Coupang Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coupang Bundle

What is included in the product

Tailored analysis for Coupang's product portfolio, revealing strategic investments and divestments.

Printable summary optimized for A4 and mobile PDFs, helps easily share Coupang's portfolio analysis.

Delivered as Shown

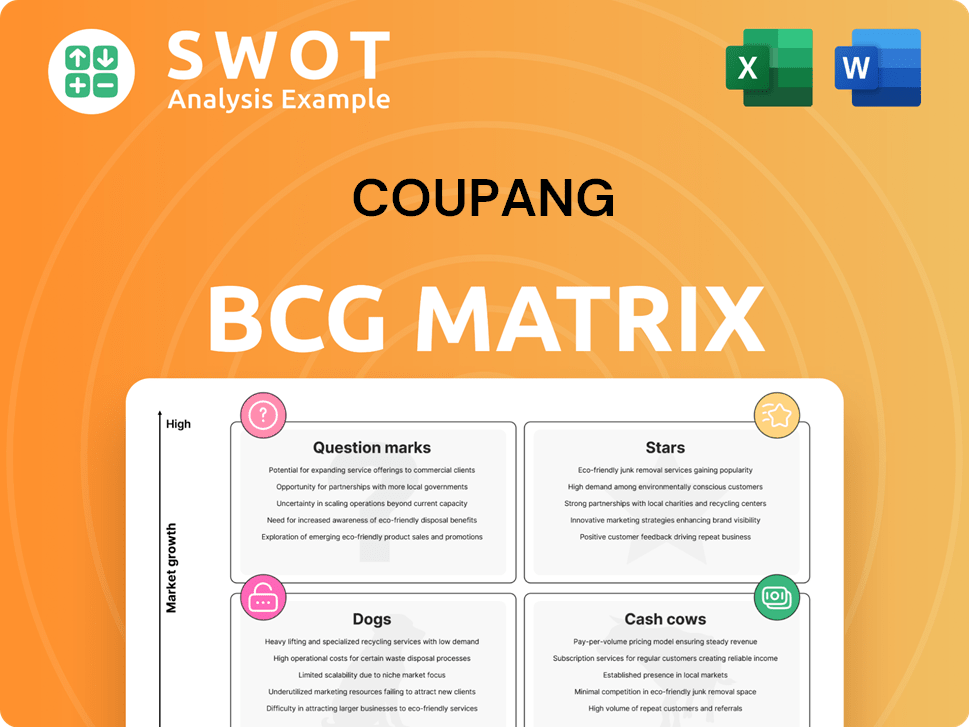

Coupang BCG Matrix

The Coupang BCG Matrix preview mirrors the purchased document. It's the complete, ready-to-use report with no hidden content. Access the full strategic analysis immediately after your purchase. Download the fully formatted file and utilize it to its full potential. No extra steps are needed, just the professional insights you're after.

BCG Matrix Template

Explore Coupang's market strategy through a condensed BCG Matrix preview. See where its products sit – are they Stars, Cows, Dogs, or Question Marks? This glimpse barely scratches the surface of Coupang's dynamic portfolio. Unlock the complete analysis! Purchase now for a full breakdown and a strategic advantage.

Stars

Coupang dominates South Korea's e-commerce, keeping Amazon at bay, showcasing a strong competitive edge. Its market share hit 24% in 2023. Projections estimate a rise to about 35% by 2028, indicating robust growth. This solidifies its "Star" status within its home market.

Coupang's Rocket Wow membership, a key element in its BCG matrix, boasts same-day delivery, streaming, and more, drawing a dedicated following. The program's appeal is evident in its growing subscriber base, even with fee hikes; as of Q4 2023, Coupang's active customers reached 21.5 million. This growth significantly boosts Coupang's market position, solidifying its star status within its portfolio. By Q4 2023, Wow members spent almost 3 times more than non-members.

Coupang's logistics, a "Star," boasts rapid delivery via its infrastructure. By 2023, Rocket Wow had 14 million subscribers. Automation investments cut costs by 16%. The network serves 70% of South Korea's population within 7 miles.

Technology and AI Innovation

Coupang's dedication to technology and AI is a core strength, driving efficiency and enhancing customer experience. CEO Bom Kim highlighted AI's role in boosting profitability, with strategic capital allocation focusing on long-term gains. Coupang's innovations leverage AI, robotics, and automation, earning recognition as a top innovator.

- AI-driven innovations are a key focus for efficiency and profitability.

- Strategic capital allocation prioritizes long-term profitability.

- Coupang was recognized as one of the World's Most Innovative Companies for 2025 by Fast Company.

Expansion into Taiwan

Coupang's expansion into Taiwan, particularly with its Rocket Delivery service, has been a success story. This expansion has been instrumental in driving revenue growth and highlighting its international potential. The company's revenue in 2024 reached an impressive 41.29 trillion won ($30.27 billion), reflecting a 29% increase compared to the prior year, with Taiwan playing a significant role in this growth. To boost customer retention, Coupang introduced its Wow membership in Taiwan, demonstrating its dedication to building a solid market presence.

- Rocket Delivery success in Taiwan.

- 2024 revenue: 41.29 trillion won ($30.27 billion).

- 29% revenue increase year-over-year.

- Wow membership launch in Taiwan.

Coupang, a "Star" in its BCG matrix, leads South Korea's e-commerce. Its market share hit 24% in 2023, with projections for 35% by 2028. Rocket Wow membership and AI innovations fuel growth, solidifying its strong market presence.

| Feature | Details | Data |

|---|---|---|

| Market Share (2023) | South Korea E-commerce | 24% |

| Projected Market Share (2028) | South Korea E-commerce | 35% |

| 2024 Revenue | Total | $30.27 billion |

Cash Cows

Coupang's product commerce is its cash cow, heavily reliant on its South Korean e-commerce dominance. In 2024, this segment generated $26.7 billion in net revenue, up 18% YoY. It boasts 22.8 million active customers, growing 10% YoY, and a gross profit of $2.3 billion with a 32.7% margin. This segment's profitability and strong market position solidify its cash cow status.

Coupang Eats, Coupang's food delivery service, has shown significant growth. Its active user base surged from 6.26 million in March 2023 to 10.26 million recently. Free delivery for Wow members, introduced in March 2024, boosted its market position. It surpassed Yogiyo, becoming the second-largest food delivery platform.

Coupang's Rocket Delivery is a cash cow, valued for its quick, dependable service, which fosters strong customer loyalty. Millions of items are available for next-day delivery by dawn, highlighting Coupang's dedication to speedy service. In 2024, Coupang's net revenue was $24.4 billion, showing a strong market position. Strategic investments in delivery and automation have solidified its dominance in Korea.

Marketplace for Small and Medium Businesses

Coupang's marketplace is a reliable cash cow. It allows small and medium-sized businesses (SMBs) to sell, generating revenue through retail margins and commissions. Around 70% of merchants are SMBs, while also including bigger international brands. This mix strengthens Coupang's market position and provides consistent revenue.

- In 2024, Coupang reported a significant increase in its marketplace revenue.

- The platform's commission structure contributed substantially to overall profitability.

- The diverse merchant base has been key to maintaining customer engagement.

- Coupang's focus on SMBs has fostered a strong ecosystem.

Coupang Play

Coupang Play, Coupang's streaming platform, is a cash cow. It boosts customer retention, especially when bundled with Rocket Wow. In August 2024, active users grew by 11% year-over-year. Coupang Play leads in audience size in South Korea.

- Coupang Play enhances customer loyalty.

- It is a leader in South Korean market.

- Rocket Wow boosts Coupang Play's appeal.

- Coupang Eats grew user base by over 50% in 2024.

Coupang's cash cows include product commerce, Rocket Delivery, the marketplace, and Coupang Play, each generating consistent revenue and market dominance. Rocket Delivery's 2024 net revenue reached $24.4B. The marketplace saw significant revenue increases, driven by commissions. Coupang Play boosts customer retention.

| Cash Cow | Revenue Source | Key Metric (2024) |

|---|---|---|

| Product Commerce | Retail Sales | $26.7B Net Revenue |

| Rocket Delivery | Delivery Fees | $24.4B Net Revenue |

| Marketplace | Commissions | Revenue Increase |

| Coupang Play | Subscription | 11% YoY Growth |

Dogs

Coupang's acquisition of Farfetch aimed to enter luxury fashion, but integration hurdles persist. Farfetch is not yet profitable, however, it has contributed to the top line. Coupang managed to bring the acquired Farfetch to break-even in under a year. This integration demands significant resources and focus, potentially affecting other business areas.

Coupang's IPO performance is categorized as a "Dog" in the BCG Matrix. Despite a 77% increase in the past year, the stock price is still 51% below its $63.50 IPO price from March 2021. As of late 2024, the stock trades around $23.00 per share, indicating challenges in meeting initial investor expectations. This underperformance reflects potential concerns regarding growth sustainability and profitability.

Coupang's operating profit saw a 2.4% year-on-year decrease in 2024. This decline was significantly influenced by a 162.8 billion won fine from the Korea Fair Trade Commission and losses stemming from Farfetch. Despite insurance payouts in Q4, the drop in profit highlights financial performance concerns. This situation places Coupang in the "Dogs" quadrant of the BCG Matrix.

Competition from Naver

Coupang must contend with Naver, a major player in South Korea's digital landscape. Naver's long-standing dominance as the leading search engine gives it a competitive advantage in attracting online shoppers. In 2024, Naver's commerce revenue surged, showing its strength in the e-commerce sector. This indicates a significant challenge for Coupang.

- Naver's Search Engine Leadership: Decades of dominance.

- Commerce Revenue Growth (2024): 15% increase to $2.1 billion.

- Competitive Pressure: Naver's impact on Coupang's market share.

Dependence on South Korean Market

Coupang's "Dogs" status in its BCG matrix stems from its heavy reliance on the South Korean market. This dependence restricts its growth compared to globally diversified competitors. South Korea's 52 million population, plus Taiwan's 24 million, yields a limited market under 100 million. Coupang faces challenges in diversifying revenue as its core market matures.

- South Korea's e-commerce market is valued at approximately $100 billion, with Coupang holding a significant share.

- Coupang's international expansion efforts include ventures in Japan and Southeast Asia, but with mixed results.

- The company's revenue growth rate in 2024 is projected to be around 15%, slower than its earlier expansion.

Coupang's "Dogs" status is reinforced by financial underperformance and market challenges. The stock price, despite gains, remains significantly below its IPO value. Operating profit decreased in 2024, impacted by fines and acquisitions like Farfetch.

| Metric | Data | Implication |

|---|---|---|

| Stock Price (late 2024) | Around $23.00/share | Below IPO price, investor concerns. |

| Operating Profit Change (2024) | -2.4% YoY | Financial performance concerns. |

| Market Dependence | South Korea | Limited growth potential. |

Question Marks

Coupang's fintech, including Coupang Pay, is a question mark in its BCG Matrix. While Coupang Pay's revenue grew 146% YoY in Q3, its market share lags. This segment's growth needs to accelerate to compete with established fintech companies. To become a star, Coupang must rapidly increase fintech adoption.

Coupang's international expansion, beyond its Taiwanese presence, is nascent, with unclear outcomes. Logistics hubs in Singapore exist, but significant market share gains need more investment. These new markets' performance will define their BCG matrix status, potentially becoming stars or dogs. In 2024, Coupang's international revenue was approximately $1.5 billion, representing 7% of total revenue.

Coupang Play's original content investments place it in the question mark quadrant. Despite its leading position in South Korea, Coupang Play requires continuous investment in original content to attract subscribers. The service focuses on original content and sports broadcasts, mirroring strategies of global competitors like Netflix, which spent $17 billion on content in 2024.

Strategic Capital Allocation

Coupang's strategic capital allocation, guided by CEO Bom Kim, focuses on long-term profitability through investments in AI and automation. These investments aim to enhance customer experience and operational efficiency. However, the success hinges on effective capital management to ensure returns. The company’s strategy includes expansion, which is essential for growth.

- In 2024, Coupang allocated a significant portion of its capital towards technological advancements.

- The company's market capitalization was approximately $30 billion as of late 2024, reflecting investor confidence in its strategic initiatives.

- Coupang's revenue growth rate in 2024 was around 20%, indicating successful expansion efforts.

- The investment in AI and automation is projected to increase operational efficiency by 15% by the end of 2025.

Coupang's Global US

Coupang Global US, representing Coupang's expansion into international markets, fits the question mark quadrant of the BCG matrix. This segment is still developing, and its impact on Coupang's overall performance is uncertain. Hundreds of online sellers are exploring Coupang Global US to reach new customers globally. Coupang's success hinges on effectively using AI, robotics, and automation in global commerce.

- Coupang's international expansion is a key area of focus.

- The company is investing in technologies like AI for global commerce.

- The success of Coupang Global US is yet to be fully realized.

- Market adoption and effective implementation are critical.

Coupang's fintech, international expansion, and Coupang Play are all question marks in its BCG matrix.

They require significant investments and have uncertain outcomes despite revenue growth. Coupang must increase market share to succeed in these sectors.

Success hinges on effective capital management and technology adoption, as seen with investments in AI and automation.

| Segment | Status | Key Challenges |

|---|---|---|

| Fintech (Coupang Pay) | Question Mark | Increasing market share, competition. |

| International Expansion | Question Mark | Gaining market share, Investment. |

| Coupang Play | Question Mark | Content investment, Subscriber growth. |

BCG Matrix Data Sources

Coupang's BCG Matrix leverages diverse sources, including financial reports, market analyses, and industry data, offering robust insights.