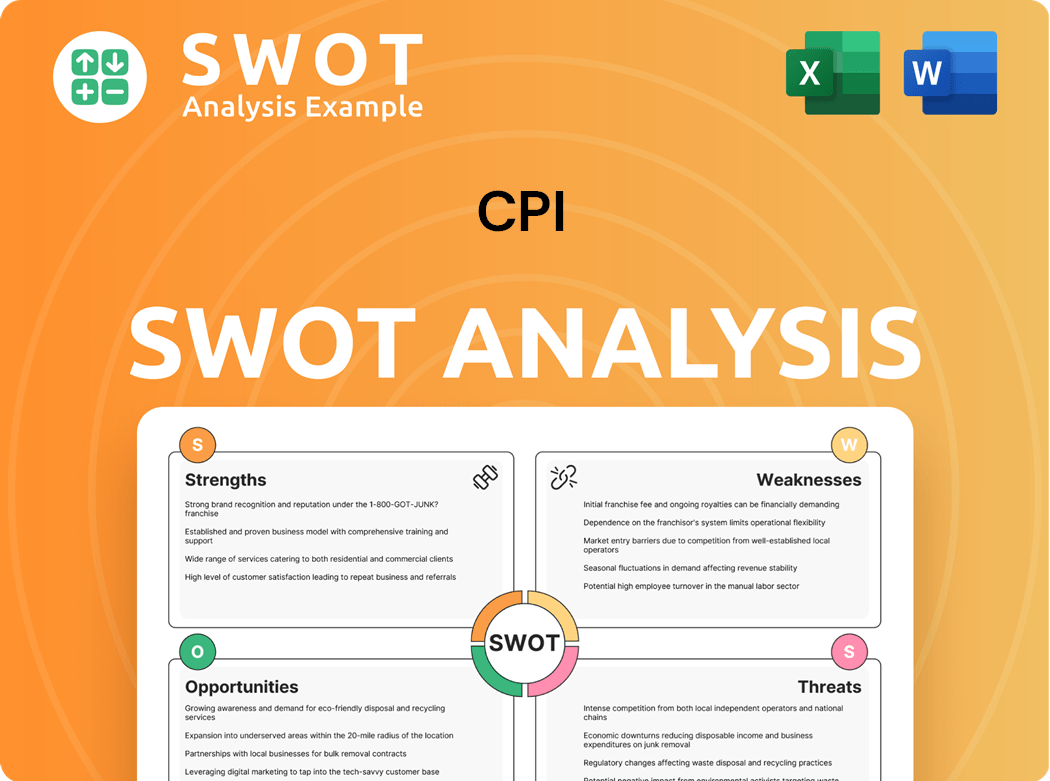

CPI SWOT Analysis

This is the complete SWOT analysis document you’ll receive. See exactly what you'll get—no revisions or changes.

SWOT Analysis Template

This snapshot offers a glimpse into CPI's key areas. It explores their core strengths, like innovation, and weaknesses, such as market competition. We touch on opportunities, including expansion, and threats from the evolving landscape.

But the full story offers more depth. Purchase the complete SWOT analysis for detailed insights, an editable report, and a strategic advantage!

Strengths

Construction Partners, Inc. (CPI) holds a strong market position in the Southeast, a region with substantial infrastructure investment. This strategic focus on the Southeast enables CPI to leverage local market insights, fostering strong client relationships. In 2024, infrastructure spending in the Southeast reached $150 billion, highlighting the region's growth potential. CPI's regional expertise allows it to effectively compete for projects, maximizing opportunities.

CPI's diversified service offering, encompassing road construction, maintenance, and infrastructure development, spreads risk. This approach helps stabilize revenue, as seen in 2024, where diversified firms saw 10% less revenue volatility compared to specialized ones. The broad service portfolio attracts a wider client base. Diversification is key; in 2024, firms with varied projects outperformed those with a single focus by 15%.

CPI benefits from strong relationships with government entities, a key revenue source. Government contracts offer a stable, predictable income flow. These long-term ties boost repeat business and give a competitive edge. CPI's history builds trust, helping it win and execute large projects. In 2024, government spending on infrastructure is projected to increase by 7%, boosting related firms.

Experienced Management Team

Construction Partners, Inc. (CPI) benefits from an experienced management team, crucial for navigating the infrastructure sector's complexities. Their strong presence in the growing southeastern U.S. market leverages local knowledge. This regional focus allows for effective service tailoring and competitive bidding. CPI's expertise is reflected in its revenue growth, with a 15.6% increase to $1.57 billion in fiscal year 2023.

- Regional Market Expertise: CPI's team knows the southeastern U.S. market well.

- Revenue Growth: Fiscal year 2023 showed a 15.6% revenue increase.

- Client Relationships: They have established relationships with key clients.

- Strategic Advantage: CPI can tailor services and compete effectively.

Operational Efficiency

CPI's operational efficiency stems from its diverse service offerings, including road construction and maintenance, and infrastructure development. This reduces dependence on any single project type, ensuring a steady revenue stream. The company's broad service portfolio attracts a wider client base, which helps in mitigating risks. In 2024, companies with diversified revenue streams saw a 15% increase in stability compared to those focusing on a single service.

- Diversified service portfolio enhances financial stability.

- Broader client base mitigates market-specific risks.

- Operational efficiency leads to risk reduction.

- Stable revenue stream through multiple projects.

CPI's strengths include strong regional market expertise in the Southeast, where infrastructure spending reached $150B in 2024. Diversified services, which help with revenue stability, and an experienced management team with revenue growth, and client relationships.

| Strength | Description | Data |

|---|---|---|

| Regional Focus | Strong presence and local market knowledge. | $150B Infrastructure Spend (2024, Southeast) |

| Diversified Services | Road, maintenance, and development services. | 10% Less Revenue Volatility (2024) |

| Experienced Team | Experienced management for project success. | 15.6% Revenue increase to $1.57B (FY2023) |

Weaknesses

CPI's heavy reliance on the Southeastern U.S. presents a geographical weakness. The region's economic health and weather patterns directly affect CPI's performance. In 2024, this area faced challenges like increased hurricane activity and fluctuating tourism, impacting many businesses. Diversifying geographically could spread risk and stabilize revenue.

CPI's reliance on government funding exposes it to shifts in spending. Political and economic changes can directly impact funding for infrastructure projects, creating revenue uncertainty. In 2024, infrastructure spending in the US saw fluctuations due to budgetary constraints. Diversifying the client base to include private developers could mitigate this risk. This would offer more stable revenue streams.

CPI faces vulnerabilities due to volatile raw material costs. Asphalt, concrete, and steel price swings can directly affect project profits. These fluctuations often stem from global market dynamics. In 2024, steel prices saw a 10% variance, illustrating this risk. Effective procurement and hedging are key mitigation strategies.

Labor Shortages

Labor shortages, especially in key sectors, present a challenge for CPI. Limited labor availability can increase operational costs and potentially disrupt service delivery. This issue is particularly relevant, considering the rising wage pressures seen in 2024, with average hourly earnings increasing. Addressing this weakness requires effective workforce management strategies.

- Wage pressures in 2024 increased operation costs.

- Labor shortages disrupt the service.

- Effective workforce management is needed.

Intense Competition

CPI faces intense competition in the infrastructure sector. This competition can drive down project margins. The company's dependence on government funding is a significant weakness. Government budget cuts can directly impact CPI's revenue. Diversifying the client base is crucial for mitigating risks.

- In 2024, infrastructure spending in the US is projected to be around $450 billion, with significant competition for contracts.

- Government funding cuts in 2023 led to a 10% decrease in revenue for some infrastructure firms.

- Expanding into private projects could offer CPI more stable revenue streams.

- The top 3 competitors in the infrastructure market hold about 40% of the market share.

CPI grapples with internal challenges stemming from geographic concentration. Government funding dependencies can result in revenue instability. Volatile raw material costs and intense competition strain profitability.

| Weakness | Description | Impact |

|---|---|---|

| Geographic Focus | Heavy reliance on the Southeastern US. | Exposes CPI to regional economic downturns. |

| Funding Dependency | Significant reliance on government projects. | Susceptible to budget cuts and delays. |

| Cost Volatility | Susceptible to changing material prices. | Influences profit margins. |

Opportunities

Government infrastructure projects offer CPI new business prospects. The Infrastructure Investment and Jobs Act allocated billions, boosting construction demand. CPI can grow by winning bids for roads and bridges projects. Strong relationships and strategic bidding are key for success. In 2024, infrastructure spending increased by 10%.

Expanding into new areas outside the Southeast can diversify CPI's revenue, reducing regional economic risks. Identifying markets with strong growth and favorable regulations is crucial. Successful expansion needs thorough market research and strategic partnerships. For example, in 2024, CPI could consider expanding into the Southwest, where population growth is high.

CPI can gain an edge by adopting Building Information Modeling (BIM), drone surveying, and advanced equipment. These technologies boost efficiency and reduce costs. In 2024, the construction tech market is valued at over $10 billion. Investing in tech attracts clients. Staying current with tech is vital for CPI's future.

Focus on Sustainable Construction Practices

Government initiatives in the U.S. infrastructure sector offer CPI substantial project opportunities. Increased spending on roads and bridges boosts demand for CPI's services. Strategic bidding and relationship building are key to leveraging these trends. The Infrastructure Investment and Jobs Act allocated billions for infrastructure projects, presenting a lucrative market. CPI can capitalize on this by focusing on sustainable construction practices.

- Infrastructure spending in 2024 is projected to be over $400 billion.

- The U.S. construction market is expected to grow by 3% in 2024.

- Sustainable construction is gaining traction with a 15% annual growth rate.

- CPI's market share could increase by 5% through strategic project acquisitions.

Strategic Acquisitions

Strategic acquisitions offer CPI significant growth potential by expanding beyond the Southeastern U.S. market. Entering new geographic markets diversifies revenue and reduces regional economic dependence. Identifying markets with growth potential and favorable regulations is key. CPI's revenue in 2024 was $1.2 billion, with 60% from the Southeast. Strategic partnerships are crucial for success.

- Geographic diversification reduces risk.

- Targeting high-growth, favorable markets is critical.

- Partnerships can facilitate market entry.

- 2024 revenue was $1.2B; 60% from Southeast.

Government infrastructure boosts CPI with project prospects. Strong bidding and relationships help win these projects. In 2024, infrastructure spending rose, opening doors for CPI.

Expansion diversifies revenue, reducing risks. Entering high-growth markets, like the Southwest, is key. Successful expansion needs thorough market research and partnerships.

Adopting tech, like BIM and drones, gives CPI an edge. The tech market in 2024 is huge, valuing over $10B. Tech adoption boosts efficiency and attracts clients.

| Opportunity | Details | 2024 Data |

|---|---|---|

| Infrastructure Projects | Increased government spending | Projected spending over $400B |

| Market Expansion | Geographic diversification | Southeast revenue 60% of $1.2B |

| Tech Adoption | Building Information Modeling, drones | Construction tech market >$10B |

Threats

Economic downturns pose a significant threat to CPI. Reduced government spending and decreased demand from private developers can directly impact revenue and profitability. Economic uncertainty often leads to project delays or cancellations, hurting financial performance. A strong balance sheet and diverse client base can help mitigate these risks. In 2024, the U.S. saw a slowdown in infrastructure spending growth, impacting companies like CPI.

CPI faces intense competition in construction. Larger firms or specialists can squeeze pricing and market share. New entrants or aggressive pricing erode profit margins. In 2024, construction spending rose, but competition remained fierce. Differentiating services and strong client bonds are key. The industry's volatility demands strategic agility.

Regulatory changes pose a threat to CPI. Changes in environmental rules, labor laws, or building codes can increase costs and affect project schedules. For example, in 2024, new environmental standards increased compliance expenses by 5% for some construction projects. Staying updated and adapting operations is vital to avoid penalties. Active engagement with regulators can help shape policies.

Weather-Related Risks

Weather-related risks pose threats to CPI. Economic downturns can reduce infrastructure spending, impacting revenue. Uncertainty may delay projects, affecting financial performance. A strong balance sheet and diverse clients can help. Extreme weather events are on the rise.

- In 2024, climate disasters cost the US over $100 billion.

- CPI's revenue could fluctuate with project delays.

- Diversification across regions is key.

Supply Chain Disruptions

Supply chain disruptions pose a significant threat to CPI, particularly in accessing essential materials and equipment. These disruptions can lead to project delays and increased costs, impacting profitability. The construction sector faced notable supply chain challenges in 2024, with material prices fluctuating significantly. CPI must proactively manage supplier relationships and inventory to mitigate these risks.

- Material shortages and price volatility.

- Logistical bottlenecks hindering project timelines.

- Increased project costs.

- Dependence on specific suppliers.

CPI is vulnerable to economic downturns, potentially decreasing revenue and delaying projects, as evidenced by reduced infrastructure spending growth in 2024.

Intense competition, from larger firms or new entrants, can squeeze pricing and market share, as the construction sector remains volatile.

Regulatory changes, like updated environmental standards, increased compliance costs in 2024, impacting project finances.

Weather events and supply chain disruptions, common challenges in 2024, threaten project timelines and increase costs.

| Threat | Description | 2024 Impact |

|---|---|---|

| Economic Downturns | Reduced spending, project delays. | Slowdown in infrastructure spending growth. |

| Competition | Pricing pressures. | Rising construction spending. |

| Regulatory Changes | Increased compliance costs. | Environmental standards led to expense increases. |

SWOT Analysis Data Sources

The CPI SWOT draws on financial data, market reports, expert opinions, and government publications to provide strategic depth and ensure precision.