Costco Wholesale Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Costco Wholesale Bundle

What is included in the product

Tailored exclusively for Costco, analyzing its position within its competitive landscape.

Customize pressure levels based on new data or evolving market trends.

Full Version Awaits

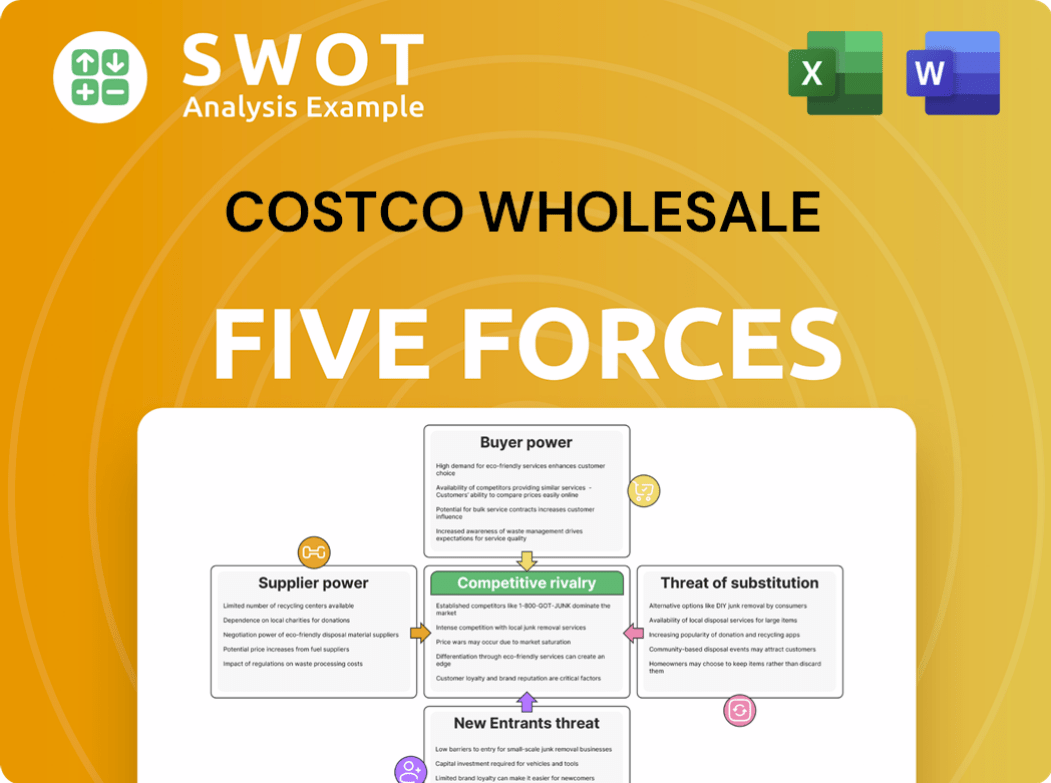

Costco Wholesale Porter's Five Forces Analysis

You're viewing the complete Costco Wholesale Porter's Five Forces analysis. This analysis examines the competitive forces shaping Costco's industry, including rivalry, supplier power, and buyer power. The presented document details these forces, assessing their impact on Costco's profitability and market position. Upon purchase, you'll receive this exact, comprehensive analysis, ready for your use. This is the file you download—no hidden content.

Porter's Five Forces Analysis Template

Costco Wholesale operates in a competitive retail landscape. Supplier power is moderate due to bulk purchasing leverage. Buyer power is strong, driven by value-seeking customers. The threat of new entrants is low, thanks to established brand and scale. Substitute products (online retail, other retailers) pose a threat. Competitive rivalry is intense.

This preview is just the starting point. Dive into a complete, consultant-grade breakdown of Costco Wholesale’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

Costco's massive scale gives it significant bargaining power. They can secure advantageous terms from suppliers. Costco's ability to change suppliers keeps supplier power in check. This strategy helps maintain competitive pricing. In 2024, Costco's revenue was about $252 billion.

Costco's Kirkland Signature brand significantly boosts its negotiating power. This private label offers alternatives to national brands, lessening dependence on any single supplier. For instance, in 2024, Kirkland Signature accounted for roughly 30% of Costco's sales, demonstrating its influence. This strategy allows Costco to manage costs and product quality effectively.

Costco's standardized product specifications give it strong bargaining power. This approach simplifies switching suppliers, lessening reliance on any one source. Costco's ability to maintain quality while negotiating optimal prices is enhanced by this strategy. In fiscal year 2024, Costco reported $242.3 billion in net sales, demonstrating its substantial market presence and buying power.

Global Sourcing Options

Costco's global sourcing significantly impacts supplier bargaining power. By sourcing worldwide, Costco diversifies its supplier base, lessening dependence on any single region. This strategy allows Costco to negotiate favorable terms, driving down costs. In 2024, Costco's international sales reached approximately $75 billion, demonstrating its global reach and supplier leverage.

- Global sourcing reduces supplier concentration, enhancing Costco's negotiating power.

- Costco leverages international market competition to secure better pricing.

- The company's vast scale and global presence further empower its bargaining position.

- Costco's strategy includes direct sourcing and private label brands, increasing its control.

Long-Term Partnerships

Costco's approach to suppliers involves a mix of negotiation power and collaborative relationships. They leverage their size to negotiate favorable terms. However, Costco builds long-term partnerships, promoting a stable supply chain and innovation. This strategy is crucial for their business model.

- Costco's revenue in 2024 was approximately $253 billion.

- They have a high inventory turnover rate, about 11 times per year.

- Costco's long-term supplier relationships ensure product availability.

- Collaborative efforts contribute to exclusive products.

Costco's vast size and global reach boost its bargaining power over suppliers, keeping costs down. Direct sourcing and private labels, like Kirkland Signature (30% of 2024 sales), increase control. Long-term partnerships and a high inventory turnover rate (11 times per year) ensure product availability.

| Metric | Details | 2024 Data |

|---|---|---|

| Revenue | Total Sales | $253 billion |

| International Sales | Global Revenue | $75 billion |

| Inventory Turnover | Times per Year | 11 |

Customers Bargaining Power

Costco's model hinges on members' bulk purchases, giving them strong bargaining power. This bulk buying enables members to seek lower unit prices. Costco responds with competitive pricing and bulk discounts, as seen with its 2024 sales of $253 billion. This strategy attracts and retains members. Costco's membership renewal rate was over 90% in 2024.

Costco's membership model significantly influences customer bargaining power. The annual fee establishes a value proposition, making customers price-sensitive. Members demand considerable savings to offset the fee; in 2024, the Gold Star membership cost $60. Costco must offer competitive pricing to retain its 74.5 million members and draw in new ones.

Costco's product selection, while broad, is often limited within specific categories, giving customers less variety. This can enhance customer bargaining power, but Costco mitigates this. In 2024, Costco's revenue reached $252.6 billion, showcasing its ability to negotiate favorable terms with suppliers despite selection constraints. Costco's strategy focuses on balancing selection and pricing.

Price Transparency

Costco's price transparency allows customers to easily compare prices, giving them significant bargaining power. This is crucial for maintaining competitive pricing. Costco's revenue in 2024 reached approximately $252 billion. This transparency fosters trust and loyalty among its members.

- Price comparison is easy for customers.

- Costco must offer competitive prices.

- Customer loyalty is boosted.

Switching Costs

Costco's competitive pricing strategy, though attractive, is coupled with an annual membership fee, presenting a minor switching cost for customers. However, the perceived value, driven by significant savings on bulk purchases and exclusive products, often mitigates this cost. In 2024, Costco reported a membership renewal rate of over 90%, indicating strong customer loyalty despite the fee and readily available alternatives. Costco's business model focuses on providing substantial value to retain members, ensuring they see the benefits outweighing any switching considerations.

- Membership Fee: $60 per year for Gold Star and Business memberships.

- Renewal Rate: Over 90% in 2024.

- Value Proposition: Significant savings on bulk purchases and exclusive products.

- Competitive Landscape: Presence of other retailers like Walmart and Amazon.

Costco customers wield strong bargaining power, leveraging bulk purchases and price transparency. Competitive pricing is essential to attract and retain members. Despite a $60 annual fee for Gold Star memberships, high renewal rates (over 90% in 2024) show member satisfaction.

| Feature | Details |

|---|---|

| Membership Fee | $60 (Gold Star) |

| Renewal Rate (2024) | Over 90% |

| 2024 Revenue | $252 Billion |

Rivalry Among Competitors

Costco faces fierce price competition in the retail sector. Competitors constantly challenge Costco, impacting its profit margins. To stay ahead, Costco focuses on operational efficiency. In 2024, Costco's gross margin was around 11%, showing the pressure from rivals.

Costco faces intense rivalry from established players. Walmart, with Sam's Club, is a key competitor, along with Amazon and traditional supermarkets. These rivals boast vast resources and market presence. Costco's membership model and value proposition set it apart. In 2024, Walmart's revenue reached $648.1 billion, showcasing the scale of competition.

Costco employs differentiation through its membership structure, private-label goods (Kirkland Signature), and unique shopping environment. These strategies help in customer attraction and retention, fostering loyalty. This builds a strong brand identity within the competitive retail sector. In 2024, Kirkland Signature sales accounted for about 30% of Costco's total revenue, showing its impact.

Market Saturation

Market saturation intensifies competition in the retail sector, influencing Costco's strategic moves. To counter saturation, Costco actively explores new markets and refines its strategies. This includes geographical expansions, with recent openings in areas like China and Australia. Costco's ability to adapt to evolving market dynamics is crucial for sustaining growth. The need for innovation and strategic agility is paramount.

- Costco's 2024 sales: $252.67 billion.

- International expansion: Significant growth in China and Australia.

- Strategic adjustments: Focus on e-commerce and membership benefits.

- Market challenges: Increased competition from online retailers.

E-commerce Growth

E-commerce growth significantly impacts Costco's competitive landscape. Online retailers, especially Amazon, are formidable rivals. Costco is actively expanding its online platform to compete. This dual approach of physical and digital retail is key for success. In 2024, e-commerce sales accounted for a substantial portion of overall retail sales, highlighting the need for Costco's digital strategy.

- Amazon's market share in online retail is substantial, posing a direct threat to Costco.

- Costco's online sales are growing, reflecting its effort to capture e-commerce market share.

- The balance between physical stores and online presence is critical for Costco's future.

Costco faces stiff competition from giants like Walmart and Amazon, impacting profit margins. Its membership model and private-label goods differentiate it within the retail sector. E-commerce growth poses a challenge, prompting Costco to expand online. In 2024, e-commerce sales showed the need for digital strategies.

| Aspect | Details |

|---|---|

| Key Competitors | Walmart (Sam's Club), Amazon |

| Differentiation | Membership model, Kirkland Signature |

| E-commerce Impact | Growing, requires online presence |

SSubstitutes Threaten

Traditional supermarkets and discount stores like Walmart act as substitutes for Costco, offering similar groceries and household items. These competitors often attract customers looking for smaller pack sizes or a broader variety of brands. In 2024, Walmart reported $648.1 billion in revenue, showcasing its scale. To counter this, Costco highlights its bulk discounts and exclusive offerings, like its Kirkland Signature brand, to maintain customer loyalty. Costco's membership model also fosters a unique value proposition.

Online marketplaces like Amazon pose a strong substitution threat to Costco. They offer a wide range of products, frequently at lower prices. Costco must boost its online presence and offer unique value. In 2024, Amazon's net sales exceeded $575 billion, highlighting the competitive pressure. This includes using its membership and private-label brands.

Specialty stores, like electronics or apparel retailers, pose a threat by offering expert advice and premium products. Costco must ensure its product quality and pricing are competitive to retain customers. For example, in 2024, electronics sales at Best Buy, a specialty retailer, reached $40 billion. Maintaining a diverse product range remains crucial for Costco's appeal.

Alternative Membership Clubs

The threat of substitute membership clubs poses a competitive challenge to Costco. Sam's Club, a direct competitor, operates under a similar model, vying for the same customer base. Costco needs to maintain its competitive edge to avoid losing members to these alternatives. Differentiating through value and service is crucial for retaining customers.

- Sam's Club had approximately 61 million members in 2024.

- Costco reported over 129 million cardholders in 2024.

- Costco's membership renewal rate was about 93% in 2024.

- Sam's Club's renewal rate was around 88% in 2024.

Direct-to-Consumer Brands

The surge in direct-to-consumer (DTC) brands poses a substitution threat to Costco. These brands often provide specialized products and tailored customer experiences. For example, in 2024, DTC sales in the U.S. reached over $200 billion, indicating significant consumer interest. Costco can respond by collaborating with DTC brands or expanding its private-label offerings.

- DTC sales in the U.S. in 2024: over $200 billion

- Costco's 2024 net sales: $253.7 billion

- Growth of private-label brands: increasing market share

- Consumer preference shift: towards convenience and personalization

The threat of substitutes for Costco comes from various retailers. These include traditional supermarkets and online marketplaces like Amazon, creating competition. Specialty stores and other membership clubs also pose challenges, requiring Costco to differentiate its offerings. Direct-to-consumer brands add further pressure to Costco's business model.

| Substitute Type | Competitor | 2024 Revenue/Members |

|---|---|---|

| Traditional Supermarkets | Walmart | $648.1 billion |

| Online Marketplaces | Amazon | $575+ billion |

| Membership Clubs | Sam's Club | 61 million members |

Entrants Threaten

Establishing a large-scale warehouse retail operation, like Costco, demands substantial capital, discouraging new entrants. This high capital requirement acts as a major barrier, shielding Costco from smaller competitors. In 2024, Costco's capital expenditures were around $3.5 billion. Extensive infrastructure and inventory needs are significant hurdles.

Costco's strong brand loyalty, stemming from consistent value and quality, presents a significant barrier to new entrants. This established loyalty, backed by a membership renewal rate of around 90% in 2024, means new competitors face an uphill battle. New entrants must offer substantial incentives to lure customers away. They must directly challenge Costco's value proposition.

Costco's massive scale is a major barrier. They leverage economies of scale to offer lower prices. New competitors find it hard to match Costco's buying power. Building comparable scale takes years and huge capital. In 2024, Costco's revenue hit $242.2 billion.

Complex Supply Chain

Costco's intricate global supply chain poses a significant barrier to new entrants. Replicating Costco's extensive network of suppliers, distribution centers, and logistics capabilities is a major undertaking. This complexity requires substantial investment and expertise, making it difficult for new competitors to compete. The established supply chain gives Costco a competitive edge.

- Costco operates over 800 warehouses globally, demonstrating the scale of its supply chain.

- In 2024, the company's logistics expenses amounted to approximately $3.5 billion.

- Building such a comprehensive supply chain can take years and billions of dollars.

Regulatory and Legal Hurdles

New entrants face significant regulatory and legal obstacles. These include zoning laws, environmental regulations, and consumer protection laws, which are time-intensive and expensive to navigate. For example, Costco must comply with various local and federal regulations to maintain its operations [1]. These hurdles increase the initial investment needed. Compliance is crucial for long-term sustainability and is monitored constantly.

- Zoning laws dictate where a business can operate, potentially limiting locations.

- Environmental regulations ensure responsible practices, adding to operational costs.

- Consumer protection laws safeguard customer interests, impacting business practices.

- Compliance with these laws requires significant financial and human resources.

New entrants face high barriers. Costco's large capital needs and economies of scale deter competition. Established brand loyalty and complex supply chains further protect Costco. Regulatory hurdles also add to the challenges.

| Barrier | Description | Impact |

|---|---|---|

| Capital Requirements | High initial investment for warehouses, inventory, etc. | Discourages new entrants. In 2024, capex was ~$3.5B. |

| Brand Loyalty | Strong customer loyalty. Membership renewal rate ~90% in 2024. | Requires significant incentives to attract customers. |

| Economies of Scale | Costco's ability to offer lower prices due to its size. Revenue in 2024 was $242.2B. | Hard for new competitors to match Costco's prices. |

Porter's Five Forces Analysis Data Sources

This analysis leverages annual reports, industry surveys, and competitor profiles from financial databases for a data-driven evaluation.