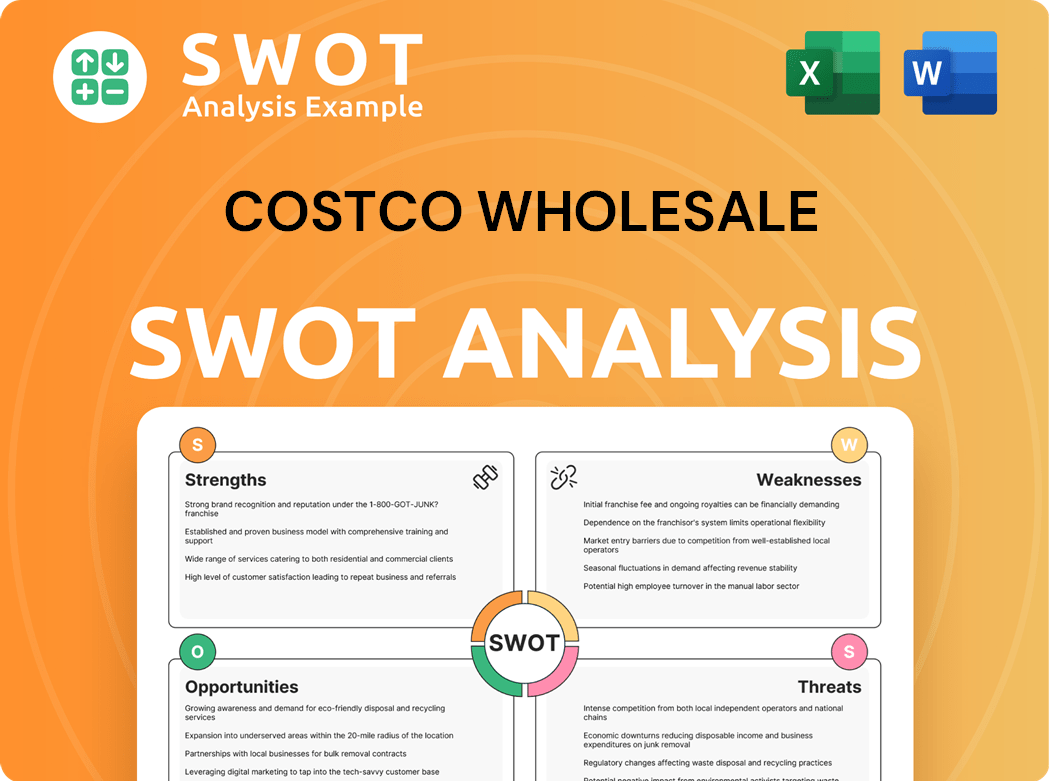

Costco Wholesale SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Costco Wholesale Bundle

What is included in the product

Provides a clear SWOT framework for analyzing Costco Wholesale’s business strategy.

Provides a simple, high-level SWOT template for fast decision-making.

What You See Is What You Get

Costco Wholesale SWOT Analysis

See a live look at the actual Costco SWOT analysis! What you see here is the complete, in-depth report you will download upon purchasing. There are no hidden versions or truncated reports. Everything you need is accessible after checkout. Get the full picture now.

SWOT Analysis Template

Costco's success hinges on its unique membership model and bulk-buying appeal. Its strengths lie in its loyal customer base & operational efficiency. Potential threats include competition and changing consumer habits. Opportunities involve expanding into new markets & services. The full SWOT analysis delivers deep, research-backed insights & tools to strategize and invest smarter – available instantly.

Strengths

Costco's strong brand reputation is a cornerstone of its success. The company is known for its high-quality products at competitive prices, creating customer loyalty. This is reflected in its high membership renewal rates, which were over 90% in the U.S. and Canada in 2023. Costco's brand strength helps drive sales and attract new members.

Costco's membership model cultivates a loyal customer base. This exclusivity drives high renewal rates and repeat business. This provides a stable revenue stream, a key competitive edge. Costco's renewal rates regularly surpass 90%, showcasing its strong member value. In Q1 2024, membership fees reached $1.1 billion.

Costco's supply chain, optimized with strategic warehouse locations, excels in inventory management and cost control. This efficiency supports competitive pricing and profitability; in 2024, their gross margin was around 11%. Direct manufacturer negotiations and optimized logistics further reduce costs. As of 2024, Costco operates nearly 900 warehouses globally, enhancing its supply chain’s effectiveness.

High Sales Volume

Costco's high sales volume is a cornerstone of its success, driven by its strong brand reputation. The company's ability to offer quality products at competitive prices encourages repeat business. This strategy translates into substantial revenue, with Costco reporting over $247 billion in net sales for fiscal year 2023. High sales volume allows Costco to negotiate favorable terms with suppliers, further enhancing its value proposition.

- Net Sales: Over $247 billion (Fiscal Year 2023)

- Membership Renewal Rate: Consistently above 90%

- Average Transaction Value: High due to bulk purchasing

Membership Fee Revenue

Costco's membership fee revenue is a significant strength. The membership model cultivates a strong community and exclusivity, driving high renewal rates and repeat business. This dedicated customer base offers a stable revenue stream and a competitive edge. Costco's membership renewal rates regularly surpass 90%, showcasing the strong value proposition.

- Membership fees generated $4.6 billion in revenue in 2023.

- Renewal rates consistently above 90% reflect customer loyalty.

- This revenue stream contributes significantly to overall profitability.

Costco's brand strength fosters customer loyalty. Its high renewal rates and premium offerings are key. Membership fees provide stable revenue, bolstering financials. Robust sales volume drives favorable supplier terms, enhancing profitability.

| Strength | Description | Data |

|---|---|---|

| Strong Brand Reputation | High-quality goods at competitive prices cultivate loyalty. | US/Canada renewal rates over 90% in 2023 |

| Membership Model | Exclusivity leads to repeat business and stable revenue. | Q1 2024 membership fees: $1.1B |

| Efficient Supply Chain | Strategic warehouse locations, efficient inventory control. | Approx. 900 warehouses as of 2024 |

| High Sales Volume | Drives favorable supplier terms; competitive advantage. | Net sales in FY2023: $247B+ |

| Membership Fee Revenue | Stable revenue source driving profitability. | Membership revenue in 2023: $4.6B |

Weaknesses

Costco's product range is notably smaller than competitors, a key weakness. Compared to Walmart's 150,000 SKUs, Costco stocks only around 3,700 items. This limited choice might push away customers wanting more variety. This constrained selection strategy impacts sales, especially for those seeking specific brands or niche products.

A substantial portion of Costco's revenue comes from membership fees, making the company susceptible to changes in renewal rates. In fiscal year 2023, membership fees accounted for approximately 2.8% of total revenue. This reliance means that a drop in renewals could severely affect Costco's financial health. Membership fees are crucial, contributing a large percentage to operating income, thereby increasing its vulnerability to changes in renewal rates.

Costco's online presence is still developing, trailing behind major rivals. In 2024, e-commerce sales represented a smaller portion of its total revenue compared to competitors. This limited digital footprint could restrict access to customers prioritizing online convenience. Costco's focus on physical stores means it misses out on a broader online market reach.

Narrow Profit Margins

Costco faces challenges with narrow profit margins due to its business model. The company prioritizes low prices and high sales volume, which can squeeze profit margins. This strategy, while attracting customers, leaves less room for profit compared to retailers offering a wider variety of products. Costco's focus on high-volume items limits selection, potentially deterring customers seeking diverse choices, with about 3,700 SKUs compared to Walmart's 150,000.

Limited Customization

Costco's limited ability to customize products or services presents a weakness. A significant portion of Costco's profitability relies on membership fees, making the company vulnerable to fluctuations in membership renewal rates. Any decline in membership could significantly impact financial performance. Membership fees contribute a large percentage to the company's operating income, making the company vulnerable to fluctuations in renewal rates.

- Membership fees accounted for 2.3% of total revenue in fiscal year 2023.

- Costco's membership renewal rate was approximately 90.5% in the U.S. and Canada as of the end of fiscal year 2023.

- Membership fees represented over 70% of Costco's operating income in 2023.

Costco's limited product selection, with about 3,700 SKUs versus Walmart's 150,000, can deter customers seeking variety. A high reliance on membership fees, contributing to over 70% of operating income in 2023, leaves the company vulnerable to renewal rate changes. Weak e-commerce presence, with online sales lagging in 2024, restricts market reach.

| Weakness | Impact | Data (2024) |

|---|---|---|

| Limited Product Range | Restricts choice, sales | 3,700 SKUs vs. Walmart's 150,000 |

| Membership Fee Dependency | Vulnerable to renewal changes | Membership over 70% of operating income |

| E-commerce Underdevelopment | Limits online reach | Lower online sales than competitors |

Opportunities

E-commerce expansion is a key opportunity for Costco. It allows reaching a broader customer base and boosting sales. Investing in online platforms and delivery services can improve customer convenience. In 2024, online retail sales in the U.S. reached over $1.1 trillion.

Global expansion presents substantial growth opportunities for Costco. The company can boost revenue by entering new markets and tailoring its model to local tastes. The global retail market is massive, and Costco can capitalize on this by expanding its footprint. In 2024, Costco's international sales accounted for approximately 28% of its total revenue, highlighting the importance of global presence. Costco has plans to open new warehouses in several international locations.

Costco has a great chance to tap into the growing health and wellness market. This means more opportunities for sales as they broaden their organic and natural food selections. The company can attract new customers by including fitness and wellness services. In 2024, the health and wellness market is estimated to reach $7 trillion globally.

Private Label Growth

Costco can significantly boost revenue by expanding its e-commerce presence and private label offerings. The growth of online shopping provides a prime opportunity to capture a broader market. Investing in user-friendly online platforms and efficient delivery services can enhance customer convenience and drive sales. E-commerce sales in the U.S. reached $1.1 trillion in 2023, highlighting the potential. Private label brands, like Kirkland Signature, offer higher profit margins and customer loyalty.

- E-commerce sales in the U.S. reached $1.1 trillion in 2023.

- Kirkland Signature products contribute significantly to Costco's profitability.

Digital Advertising

Costco can leverage digital advertising to boost sales and customer engagement. Utilizing online platforms allows for targeted marketing campaigns, reaching specific demographics with tailored promotions. This strategy can improve brand visibility and drive traffic to both online and physical stores. In 2024, digital ad spending is projected to exceed $300 billion in the U.S. alone.

- Targeted marketing campaigns can improve brand visibility.

- Digital advertising can drive traffic to online and physical stores.

- Digital ad spending is projected to be huge in 2024.

Costco's e-commerce growth, exemplified by the $1.1T U.S. 2023 online sales, boosts its reach. Global expansion, with 28% of 2024 revenue from abroad, opens doors for new markets. The $7T global health market provides another chance. Costco should expand private-label brands, such as Kirkland Signature.

| Opportunity | Description | Data Point (2024) |

|---|---|---|

| E-commerce Expansion | Enhance online presence for broader customer access and sales growth. | U.S. online retail sales over $1.1T |

| Global Expansion | Extend market reach, increase revenue through international presence. | ~28% revenue from int'l markets |

| Health & Wellness Market | Tap into rising demand with organic and wellness offerings. | $7T global market |

Threats

Costco faces fierce competition in the retail sector, battling against various players for market share. Online retailers, discount stores, and other warehouse clubs intensify the competition, potentially affecting Costco's sales and profit margins. For instance, Walmart's Sam's Club is a direct competitor. In 2024, the retail industry saw a 3.6% increase in competition. This dynamic environment requires Costco to continually innovate and differentiate itself.

Economic downturns pose a threat, potentially curbing consumer spending at Costco. The Consumer Confidence Index was 61.3 in January 2024, signaling possible spending limitations. Recessions could decrease demand for Costco's offerings, impacting sales. Economic instability can affect the company's financial performance. The company must prepare for reduced consumer activity.

Supply chain disruptions, from natural disasters to geopolitical issues, pose a threat to Costco's sourcing and pricing strategies. Interruptions, including transportation problems or supplier bankruptcies, can disrupt operations and impact low prices. In 2024, global supply chain issues, like the Suez Canal blockage, affected numerous retailers. These disruptions can lead to increased costs, potentially impacting Costco's profitability, which had a net income of $6.8 billion in fiscal year 2023.

Changing Consumer Preferences

Changing consumer preferences pose a significant threat to Costco. The retail landscape is fiercely competitive, with various entities striving for market dominance. Increased competition from online retailers, discount stores, and other warehouse clubs could negatively affect Costco's sales and profitability. This environment demands constant adaptation. For instance, in 2024, e-commerce sales for retailers grew, highlighting the pressure to evolve.

- Increased competition from online retailers.

- Changing consumer shopping habits.

- Shift towards e-commerce.

Rising Operational Costs

Rising operational costs pose a significant threat to Costco's profitability. Economic downturns and recessions can curb consumer spending, impacting demand for products and services. The Consumer Confidence Index in January 2024 was 61.3, signaling potential spending limitations. Higher labor expenses and supply chain disruptions also contribute to increased costs.

- Inflationary pressures on goods and services.

- Increasing labor costs and benefits.

- Supply chain disruptions and logistics expenses.

Costco's susceptibility to external factors such as tough market rivalry and financial pressures are essential concerns. Diminishing customer confidence and monetary slumps can limit purchasing behavior. Global logistics challenges and shifting preferences create considerable difficulties.

| Threat | Impact | Data |

|---|---|---|

| Intense Competition | Reduced Sales & Profit Margins | Retail industry competition rose by 3.6% in 2024 |

| Economic Downturn | Decreased Consumer Spending | Consumer Confidence Index was 61.3 in Jan 2024 |

| Supply Chain Issues | Higher Costs, Operations Interruption | Global disruptions; e.g., Suez Canal |

SWOT Analysis Data Sources

This SWOT analysis draws on financial statements, market reports, and industry research for accuracy and strategic depth.